Stablecoins Surge: USDT Leads $400 Million Inflows, Signaling Investor Confidence

01 Febbraio 2024 - 4:00PM

NEWSBTC

The cryptocurrency industry has witnessed a significant change in

the movement of stablecoins, offering valuable observations into

the evolving dynamics of the market. Recent data from IntoTheBlock

and CryptoQuant has shown a surge in stablecoin inflows into

exchanges, reaching record highs in January. Related Reading: XRP

Price Poised For Liftoff? Whale Holdings Soar Despite Ripple Hack

Notable inflows were observed on January 2nd ($478 million),

January 3rd ($489 million), and January 26th ($673 million).

However, this trend has since reversed, with outflows dominating

the market. On January 30th, there was a substantial outflow of

$412 million, marking the second-highest daily outflow recorded in

the month, following the $541 million outflow on January 19th. USDT

Leads Stablecoin Rally, But Caution Persists In Crypto Market An

analysis of the 24-hour trading volume of the top stablecoins on

CoinMarketCap reveals that Tether (USDT) and USD Coin (USDC)

collectively accounted for approximately 90% of the total volume.

Tether, in particular, has been dominant in terms of flows, with a

24-hour trading volume exceeding $42 billion, while USDC’s volume

stood at around $6 billion. Taking a closer look at the flow of

USDT through CryptoQuant, it was found that there was a substantial

inflow of $373 million on January 26th, followed by a prevailing

trend of outflows, with over $83.4 million observed at the time of

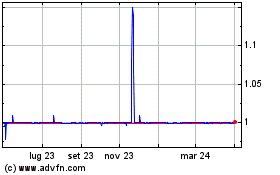

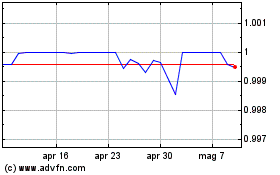

writing. USDTUSD currently trading at $0.99897 on the daily chart:

TradingView.com Experts suggest that the rise in stablecoin inflows

onto exchanges, particularly the $478 million on January 2nd, could

indicate traders’ and investors’ readiness to participate in the

market or their desire to safeguard their funds during uncertain

times. Conversely, the shift towards outflows may signal caution or

preparation for potential market volatility. Additionally, the

substantial inflow of stablecoins, especially USDT, could indicate

increased buying power and intentions to establish positions in the

cryptocurrency space. Stablecoins Surge, Signal Investor

Preparation The increase in stablecoin inflows onto exchanges can

be interpreted in two ways. Firstly, it may indicate that investors

and traders are preparing to enter the market. By moving their

funds into stablecoins, they can quickly transition into other

cryptocurrencies when they perceive favorable opportunities. This

suggests a readiness to participate and take advantage of potential

market movements. Related Reading: Can February Be Dogecoin Month?

Bullish Indicators Point To Potential Price Explosion Secondly, the

rise in stablecoin inflows may also reflect a desire to keep funds

in a secure manner, particularly during uncertain times.

Stablecoins offer stability by being pegged to a specific asset,

such as the US dollar, which can be appealing to investors seeking

to protect their capital in times of market volatility. This

cautious approach can be seen as a way to safeguard funds and

mitigate risks in an unpredictable market. Tether Records Nearly $3

Billion Profit Meanwhile, Tether announced a

“record-breaking” $2.85 billion in quarterly profits as the market

capitalization of its main token, USDT, approached $100 billion.

According to a blog post by Tether, the interest gained on the

company’s enormous holdings in US Treasury, reverse repo, and money

market funds—which support the USDT stablecoin—account for around

$1 billion of the earnings in the most recent quarterly attestation

report that was released on Wednesday. Everything else was “mainly”

due to the growth of Tether’s other assets, like gold and bitcoin

(BTC), the stablecoin issuer said. Featured image from Wccftech,

chart from TradingView

Grafico Azioni Tether USD (COIN:USDTUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Tether USD (COIN:USDTUSD)

Storico

Da Dic 2023 a Dic 2024