Bitcoin Miners Strike Gold: $107 Million Profit From Runes-Fueled Minting Spree

22 Aprile 2024 - 10:30AM

NEWSBTC

Bitcoin miners have struck a proverbial goldmine, reaping an

astonishing $107 million in profits, according to data from

Glassnode, a leading analytics platform. This unprecedented

windfall, amassed on April 20th, underscores a significant shift in

the revenue dynamics of Bitcoin mining operations. Related Reading:

Will Celestia (TIA) Hit $130? Analyst Makes Bold Prediction The

meteoric rise in transaction fees serves as a bellwether for the

evolving economic landscape of Bitcoin mining. As the network

adapts to new market demands and technological advancements,

transaction fees have emerged as a crucial revenue stream for

miners. This trend is particularly noteworthy given the scheduled

reductions in block rewards, highlighting the resilience and

adaptability of Bitcoin’s economic model. According to glassnode,

affected by the Runes minting activity, on April 20, Bitcoin miner

revenue reached US$106.7 million, of which 75.444% came from

network transaction fees, both reaching record highs.

https://t.co/lVSyqn1UaE pic.twitter.com/xjkkTor2I9 — Wu Blockchain

(@WuBlockchain) April 21, 2024 Runes-Fueled Minting Spree Boosts

Miner Revenue Driving this surge in profitability is a recent

minting spree focused on Runes, a pivotal development that has left

a tangible mark on the network’s dynamics. Reports indicate that a

staggering 75% of the total profits stemmed from transaction fees,

marking a new pinnacle in the distribution of revenue among BTC

miners. Runes is similar to Ordinals; they both let users

permanently store data directly on the Bitcoin blockchain, like an

inscription etched in stone. But there’s a key distinction in what

they store: Ordinals are one-of-a-kind digital collectibles,

similar to fancy trading cards. Runes, on the other hand, are

designed to act more like meme coins, those widely tradable and

often humorous tokens that have been a recent craze in the crypto

world. BTCUSD trading at $66,144 on the weekly chart:

TradingView.com This paradigm shift in income composition

underscores the growing importance of transaction fees as a vital

income source, especially as block rewards face planned reductions

in the context of Bitcoin’s halving system. This financial triumph

comes amidst ongoing debates surrounding the sustainability and

profitability of mining activities. With escalating energy demands

and mounting regulatory scrutiny, the viability of mining

operations has been called into question. However, the recent data

paints a reassuring picture of the economic vitality of Bitcoin

mining, demonstrating its resilience in the face of external

pressures. Implications For Bitcoin’s Future Beyond the immediate

financial gains, the surge in transaction fees holds profound

implications for the future trajectory of Bitcoin. The

unprecedented collection of fees signifies robust network activity

and user engagement, indicating strong demand and utilization of

the Bitcoin blockchain. This bodes well for the long-term

sustainability and development of Bitcoin as a prominent digital

currency, bolstering confidence among stakeholders and enthusiasts

alike. Related Reading: Ethereum Fueled Up: Will 320 Million USDT

Inflow Ignite Price Surge? Featured image from VistaCreate, chart

from TradingView

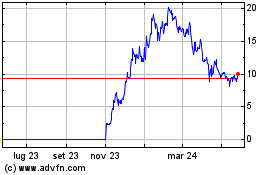

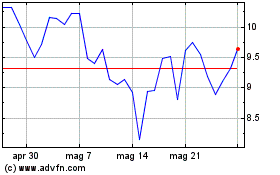

Grafico Azioni Celestia (COIN:TIAUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Celestia (COIN:TIAUSD)

Storico

Da Feb 2024 a Feb 2025