Analysts Debate Bitcoin’s Next Move As BTC Hits $75K All-Time High

07 Novembre 2024 - 9:00AM

NEWSBTC

Bitcoin has experienced a notable surge in price, reaching an

all-time high of $75,358 following the announcement that former US

President Donald Trump has been reelected, becoming the 47th

President of the United States. So far, the asset’s value has seen

a nearly 10% spike in the past day before experiencing a slight

correction, trading at $74,037 at the time of writing—a decline of

approximately 1.1% from its peak earlier today. The dramatic price

increase has prompted widespread discussion within the

cryptocurrency community, with prominent analysts offering their

insights on the next move of Bitcoin. Related Reading: Bitcoin

Price Touches $75,000 ATH: Analyst Says This Is What You Should

Expect Next Is The Top In For Bitcoin? CryptoBullet, a well-known

market analyst on X, focused on Bitcoin’s dominance index (BTC.D)

about a technical indicator called the TD Sequential. In a recent

post on X, the analyst wrote, “Is BTC Dominance finally topping

out? BTC.D is printing the second TD-9 Sell on the 2W timeframe

this cycle.” The TD Sequential is a technical analysis tool used to

identify potential trend reversals. According to CryptoBullet, the

current cycle shows similarities to previous years, where a second

TD-9 signal often marks a significant reversal. He highlighted past

patterns from 2018, 2019, and 2021, suggesting that a similar trend

could unfold in 2024, with Bitcoin dominance potentially nearing

its peak. Is #BTC #Dominance finally topping out? 🤔$BTC.D is

printing the second TD-9 Sell on the 2W timeframe this cycle 👀 IMO

this is something worth paying close attention to. 💡 We can see the

same pattern repeating itself over and over again: no matter which

direction #BTC… pic.twitter.com/j7Y3kGaQXJ — CryptoBullet

(@CryptoBullet1) November 6, 2024 More Room For Rally? Adding to

the conversation, another analyst, Ali, shared his perspective on

X, cautioning market participants. Ali noted that the TD Sequential

recently flashed a sell signal on Bitcoin’s four-hour chart,

indicating a possible pullback to $72,000. However, he noted that a

sustained close above $75,400 could negate this bearish outlook and

potentially push Bitcoin’s price to a new high of $78,000. If

you’re late to the bull party, take caution: the TD Sequential just

flashed a sell signal on the #Bitcoin $BTC 4-hour chart, hinting at

a possible pullback to $72,000. However, a sustained close above

$75,400 would invalidate this bearish setup and trigger an upswing

to… pic.twitter.com/Ljd8lyPsM4 — Ali (@ali_charts) November 6, 2024

Meanwhile, a CryptoQuant analyst known as MAC.D offered a broader

perspective on Bitcoin’s market cycle using the MVRV (Market Value

to Realized Value) ratio. This on-chain metric measures whether

Bitcoin is undervalued or overvalued relative to its historical

price levels. According to MAC.D, the MVRV ratio suggests that

Bitcoin has not yet reached an “overheating stage,” indicating

further upside potential. Related Reading: Analyst Reveals

Bitcoin’s ‘Chopsolidation’ Phase Nears End—Are New Highs in Sight?

However, as the market matures and capitalization grows, Mac noted

that the rate of price increase tends to slow down. Adding: “Using

this as a trend line, we can expect the market to overheat when the

MVRV value is around 3.” Featured image created with DALL-E, Chart

from TradingView

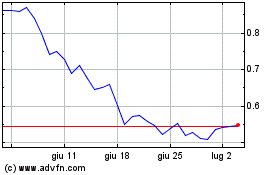

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Dic 2023 a Dic 2024