Bitcoin Bulls On The Charge: Crypto Platform Forecasts $63K Surge By March

24 Febbraio 2024 - 12:00AM

NEWSBTC

Prominent digital asset financial services platform Matrixport has

recently issued a bullish projection indicating a potential surge

in Bitcoin’s (BTC) value. According to their analysis, Bitcoin may

surpass its previously established two-year peak and climb to

$63,000 by next month. This bold prediction stems from a confluence

of factors poised to exert significant influence on the trajectory

of Bitcoin’s price in the coming weeks and months. Related Reading:

How Spot Bitcoin ETFs Could Catapult BTC Price To $500,000,

According To This Crypto Trader Rationale Behind Matrixport’s

Optimistic Projection The primary driver behind Matrixport’s

optimistic outlook is the live trading of Bitcoin spot

Exchange-Traded Funds (ETFs). According to the report, these spot

ETFs have opened the doors for more investors to engage in crypto

trading through conventional financial channels. Additionally, with

the increasing demand for these spot ETFs and the daily trading

volumes reaching noteworthy levels, signaling growing investor

interest in Bitcoin as an asset class, this could help propel the

flagship crypto to trade above $60,000 by next month, according to

the report. [1/3] Bitcoin ETF Flow – Up to 22 Feb 2024 All data in.

+$251.4m net flow on 22nd Feb. A strong day.

pic.twitter.com/IdrCmgq5u8 — BitMEX Research (@BitMEXResearch)

February 23, 2024 Furthermore, the impending Bitcoin halving event,

scheduled for April 2024, is anticipated to catalyze further upward

momentum in BTC prices. Bitcoin halvings result in a reduction in

the rate of new BTC generation, and historically, this leads to a

decrease in supply, typically driving up Bitcoin’s value.

Matrixport’s report also mentions the influence of macroeconomic

factors on BTC’s price. The expectations of interest rate

adjustments following the Federal Reserve’s Federal Open Market

Committee (FOMC) gatherings are anticipated to have a significant

impact. Furthermore, the forthcoming uncertainty surrounding the US

presidential elections may instigate market fluctuations, leading

investors to turn to alternative assets such as Bitcoin to

safeguard against potential shifts in economic policies. Bitcoin

Price Action And Expert Sentiments Meanwhile, despite Bitcoin

experiencing a nearly 10% surge over the past 14 days, the asset

has witnessed quite a retracement in the previous week, declining

by 2.2%. It’s worth noting that despite this setback, the

cryptocurrency’s market capitalization remains above the $1

trillion mark. Related Reading: Is Bitcoin Price Facing A

Correction To $46,000? Here’s What This Analyst Thinks An analyst

known as Mags has expressed an overwhelmingly bullish sentiment

toward Bitcoin, noting that the asset has “never been this

bullish.” Mags city’s historical patterns and bullish technical

signals reveal that BTC has recently closed a weekly candle above

the 0.618 Fibonacci level, a rare occurrence in the

cryptocurrency’s four-year cycle. #Bitcoin has never been this

bullish For the first time ever, BTC is deviating from the 4 year

cycle by closing a weekly candle above the 0.618 level before the

halving event. The best part about this deviation is it’s a bullish

one, with the rise in demand among institutional…

pic.twitter.com/F9xpTbEZ1d — Mags (@thescalpingpro) February 22,

2024 However, Mike Novogratz, CEO of Galaxy Digital, has cautioned

against potential downside risks, speculating on the possibility of

a regulatory setback or market sentiment shift that could lower BTC

prices to the $45,000-$42,000 range. Featured image from Unsplash,

Chart from TradingView

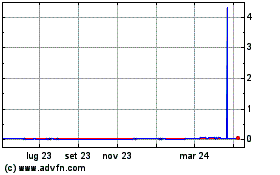

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Dic 2023 a Dic 2024