Bitcoin Rally Expected: Standard Chartered Eyes New High Of $73,800 Pre-US Election

15 Ottobre 2024 - 9:44PM

NEWSBTC

Bitcoin has recently shown significant momentum, reaching its

highest level since July, briefly touching $67,900 and recovering

7%. This surge follows a dip to $58,900 at the end of last week,

further fueling bullish sentiment among investors optimistic about

the cryptocurrency’s potential to reach new heights before the end

of the year. However, according to research from multinational bank

Standard Chartered, this optimistic outlook may be realized even

sooner than expected. Key Factors Behind BTC’s Price Surge

Geoff Kendrick, the head of digital asset research at Standard

Chartered, recently estimated that the Bitcoin price could hit

$73,800 ahead of the US presidential election on Tuesday November 5

, representing a 10% increase from current levels. particularly in

relation to one of the largest public BTC holders, MicroStrategy,

which recently increased its holdings to 252,000 BTC, led by the

vision of co-founder and renowned Bitcoin bull Michael

Saylor. Related Reading: Worldcoin Gains Upside Momentum: Is

A Major Breakout Ahead? Historically, MicroStrategy and Bitcoin

have traded in tandem; however, Kendrick notes that MicroStrategy’s

stock has recently outperformed Bitcoin, suggesting a developing

premium that could drive Bitcoin prices higher in the coming days.

Two key factors underpin this bullish outlook. The first is the

news, reported by Bitcoinist last month, that BNY Mellon has

received an exemption from SAB 121, a regulation that requires

financial institutions to list cryptocurrencies on their balance

sheets. Kendrick explains that such regulatory relief is

often seen as a positive signal for the broader Bitcoin market,

potentially encouraging wider institutional adoption and therefore

acting as a bullish catalyst for the ongoing rally seen in recent

days. The second factor relates to MicroStrategy’s declared

intention to evolve into a “Bitcoin bank,” which would involve

offering Bitcoin capital market instruments. Kendrick believes that

future exemptions could enable the firm to generate yield by

lending out its Bitcoin holdings. The analyst argues that as

the digital asset ecosystem gains legitimacy and accessibility,

MicroStrategy’s valuation should rise, further benefiting BTC’s

price over the long term. Both Presidential Candidates Could Boost

Bitcoin price Regarding the upcoming presidential election,

Kendrick views the outcome as secondary to these fundamental

factors. He asserts that regardless of whether Donald Trump or

Kamala Harris wins, the broader digital asset ecosystem is

increasingly poised to become mainstream. Related Reading:

SUI Records Substantial 120% Price Surge, But Insider Selling

Claims Raise Red Flags While Kendrick has previously suggested that

a Trump presidency would be the most beneficial scenario for BTC,

with notable proposals for the industry including the establishment

of a Bitcoin reserve for the country, he maintains that both

candidates could positively impact the asset in the long term. In

fact, Kendrick projects that if Trump regains the presidency, the

Bitcoin price could soar to as high as $125,000 by the end of 2024.

At the time of writing, BTC trades at $67,000, still holding to

some of its gains of 2% in the 24-hour time frame despite quickly

retracing before hitting $68,000. Featured image from DALL-E,

chart from TradingView.com

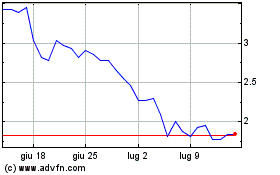

Grafico Azioni Worldcoin (COIN:WLDUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Worldcoin (COIN:WLDUSD)

Storico

Da Dic 2023 a Dic 2024