Q1’24 adjusted organic growth of +16,1%, with digital revenue

growth in line with Q4’23 Confirmed outlook with organic growth

expected to accelerate in the next quarters

Q1’24 adjusted organic growth of +16,1%,

with digital revenue growth in line with Q4’23

Confirmed outlook with organic growth

expected to accelerate in the next quarters

Paris, France – April 24,

2024

Q1 2024 Key Figures

- Revenue of €230.3 million in Q1’24, up +15.9% at current rate,

with organic growth of +12.5% including currency headwinds embedded

in Premium solutions digital sales. Quarterly adjusted organic

growth1 amounted to +16.1% in Q1’24.

- Digital sales grew at par with Q4’23 on an organic basis, while

non-digital sales were flat during the quarter after strong

double-digit growth at the end of last year due to strong live and

branding activities.

Q1 2024

Highlights

- Healthy paid streaming growth continued, uplifted by several

DSPs’ price increases. These positive trends were however mitigated

by persistent currency headwinds directly embedded in digital

monetization.

- Strong revenue growth in France and Europe driven by success in

developing local acts.

- Performance in Asia reflecting the absence of ad-funded

streaming recovery, value decrease of several Southeast Asian

markets and a soft performance in India at par with the local

market.

- Focus on artist development through the launch of new features

and development of new solutions.

- Reviewed organization to further increase strategic and

execution capabilities and prepare for the next phase of

expansion.

2024 Outlook

- Organic growth was in line with expectations in Q1’24 and is

anticipated to accelerate in Q2’24. Believe confirms its growth

scenario for FY’24: increase in paid streaming driven by volume and

price, progressive recovery in ad-funded streaming and additional

market share gains. Believe assumes limited currency headwinds

embedded in the market (c. -2% expected for FY’24). Believe will

further invest in its development during the year, while pursuing

efficiency gains. Based on those assumptions, Believe expects:

- Organic growth of c. +18%. Adjusted organic growth for embedded

market FX of c. +20%.

- Further progress in Adjusted EBITDA margin: c. 6.5%.

- The Group’s reinforced appeal is generating a higher level of

attractive commercial opportunities and therefore of advances. The

Group anticipates that artists and labels’ advances will increase

in FY’24 in line with revenue, further building its long-term

revenue base. Overall, advances will continue impacting free cash

flow generation and the Group therefore anticipates free cash flow

to be slightly positive in FY’24.

Denis Ladegaillerie, Founder and

CEO said: “Despite market headwinds in some of our key

geographies, Believe continues to demonstrate its capacity to grow.

We are leveraging our innovation and digital expertise to shift the

company towards higher market segments. Our attractivity opens new

opportunities and we are well positioned to benefit from the

structural trends of the music market.”

Q1 2024 Revenue

|

in € million |

Q1 2023 |

Q1 2024 |

Change YoY |

Organic change2 |

| Group Revenues |

198.6 |

230.3 |

+15.9% |

+12.5% |

|

Premium Solutions |

186.0 |

215.3 |

+15.8% |

+12.6% |

|

Automated Solutions |

12.7 |

14.9 |

+18.2% |

+10.8% |

Q1 2024 HIGHLIGHTS

Organic revenue growth adjusted from

currency headwinds is up c. +16.1%

In Q1’24, Believe recorded as anticipated a

lower organic growth than in Q4’23, which benefited from a very

strong level of live and branding activities. Revenue was still

penalized by negative embedded market FX. As previously described,

the Group’s organic growth captures currency translation effects

directly embedded in the royalties that Believe receives from its

digital partners.

Paid streaming trends were solid and uplifted by

price increases at several large digital platforms. Ad-funded

streaming monetization presented better trends in Europe and

Americas but did not yet recover in Asia as expected.

Asia was penalized by the decline of several

Southeast Asian music markets due to lower volumes and currency

headwinds. The level of activity in India was soft and at par with

the local market. With a view to mitigate this impact, the Group

pursued its strategy to focus on premium segments and increase the

commercial value of artists and labels within these segments.

Q1’24 revenue grew by +15.9% to reach €230.3

million, reflecting organic growth of +12.5%, a positive perimeter

effect related to the acquisition of Sentric (music publishing) of

+5.1% and a negative forex effect (-1.7%) mostly related to the

Turkish lira devaluation. Revenue was also strongly affected by

currency headwinds in Q1’24 (-3.6%).

Pursuing investment locally to support

artist development and increase artists’ commercial value at each

stage of their career In France, the Group pursued its

strategy of smart partnerships to consolidate position in specific

music genres and offer new discovery and development opportunities.

