Bitcoin Price Hits $63,000 – Is The Market Set For Takeoff?

12 Ottobre 2024 - 5:00PM

NEWSBTC

According to data from CoinMarketCap, Bitcoin (BTC) gained by 4.08%

in the last 24 hours as it briefly traded above the $63,000 price

mark. Notably, this price rise comes following a decline that saw

the market leader trade below $59,000 on Thursday. While the market

sentiment is currently bullish, certain conditions are needed to

procure an actual bullish breakout. Related Reading: Bitcoin Price

Crash: $1.83 Billion Makes Its Way To Exchanges, Is A Bloodbath

Coming? Bitcoin On The Brink Of Short-Term Bullish Run Following

Bitcoin’s price ascent to around $62,000 on Friday, CryptoQuant

analyst with the username Yonsei_dent shared a key insight on the

asset’s potential price movement. In a Quickake post,

Yonsei_dent highlights $62,700 to be the key price level for

short-term holders i.e. $62,700 represents the average price at

which many short-holders acquired Bitcoin, which the analyst states

has remained consistent for the last three months. Therefore, this

presents a critical price level for BTC, a movement above which

signals a change in a market shift and can spur buying activity

from short-term holders. However, Yonsei_dent notes that Bitcoin

needs to rise above $63,000 to initiate a significant bullish

momentum over the coming weeks. Since this price commentary,

Bitcoin has traded above $63,000, albeit temporarily before

retracing to around $62,300. This brief breakout can be traced to a

lack of significant trading volume, a condition critical to the

short-term bullish breakout deceived by Yonsei_dent. Currently,

Bitcoin’s trading volume is valued at $30.75 billion, however,

reflecting only a minor 2.94% gain in the last 24 hours. If

the price of BTC returned above $63,000 with a marked increase in

trading activity, the premier cryptocurrency could rise to around

$67,000, at which lies its next significant price resistance level.

Related Reading: Is The Bitcoin Bull Run Over? Top Analyst Predicts

What’s Next For Crypto Bitcoin Approaches Critical November

In contrast to popular sentiments, Bitcoin has so far experienced a

rather tumultuous experience in October. And while the crypto

market leader may eventually pull off an “Uptober”, November is

shaping up to potentially provide the needed bullish drivers for

the BTC market. Firstly, investors expect the Federal Reserve to

implement a 25 basis points cut which would avail more liquidity

for volatile assets such as Bitcoin. Furthermore, the

upcoming US elections have also gained significant influence in the

crypto market with digital asset regulation becoming a major policy

discussion. If pro-crypto Republican candidate Donald Trump secures

victory over Vice President Kamala Harris, analysts are hopeful the

Bitcoin bull run will finally take off. At the time of

writing, Bitcoin trades at $62,697 reflecting a 1.07% gain in the

last week. Featured image from Forbes, chart from Tradingview

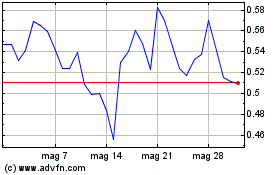

Grafico Azioni Sei (COIN:SEIUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Sei (COIN:SEIUSD)

Storico

Da Dic 2023 a Dic 2024