Pharming Group announces the placement of €100 million convertible

bonds due 2029

NOT FOR DISTRIBUTION IN OR INTO THE

UNITED STATES OR IN OR INTO AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA

OR ANY OTHER JURISDICTION IN WHICH SUCH DISTRIBUTION WOULD BE

PROHIBITED BY APPLICABLE LAW.

Leiden, the Netherlands, 18th

April, 2024: Pharming Group N.V.

("Pharming" or the "Company")

(Euronext Amsterdam: PHARM) announces today the placement of €100

million of senior unsecured convertible bonds due 2029 (the

“New Bonds”) convertible into new and/or existing

ordinary shares in the capital of the Company (the

"Shares"). The offer was fully subscribed. The New

Bonds were offered via an accelerated book building process through

a private placement only to institutional investors outside the

United States of America, Australia, Canada, Japan and South

Africa.

The New Bonds will have a principal amount of

€100,000 each. The New Bonds will be issued at par and will carry a

coupon of 4.50% per annum payable semi-annually in arrear in equal

instalments on 25th April and 25th October of each year, commencing

on 25th October 2024. Unless previously converted, redeemed or

purchased and cancelled, the New Bonds will be redeemed at par on

25th April 2029.

The initial conversion price has been set at

€1.2271, representing a premium of 37.5% above the volume weighted

average price (VWAP) of a Share on Euronext Amsterdam between

opening of trading on the launch date and the pricing of the

offering (i.e. €0.8924). The initial conversion price of the New

Bonds will be subject to customary adjustment provisions as set out

in the terms and conditions.

Pharming will use the net proceeds of the New

Bonds for the repurchase of the outstanding €125 million 3.00%

senior unsecured convertible bonds due 2025 issued on 21 January

2020 (the “2025 Bonds”; ISIN: XS2105716554), which

has been launched concurrently to the offering of the New Bonds

(the “Invitation”) to strengthen its financial

position while enhancing flexibility for the continued execution of

its business strategy over the next several years.

The Invitation is expected to close at 5.30pm

CET on 19th April 2024, unless amended, extended, re-opened or

terminated, and the results will be announced via a separate press

release shortly thereafter.

Sijmen de Vries, Chief Executive Officer

of Pharming, said:

“This successful convertible bond issuance

demonstrates strong support from investors and is a positive step

for Pharming. Taking into consideration the upcoming maturity of

our convertible bonds in January 2025, this issuance and repurchase

strengthens our financial position while enhancing flexibility for

the continued execution of our business strategy over the next

several years.”

Further Details on the New

BondsThe Company will have the option to redeem all, but

not some only, of the outstanding New Bonds in cash at par plus

accrued but unpaid interest at any time, a) if, on or after 16th

May 2027, the parity value on each of at least 20 dealing days in a

period of 30 consecutive dealing days shall have exceeded 130% of

the principal amount or b) if, at any time, 85% or more of the

aggregate principal amount of the New Bonds originally issued shall

have been previously converted and/or repurchased and

cancelled.

Settlement of the New Bonds is expected to take

place on or around 25th April 2024 (the “Issue

Date”).

Application will be made for the New Bonds to be

admitted to trading on the Open Market (Freiverkehr) of the

Frankfurt Stock Exchange by no later than 30 days following the

Issue Date.

In the context of the offering, the Company and

its subsidiaries have agreed to a lock-up period of 90 days

following the Issue Date, subject to certain customary

exceptions.

HSBC and Jefferies acted as Joint Global

Coordinators and Joint Bookrunners for the offering. Van Lanschot

Kempen acted as advisor to the Company.

About Pharming Group

N.V.Pharming Group N.V. (EURONEXT Amsterdam: PHARM/Nasdaq:

PHAR) is a global biopharmaceutical company dedicated to

transforming the lives of patients with rare, debilitating, and

life-threatening diseases. Pharming is commercializing and

developing an innovative portfolio of protein replacement therapies

and precision medicines, including small molecules, biologics, and

gene therapies that are in early to late-stage development.

Pharming is headquartered in Leiden, the Netherlands, and has

employees around the globe who serve patients in over 30 markets in

North America, Europe, the Middle East, Africa, and

Asia-Pacific.

