+6% organic growth and strong financial performance led by

Electrification businesses in H1 2024

2024 guidance upgraded

_PRESS

RELEASE_

- H1 2024 standard sales of

€3.5 billion (current sales of €4.2 billion), up +6.1% organically

and Q2 2024 standard sales of €1.9 billion, up +9.4%

organically

- Acceleration in

Electrification businesses, up +14.1% organically in H1 2024,

thanks to continued focus on value-added solutions

- Record adj. EBITDA

of €412 million, up +16.4% year-on-year, adj. EBITDA margin

at 11.6% up +96bps

- Robust Normalized FCF at

€189 million, reflecting strong operational

performance

- Balance sheet strengthened

with two successful bond issuances

- Completion of the La

Triveneta Cavi’s acquisition, enhancing European footprint and

product offerings

- Halden subsea high-voltage

plant's extended capacity now operational, bolstering leadership in

high-voltage solutions

- Full-year 2024 guidance

upgraded, boosted by robust performance and integration of

La Triveneta Cavi

- Adjusted EBITDA of between €750 and

€800 million (€670 - €730 million previously)

- Normalized Free Cash Flow of

between €275 and €375 million (€200 - €300 million previously)

- Capital Markets Day to be

held on November 13, 2024 in London, and US investors day on

November 20, 2024 in New York City

~ ~ ~

Paris, July 24, 2024 – Today,

Nexans, a global leader in the design and manufacturing of cable

systems to power the world, published its financial statements for

the first-half of 2024, as approved by the Board of Directors at

its meeting on July 23, 2024 chaired by Jean Mouton. Commenting on

the Group’s performance, Christopher Guérin, Nexans’ Chief

Executive Officer, said:

“The record profitability we have achieved in

the first half of 2024 evidences our value growth focus and the

strategic direction we have set for Nexans. We have seen robust

growth across our Electrification segments, particularly in

Generation & Transmission where the strategic expansion of our

Halden plant in Norway has already begun to yield benefits.

The successful finalization of the acquisition

of La Triveneta Cavi in Italy early June marks a significant

milestone in our journey. This strategic move expands our Usage

capabilities and reinforces our commitment to providing

comprehensive, high-quality solutions to our customers

globally.

Innovation continues to be a driving force

behind our success, and our pioneering work, such as the

superconducting fault current limiter developed with SNCF Réseau,

exemplifies our dedication to pushing technological

advancements.”

H1 2024 KEY FIGURES

|

(in millions of euros) |

H1 2023 |

H1 2024 |

|

Sales at current metal prices |

4,009 |

4,224 |

| Sales

at standard metal prices1 |

3,322 |

3,546 |

|

Organic growth |

-0.6% |

+6.1% |

| Adj.

EBITDA |

354 |

412 |

|

Adj. EBITDA as a % of standard sales |

10.7% |

11.6% |

|

Specific operating items |

(27) |

(12) |

|

Depreciation and amortization |

(87) |

(100) |

|

Operating margin |

240 |

300 |

| Reorganization

costs |

(23) |

(23) |

| Other operating

items |

(1) |

15 |

|

Operating income |

217 |

291 |

| Net financial

income (loss) |

(38) |

(44) |

| Income

taxes |

(45) |

(71) |

|

Net income |

134 |

176 |

|

Net debt |

229 |

810 |

| Normalized free

cash-flow |

281 |

189 |

|

ROCE |

21.2% |

19.7% |

H1 2024 BUSINESS

PERFORMANCE

Sales at standard metal prices

reached €3,546 million in H1 2024. Demonstrating solid organic

growth of +6.1% at constant scope and currency compared to H1 2023,

the Group’s strategic initiatives are paying off. Excluding the

Other activities segment, which is being strategically scaled down,

organic growth stood at +9.0%. The Electrification businesses grew

by +14.1% organically, driven largely by the Generation &

Transmission segment's strong growth following the Halden plant

expansion. Despite a challenging automation market and a high

comparison base, the Non-electrification business proved resilient

with a slight organic decline of -1.6%.

In Q2 2024, Nexans achieved organic growth of

+9.4% compared to Q2 2023. Excluding the Other activities, the

growth rate accelerated to +13.3%. Showcasing the strength of its

core business focus, the Electrification businesses outperformed

with +21.3% organic growth.

