ORDI: Extraordinary Price Movement Excites Investors – Here’s Why

30 Gennaio 2024 - 8:59AM

NEWSBTC

At the time of writing, ORDI is experiencing a substantial increase

in price after several events in the crypto world unraveled.

Coingecko data reveals that ORDI is up nearly 12% in the past 24

hours. However, it remains to be seen whether this uptick in price

will erase the bearishness experienced in the past few weeks.

But right now, the crypto market, as a whole, is up a huge amount.

The latest market data shows that the broader market is up nearly

3% after the bullishness brought by major coins and tokens like

Bitcoin. Related Reading: MakerDAO Co-Founder Cashes Out, Sends MKR

Wobbling After $4.5 Million Sell Stiff Competition In The Bitcoin

ETF Space After 11 Bitcoin spot exchange-traded funds were approved

by the Securities and Exchange Commission earlier this month, the

competition surrounding the Bitcoin ETF space grew this month.

According to recent news, Fidelity’s Bitcoin ETF has outpaced

Grayscale’s GBTC in inflows. JP Morgan also said that the outflows

from GBTC were directed to its newer competitors with lower

fees. “GBTC profit taking has largely happened already…This

would imply that most of the downward pressure on Bitcoin from that

channel should be largely behind us,” said JPMorgan analysts led by

Managing Director Nikolaos Panigirtzoglou in a recent

statement. ORDIUSD currently trading at $61.5808 on the daily

chart: TradingView.com The financial institution also points to

Blackrock and Fidelity’s individual Bitcoin ETFs to dominate the

market in the long term. However, Grayscale’s CEO Michael

Sonnenshein believes that the majority of the recently approved

ETFs won’t survive in the long term. He also defended the higher

feeds imposed by Grayscale compared to its competitors. “Investors

are weighing heavily things like liquidity and track record and who

the actual issuer is behind the product. Grayscale is a crypto

specialist. And it has really paved the way for a lot of these

products coming through,” said Sonnenshein in a recent interview

with CNBC. Related Reading: Solana Breakout Looms – Will SOL

Retake $100 Before Start Of February? ORDI: Higher High In The Near

Future ORDI is mostly following Bitcoin’s pace in the broader

market. As of writing, BTC is sitting at $43.4k and rising. If

Bitcoin continues to sail the bullishness, we might see ORDI follow

suit. In the context of ORDI, events such as those mentioned

above will also put the spotlight on BRC-20 standard tokens which

has gained momentum since last year. As of now, ORDI’s position

remains attractive for investors and traders as it rides the

bullish wave that Bitcoin created. If this bullishness continues,

bulls will have enough momentum to settle on the 50% retracement

level, which will provide a solid base to pump higher in the

future. However, a more conservative bullish prediction is ORDI

stabilizing above the 61.80% retracement level. If this happens,

investors and traders will still experience profits with a much

more stable platform for future price movements. Featured

image from Shutterstock, chart from TradingView

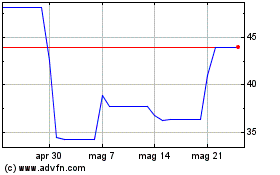

Grafico Azioni Ordinals (COIN:ORDIUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Ordinals (COIN:ORDIUSD)

Storico

Da Mar 2024 a Mar 2025