It’s Not You, It’s Crypto: Execs Leave Silicon Valley To Join Crypto Startups

24 Dicembre 2021 - 12:59AM

NEWSBTC

A few years ago it was an executives’ dream to work at Google,

Amazon, Apple, and the other Big Tech firms of Silicon Valley, but

now that dream has evolved into crypto startups. Whether it is to

join a blockchain-related company or start a new one, high-paying

executives and engineers are leaving the valley of big salaries and

CEOs at an accelerating rate. The New York Times reported the

exodus of Big Tech executives and the boom of crypto products like

NFTs is seen as a possible reason for it. But if the fantasy of

Silicon Valley talent used to be that cushy position involving good

money, what do crypto firms represent to them now? Could it still

be just about money? Big companies like Google are getting worried

about keeping the talent in. Allegedly, they have started to offer

additional stock grants for the employees who are likely to choose

a crypto startup over them, although the company refused to comment

for the paper. Evan Cheng, co-founder and chief executive of a

blockchain-related startup called Mysten Labs, commented about the

change of hearts: “Back in 2017 or so, people were mostly in it for

the investment opportunity,” and added that “Now it’s people

actually wanting to build stuff.” Execs Are Silicon Valley’s Exes

Here are some of the executives that have broken the Big Tech guys

frozen hearts: Sandy Carter used to be Amazons’ vice president, now

she’s Senior Vice President and Channel Chief of Unstoppable

Domains, a company that uses blockchain domains to connect Web2 to

Web3. Former chief financial officer of Lyft, Brian Roberts, left

the company to join the popular OpenSea Jack Dorsey, of course,

left his position as Twitter’s chief executive to dedicate himself

to Square, now renamed Block because of the blockchain. David

Marcus, the head of cryptocurrency efforts at Meta, is leaving the

company and reportedly joining a cryptocurrency project of his own.

Surojit Chatterjee, Google’s former vice president, is now

Coinbase’s chief product officer. Related Reading | Deloitte

Survey Shows 76% Of Finance Execs Think Physical Money Is Nearing

Its End Will The Exodus Continue? Absolutely yes, said Sandy

Carter, the former Amazon vice president. She thinks that “It’s the

perfect storm,” and added that “The time is just perfect to jump in

on it.” Meanwhile, Brian Roberts told The New York Times in an

email: “I’ve seen enough cycles and paradigm shifts to be cognizant

when something this big is just emerging, … We are Day 1 in terms

of NFTs and their impact.” Back to the question of why exactly is

the talent leaving Silicon Valley, a part of the decision might be

related to the salaries, but another side of it is ideological and

enthusiastic: engineers are tired of dealing with bureaucracy, many

feel the desire to build something, plus the ethics and moral

aspects of Big Tech firms don’t help either. Ms. Carter noted that

some of this talent is being lured by the empowerment of

decentralization against the dominance of large companies. It is

appealing to not be part of the ones controlling personal data to

generate a large income. “Software engineering culture has always

leaned toward anti-authoritarianism” explained Dan

McCarthy from the firm Paradigm. He, who spent seven years

recruiting talent for Google, paints the scenario of working for a

FAANG company (Facebook, Amazon, Apple, Netflix, and Google): your

impact on the product you’re building may be negligible, nothing

you’ll work on is truly yours, … That’s setting aside all of the

ethical quandaries related to privacy, security, and ownership that

are inherent to those companies and grating to anyone who

self-identifies as anti-authoritarian on any level. He further

explains the attractiveness of crypto startups token-based vesting

model, where “employees accrue an ownership stake in the company

over time just like stock options”, but including the benefits of

“no exercise cost”, tokens being “governed by a transparent,

immutable smart contract”, plus they retain “liquidity continuously

over time”, and other positive aspects. He notes several other

luring points, like the openness of DAOs in comparison to the lack

of transparency and invasive behavior of big tech, and the

possibility of causing “real-world impact”, which he defines as

“the ability of one person to influence the direction of a project

or technology.” Related Reading | Cardano Founder Spills The

Beans on “Fakeness” of Silicon Valley

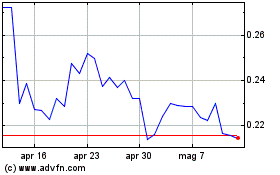

Grafico Azioni ICON (COIN:ICXUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni ICON (COIN:ICXUSD)

Storico

Da Nov 2023 a Nov 2024