For more information, visit www.pharming.com and

find us on LinkedIn.

Forward-looking Statements This

press release may contain forward-looking statements.

Forward-looking statements are statements of future expectations

that are based on management’s current expectations and assumptions

and involve known and unknown risks and uncertainties that could

cause actual results, performance, or events to differ materially

from those expressed or implied in these statements. These

forward-looking statements are identified by their use of terms and

phrases such as “aim”, “ambition”, ‘‘anticipate’’, ‘‘believe’’,

‘‘could’’, ‘‘estimate’’, ‘‘expect’’, ‘‘goals’’, ‘‘intend’’,

‘‘may’’, “milestones”, ‘‘objectives’’, ‘‘outlook’’, ‘‘plan’’,

‘‘probably’’, ‘‘project’’, ‘‘risks’’, “schedule”, ‘‘seek’’,

‘‘should’’, ‘‘target’’, ‘‘will’’ and similar terms and phrases.

Examples of forward-looking statements may include statements with

respect to timing and progress of Pharming's preclinical studies

and clinical trials of its product candidates, Pharming's clinical

and commercial prospects, and Pharming's expectations regarding its

projected working capital requirements and cash resources, which

statements are subject to a number of risks, uncertainties and

assumptions, including, but not limited to the scope, progress and

expansion of Pharming's clinical trials and ramifications for the

cost thereof; and clinical, scientific, regulatory, commercial,

competitive and technical developments. In light of these risks and

uncertainties, and other risks and uncertainties that are described

in Pharming's 2023 Annual Report and the Annual Report on Form 20-F

for the year ended December 31, 2023, filed with the U.S.

Securities and Exchange Commission, the events and circumstances

discussed in such forward-looking statements may not occur, and

Pharming's actual results could differ materially and adversely

from those anticipated or implied thereby. All forward-looking

statements contained in this press release are expressly qualified

in their entirety by the cautionary statements contained or

referred to in this section. Readers should not place undue

reliance on forward-looking statements. Any forward-looking

statements speak only as of the date of this press release and are

based on information available to Pharming as of the date of this

release. Pharming does not undertake any obligation to publicly

update or revise any.

Inside InformationThis press

release relates to the disclosure of information that qualified, or

may have qualified, as inside information within the meaning of

Article 7(1) of the EU Market Abuse Regulation.

For further public information,

contact:Pharming Group, Leiden, the NetherlandsMichael

Levitan, VP Investor Relations & Corporate CommunicationsT: +1

(908) 705 1696E: investor@pharming.comFTI Consulting, London,

UKVictoria Foster Mitchell/Alex Shaw/Amy ByrneT: +44 203 727

1000

LifeSpring Life Sciences Communication, Amsterdam,

the NetherlandsLeon MelensT: +31 6 53 81 64 27E:

pharming@lifespring.nl

NO ACTION HAS BEEN TAKEN BY THE COMPANY, THE

JOINT GLOBAL COORDINATORS AND JOINT BOOKRUNNERS (TOGETHER, THE

“MANAGERS”) OR ANY OF THEIR RESPECTIVE AFFILIATES

THAT WOULD PERMIT AN OFFERING OF THE NEW BONDS OR POSSESSION OR

DISTRIBUTION OF THIS PRESS RELEASE OR ANY OFFERING OR PUBLICITY

MATERIAL RELATING TO THE NEW BONDS OR THE ORDINARY SHARES TO BE

ISSUED OR DELIVERED UPON CONVERSION OF THE NEW BONDS AND NOTIONALLY

UNDERLYING THE BONDS (TOGETHER WITH THE NEW BONDS, THE

“SECURITIES”) IN ANY JURISDICTION WHERE ACTION FOR

THAT PURPOSE IS REQUIRED. PERSONS INTO WHOSE POSSESSION THIS PRESS

RELEASE COMES ARE REQUIRED BY THE COMPANY AND THE MANAGERS TO

INFORM THEMSELVES ABOUT, AND TO OBSERVE, ANY SUCH RESTRICTIONS.