In early June, Nexans successfully completed the

acquisition of La Triveneta Cavi, a leading Italian cable

manufacturer, for an enterprise value of approximately €520

million. With a robust presence in thirty countries, La Triveneta

Cavi's performance in 2023, with current sales of around €800

million underscores the strategic value of this acquisition. The

Group is poised to unlock approximately €20 million in annual

synergies post-integration, leveraging its unique SHIFT Performance

and Prime transformation programs, enhanced operational

efficiencies and cross-selling opportunities. Nexans' proven track

record of successful integrations inspires confidence in its

ability to seamlessly incorporate La Triveneta Cavi into its

operations. This strategic move is expected to unlock substantial

value, reinforcing the Group’s commitment to excellence in

electrification.

In H1 2024 net acquisitions/disposals had an

impact on standard sales of +€8 million reflecting i) the

integration of La Triveneta Cavi into the Usage segment from June

1, 2024, ii) the acquisition of Reka Cables since April 2023

bolstering the Distribution and Usage segments, and iii) the

divestment of the Telecom Systems business since October 2023 in

line with Nexans' vision to become an Electrification Pure

Player.

Adjusted EBITDA reached €412

million in H1 2024, up by a strong +16.4% versus €354 million in

H1 2023. This performance underscored the profitability

enhancements realized across all business segments. The

adjusted EBITDA margin reached an all-time high of

11.6%, surpassing the previous year's strong performance of 10.7%.

This achievement illustrates the Group’s strategic focus on

operational excellence and value-driven growth. Notably, the €18

million contribution from the SHIFT Prime program and the €4

million contribution from the Amplify program to the

Electrification businesses' EBITDA, as compared to H1 2023,

exemplify the tangible impact of strategic initiatives on

value-added solutions.

In H1 2024, specific operating

items amounted to €(12) million in H1 2024. They included

€(9) million related to share-based payment expenses, and €(4)

million related to additional costs on long-term projects impacted

by past reorganizations.

EBITDA including share-based

payment expenses - as per the 2021 Capital Markets Day definition

-amounted to €404 million in H1 2024, versus €347 million in H1

2023. The Group’s EBITDA margin stood at 11.4% in H1 2024, in line

with the Group’s 2021 Capital markets day target of 10%-12%.

ROCE pursued its strong

trajectory, reaching 19.7% for the Group, and 22.5% for the

Electrification businesses, reflecting the acquisition of La

Triveneta Cavi.

Operating margin totaled €300

million in H1 2024, representing 8.4% of sales at standard metal

prices (versus 7.2% in H1 2023).

The Group ended H1 2024 with operating

income of €291 million, compared with €217 million in

H1 2023. The main changes were as follows:

- The core

exposure effect amounted to €25 million in H1 2024, versus

€6 million in H1 2023 reflecting the increase in copper prices

in the first half of the year

- Other

operating income and expenses was €14 million expense in

H1 2024, versus €6 million expense in H1 2023, of which:

-

Acquisition-related costs of €12 million in H1

2024, mainly related to the acquisition of La Triveneta Cavi. In H1

2023, acquisition-related costs of €6 million was mainly related to

the acquisition of Reka Cables in Finland.

- Net asset

impairment had no impact in H1 2024. They included a

reversal of €7 million on Amercable activities in H1 2023.

The net financial expense

amounted to €44 million in H1 2024, compared with €38 million

during the same period last year. The increase primarily reflects

the successful issuance of bonds for €575 million in May

maturing in 2029 and €350 million bond in March 2024 maturing in

2030.

Income tax expense stood at

€71 million, up from €45 million in H1 2023. The tax rate

amounted to 29% of income before tax in H1 2024.

Net income amounted to €176

million in H1 2024, versus €134 million in H1 2023,

representing €3.98 per share.

CASH FLOW AND NET DEBT AT JUNE 30,

2024

Normalized free cash flow stood

at €189 million in H1 2024, reflecting the Group’s solid operating

performance. Calculated based on normalized free cash flow, the

adj. EBITDA to cash conversion rate was 46%.

Cash from operations was a

strong €315 million in H1 2024, up +48.1% compared to H1 2023.

Change in working capital amounted to €(7)

million, versus €142 million in H1 2023 which was supported by the

positive impact of cash collection in the Generation &

Transmission segment. Thus, operating working capital

represented 2.3% of the Group’s annualized second quarter

sales at June 30, 2024 (1.7% at June 30, 2023), below its normative

level of ≤6%.

Normalized free cash flow also included a

negative reorganization cash impact of €30 million in H1 2024.

Recurring capital expenditure amounted to €87

million in H1 2024, representing 2.5% of Group’s standard sales.

Normalized free cash flow also included financial interest for €42

million, versus €33 million in H1 2023, and other investing

impacts for a positive €5 million, versus a negative €3 million in

H1 2023.

