Bullish Bitcoin Indicator Which Led To A Reversal Has Returned, Is $70,000 Possible?

14 Luglio 2024 - 3:30AM

NEWSBTC

Jamie Coutts, the chief crypto analyst at Real Vision, has

highlighted an indicator that paints a bullish picture for Bitcoin

(BTC). Based on this indicator, the crypto analyst suggested that a

reversal might already be on the horizon for the flagship

crypto. Bitcoin Hashrate Decline Is Slowing Coutts mentioned

in an X (formerly Twitter) post that Bitcoin’s hash rate decline is

slowing, which he noted usually precedes a bottom ad reversal of

the bearish cross, which happened after the halving event. He,

however, warned that a bullish reversal still depends on a

“stabilization in the downtrend.” Related Reading: Analyst Predicts

2,750% Celestia (TIA) Price Explosion To $188, Here’s The Roadmap

The crypto analyst further noted that the percentage difference

between the 30- and 90-day moving averages aligns with previous

hash rate contractions and isn’t as severe as the post-2020

halving. A slowdown in Bitcoin’s hash rate decline is significant

because it suggests that miners’ capitulation may be ending

soon. Crypto expert Willy Woo previously mentioned that the

market will recover when “weak miners die, and hash rate recovers.”

He further explained that inefficient miners will have to go into

bankruptcy while other miners are forced to purchase more efficient

hardware. Cryptoquant’s CEO Ki Young Ju has provided insights into

when this miners’ capitulation might end. He stated that it usually

ends when the daily average mined value is 40% of the yearly

average. The crypto founder further revealed that it is currently

at 72%, suggesting that it could still take a while before miners

eventually cool off on offloading their reserves. Ki Young Ju

told market participants to expect the crypto markets to be dull

for the next two to three months. He urged them to stay long-term

bullish but avoid excessive risk. Crypto analysts like Mikybull

Crypto have also assured that Bitcoin’s long-term outlook is

bullish as the flagship crypto is still far from its bull market

peak. Market Still Recovering From Supply Overhang Coutts

also mentioned that the market is still recovering from the supply

overhang. This is in relation to the selling pressure that Bitcoin

experienced thanks to the German government, which offloaded nearly

50,000 BTC on the market. As such, it could take a while for the

market to suck up this Bitcoin supply. Related Reading:

Market Strategist Predicts 32% Stock Market Crash, How Will This

Affect Crypto? While this selling pressure has negatively impacted

the market, Coutts stated that the distributions of the German

government sales and Mt. Gox reserves can help remove the “annoying

supply overhang.” The analyst noted that this would happen through

distributing these coins to a wider array of holders, which would,

in turn, grow the Bitcoin network and leave the flagship crypto

even better off than before. At the time of writing, Bitcoin

is trading at around $58,300, up over 2% in the last 24 hours,

according to data from CoinMarketCap. Featured image created

with Dall.E, chart from Tradingview.com

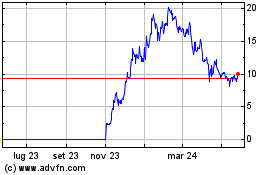

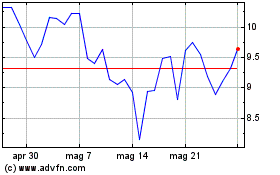

Grafico Azioni Celestia (COIN:TIAUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Celestia (COIN:TIAUSD)

Storico

Da Feb 2024 a Feb 2025