As Bitcoin Supply Tightens, Could A Breakout Be On The Horizon?

12 Settembre 2024 - 8:30PM

NEWSBTC

Recent changes in the behavior of Bitcoin on the market suggest the

coin could be preparing for its next significant bull run. One

important consideration is the fall in Bitcoin reserves on

exchanges. Less of Bitcoin is accessible for trading as owners

migrate it to cold storage. Historically, this kind of decrease

usually comes before significant price rises. Related Reading: AAVE

Excites Investors With 20% Gain As Developments Roll Out Declining

Bitcoin Reserve Reserves of Bitcoin on exchanges have been

declining drastically. This drop means that everyday traders are

losing control over the crypto while it is being transferred to

cold storage. Recent data by CryptoQuant amply illustrates this

trend. Usually, declining exchange reserves for Bitcoin point to

declining selling pressure. This thus produces conditions fit for

possible price increase. Looking back at past trends, such declines

in reserves have sometimes been accompanied by somewhat substantial

price swings. Bitcoin’s Next Bull Run? “Decreasing #Bitcoin

reserves and rising stablecoin reserves indicate a bullish outlook

for Bitcoin. As the market supply tightens and buying power builds,

we could be on the verge of a price rally.” – By @OnchainTarek Link

👇https://t.co/frUAfdSBrk pic.twitter.com/4fxB9cowf1 —

CryptoQuant.com (@cryptoquant_com) September 11, 2024 Regular

Withdrawal Patterns Supporting these observations, further

understanding comes from IntoTheBlock’s netflow data. Over many

time periods, the data shows a constant pattern of Bitcoin

withdrawals from exchanges. Bitcoin saw a net loss of 8.03K BTC in

the past 24 hours alone, while 6.29K BTC was taken out throughout

last week. The netflow has been negative even during the past

month. This consistent loss of Bitcoin from markets supports the

belief that investors are clinging to their assets, maybe waiting

for more favorable conditions to sell. Increase In Stablecoin

Reserves Apart from the declining BTC holdings, stablecoin reserves

on exchanges clearly have increased. This increase speaks to market

liquidity rising. Usually, traders are getting ready for

opportunities for future purchase. Increase in USDT stablecoin

holdings on exchanges since August “When stablecoins flow into

exchanges and increase their holdings, it is generally interpreted

as funds waiting to buy, which will have a positive effect on the

price.” – By @Yonsei_dent Link 👇… pic.twitter.com/wsrY0rCFaC —

CryptoQuant.com (@cryptoquant_com) September 10, 2024 Stablecoins

are easily accessible pool of money ready for swift deployment.

More stablecoins entering the market indicate that investors are

ready to seize possibilities, which may cause a major price

breakout. Looking ahead, institutional interest and macroeconomic

elements are also rather important in determining the possible

price trajectory of Bitcoin. Although past rate increases by the

Federal Reserve have slowed down the crypto asset’s expansion,

possible rate reduction could create a more suitable habitat for

the BTC. Furthermore increased institutional demand spurred by

potential approval of physical exchange-traded funds (ETFs) could

help to further increase Bitcoin’s liquidity and general

acceptance. Related Reading: Analysts Predict XRP ‘Mega Pump’ And

‘Perpetual Cycle’ – Details Bitcoin Price Forecast The future of

Bitcoin excites experts; some estimate a price of $100,000 by 2025.

Macroeconomic changes and increasing institutional participation

help to encourage this positive attitude. With the decline in

exchange reserves and increase in stablecoin reserves, the present

market dynamics point to Bitcoin perhaps preparing the ground for

its next significant surge. The indicators suggest a possible

Bitcoin bull run. The backdrop created by declining reserves on

exchanges, rising stablecoin liquidity, and consistent withdrawal

patterns should help to support notable price rises. With improving

macroeconomic conditions and rising institutional interest,

Bitcoin’s road to $100,000 by 2025 seems increasingly feasible.

Featured image from Pexels, chart from Trading View

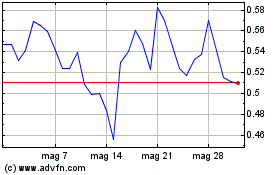

Grafico Azioni Sei (COIN:SEIUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Sei (COIN:SEIUSD)

Storico

Da Dic 2023 a Dic 2024