Free cash flow before M&A and equity

operations was €79 million in H1 2024, versus €171 million

in H1 2023, and included strategic capital

expenditure in the Generation & Transmission business

for €105 million, corresponding mainly to the finalization of the

expansion of the Halden plant in Norway, and the ongoing investment

in a third cable-laying vessel. The other differing items between

Normalized free cash flow and Free cash flow before M&A

corresponded to normative project tax cash-out for €5 million (€22

million in H1 2023).

Net cash flow from M&A

amounted to a net outflow of €533 million in H1 2024, primarily

related to the acquisition of La Triveneta Cavi in June. In H1

2023, this figure was a net outflow of €70 million related to the

acquisition of Reka Cables.

Equity operations represented a

net outflow of €118 million including the payment of the 2023

dividend of €2.30 per share for a total amount of €101 million, and

share buybacks for €17 million. There was a net outflow of €24

million related to unfavorable foreign exchange fluctuations and

new lease liabilities.

Net debt increased to €810

million at June 30, 2024, from €214 million at December 31, 2023,

representing a 0.7x leverage ratio as per the covenant

definition2.

SUSTAINABILITY

As a global leader in the electrification,

Nexans is dedicated not only to powering the future but also to

ensuring that its operations and activities embed and promote

sustainability and safety at every level. In alignment with its

core values and pledge to achieve Net-Zero emissions by 2050, three

key initiatives took place during the first half:

- Nexans

celebrated its annual Internal Planet Week, a company-wide event

that brings together employees from all corners of the globe to

engage in activities and dialogues centered around environmental

sustainability. This initiative reflects ongoing efforts to reduce

carbon footprint, conserve resources, and foster a culture of

eco-consciousness within the organization. During the week, various

workshops, seminars, and interactive sessions were held to educate

and inspire Nexans’ workforce on the importance of environmental

stewardship.

- Electrification

sites were awarded their E3 performance scores based on 2023 data.

This scoring provides each site with a clear understanding of their

systemic performance and helps to reinforce and drive their

respective action plans.

- Nexans also

observed Global Safety Day across all units, reaffirming its

unwavering commitment to the health and safety of its employees.

This day serves as a reminder of the critical importance of

maintaining a safe work environment and the role each individual

plays in achieving this objective.

H1 2024 PERFORMANCE BY

SEGMENT

| GENERATION &

TRANSMISSION (18% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

H1 2023 |

H1 2024 |

Q2 2024 |

|

Sales at standard metal prices |

384 |

622 |

365 |

| Organic

growth |

-10.3% |

+64.0% |

+95.0% |

|

Adjusted EBITDA |

30 |

68 |

|

|

Adjusted EBITDA as a % of standard sales |

7.8% |

10.9% |

|

Generation & Transmission standard

sales came in at €622 million in H1 2024, up +64.0%

organically compared to H1 2023, propelled by the completion of the

Halden plant expansion in Norway at the beginning of the year,

which doubled XLPE technology capacities and bolstered production

capabilities.

The segment’s adjusted

EBITDA reached €68 million in H1 2024, up

+125% compared to the same period last year. The adjusted EBITDA

margin showcased a significant uptick to 10.9% in H1 2024, versus

7.8% in H1 2023. As expected, the gradual margin upturn was

supported by extended capacity utilization, and the successful

installation of projects and execution of IMR3 campaigns, which

helped to mitigate the impact of executing lower-margin legacy

projects.

Customer activity remained robust, and in line

with its risk-reward selectivity approach, the segment’s

adjusted backlog reached €6.7 billion at June 30,

2024, up +29.9% compared to June 30, 2023. This growth was notably

fueled by initial call-offs from TenneT's frame agreement for the

BalWin3 and LanWin4 offshore wind projects in the first half of the

year. During the second quarter, Nexans signed a four-year

contingency and preparedness contract with Equinor.

The robust visibility of manufacturing and

installation asset loads has been extended through 2030.

Construction of Nexans’ third cable-laying vessel, the Nexans

Electra, is ongoing. This state-of-the-art vessel is a strategic

asset that will significantly enhance capacity to address the

substantial growth in the business’ backlog.

| DISTRIBUTION

(18% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

H1 2023 |

H1 2024 |

Q2 2024 |

|

Sales at standard metal prices |

599 |

635 |

332 |

| Organic

growth |

+4.3% |

+2.4% |

+1.6% |

|

Adjusted EBITDA |

82 |

99 |

|

|

Adjusted EBITDA as a % of standard sales |

13.7% |

15.6% |

|

Standard sales in the

Distribution segment rose organically by +2.4% compared with H1

2023 to €635 million. Demand was solid, driven by robust

market conditions and strategic contract wins. In Europe, the

segment benefited from increased demand and the securing of new

frame agreements, including a major contract in Italy. The Near

East and Africa was boosted by a series of renewable energy

projects, reflecting the Group’s strategic alignment with global

sustainability trends, while North America and South America

encountered project delays.

