Grayscale Claims ‘Next Bitcoin Halving Is Different’: What’s Changed?

13 Febbraio 2024 - 12:00AM

NEWSBTC

In Grayscale’s latest report, “2024 Halving: This Time It’s

Actually Different,” Michael Zhao, provides an in-depth analysis of

the evolving dynamics within the Bitcoin ecosystem as the next

halving event approaches in mid-April 2024. The report argues for a

significant departure from previous cycles, underlined by the

advent of spot Bitcoin ETFs in the United States, evolving

investment flows, and innovative use cases emerging within the

Bitcoin network. The Essence Of Bitcoin Halvings Halvings, designed

to halve the reward for mining Bitcoin transactions every four

years, are pivotal in maintaining Bitcoin’s scarcity and

disinflationary profile. Zhao articulates, “This disinflationary

characteristic stands as a fundamental appeal for many Bitcoin

holders,” emphasizing the stark contrast with the unpredictable

supplies of fiat currencies and precious metals. Despite historical

price surges post-halving, Zhao cautions against assuming such

outcomes as guarantees, stating, “Given the highly anticipated

nature of these events, if a price surge were a certainty, rational

investors would likely buy in advance, driving up the price before

the halving occurs.” Distinguishing Factors Of The 2024 Halving

Macroeconomic Factors According to Zhao, macroeconomic factors have

differed in each cycle, however, always propelling the BTC price to

new heights. The researcher describes the European debt crisis in

2012 as a significant catalyst for Bitcoin’s rise from $12 to

$1,100, highlighting its potential as an alternative store of value

amidst economic turmoil, “Similarly, the Initial Coin Offering boom

in 2016—which funneled over $5.6 billion into altcoins—indirectly

benefited Bitcoin as well, pushing its price from $650 to $20k by

December 2017. Most notably, during the 2020 COVID-19 pandemic,

expansive stimulus measures […] [drove] investors towards Bitcoin

as a hedge, which saw its price escalate from $8,600 to $68k by

November 2021,” Zhao states. Thus, Zhao suggests that while the

halvings contribute to Bitcoin’s scarcity narrative, the broader

economic context is also always critically impacting Bitcoin’s

price. Miners’ Strategic Adjustments Anticipating the next BTC

halving in April, miners have proactively adjusted their strategies

to counterbalance the impending reduction in block reward income

amidst escalating mining difficulties. Zhao observes a strategic

move among miners, noting, “There was a noticeable trend of miners

selling their Bitcoin holdings onchain in Q4 2023, presumably

building liquidity ahead of the reduction in block rewards. Related

Reading: Bitcoin Price Forecast: Analyst Predicts $100,000 Peak

Before Halving Event This foresight suggests miners are not merely

reacting but are actively preparing to navigate the challenges

ahead, ensuring the network’s resilience. “These measures

collectively suggest that Bitcoin miners are well-positioned to

navigate the upcoming challenges, at least in the short term,” the

Grayscale researcher argues. The Emergence Of Ordinals And Layer 2

Solutions The introduction of Ordinal Inscriptions and the

exploration of Layer 2 solutions have introduced new dimensions to

Bitcoin’s functionality and scalability. Zhao emphasizes the

significance of these innovations, stating, “Digital

collectibles…have been inscribed, generating more than $200 million

in transaction fees for miners.” This development has not only

augmented Bitcoin’s utility but also provided miners with new

avenues for revenue generation. Furthermore, Zhao highlights the

potential of Layer 2 solutions to address Bitcoin’s scalability

challenges, pointing out, “The growing interest in Taproot-enabled

wallets…indicates a collective move toward addressing these

challenges.” This reflects a concerted effort within the Bitcoin

community to enhance the network’s capabilities and accommodate a

broader range of applications. The Role Of ETF Flows The approval

and subsequent introduction of spot Bitcoin ETFs have significantly

influenced Bitcoin’s market structure, facilitating wider access

for investors and potentially mitigating sell pressure from mining

rewards. Zhao articulates the impact of ETF flows, asserting,

“Following US spot Bitcoin ETF approvals, the initial net

flows…amounted to approximately $1.5 billion in just the first 15

trading days.” Related Reading: Expert Predicts Bitcoin Price Rally

To $58,000, Here’s Why This suggests that ETFs could play a crucial

role in balancing the market dynamics post-halving by absorbing a

significant portion of the typical sell pressure post-Halving. “In

order to maintain current prices, a corresponding buy pressure of

$14 billion annually is needed. Post-halving, these requirements

will decrease by half: […] that equates to a decrease to $7 billion

annually, effectively easing the sell pressure.” A Promising

Outlook for Bitcoin According to Grayscale’s analysis, the next

Bitcoin halving will be different for a number of reasons. Overall,

the outlook is highly bullish: Bitcoin has not only weathered the

storm of the bear market but has also emerged stronger, challenging

outdated perceptions with its evolution in the past year. While it

has long been heralded as digital gold, recent developments suggest

that Bitcoin is evolving into something even more significant. At

press time, BTC traded at $49,708. Featured image created with

DALLE, chart from TradingView.com

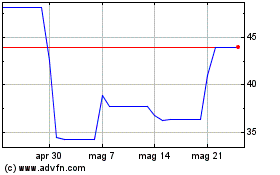

Grafico Azioni Ordinals (COIN:ORDIUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Ordinals (COIN:ORDIUSD)

Storico

Da Feb 2024 a Feb 2025