Tether Holds $3.4 Billion In Gold Reserves, Nears ATH Market Cap 1 Year Post Terra Collapse

14 Maggio 2023 - 8:40AM

NEWSBTC

Tether (USDT), the world’s largest stablecoin by market

capitalization, was one of the dollar-pegged cryptocurrencies to

have been affected by the collapse of the Terra ecosystem. Now – a

year later, the stablecoin has reclaimed its stable dollar peg and

boasts one of the deepest reserves in the cryptocurrency industry.

Related Reading: Tether Smashes Records, $1.48 Billion Profit In

Q1- Surplus Over Reserves Hits All-Time High Prominent Crypto

Figure Dubs Tether A ‘Precious Metals Powerhouse’ Gabor

Gurbacs, on Friday, May 12, provided an insight into the

significance of precious metals to Tether’s financial setup.

Interestingly, Gurbacs, the founder of PointsVille, dubbed Tether’s

USDT a “precious metals powerhouse”. According to Gurbacs’ tweet,

Tether Holdings Limited, the issuer of the USDT stablecoin, has

placed substantial importance on gold, forging a solid reputation

in the industry. His tweet also reveals that USDT, the

third-largest cryptocurrency by market cap, has a staggering sum of

roughly $3.4 billion in reserves held in gold. In the same breath,

Gurbacs noted that approximately $500 million backs the circulating

supply of Tether Gold (XAUT), Tether’s gold-pegged stablecoin.

Furthermore, the amount of gold in Tether reserves far outweighs

that of Bitcoin (BTC), which stands at about $1.5 billion.

From Gubarcs’ perspective, the diversity of the USDT reserves –

which consists of gold, cash, corporate bonds, BTC, etc. – helps

protect the stablecoin against potential market collapses and

unexpected negative events. Considering his advisory role within

the firm, it may be fair to consider Gubarcs’ analysis of Tether’s

financial strategy as an insider viewpoint. Terra Collapse –

One Year Later In one of the most catastrophic events in the crypto

industry, the Terra ecosystem collapsed in May 2022, with its UST

stablecoin losing its dollar peg. The ripple effect saw investors

lose faith in most dollar-backed assets, including Tether USD. This

caused the panic sale of these dollar-backed assets. As a result,

Tether’s dollar peg broke momentarily, with the token falling as

low as 92 cents at times. Furthermore, two months after the Terra

collapse, Tether’s market capitalization had dropped by roughly $16

billion to $65 billion, an indication of massive withdrawals by

token holders. While this unfortunate event was an unexpected test

of USDT’s resilience and stablecoins, as an entity, many would

agree with the fact that Tether passed the test resoundingly. After

all, USDT regained its dollar peg only two months after the crash.

Meanwhile, in terms of market capitalization, USDT has made a

robust recovery since. In fact, USDT’s market cap currently stands

at $82.9 billion, according to data from CoinGecko. This means that

the stablecoin is now more than ever closer to its all-time high

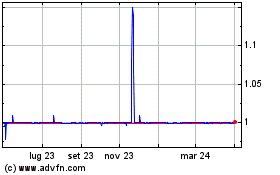

market cap of $83 billion. Tether USD maintains dollar peg |

Source: USDTUSD chart from TradingView Related Reading: Tether: How

Its $2 Billion USDT Minting Impacts Ethereum’s Success In The Bull

Market -Featured image from Wit Olszewski/Alamy, chart from

TradingView

Grafico Azioni Tether USD (COIN:USDTUSD)

Storico

Da Nov 2024 a Dic 2024

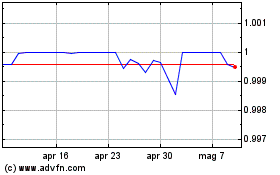

Grafico Azioni Tether USD (COIN:USDTUSD)

Storico

Da Dic 2023 a Dic 2024