Believe and Kidding Aside concluded a strategic partnership with

the creation of All Night Long, a label uniquely positioned to

support artists spanning the whole spectrum of electronic music

(from underground and mainstream to techno and EDM). The label will

provide artists with a personalized comprehensive toolkit,

specialized digital know-how, and dedicated promotional and

marketing teams tailored to the specificities of electronic music.

The first lineup of artists revealed on the label includes NTO,

Folamour, TDJ, Urumi, The Acid Arab collective, and Trym. Believe

became also the first music company to partner with BeReal in

France, opening new avenues for its artists to engage and grow

their audiences.

In addition, Believe demonstrated its ability to

develop innovative solutions to promote the development of artists

and their engagement with their fans, as illustrated by the launch

of ‘The Girliverse’ in the UK, the brand new interactive online

experience of alt-pop sensation Girli.

With sustained growth in the past few years,

Believe is now positioned in Brazil as one of the country’s leading

music companies, supporting a growing number of artists across all

music genres and stages of their career. During the quarter, the

Group further supported Brazil’s music scene growth by

strengthening its investment locally and adding to its roster

several top names from Brazil’s rap music scene, including Cryzin,

Grego, Marquinho No Beat, Giana Mello and Slim Rimografia. These

signings confirmed Believe’s global leadership in this fully

digital music genre.

New partnership to support the development of

self-releasing artists

At the end of Q1’24, TuneCore successfully

launched an integrated partnership with Presonus®’ digital audio

workstation Studio One®. The partnership will allow Studio One®

users to send their music to stores and streaming platforms as soon

as they finish the recording process and will drastically enhance

the user experience by simplifying the distribution process for

self-releasing artists.

Reviewed organization to prepare the next phase of

expansion

Believe shaped a new organization to improve its

strategic and execution capabilities with two notable changes: the

introduction of a new role of Global head of music and an increased

focus on regionalization.

The Global Head of Music is responsible for

designing Believe’s global music strategy, overseeing the

acceleration in Artist Services which has been deployed in over 14

countries in the past few years and the full deployment of a

value-based strategy for Label & Artist Solutions. This will be

key to further growing the commercial value of artists and labels

at any stage of their career.

The Group also implemented a regional

organization for the local teams. On the back of his success in

developing Believe in France, Romain Vivien was promoted to the new

role of Global head of Music and President Europe, covering France,

Germany and the UK. Sylvain Delange will continue overseeing the

Asia Pacific region that notably includes Japan, China and India, 3

out of the top 10 global music markets, while Viktoria Siniavskaia

added new regional responsibilities covering the other markets

(Southern and Eastern Europe, Middle East, Africa), to ensure a

consistent deployment of the strategy focused on developing

commercial value of artists and labels in all top 15-30 global

music markets.

Q1 2024 FINANCIALS

Solid trends in Premium and Automated

Solutions despite persistent currency headwinds In

Premium Solutions, revenues amounted to €215.3

million, up +15.8% at current rate. Believe faced persistent

currency headwinds, which affected digital monetization of the

segment. Organic growth adjusted for estimated embedded market FX

amounted to +16.5%, resulting from organic growth amounting to

+12.6%. Revenue included a perimeter effect of +4.8% driven by the

acquisition of Sentric in April 2023. Music publishing activities

performed well and benefited from the switch to SACEM as digital

partner for collection at better terms than previous arrangements.

The Group continued to gain market share in most key countries and

continued to outperform in Europe and Americas in the quarter. The

level of activity in Asia was however less buoyant as the ad-funded

streaming did not recover yet in the region and several Southeast

Asian markets recorded a significant value decrease compared with

last year, reflecting lower volumes and currency headwinds.

Automated Solutions revenues

amounted to €14.9 million, up +18.2% year-over-year reflecting

organic growth of +10.8% and a perimeter effect linked to Sentric

acquisition of +9.9%. These positive effects were however mitigated

by a negative forex impact of -2.6% mostly related to the Japanese

yen weakening versus the euro. After a successful launch in Q4’23

as a free trial, the new artist and audience development program,

TuneCore Accelerator, started contributing revenue. The program

serves artists at different stages of their career and was created

in direct response to self-releasing artists’ growing need for a

better way to find and develop their audiences, especially in the

early phases of their career. Separately, TuneCore’s price

increases enacted in December ’23 will be accounted for over the

year and therefore had a limited positive impact in Q1’24. Finally,

TuneCore rolled out a comprehensive suite of music publishing

services to help independent songwriters increase their earnings in

over 200 countries, creating a more efficient and greatly enhanced

user experience.

