COIL: STRONG 2022 HALF-YEAR RESULTS IN A CONTEXT OF ENERGY CRISIS

AND COST INCREASES

STRONG 2022 HALF-YEAR RESULTS IN A

CONTEXT OF ENERGY CRISIS AND COST

INCREASES

- Sales:

€13.9

M, up

12.1

%

- EBITDA:

€2.5

M

(18.1%

of sales)

- Net income:

€0.85

(5.7

% of sales)

- Net financial debt:

15.3

% of equity at

30 June

2022

Brussels, 31 October 2022 (17.45) - COIL, world

leader in aluminium anodising, has released its results for the

first half of the 2022 financial year.

In the first six months of 2022, COIL recorded a

turnover of €13.9m, up +12.1% compared to the previous year.

Tolling sales (84% of half-yearly sales)

continued to be strongly influenced by the supply/demand imbalance

caused by the COVID-19 pandemic. Initially, the lengthy delivery

times for flat-rolled products on the market had forced

distributors to build up stocks in order to meet renewed demand.

The sharp fall in the price of aluminium at the end of Q1 then led

to a sharp deceleration in orders by distributors and a rapid

return to more normal delivery times by rolling mills in the

market. Typically, this slowdown in demand from distributors takes

several months to be reflected in the Company's sales. In this

context, tolling sales continued to be strong until after the end

of the period and grew by 18.5% for the half year as a whole.

Package Sales, which include metal (16% of

half-year sales), fell by 12.5%, despite the increase in sales in

Europe. They were impacted by i) the closure of the Russian market

due to the conflict in Ukraine and ii) the continued weakness of

the Asian markets due to high costs and long delivery times.

During the half year, the macro-economic

environment was strongly affected by renewed inflation, which

accelerated following the outbreak of war in Ukraine and Russia and

its impact on the global economic environment. The company reacted

by increasing its prices; however, the growth of its operating

expenses, including a significant increase in its energy and raw

material costs, weighed on the half-year results.

Despite the lower results against a high base of

comparison in 2021, the Company still managed to maintain a high

level of profitability and a strong and healthy balance sheet at 30

June 2022.

The increase in the Company's sales and the

shift in the product mix towards subcontracting were strongly

affected by the rise in production costs (energy and raw

materials), which impacted the gross margin for the first half of

the year, which rose by only 2.9% compared to the previous

year.

Increased personnel costs (+5.1%) and other

operating expenses (+24%) also affected the Company's operating

profitability. EBITDA thus decreased by - €0.5m compared to the

previous year and amounting to €2.5m, representing 18.1% of sales,

compared to 24.4% of sales in the first half of 2021.

After depreciation and amortisation down by

€0.4m to €1.5m, operating profit was €1.0m, or 7.2% of sales,

compared with €1.1m in the first half of 2021 and a loss of €(1.9)m

in the first half of 2020.

The net result for the first half of 2022 is a

profit of €0.85m, compared to €0.95m in the first half of 2021 and

a loss of €(2.1)m in the first half of 2020.

- Simplified income

statement

|

(€M) |

2022 H1 |

2021 H1 |

|

Sales |

13.95 |

12.45 |

|

Tolling sales |

11.68 |

9.86 |

|

Package sales1 |

2.27 |

2.59 |

|

EBITDA |

2.52 |

3.04 |

|

% of sales |

18.1% |

24.4% |

|

Operating profit |

1.01 |

1.13 |

|

% of sales |

7.2% |

9.1% |

|

Income before tax |

0.85 |

0.95 |

|

Net income |

0.80 |

0.95 |

|

% of sales |

5.7% |

7.6% |

Taking into account the results of the

half-year, shareholders' equity at 30 June 2022 was €30.0m, an

increase of €0.8m compared to 31 December 2021. Cash and cash

equivalents at 30 June 2022 improved to €3.4m, compared to €2.2m at

31 December 2021 and €0.5m at 30 June 2021. Net financial debt at

30 June 2022 was €4.6m, up €0.7m on the previous year, and

represented 15.3% of equity, compared with 13.4% at 31 December

2021 and 25.2% at 30 June 2021.

Sales for the third quarter of 2022 amounted to

€6.7m, up 5.3% on the previous year. Tolling sales decreased (-

3.1%), while Package Sales grew strongly (+ 38.5%). As a result,

sales for the first nine months of the 2022 financial year amounted

to €20.7m, up 9.8% on the same period of the previous year.

In an increasingly unstable environment, the

Company remains cautious and anticipates a continued slowdown in

tolling demand towards the end of the year as distributors run down

part of their stocks.

In order to cope with the significant increases

in energy costs in Europe, the Company is gearing its operations in

the short term to its Landen site in Belgium, where energy prices

are currently lower, and is relying on its high-efficiency Line 6

in Germany as a back-up.

At the same time, the company is accelerating

its energy efficiency investment projects through an action plan

aimed at the sustainable use of renewable energy sources at

attractive costs. A solar energy park, developed in partnership

with local specialist operators in Germany, came on stream in

October 2022; this will make it possible to significantly reduce

part of the electricity costs in the medium term at the Bernburg

site.

More generally, the Company is taking steps to

limit the impact of an economic slowdown on its results, relying in

particular on the flexibility of its industrial facilities and the

continued optimisation of its cost base.

The Company is confident in its longer-term

development prospects and is capitalising on its broad portfolio of

premium, sustainable and low carbon footprint products to increase

the potential of its business.

The financial statements were approved by the

Board of Directors on 28 October 2022. They are included in the

2022 half-yearly financial report available on the company's

financial website (http://investors.coil.be).

2022 annual sales will be published on 26

January 2023 after the close of trading.

About COIL

COIL is the world's leading anodiser in the

building and industrial sectors and trades under the ALOXIDE brand

name.

Anodising is an electrochemical process

(electrolysis) which develops a natural, protective oxide layer on

the surface of aluminium and can be coloured in a range of UV-proof

finishes. It gives the metal excellent resistance to corrosion

and/or reinforces its functional qualities. Anodising preserves all

the natural and ecological properties of aluminium; it retains its

high rigidity and excellent strength-to-weight ratio, its

non-magnetic properties, its exceptional resistance to corrosion.

The metal remains totally and repeatedly recyclable through simple

re-melting. Anodised aluminium is used in a wide variety of

industries and applications: architecture, design, manufacturing

and the automotive sector.

COIL deploys an industrial model that creates

value by leveraging its unique know-how, its operational

excellence, the quality of its investments and the expertise of its

people. COIL has around 110 employees in Belgium and Germany and

generated a turnover of €25 million in 2021.

Listed on Euronext Growth Paris | Isin:

BE0160342011 | Reuters: ALCOI.PA | Bloomberg: ALCOI: FP

For more information, please visit

www.aloxide.com

Contact

|

COILTim Hutton | Chief Executive Officer

tim.hutton@coil.be | Tel.: +32 (0)11 88 01 88 |

CALYPTUSCyril Combe cyril.combe@calyptus.net |

Tel.: +33 (0)1 53 65 68 68 |

1 Anodising and metal included

- COIL pressrelease31oct2022_EN

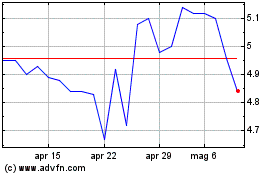

Grafico Azioni COIL (EU:ALCOI)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni COIL (EU:ALCOI)

Storico

Da Dic 2023 a Dic 2024