THIS PRESS RELEASE IS NOT FOR DISTRIBUTION,

DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES. THIS PRESS

RELEASE IS NOT AN OFFER TO SELL SECURITIES OR THE SOLICITATION OF

ANY OFFER TO BUY SECURITIES, NOR SHALL THERE BE ANY OFFER OF

SECURITIES IN ANY JURISDICTION IN WHICH SUCH OFFER OR SALE WOULD BE

UNLAWFUL.THIS PRESS RELEASE AND THE OFFERING WHEN MADE ARE ONLY

ADDRESSED TO, AND DIRECTED IN, THE UNITED KINGDOM AND MEMBER STATES

OF THE EUROPEAN ECONOMIC AREA (THE “EEA”) AT

PERSONS WHO ARE “QUALIFIED INVESTORS” WITHIN THE

MEANING OF THE PROSPECTUS REGULATION (“QUALIFIED

INVESTORS”). FOR THESE PURPOSES, THE EXPRESSION

"PROSPECTUS REGULATION" MEANS REGULATION (EU)

2017/1129 AND REGULATION (EU) 2017/1129 AS IT FORMS PART OF UNITED

KINGDOM DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL)

ACT 2018 (THE “EUWA”).

SOLELY FOR THE PURPOSES OF THE PRODUCT

GOVERNANCE REQUIREMENTS CONTAINED WITHIN: (A) EU DIRECTIVE

2014/65/EU ON MARKETS IN FINANCIAL INSTRUMENTS, AS AMENDED

(“MIFID II”); (B) ARTICLES 9 AND 10 OF COMMISSION

DELEGATED DIRECTIVE (EU) 2017/593 SUPPLEMENTING MIFID II; (C) LOCAL

IMPLEMENTING MEASURES IN THE EEA; (D) REGULATION (EU) NO 600/2014

AS IT FORMS PART OF UNITED KINGDOM DOMESTIC LAW BY VIRTUE OF THE

EUWA (“UK MIFIR”); AND (E) THE FCA HANDBOOK

PRODUCT INTERVENTION AND PRODUCT GOVERNANCE SOURCEBOOK (TOGETHER,

THE “PRODUCT GOVERNANCE REQUIREMENTS”), AND

DISCLAIMING ALL AND ANY LIABILITY, WHETHER ARISING IN TORT,

CONTRACT OR OTHERWISE, WHICH ANY “MANUFACTURER”

(FOR THE PURPOSES OF THE PRODUCT GOVERNANCE REQUIREMENTS) MAY

OTHERWISE HAVE WITH RESPECT THERETO, THE NEW BONDS HAVE BEEN

SUBJECT TO A PRODUCT APPROVAL PROCESS, WHICH HAS DETERMINED THAT:

(I) THE TARGET MARKET FOR THE NEW BONDS IS (A) IN THE EEA, ELIGIBLE

COUNTERPARTIES AND PROFESSIONAL CLIENTS ONLY, EACH AS DEFINED IN

MIFID II AND (B) IN THE UNITED KINGDOM, ELIGIBLE COUNTERPARTIES (AS

DEFINED IN THE FCA HANDBOOK CONDUCT OF BUSINESS SOURCEBOOK) AND

PROFESSIONAL CLIENTS (AS DEFINED IN UK MIFIR); AND (II) ALL

CHANNELS FOR DISTRIBUTION OF THE NEW BONDS TO ELIGIBLE

COUNTERPARTIES AND PROFESSIONAL CLIENTS ARE APPROPRIATE. ANY PERSON

SUBSEQUENTLY OFFERING, SELLING OR RECOMMENDING THE NEW BONDS (A

"DISTRIBUTOR") SHOULD TAKE INTO CONSIDERATION THE

MANUFACTURERS’ TARGET MARKET ASSESSMENT; HOWEVER, A DISTRIBUTOR

SUBJECT TO MIFID II OR THE FCA HANDBOOK PRODUCT INTERVENTION AND

PRODUCT GOVERNANCE SOURCEBOOK IS RESPONSIBLE FOR UNDERTAKING ITS

OWN TARGET MARKET ASSESSMENT IN RESPECT OF THE NEW BONDS (BY EITHER

ADOPTING OR REFINING THE MANUFACTURERS’ TARGET MARKET ASSESSMENT)

AND DETERMINING APPROPRIATE DISTRIBUTION CHANNELS.

