Linedata : Revenue for the first 9 months of 2020: € 115.1m

21 Ottobre 2020 - 5:45PM

Linedata : Revenue for the first 9 months of 2020: € 115.1m

Revenue for the first 9 months of 2020:

€ 115.1m

| |

9M 2019 |

9M 2020 |

Change |

| ASSET MANAGEMENT(*) |

83.6 |

81.0 |

-3.2% |

| LENDING & LEASING |

41.2 |

34.1 |

-17.2% |

| TOTAL LINEDATA |

124.8 |

115.1 |

-7.8% |

Rounded and unaudited figures (€

m)

(*) The “Other” segment, made up of insurance and

retirement savings, has been integrated into AM.

Neuilly-sur-Seine, October 21,

2020 – Linedata (LIN:FP) generated

sales of € 115.1m over the first 3 quarters of 2020,

down 7.8% compared to the same period in 2019.

The share of recurring revenues continued to

increase (+€ 3.9m), reaching € 95.0m, that is 83% of

total sales. This demonstrates the robustness of Linedata's

business model, which promotes long-term revenue.

Order intake came in at €34.7m, a limited

decline of 3.2% compared with the previous period.

Performance analysis by segment:

ASSET MANAGEMENT (Q1: € 28.4M,

+2.8%; Q2: € 27.0M, -7.3%; Q3: € 25.6M, -5.0%)

The Asset Management segment saw a slide of 3.2%

over the first nine months of the year due to the health

crisis.

Software sales came in at € 68.3m (-3.7%).

The front office division is still performing well with a

noticeable increase in order intake stemming from the first

migrations of the installed base to the new AMP platform.

Conversely, there was a decline in professional services revenues

for back-office software with the postponement of some clients’

projects, particularly in Europe.

Services revenues were stable at € 12.6m with a

favourable sales trend for middle and back-office outsourcing for

asset managers. Order intake over the first three quarters was thus

up 16.6%.

LENDING & LEASING (Q1: € 11.9M,

- 4.2%; Q2: € 11.2M, -28.4%; Q3: € 11.1M,

-16.2%)

Revenues of the Lending & Leasing segment to

end September 2020 were down 17.2% vs. the same period in 2019, hit

hard by the wait-and-see attitude caused by the crisis. This has

mainly resulted in a fall in consulting and perpetual licenses.

With clients’ sites gradually reopening in Q3,

sales discussions put on hold during the previous quarter were able

to resume.

Outlook

The group expects business to pick up towards

the end of the year with an increase in Q4 2020 revenues compared

to the previous quarter.

Next announcement: Full-year

2020 sales on 9 February 2021, after trading.

ABOUT LINEDATA

With 20 years’ experience and 700+ clients in 50

countries, Linedata’s 1300 employees in 20 offices provide global

humanized technology solutions and services for the asset

management and credit industries. Linedata supports corporate

development and boosts its clients’ growth. Linedata's 2019 revenue

was €169.7 million. Linedata is listed on Euronext Paris

compartment B FR0004156297-LIN – Reuters LDSV.PA – Bloomberg

LIN:FPlinedata.com

|

LinedataFinance Department+33 (0)1 73 43 70

27infofinances@linedata.com |

Cap Value+33 (0)1 80 81 50 00info@capvalue.frwww.capvalue.fr |

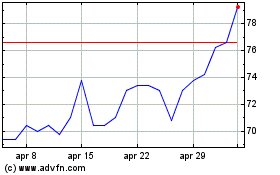

Grafico Azioni Linedata Services (EU:LIN)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Linedata Services (EU:LIN)

Storico

Da Gen 2024 a Gen 2025