Adjusted EBITDA rose by a sharp

+20% year-on-year to €99 million supported by new frame-agreements,

operational excellence and the contribution of the Reka Cables

acquisition completed in April 2023. The adjusted EBITDA

margin reached an unprecedented 15.6% in H1 2024 compared

with 13.7% in H1 2023, reflecting robust demand and increased

selectivity in project engagement.

| USAGE (28%

OF TOTAL STANDARD SALES)

|

(in millions of euros) |

H1 2023 |

H1 2024 |

Q2 2024 |

|

Sales at standard metal prices |

890 |

989 |

524 |

| Organic

growth |

-2.8% |

+1.0% |

+4.7% |

|

Adjusted EBITDA |

137 |

139 |

|

|

Adjusted EBITDA as a % of standard sales |

15.4 % |

14.1% |

|

Standard sales in the Usage

segment amounted to €989 million in H1 2024, up +1.0% organically,

underpinned by market stabilization in North America (Canada).

While Europe faced softer demand in certain residential markets,

the Near East and Africa, and South America regions delivered a

strong performance, contributing positively to the segment’s

trajectory.

H1 2024 reflects the contributions of La

Triveneta Cavi, starting from June 1, 2024, and Reka Cables, since

April 2023. These acquisitions are integral to Nexans'

Electrification strategy, expanding the Group’s capabilities and

reinforcing its market position in key regions.

Aligned with the Group’s value-added and prime

approach, the number of active and engaged users on digital

platforms has doubled year-on-year. The increase in digital

engagement, and the introduction of innovative packaging like

Mobiway Boost in Asia Pacific and the penetration of fire safety

solutions are clear indicators of Nexans’ proactive approach to

value growth and innovation.

Adjusted EBITDA reached €139

million in H1 2024, up +1.4% year-on-year. Adjusted EBITDA

margin was a robust 14.1%, thanks to structural

performance improvement initiatives, selectivity, and a focus on

delivering value-added solutions. These efforts have effectively

balanced the normalization in North America compared to the

previous year exceptional performance.

| NON-ELECTRIFICATION

(Industry & Solutions) (25% OF TOTAL STANDARD

SALES)

|

(in millions of euros) |

H1 2023 |

H1 2024 |

Q2 2024 |

|

Sales at standard metal prices |

908 |

890 |

443 |

| Organic

growth |

+20.0% |

-1.6% |

-3.3% |

|

Adjusted EBITDA |

109 |

114 |

|

|

Adjusted EBITDA as a % of standard sales |

12.0% |

12.8% |

|

In the Industry & Solutions segment,

standard sales for H1 2024 amounted to €890

million, reflecting a marginal organic year-on-year decline of

-1.6%. This was primarily attributed to a slowdown in Automation in

Europe, which was partially offset by robust growth in the

Shipbuilding and Aerospace markets, as well as a slight increase in

the Auto-harnesses business. Notably, Nexans announced a strategic

investment of €4.5 million in France during the quarter to double

its medical cable production capacity, in response to surging

demand in this sector.

Adjusted EBITDA for the segment

increased by +4.2% to reach €114 million, resulting in an adjusted

EBITDA margin of 12.8% in H1 2024, compared to 12.0% in the

previous year. This improvement reflects the positive impact of

operational enhancements and a favorable product mix.

| OTHER

ACTIVITIES (12% OF TOTAL STANDARD SALES)

|

(in millions of euros) |

H1 2023 |

H1 2024 |

Q2 2024 |

|

Sales at standard metal prices |

541 |

410 |

191 |

| Organic

growth |

-19.2% |

-11.8% |

-15.7% |

|

Adjusted EBITDA |

(5) |

(7) |

|

The Other Activities segment –

corresponding for the most part to copper wire sales and corporate

costs that cannot be allocated to other segments – reported

standard sales of €410 million in H1 2024.

Standard sales were down -11.8% organically year-on-year, mainly

linked to the Group’s strategy to reduce copper wire external sales

through tolling agreements in order to mitigate their dilutive

effect.