THE TARGET MARKET ASSESSMENT IS WITHOUT

PREJUDICE TO THE REQUIREMENTS OF ANY CONTRACTUAL OR LEGAL SELLING

RESTRICTIONS IN RELATION TO ANY OFFERING OF THE BONDS.

FOR THE AVOIDANCE OF DOUBT, THE TARGET MARKET

ASSESSMENT DOES NOT CONSTITUTE: (A) AN ASSESSMENT OF SUITABILITY OR

APPROPRIATENESS FOR THE PURPOSES OF MIFID II OR UK MIFIR; OR (B) A

RECOMMENDATION TO ANY INVESTOR OR GROUP OF INVESTORS TO INVEST IN,

OR PURCHASE, OR TAKE ANY OTHER ACTION WHATSOEVER WITH RESPECT TO

THE NEW BONDS.

THE NEW BONDS ARE NOT INTENDED TO BE OFFERED,

SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD

OR OTHERWISE MADE AVAILABLE TO ANY RETAIL INVESTOR IN THE EEA OR

THE UNITED KINGDOM. FOR THESE PURPOSES, A RETAIL INVESTOR MEANS (A)

IN THE EEA, A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT

AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF MIFID II; OR (II) A

CUSTOMER WITHIN THE MEANING OF DIRECTIVE (EU) 2016/97, WHERE THAT

CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN

POINT (10) OF ARTICLE 4(1) OF MIFID II AND (B) IN THE UNITED

KINGDOM, A PERSON WHO IS ONE (OR MORE) OF (I) A RETAIL CLIENT, AS

DEFINED IN POINT (8) OF ARTICLE 2 OF REGULATION (EU) NO 2017/565 AS

IT FORMS PART OF UNITED KINGDOM DOMESTIC LAW BY VIRTUE OF THE EUWA

OR (II) A CUSTOMER WITHIN THE MEANING OF THE PROVISIONS OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 OF THE UNITED KINGDOM (THE

“FSMA”) AND ANY RULES OR REGULATIONS MADE UNDER

THE FSMA TO IMPLEMENT DIRECTIVE (EU) 2016/97, WHERE THAT CUSTOMER

WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT, AS DEFINED IN POINT (8)

OF ARTICLE 2(1) OF REGULATION (EU) NO 600/2014 AS IT FORMS PART OF

UNITED KINGDOM DOMESTIC LAW BY VIRTUE OF THE EUWA.

CONSEQUENTLY, NO KEY INFORMATION DOCUMENT

REQUIRED BY REGULATION (EU) NO 1286/2014, AS AMENDED (THE

"PRIIPS REGULATION") OR THE PRIIPS REGULATION AS

IT FORMS PART OF UNITED KINGDOM DOMESTIC LAW BY VIRTUE OF THE EUWA

(THE “UK PRIIPS REGULATION”) FOR OFFERING OR

SELLING THE NEW BONDS OR OTHERWISE MAKING THEM AVAILABLE TO RETAIL

INVESTORS IN THE EEA OR THE UNITED KINGDOM HAS BEEN PREPARED AND

THEREFORE OFFERING OR SELLING THE NEW BONDS OR OTHERWISE MAKING

THEM AVAILABLE TO ANY RETAIL INVESTOR IN THE EEA OR THE UNITED

KINGDOM MAY BE UNLAWFUL UNDER THE PRIIPS REGULATION AND/OR THE UK

PRIIPS REGULATION.

IN ADDITION, IN THE UNITED KINGDOM THIS PRESS

RELEASE IS BEING DISTRIBUTED ONLY TO, AND IS DIRECTED ONLY AT,

QUALIFIED INVESTORS (I) WHO HAVE PROFESSIONAL EXPERIENCE IN MATTERS

RELATING TO INVESTMENTS FALLING WITHIN ARTICLE 19(5) OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER

2005, AS AMENDED (THE “ORDER”) AND QUALIFIED

INVESTORS FALLING WITHIN ARTICLE 49(2)(A) TO (D) OF THE ORDER, AND

(II) TO WHOM IT MAY OTHERWISE LAWFULLY BE COMMUNICATED (ALL SUCH

PERSONS TOGETHER BEING REFERRED TO AS “RELEVANT

PERSONS”). THIS PRESS RELEASE MUST NOT BE ACTED ON OR

RELIED ON (I) IN THE UNITED KINGDOM, BY PERSONS WHO ARE NOT

RELEVANT PERSONS, AND (II) IN ANY MEMBER STATE OF THE EEA, BY

PERSONS WHO ARE NOT QUALIFIED INVESTORS. ANY INVESTMENT OR

INVESTMENT ACTIVITY TO WHICH THIS PRESS RELEASE RELATES IS

AVAILABLE ONLY TO (A) RELEVANT PERSONS IN THE UNITED KINGDOM AND

WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS IN THE UNITED KINGDOM

AND (B) QUALIFIED INVESTORS IN MEMBER STATES OF THE EEA.

