Coil: 2023 Sales of €21.8m Impacted by a Challenging Economic Environment

02 Febbraio 2024 - 5:45PM

Coil: 2023 Sales of €21.8m Impacted by a Challenging Economic

Environment

|

PRESS RELEASEBrussels, 2 February 2024

(17.45) |

World leader in aluminium anodising |

2023 SALES OF €21.8M

IMPACTED BY A CHALLENGING ECONOMIC ENVIRONMENT

COIL, world leader in aluminium anodising,

announces annual sales of €21.8 M for the 2023 financial year, a

decline of -17.5% against 2022. Sales were impacted by a difficult

economic environment, with a sharp slowdown in demand for Tolling

services throughout the year and a decline in Package Sales from

the second half of the year onwards, against strong

comparatives.

- Sales evolution by quarter

and by activity

|

(€M) |

2023 |

2022 |

Variation |

|

Q1 |

6.41 |

6.61 |

- 3.1 % |

|

Q2 |

5.39 |

7.34 |

- 26.6 % |

|

Q3 |

5.29 |

6.73 |

- 21.5 % |

|

Q4 |

4.76 |

5.78 |

- 17.6 % |

|

Annual total |

21.85 |

26.47 |

- 17.5 % |

|

Of which |

|

|

|

|

Tolling Sales |

17.45 |

20.60 |

- 15.3 % |

|

Package Sales1 |

4.40 |

5.86 |

- 25.0 % |

- Significant events of the

financial year

After two years of growth in 2021 (+9.7%) and

2022 (+4.9%) driven by the post-Covid recovery, the Company's sales

fell significantly in 2023 (-17.5%) in an environment shaped by the

slowdown in global growth, falling demand in end markets and the

continuing rise in economic and geopolitical uncertainties.

Tolling Sales were adversely affected by

destocking in the distribution chain due to low aluminium price

following the major distortion in the market caused by the

post-COVID market. Package Sales were impacted by a falloff in new

architectural projects in Europe as from the second half of 2023,

and by the slow post-COVID recovery in the projects business in

Asia.

The Company has done its utmost to limit the

impact of this slowdown by continuing to optimise its variable

costs. On the industrial front, the Company has streamlined

production on a limited number of lines at its Landen site in

Belgium and on its high-yield line 6 in Germany.

- Tolling Sales: slowdown in

an uncertain economic climate

Against a difficult market backdrop, Tolling

Sales (€17.4M) were down by 15.3% compared with 2022, and accounted

for 79.9% of 2023 annual sales, compared with 77.8% the previous

year. Sales were adversely affected by i) the cyclical slowdown in

demand resulting from metal distributors' conservative expectations

due to the weakness of the LME aluminium price, which reached a low

point during the year, prompting them to keep their inventories at

minimum levels, and ii) the loss of market share due to the

emergence of a competitor in the European continuous anodising

market. However, Q4 sales showed a turning point, with sales

virtually stable compared with the same period last year.

- Package Sales: decline

against strong comparatives

Package Sales (€4.4M), which include pre-anodised metal supplied

directly to the end customer, were down -25.0% against a high basis

of comparison in 2022, which was up +14.8%. They accounted for

20.1% of annual sales in 2023, compared with 22.2% the previous

year. This trend is attributable to the slowdown in demand in

Europe, particularly in the second half of the year, after two

years of dynamic growth in 2021 and 2022 due to the delivery of

major orders. In 2023, to further support the diversification of

its sales, the Company stepped up its sales drive in Asia. The

slowdown in the Chinese economy does not appear to have had a major

impact on major infrastructure projects.

COIL is maintaining a cautious approach for the

first half of the 2024 financial year. The macroeconomic

environment remains uncertain, and the persistent weakness in

demand is likely to continue to weigh on the recovery in

subcontracting volumes in the short term. Nevertheless, the

flexibility of its industrial facilities will enable it to react

quickly to an improvement in demand during the course of the year.

In parallel, the Company is pursuing its diversification strategy

by strengthening its geographical presence in mature and emerging

markets through the development of its Package offers.

The Company is confident in its longer-term

development prospects, capitalising on its broad portfolio of

premium, sustainable products with a smaller carbon footprint to

boost its business potential.

|

|

2023 annual results and annual financial report |

|

|

Annual General Meeting |

|

|

First half 2024 sales |

|

|

First half 2024 results and half-year financial report |

Press releases are issued after close of

trading.

About COIL

COIL is the world's leading anodiser in the

building and industrial sectors and trades under the ALOXIDE brand

name.

Anodising is an electrochemical process

(electrolysis) which develops a natural, protective oxide layer on

the surface of aluminium and can be coloured in a range of UV-proof

finishes. It gives the metal excellent resistance to corrosion

and/or reinforces its functional qualities. Anodising preserves all

the natural and ecological properties of aluminium; it retains its

high rigidity and excellent strength-to-weight ratio, its

non-magnetic properties, its exceptional resistance to corrosion.

The metal remains totally and repeatedly recyclable through simple

re-melting. Anodised aluminium is used in a wide variety of

industries and applications: architecture, design, manufacturing,

and the automotive sector.

COIL deploys an industrial model that creates

value by leveraging its unique know-how, its operational

excellence, the quality of its investments and the expertise of its

people. COIL has around 110 employees in Belgium and Germany and

generated a turnover of €21,8 million in 2023.

Listed on Euronext Growth Paris | Isin:

BE0160342011 | Reuters: ALCOI.PA | Bloomberg: ALCOI: FP

For more information, please visit

www.aloxide.com

Contact

|

COILTim Hutton | Chief Executive Officer

tim.hutton@coil.be | Tel. : +32 (0)11 88 01 88 |

CALYPTUSCyril Combe cyril.combe@calyptus.net |

Tel. : +33 (0)1 53 65 68 68 |

1 Anodising and metal included

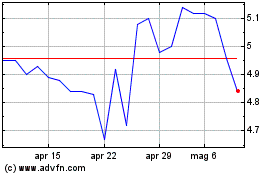

Grafico Azioni COIL (EU:ALCOI)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni COIL (EU:ALCOI)

Storico

Da Dic 2023 a Dic 2024