Correction: Cegedim: revenues up in the first half of 2024

Quarterly financial information as of June 30, 2024

IFRS - Regulated information - Not audited

Cegedim revenues up in the first half of

2024

- H1 2024 revenues

grew 6.0%

- The digitalization,

marketing, and cloud businesses posted solid growth

Boulogne-Billancourt, France, July 25, 2024, after the

market close

Revenue

|

|

First half |

Change H1 2024 / 2023 |

|

in millions of euros |

2024 |

2023 reclassified(1) |

Reclassification(1) |

2023 reported |

Reported vs. reclassified(1) |

Like for

like(2)(3)

vs.

reclassified |

|

Software & Services |

152.1 |

150.6 |

-10.9 |

161.5 |

1.0% |

-1.7% |

|

Flow |

49.5 |

46.8 |

-1.4 |

48.2 |

5.8% |

5.7% |

|

Data & Marketing |

59.3 |

54.9 |

0.0 |

54.9 |

8.0% |

8.0% |

|

BPO |

39.9 |

32.8 |

0.0 |

32.8 |

21.6% |

21.6% |

|

Cloud & Support |

18.1 |

15.8 |

12.3 |

3.5 |

14.5% |

14.5% |

|

Cegedim |

319.0 |

301.0 |

0.0 |

301.0 |

6.0% |

4.6% |

(1) As of January 1, 2024,

our Cegedim Outsourcing and Audiprint subsidiaries—which were

previously housed in the Software & Services division—as well

as BSV—formerly of the Flow division—have been moved to the Cloud

& Support division in order to capitalize on operating

synergies between cloud activities and IT solutions

integration.

(2) At constant scope and exchange

rates.

(3) The positive currency impact of 0.2% was

mainly due to the pound sterling. The positive scope effect of 1.2%

was attributable to the first-time consolidation in

Cegedim’s accounts of Visiodent

starting March 1, 2024 .

Cegedim generated consolidated first-half 2024 revenue of

€319 million, up 6.0% on a reported basis and 4.6% like for

like(2)

compared with 2023. The digitalization, marketing, and cloud

businesses supported growth which, as predicted, faced a

challenging comparison with 2023 revenues boosted by Ségur public

health investments for Healthcare professionals and a headwind from

an expected slowing of international business in the second

quarter.

Analysis of business trends by division

|

|

First half |

Change H1 2024 / 2023 |

|

in millions of euros |

2024 |

2023 reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2) vs.

reclassified(1) |

|

Cegedim Santé |

38.9 |

39.8 |

-2.4% |

-11.5% |

|

Insurance, HR, Pharmacies, and other services |

86.7 |

84.5 |

2.7% |

2.7% |

|

International businesses |

26.5 |

26.3 |

0.6% |

-1.1% |

|

Software & Services |

152.1 |

150.6 |

1.0% |

-1.7% |

Cegedim Santé saw its revenues decline 2.4% in

the first half. The drop was expected and due mainly to a demanding

comparison with 2023, when the division benefited from the Ségur

public health investments. The favorable scope impact is

attributable to the consolidation of Visiodent starting on March 1,

2024. Cegedim Santé aims to offset the absence of the Ségur public

health investments with organic growth in 2024. It is off to a

great start and gradually starting to erase the shortfall: organic

growth improved from -17.1% in the first quarter to -5.5% in the

second quarter.

The other French subsidiaries posted growth of

2.7%, driven mainly by dynamic growth in HR activities, which are

proving resilient owing to the diversification of their client

base. Insurance activities benefited from project-based business in

the second quarter. Pharmacy activities, on the other hand, were

hit by a demanding comparison in revenue from installing and

updating equipment, which got a boost in 2023 in preparation for

the inclusion of new Ségur-related functionalities.

The international subsidiaries posted slightly

negative organic growth, chiefly due to the Group’s decision to

refocus its products for doctors in the UK on Scotland and exit

England, Northern Ireland, and Wales. Those refocusing efforts got

underway in the second quarter. Growth in Spain, on the other hand,

has been robust. Sales to hospitals in the Murcia region and to

health clinics are one of the big reasons. The positive currency

impact was mainly due to the pound sterling.

|

|

First half |

Change H1 2024 / 2023 |

|

in millions of euros |

2024 |

2023 reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2) vs.

reclassified(1) |

|

E-business |

30.0 |

27.8 |

7.6% |

7.4% |

|

Third-party payer |

19.6 |

19.0 |

3.1% |

3.1% |

|

Flow |

49.5 |

46.8 |

5.8% |

5.7% |

The E-business activity grew 7.6%. Both of its

business lines made positive contributions: Invoicing &

purchasing continues to develop and saw a pick-up in business in

France and abroad—notably in Germany, where companies are getting

ready for the reform set to take effect on January 1, 2025. The

Healthcare Flow segment is also getting a boost from dynamic new

offerings for hospitals that are designed to make their drug

purchasing secure.

