Bitcoin Price Forecast: Decisive 24 Hours Ahead With Crucial Support And Resistance Levels

26 Settembre 2024 - 10:30AM

NEWSBTC

According to technical analyst InspoCrypto, the current state of

the Bitcoin (BTC) market reflects mixed sentiment and potential for

volatility, particularly as the Bitcoin price hovers between

$63,000 and the $64,000 mark. Bitcoin Price Analysis

InspoCrypto’s analysis indicates that the maximum slippage recorded

was 16.5, which points to moderate liquidity in the market. A

volume delta of 415.848 million suggests a cumulative imbalance

between buy and sell orders, with increased buying pressure

supporting the recent price rise. This indicates that liquidity is

sufficient to prevent sudden price shocks. Related Reading: Solana

(SOL) Consolidates in Symmetrical Triangle – Analyst Reveals $160

Target On Breakout Hyblock Capital’s heatmap analysis reveals

critical liquidation levels based on traders’ leverage positions.

Notably, substantial liquidity exists around the $60,000 and

$64,000 zones, indicating potential resistance just above the

$64,500 mark due to a heavy cluster of short liquidations.

Conversely, long liquidations are concentrated around $61,000,

which could serve as a significant support level for the Bitcoin

price. A breach of $64,000 may trigger short liquidations,

potentially driving prices higher, while a drop below $61,000 could

lead to cascading long liquidations. Examining the distribution of

open interest (OI), significant concentrations are found in the

$64,200 to $64,400 range. This suggests strong trader positioning,

indicating that a substantial move away from this zone could lead

to increased volatility. Additionally, the funding rate

stands at -12.678%, indicating a dominant short position in the

market, with shorts effectively paying to maintain their

positions. Whales Favor Long Positions The current bid-ask

ratio is at 38.618%, reflecting a slightly ask-heavy market, which

indicates that selling pressure outweighs buying demand. This

sentiment is further supported by the average leverage delta, which

is at -6.67, showing that short traders are using more leverage

than longs, reinforcing a bearish outlook. However, the

volume delta is positive at 4.60 million, indicating a net buying

imbalance that could support upward momentum. The Whale vs. Retail

Delta stands at 56.681%, suggesting that whales are slightly longer

compared to retail traders. This minor bullish sentiment from

larger players could influence market dynamics as whales typically

have a greater market impact. Related Reading: Ethereum Whales

Spend $185 Million To Accumulate 70,000 ETH, Time To Buy? Overall,

the analyst contends that the Bitcoin price is exhibiting mixed

signals. The negative funding rate and higher short leverage

indicate a potential downward move, but significant open interest

and positive volume delta suggest that a breakout in either

direction could be imminent. InspoCrypto suggests that in the next

24 hours, traders should prepare for volatility, particularly if

liquidation zones around $61,000 or $64,500 are triggered. By

the end of the week, it is expected that the Bitcoin price could

either break resistance near $64,500 or test support at $61,000. If

funding rates shift to positive, further upward momentum may

follow. At the time of writing, the Bitcoin price stands at

$63,370, recording minor losses of 0.3% compared to Tuesday’s

trading session. Featured image from DALL-E, chart from

TradingView.com

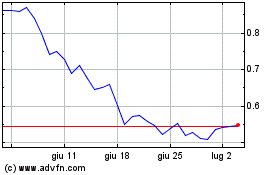

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Dic 2023 a Dic 2024