The segment’s adjusted

EBITDA was stable at a negative €7 million in H1

2024, versus a negative €5 million in H1 2023.

2024 OUTLOOK

As the world continues to embrace

electrification, Nexans is well-positioned to harness buoyant

market demand, supported by global megatrends and the Company's

commitment to delivering value-added solutions. Nexans' Generation

& Transmission segment boasts a record risk-reward adjusted

backlog, ensuring solid visibility. The Group is poised to reap

benefits from the expanded capacity of the Halden plant in Norway,

positioning Nexans to meet the growing global demand for

high-voltage solutions. Looking ahead, the Generation &

Transmission business is on a trajectory of gradual improvement

anticipated to be more pronounced in 2025. This progress is

contingent upon the successful execution of projects and the

completion of legacy contracts. The Distribution market is entering

a significant hyper cycle of investment, presenting Nexans with

opportunities for growth and enhanced profitability. Despite weak

demand in certain geographies within the construction sector,

Nexans’ Usage segment remains resilient, with strategic initiatives

in place to mitigate the impact of these macroeconomic conditions.

Seasonality impacts are anticipated in H2 2024, as in previous

years. Nexans will continue to leverage the agility and dedication

of its teams to adapt to market changes and maintain a steadfast

focus on cash generation.

Reflecting the strong performance in the first

half of the year and the successful integration of La Triveneta

Cavi, which is expected to add around €40 million to EBITDA in

2024, Nexans is upgrading its financial outlook for the full year

of 2024. The Group expects to achieve the following targets,

excluding the impact of any non-closed acquisitions and

divestments:

- Adjusted EBITDA of between €750 and

€800 million (€670 - €730 million previously);

- Normalized Free

Cash Flow of between €275 and €375 million (€200 - €300 million

previously).

Nexans reaffirms its commitment to the 2021

Capital Markets Day targets and will continue to execute its

strategic roadmap and priorities.

The H1 2024 press release and presentation

slides are available in the Investor Relations Results section at

Nexans - Financial results.

A conference call is scheduled today at 9:00

a.m. CEST. Please find below the access details:

Webcast

https://channel.royalcast.com/landingpage/nexans/20240724_1/

Audio dial-in

- International

switchboard: +44 (0) 33 0551 0200

- France: +33 (0)

1 70 37 71 66

- United Kingdom:

+44 (0) 33 0551 0200

- United States:

+1 786 697 3501

Confirmation code: Nexans

~ ~ ~

FINANCIAL CALENDAROctober 30,

2024: 2024

third-quarter financial informationNovember 13, 2024:

Capital Markets

Day, London November 20, 2024:

US investors day,

New York City February 19, 2025:

Full-year 2024

earnings

About Nexans

For over a century, Nexans has played a crucial

role in the electrification of the planet and is committed to

electrifying the future. With approximately 28,500 people in 41

countries, the Group is paving the way to a new world of safe,

sustainable and decarbonized electricity that is accessible to

everyone. In 2023, Nexans generated €6.5 billion in standard sales.

The Group is a leader in the design and manufacturing of cable

systems and services across four main business areas: Power

Generation & Transmission, Distribution, Usage and Industry

& Solutions. Nexans was the first company in its industry to

create a Foundation supporting sustainable initiatives, bringing

access to energy to disadvantaged communities worldwide. The Group

is recognized on the CDP Climate Change A List as a global leader

on climate action and has committed to Net-Zero emissions by 2050

aligned with the Science Based Targets initiative (SBTi).

Nexans. Electrify the Future.

Nexans is listed on Euronext Paris, compartment

A.For more information, please visit

www.nexans.com

Contacts

|

Investor relations |

Communication |

|

Elodie Robbe-MouillotTel.: +33 (0)1 78 15 03

87elodie.robbe-mouillot@nexans.com |

Mael Evin (Havas Paris)Tel.: +33 (0)6 44 12 14

91mael.evin@havas.com |

- Nexans_H1 2024 earnings Press release

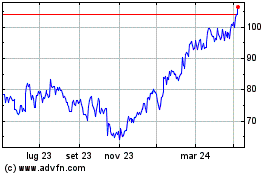

Grafico Azioni Nexans (EU:NEX)

Storico

Da Ott 2024 a Nov 2024

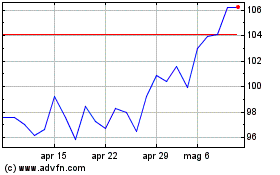

Grafico Azioni Nexans (EU:NEX)

Storico

Da Nov 2023 a Nov 2024