The 3.1% growth in Third-party payer business

was driven mainly by development of fraud detection products and

services. As a reminder, growth was hampered in the first quarter

by the transfer of business related to the Allianz contract to the

BPO division in April 2023.

|

|

First half |

Change H1 2024 / 2023 |

|

in millions of euros |

2024 |

2023 reclassified1 |

Reported vs. reclassified(1) |

Like for like(2) vs.

reclassified(1) |

|

Data |

28.1 |

28.9 |

-2.8% |

-2.8% |

|

Marketing |

31.3 |

26.1 |

20.0% |

20.0% |

|

Data & Marketing |

59.3 |

54.9 |

8.0% |

8.0% |

Data business was down marginally in the first

half, during which sales in France fared better than international

sales.

Marketing in pharmacies continues to expand at a

brisk pace, propelled by the unit’s phygital media offering.

|

|

First half |

Change H1 2024 / 2023 |

|

in millions of euros |

2024 |

2023 reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2) vs.

reclassified(1) |

|

Insurance BPO |

28.7 |

22.2 |

29.5% |

29.5% |

|

Business Services BPO* |

11.2 |

10.7 |

5.1% |

5.1% |

|

BPO |

39.9 |

32.8 |

21.6% |

21.6% |

*BPO for HR and digitalization

activities

Managed services for health and personal

protection insurance companies continues to enjoy a positive

comparison effect related to the Allianz contract, which started in

the second quarter of 2023, and a flourishing overflow

business.

Business services BPO (HR and digitalization

services) posted revenue growth of 5.1% in the first half, chiefly

due to the good momentum for its compliance offering.

|

|

First half |

Change H1 2024 / 2023 |

|

in millions of euros |

2024 |

2023 reclassified(1) |

Reported vs. reclassified(1) |

Like for like(2) vs.

reclassified(1) |

|

Cloud & Support |

18.1 |

15.8 |

14.5% |

14.5% |

The Cloud & Support division, buoyed by its

Cloud products and services, had yet another great performance in

the second quarter, with growth of 14.5%.

Highlights

Apart from the items cited below, to the best of

the company’s knowledge, there were no events or changes during H1

2024 that would materially alter the Group’s financial

situation.

On February 15, 2024, Cegedim Santé

acquired Visiodent, a leading French publisher of management

software for dental practices and health clinics. Visiodent

launched the market’s first 100% SaaS solution, Veasy, at a time

when it was significantly expanding its organization. Its users now

include the country’s largest nation-wide networks of health

clinics, both cooperative and privately owned, as well as several

thousand dental surgeons in private practice. Visiodent generated

revenue of c.€10 million in 2023 and began contributing to Cegedim

Group’s consolidation scope on March 1, 2024. Post the acquisition,

Cegedim is in compliance with all of its covenants and financing

contracts.

Cegedim, jointly with IQVIA (formerly

IMS Health), is being sued by Euris for unfair competition.

Cegedim has asked the court to dismiss the case against

the Company. On December 17, 2018, the Paris Commercial Court

granted Cegedim’s request, which IQVIA then appealed. On

December 8, 2021, the Court of Appeals upheld the judgement in

favor of Cegedim. The case was appealed to the Supreme

Court, and in a ruling on March 20, 2024, the court overturned the

Court of Appeals judgement that had exonerated Cegedim. As

a result, the case has been sent back to the Paris Court of

Appeals, with a different set of judges.

The Group does not do business in Russia or

Ukraine and has no assets exposed to those countries.

Significant transactions and events post June 30,

2024

To the best of the company’s knowledge, there

were no post-closing events or changes after June 30, 2024, that

would materially alter the Group’s financial situation. The Group

expects to finalize the refinancing of its financial debt prior to

the release of first-half results.

Outlook

Based on currently available information, the

Group expects 2024 like-for-like revenue(1)

growth to be in the range of 5-8% relative to 2023. Recurring

operating income should continue to improve, following a similar

trajectory as in 2023.

These targets are not forecasts and may need to

be revised if there is a significant worsening of geopolitical,

macroeconomic, or currency risks.

---------

(1) To take advantage of

synergies, Cegedim Outsourcing, Audiprint, and BSV have been

reassigned to the Cloud & Support division.

(2) At constant scope and exchange

rates.

|

WEBCAST ON JULY 25, 2024, AT 6:15 PM (PARIS

TIME) |

|

The webcast is available at:

www.cegedim.fr/webcast |

| |

The H1 2024 revenues presentation is available here:

https://www.cegedim.fr/finance/documentation/Pages/presentations.aspx |

|

|

2024 financial calendar

|

2024 |

September 26 after the close

October 24 after the close |

First-half 2024 results

Q3 2024 revenues |

Financial calendar:

https://www.cegedim.fr/finance/agenda/Pages/default.aspx

Notice

This press release is available in French and in English.

