Bitcoin Price Forecast: Q4 Outlook Indicates Parabolic Move Toward $120,000

26 Settembre 2024 - 11:00PM

NEWSBTC

For the past five days, the Bitcoin price has remained locked in a

narrow range between $62,000 and $64,000, following a surge of

bullish sentiment triggered by the US Federal Reserve’s (Fed)

decision to cut interest rates on September 18. This pivotal

move by the Fed has sparked optimism among investors. Yet, Bitcoin

has struggled to consolidate above the critical $64,000 level,

which, if surpassed, could pave the way for a retest of previously

lost resistance levels, potentially targeting $70,000 in the near

term. Bitcoin Price Set To Reach New All-Time Highs? Despite this

short-term stagnation, several analysts maintain an optimistic

outlook for the Bitcoin price as the market approaches the fourth

quarter (Q4) of the year. Market expert Lark Davis, for example,

recently highlighted the historical trends that suggest the average

return for Bitcoin during Q4 is a notable 88%. Davis

suggested that if the Bitcoin price were to replicate this

performance, it could soar to nearly $120,000. Even a more

conservative estimate of a 55% gain – similar to last year’s

performance – would take the price to $100,000. Related Reading:

Dogecoin Parabolic Rally To Trigger 5,500% Surge To $6, Here’s When

In addition, the expert points out that this year offers unique

catalysts that could drive significant price movements, including

the launch of the Bitcoin exchange-traded fund (ETF) market, the

upcoming US elections, and the expected $16 billion in cash

repayments from the collapsed FTX exchange. However, when

analyzing the current state of the Bitcoin market, there are signs

that current price movements are being “artificially constrained.”

Analysts Warns Of Final Dip Before Further Price Gains Analyst

InspoCrypto has noted that the price action has been persistently

hovering around $63,000, with breakout attempts being blocked. A

significant institutional options trader has reportedly executed a

block trade that appears designed to keep Bitcoin’s price stable

until October 4. InspoCrypto further explains that the Spot

Cumulative Volume Delta (CVD) indicates a pattern of distribution

even as prices rise, while the Futures CVD shows a divergence,

suggesting that recent price increases have been primarily driven

by futures trading. The Whales vs. Retail Ratio analysis from

Hyblock supports this view, revealing that while whales are

accumulating short positions, retail investors are predominantly

betting on long positions—creating a potentially unfavorable

scenario for the latter group. Yet, InspoCrypto believes that the

market will see one final dip before reaching new all-time highs

(ATHs) of $80,000 or even $85,000 for the largest cryptocurrency on

the market. Related Reading: XRP Remains Bullish: Crypto Experts

Unveil Predictions For The Price Adding to the technical analysis,

analyst Ali Martinez points out that Bitcoin is currently testing

its 200-day Simple Moving Average (SMA) at the $64,000 mark, which

is acting as a short-term resistance level. A breakout above this

key level could signal a significant bullish trend, according to

Martinez. Looking further ahead, if the Bitcoin Long-Term Power Law

holds true, Martinez believes the next market top could reach

around $400,000, with predictions for this peak to occur by October

of next year. Overall, while Bitcoin faces short-term challenges,

the consensus among analysts is that the cryptocurrency is poised

for new all-time highs in Q4 and into 2025, despite the current

state of the market and BTC’s inability to overcome short-term

hurdles. At the time of writing, BTC is trading at $63,160,

little changed from Monday’s price, and up 0.7% over the past 24

hours. Featured image from DALL-E, chart from TradingView.com

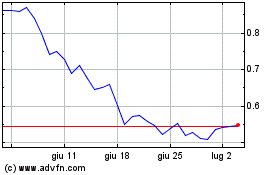

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Dic 2023 a Dic 2024