Strong growth in Europe and

France

| in €

million |

Q1 2023 |

Q1 2024 |

Change YoY |

| Europe (excl. France &

Germany) |

54.4 |

76.8 |

+41.0% |

| France |

32.1 |

38.6 |

+20.0% |

| Americas |

29.4 |

32.7 |

+11.2% |

| Asia Pacific /

Africa |

56.1 |

56.3 |

+0.5% |

| Germany |

26.6 |

26.0 |

-2.5% |

|

Total |

198.6 |

230.3 |

+15.9% |

Revenue growth amounted to +41.0% in

Europe (excluding France and Germany) and

represented 33.3% of total revenues in Q1’24. The performance was

enhanced by a perimeter effect (which positively impacted the UK

performance) related to the integration of Sentric in the region

for the last quarter as the acquisition took place in April’23.

Revenue growth was strong in Southern Europe, Eastern Europe and

Turkey.

In France, revenues were

strongly up in Q1’24 and represented 16.7% of Group revenues. The

Group continued to gain market share thanks to the greater

diversification of the roster and maintained its leadership in rap

music. Believe also launched All Night Long with the artist

management agency Kidding Aside, a label dedicated to electronic

music, as the Group is building its global position in this music

genre. Believe also benefited from strong non digital sales as its

position among the top 3 players for local acts resulted in a

strong level of live and merchandising activities for top acts.

Americas grew by +11.2% and represented 14.2% of

Group revenues. The Group further developed its presence in the

Latin music space, illustrated by a strong level of activity in

Mexico and several Latin American markets. In Brazil, revenue

growth remained solid, and the team had a strong quarter of new

signings. This solid performance also reflected TuneCore’s revenue

growth, driven notably by the roll out of the new marketing program

TuneCore Accelerator.

In Q1’24, revenue growth was up slightly

in Asia Pacific and Africa, which represented

24.5% of Group revenues. Believe further established its presence

in Greater China and had a strong start in Japan with the launch of

PLAYCODE. The performance in the region was however affected by the

absence of recovery in ad-funded streaming and by value decline in

several Southeast Asian markets due to lower volumes and currency

headwinds. The performance in India was also soft, at par with the

market, which has been affected by some pricing changes implemented

by our digital partners.

In Germany, revenues were down

-2.5% in Q1’24 and represented 11.3% of Group revenues. Digital

sales were up during the quarter confirming Q4’23 trends, thanks to

the strong positioning on local acts and the ongoing

diversification of music genres in the roster. On the back of its

strategy to accelerate exit from contracts which were too heavy in

physical sales and merchandising, non-digital sales further

declined and now represent less than 15% of revenue in the

region.

FY 2024 OUTLOOK AND MID-TERM OBJECTIVES

In FY’24, the Group will continue to drive a

profitable growth trajectory towards its long-term profitability

objective of 15% Adjusted EBITDA margin.

As anticipated, Q1’24 organic growth was below

Q4’23 rate, which benefited from a very strong level of live and

branding activities while digital revenue growth in Q1’24 was on

par with Q4’23. The growth scenario for the rest of the year

implies solid paid streaming trends, which will combine new

subscribers and price increases at some DSPs and a progressive

recovery of ad-funded streaming. Ad-funded streaming is not

anticipated to recover in emerging markets before the second half

of the year. The growth scenario also implies additional market

share gains across regions, and notably in countries where the

Group is not yet ranking in the Top 3 for local acts. Believe also

anticipates an improved currency environment for digital

monetization. The Group assumes that the negative embedded market

forex effect will reduce over time and amount to -2% in FY’24,

compared with -5.1% in FY’23. Consequently, Believe expects

Adjusted Organic growth of c. +20% in FY’24.

The Group will continue to adapt the investment

cycle to market growth and will therefore size its investment in

each key market. Believe will also continue to optimize investments

in the Central Platform and increase efficiency through

automatization. The Group will further focus on efficiency during

the year, but margin improvement will be lower than in FY’23 due to

the higher level of Tech & Product spending. As a result, the

Group anticipates an Adjusted EBITDA margin of c. 6.5%.

The Group will continue to allocate cash between

advances and acquisitions in the next months. Believe’s reinforced

appeal to a greater number of artists and labels in a wider variety

of music genres and the ongoing industry consolidation provide more

attractive opportunities for the Group, which will therefore

allocate more cash to internal and external investments going

forward.

The Group is on track to

deliver on its medium-term trajectory communicated

at the IPO, including a 2021-2025 CAGR of between +22% and +25% and

a Group Adjusted EBITDA of 5%-7% by 2025, implying a

segment Adjusted EBITDA margin of 15%-16% (which is a "high growth

period" margin, as the revenue growth is partially reinvested).

Believe reiterates its confidence in its ability to achieve its

long-term target of at least 15% Group Adjusted EBITDA margin.