In the event of any difference between the two versions, the

original French version takes precedence. This press release may

contain inside information. It was sent to Cegedim’s authorized

distributor on July 25, 2024, no earlier than 5:45 pm Paris

time.

The figures cited in this press release include guidance on

Cegedim's future financial performance targets. This

forward-looking information is based on the opinions and

assumptions of the Group’s senior management at the time this press

release is issued and naturally entails risks and uncertainty. For

more information on the risks facing Cegedim, please refer to

Chapter 7, “Risk management”, section 7.2, “Risk factors and

insurance”, and Chapter 3, “Overview of the financial year”,

section 3.6, “Outlook”, of the 2023 Universal Registration Document

filled with the AMF on April 3, 2024, under number

D.24-0233.

|

About Cegedim:

Founded in 1969, Cegedim is an innovative technology and services

group in the field of digital data flow management for healthcare

ecosystems and B2B, and a business software publisher for

healthcare and insurance professionals. Cegedim employs more than

6,500 people in more than 10 countries and generated revenue of

€616 million in 2023.

Cegedim SA is listed in Paris (EURONEXT: CGM).

To learn more please visit: www.cegedim.fr

And follow Cegedim on Twitter @CegedimGroup, LinkedIn and

Facebook.

|

Aude Balleydier

Cegedim

Media Relations

and Communications Manager

Tel.: +33 (0)1 49 09 68 81

aude.balleydier@cegedim.fr |

Damien Buffet

Cegedim

Head of Financial Communication

Tel.: +33 (0)7 64 63 55 73

damien.buffet@cegedim.com |

Céline Pardo

Becoming

Media Relations

Tel.: +33 (0)6 52 08

13 66

cegedim@becoming-group.com |

|

Annexes

Revenue trends by division

|

in millions of euros |

|

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

Software & Services |

|

74.3 |

77.8 |

|

|

152.1 |

|

| Flow |

|

25.3 |

24.2 |

|

|

49.5 |

|

| Data &

Marketing |

|

27.0 |

32.3 |

|

|

59.3 |

|

| BPO |

|

20.2 |

19.7 |

|

|

39.9 |

|

| Cloud &

Support |

|

9.0 |

9.1 |

|

|

18.1 |

|

|

Group revenue |

|

155.9 |

163.1 |

|

|

319.0 |

|

|

in millions of euros |

|

Q1 reclassified |

Q2 reclassified |

|

|

Total

reclassified |

|

Software & Services |

|

74.4 |

76.2 |

|

|

150.6 |

| Flow |

|

24.0 |

22.8 |

|

|

46.8 |

| Data &

marketing |

|

24.6 |

30.3 |

|

|

54.9 |

| BPO |

|

14.4 |

18.4 |

|

|

32.8 |

| Cloud &

Support |

|

8.4 |

7.4 |

|

|

15.8 |

|

Group revenue |

|

145.9 |

155.1 |

|

|

301.0 |

Revenue breakdown by geographic zone, currency, and

division at June 30, 2024

as a % of consolidated revenues

|

|

Geographic zone |

|

Currency |

| |

France |

EMEA

ex. France |

Americas |

|

Euro |

GBP |

Others |

|

Software & Services |

|

82.6% |

17.3% |

0.1% |

|

85.9% |

12.3% |

1.8% |

| Flow |

|

91.9% |

8.1% |

0.0% |

|

94.6% |

5.4% |

0.0% |

| Data &

Marketing |

|

97.9% |

2.1% |

0.0% |

|

98.0% |

0.0% |

2.0% |

| BPO |

|

100.0% |

0.0% |

0.0% |

|

100.0% |

0.0% |

0.0% |

| Cloud &

Support |

|

100.0% |

0.0% |

0.0% |

|

100.0% |

0.0% |

0.0% |

|

Cegedim |

|

90.0% |

9.9% |

0.1% |

|

92.1% |

6.7% |

1.2% |

- Cegedim_Revenue_1H2024_ENG

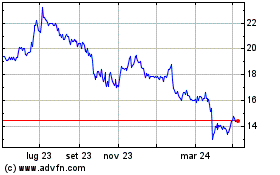

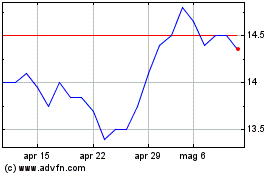

Grafico Azioni Cegedim (EU:CGM)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Cegedim (EU:CGM)

Storico

Da Dic 2023 a Dic 2024