Analyst Warns Of 10% Bitcoin Price Drop Ahead Of CPI Data

13 Novembre 2024 - 3:00PM

NEWSBTC

Recently, there have been significant fluctuations in the prices of

Bitcoin; presently, they oscillate between $87,000-$87,500. This

may not be eye candy to investors who are currently on the

sidelines waiting for the coin to hit $90k, particularly the

release of CPI data set today, November 13. This news is perceived

by analysts to have a considerable influence on market sentiment

and the expected direction of the alpha crypto asset. Related

Reading: XRP Price Patterns And 2024 Election Spark Talk Of A New

Rally The Barometer For Inflation Reflecting changes in the prices

consumers pay for goods and services, the CPI report is a main

indication of inflation. Expectations about the CPI can cause more

volatility in the bitcoin markets as inflation rates affect the

Federal Reserve’s choices on monetary policy. Recent trends imply

that should inflation remain lowered, the Federal Reserve might cut

interest rates—historically this has had a positive effect on

Bitcoin prices. Reduced borrowing rates sometimes inspire

investment in risky assets such as cryptocurrencies, hence

increasing demand for Bitcoin. #Bitcoin is up to $90,000 and I

think we’re about to get started with the markets. The sweet spot

is having a 10% correction towards the CME gap before we continue.

I’m slightly bearish going into CPI tomorrow.

pic.twitter.com/dfpUc2df1k — Michaël van de Poppe (@CryptoMichNL)

November 12, 2024 Growing Investor Trust Famous crypto expert

Michaël van de Poppe, the founder of MNConsultancy, said that the

current state of affairs in the crypto market corresponds well to

the positive assessment of Bitcoin. In case CPI statistics would

indicate more cases of inflation drops, he says that this would

lead to growing investor trust and higher capital inflows into

Bitcoin and other cryptocurrencies. Will Bitcoin Retrace? He also

cautions, though, that unanticipated inflation rises could surprise

markets and cause pricing adjustments all around. He anticipates a

10% Bitcoin retracement prior to the release of CPI data, targeting

a range of $75,660 to $81,193. Market Reactions And Predictions As

traders get ready for the CPI figures, the general market mood

remains mixed. Some experts think that positive CPI numbers could

lead to a rise in Bitcoin prices, but others say that people

shouldn’t get too excited. Meanwhile, many investors are still

optimistic about the long-run prospects of Bitcoin. The incoming

administration of newly-elected US President Donald Trump adds

another layer of complexity to market dynamics. Related Reading:

Shiba Inu Strategic US Hub Plan Sends SHIB Price On A 23% Moonshot

According to Van de Poppe, short-term regulatory actions will

benefit Bitcoin, but their long-run consequences might be something

more complex if control for inflation is not handled well.

Meanwhile, as Bitcoin continues in its path for a major price

discovery, the focus will be on the CPI data and the impact they

have on digital assets. Such an unpredictable environment should be

approached with caution by investors while they remain focused on

economic events that could swing their investments. At the time of

writing, Bitcoin was trading at $87,509, up 2.1% and 17.2% in the

daily and weekly timeframes, data from Coingecko shows. Featured

image from The VR Soldier, chart from TradingView

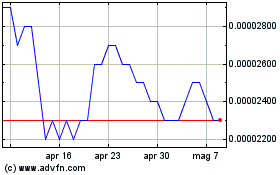

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Ott 2024 a Nov 2024

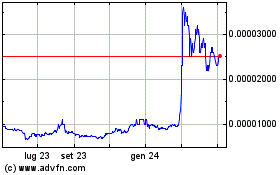

Grafico Azioni SHIBA INU (COIN:SHIBUSD)

Storico

Da Nov 2023 a Nov 2024