Webcast: We will host a webcast

https://edge.media-server.com/mmc/p/pzqhsc5g and

conference call starting at 6:30 p.m. CET (5:30 p.m. GMT) today.

Denis Ladegaillerie, our Founder and CEO, and Xavier Dumont, our

Chief Financial and Strategy Officer, will present Q1’24 revenue

and answer questions addressed in the call or submitted through the

webcast. All information related to Q1’24 revenue is available on

our investor website.

Conference call details:France, Paris: +33

(0) 1 70 91 87 04 // United Kingdom, London: +44 1 212

818 004 // United States, New York: +1 718 705 87

96Conference ID: 88365

| Investor

Relations & Financial Media Emilie

MEGELinvestors@believe.comTel: +33 1 53 09 33

91 Cell: + 33 6 07 09 98

60 |

Press

Relations Manon

JESSUAmanon.jessua@believe.comAnass BENDAFI :

+33 6 80 42 51 84anass.bendafi@agenceproches.com |

Financial agenda Believe (Ticker: BLV, ISIN:

FR0014003FE9):1st August 2024: H1 2024 earnings – Press

release to be issued after market close.

23 October 2024: Q3 2024 revenue – Press release to be issued

after market close.

Appendix

- Revenue breakdown between Digital and non-digital sales

growth (as reported)

|

|

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

FY’23 |

Q1’24 |

| Digital sales |

93% |

90% |

92% |

86% |

90% |

90% |

|

Non-digital sales |

7% |

10% |

8% |

14% |

10% |

10% |

- Revenue breakdown between Digital and

non-digital sales growth (as reported)

|

|

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

FY’23 |

Q1’24 |

| Digital sales |

+ 22.2% |

+ 11.9% |

+ 7.1% |

+ 12.3% |

+13.0% |

+ 12.1% |

|

Non-digital sales |

+ 21.8% |

+ 42.1% |

+ 39.6% |

+ 74.6% |

+48.2% |

+ 64.0% |

- Adjusted Organic Growth (organic growth

adjusted from embedded market forex impact)

|

|

Q1’23 |

Q2’23 |

Q3’23 |

Q4’23 |

FY’23 |

Q1’24 |

|

Adjusted organic growth |

+23.1% |

+18.0% |

+15.4% |

+21.8% |

+19.5% |

+ 16.1% |

About BelieveBelieve is one of

the world’s leading digital music companies. Believe’s mission is

to develop independent artists and labels in the digital world by

providing them the solutions they need to grow their audience at

each stage of their career and development. Believe’s passionate

team of digital music experts around the world leverages the

Group’s global technology platform to advise artists and labels,

distribute and promote their music. Its 1,919 employees in more

than 50 countries aim to support independent artists and labels

with a unique digital expertise, respect, fairness and

transparency. Believe offers its various solutions through a

portfolio of brands including Believe, TuneCore, Nuclear Blast,

Naïve, Groove Attack, AllPoints, Ishtar and Byond. Believe is

listed on compartment B of the regulated market of Euronext Paris

(Ticker: BLV, ISIN: FR0014003FE9). www.believe.com

Forward Looking statement

This press release contains forward-looking statements regarding

the prospects and growth strategies of Believe and its subsidiaries

(the “Group”). These statements include statements relating to the

Group’s intentions, strategies, growth prospects, and trends in its

results of operations, financial situation and liquidity. Although

such statements are based on data, assumptions and estimates that

the Group considers reasonable, they are subject to numerous risks

and uncertainties and actual results could differ from those

anticipated in such statements due to a variety of factors,

including those discussed in the Group’s filings with the French

Autorité des Marchés Financiers (AMF) which are available on the

website of Believe (Investors | Believe). Prospective information

contained in this press release is given only as of the date

hereof. Other than as required by law, the Group expressly

disclaims any obligation to update its forward-looking statements

in light of new information or future developments. Some of the

financial information contained in this press release is n

1 Adjusted organic growth aims at providing a

view on Believe’s organic revenue growth after neutralizing

embedded market forex impact: Believe assesses the forex impact on

each digital market served by the Group to estimate the market

forex embedded into its digital revenues collected from its digital

partners. Digital sales embed currency translation effects as the

amounts collected from Subscriptions and Ad-funded by digital

stores are in local currencies and perceived by Believe mainly in

euros.

2 Organic growth accounts for revenue at constant perimeter and

constant exchange reports

- 2024-04-24-Believe-Q1 2024 revenue-ENG

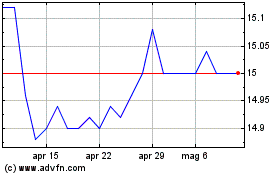

Grafico Azioni Believe (EU:BLV)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Believe (EU:BLV)

Storico

Da Nov 2023 a Nov 2024