Nelson Saiers Calls Cheap On The FED With New Sculpture, Why It Matters For Bitcoin

06 Novembre 2021 - 7:55PM

NEWSBTC

On November 3rd, U.S. Federal Reserve Chairman Jerome Powell

finally hinted at the beginning of tapering resulting in Bitcoin

and other cryptocurrencies taking a loss. The market has been

moving sideways since then, cooling off after a rally that took BTC

from $40,000 into price discovery above $65,000. Related Reading |

Inflatable Bitcoin Rat Makes Comeback Due To Federal Reserve Ethics

Issue In the meantime, fund investors turned mathematical artist

Nelson Saiers struck Wall Street once again with one of his iconic

sculptures. Part of a series of conceptual art installations that

should come out in the next weeks, Saiers sculpture is called

“Cheap Money Is Out-of-Order” and was placed in front of the iconic

Wall Street Bull statue as a response to FED Powell. Below you can

see the sculpture in its full glory. The piece is composed of a

vintage gumball machine that offers people $10, hinting at the

historical figure of Alexander Hamilton, whose ideas allowed the

FED to be created, for only 50 cents as a statement made about the

institution’s monetary policies in particular “cheap money”. Its

location is equally important, as it was placed at the heart of the

U.S. financial sector. As you can see below, the gumball machine

has a sign that reads “out of order” highlighting the moral

questions raised about the FED in the past years. Talking to

Bitcoinist about the sculpture and what it represents in a world

where the people have lost faith in the institutions, resulting in

more Bitcoin adoption, the artist claimed the following: I think

people are nervous. The Fed’s balance sheet has grown tremendously

over the last 13 years and more than doubled since spring 2020. You

are seeing more and more worries about real inflation. I mean Jack

Dorsey stated he was concerned about hyperinflation. I think

this coupled with fundamental questions about who these policies

have benefitted eg the ultra-rich have benefitted significantly

from stock and asset appreciation. The Bitcoin And The Bull, A

Hedge Against The FED As Bitcoinist reported, Saiers has a long

track of calling out the FED. In 2018, the artist placed a massive

inflatable Bitcoin rat in the U.S. Federal Reserve building.

Similar to his latest piece, the rat conveyed a general sentiment

of mistrust and lack of confidence in the institution. Saiers’ work

is a representation of the moral issues related to government

officials, especially within the FED, apparently using their

influence to benefit from market fluctuations. Some measures have

been enforced by the institution to mitigate this behavior, but the

FED’s reputation just like its monetary policies seems “cheap”,

“out of order”, insufficient, and tarnish by hidden interest. The

artist said: (…) On top of all this, some real ethics questions

were recently raised due to the personal account activity of

several of the Fed’s presidents. I think this has placed the system

itself under some scrutiny. Bitcoin was born as a response to that

demand for transparency and fairness. As the world economy enters

uncertain times, once again, it seems like the only solution for

those that want to op-out of the FED and their inflated $10 dollar

bills. As of press time, Bitcoin remains rangebound in the low

$60,000 level. The FED’s Quantitative Easing program, due to slow

down with the beginning of tapering, was one of the main drivers of

BTC’s price year-to-year rally. Related Reading | Fed Chair Says

Still “Working on” Digital Dollar as China Pulls Ahead In that

sense, some experts expect downside pressure as liquidity begins to

be removed from the global markets. In the long term, inflation

risk remains as a bullish tailwind for the benchmark crypto as

institutional investors and people buy Bitcoin as a hedge against

it.

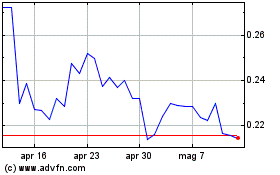

Grafico Azioni ICON (COIN:ICXUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni ICON (COIN:ICXUSD)

Storico

Da Nov 2023 a Nov 2024

Notizie in Tempo Reale relative a ICON (Criptovaluta): 0 articoli recenti

Più ICON Articoli Notizie