ANY DECISION TO PURCHASE ANY OF THE NEW BONDS

SHOULD ONLY BE MADE ON THE BASIS OF AN INDEPENDENT REVIEW BY A

PROSPECTIVE INVESTOR OF THE COMPANY’S PUBLICLY AVAILABLE

INFORMATION. NEITHER OF THE MANAGERS NOR ANY OF THEIR RESPECTIVE

AFFILIATES ACCEPT ANY LIABILITY ARISING FROM THE USE OF, OR MAKE

ANY REPRESENTATION AS TO THE ACCURACY OR COMPLETENESS OF, THIS

PRESS RELEASE OR THE COMPANY’S PUBLICLY AVAILABLE INFORMATION. THE

INFORMATION CONTAINED IN THIS PRESS RELEASE IS SUBJECT TO CHANGE IN

ITS ENTIRETY WITHOUT NOTICE UP TO THE ISSUE DATE.

EACH PROSPECTIVE INVESTOR SHOULD PROCEED ON THE

ASSUMPTION THAT IT MUST BEAR THE ECONOMIC RISK OF AN INVESTMENT IN

THE SECURITIES. NONE OF THE COMPANY OR THE MANAGERS MAKE ANY

REPRESENTATION AS TO (I) THE SUITABILITY OF THE SECURITIES FOR ANY

PARTICULAR INVESTOR, (II) THE APPROPRIATE ACCOUNTING TREATMENT AND

POTENTIAL TAX CONSEQUENCES OF INVESTING IN THE SECURITIES OR (III)

THE FUTURE PERFORMANCE OF THE SECURITIES EITHER IN ABSOLUTE TERMS

OR RELATIVE TO COMPETING INVESTMENTS.

THE MANAGERS ARE ACTING ON BEHALF OF THE COMPANY

AND NO ONE ELSE IN CONNECTION WITH THE NEW BONDS AND WILL NOT BE

RESPONSIBLE TO ANY OTHER PERSON FOR PROVIDING THE PROTECTIONS

AFFORDED TO CLIENTS OF THE MANAGERS OR FOR PROVIDING ADVICE IN

RELATION TO THE SECURITIES.

EACH OF THE COMPANY, THE MANAGERS AND THEIR

RESPECTIVE AFFILIATES EXPRESSLY DISCLAIMS ANY OBLIGATION OR

UNDERTAKING TO UPDATE, REVIEW OR REVISE ANY STATEMENT CONTAINED IN

THIS PRESS RELEASE WHETHER AS A RESULT OF NEW INFORMATION, FUTURE

DEVELOPMENTS OR OTHERWISE.

THE SECURITIES MENTIONED IN THIS DOCUMENT HAVE

NOT BEEN AND WILL NOT BE REGISTERED IN THE UNITED STATES UNDER THE

U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES

ACT”), AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES, ABSENT

REGISTRATION OR EXEMPTION FROM REGISTRATION UNDER THE U.S.

SECURITIES ACT. THERE WILL BE NO PUBLIC OFFER OF THE SECURITIES IN

THE UNITED STATES OR IN ANY OTHER JURISDICTION.

IMPORTANT NOTICE IN RELATION TO THE

INVITATION

THIS PRESS RELEASE DOES NOT CONSTITUTE AN

INVITATION TO PARTICIPATE IN THE INVITATION IN ANY JURISDICTION IN

WHICH, OR TO OR FROM ANY PERSON TO OR FROM WHOM, IT IS UNLAWFUL TO

MAKE SUCH INVITATION UNDER APPLICABLE SECURITIES LAWS. THE

DISTRIBUTION OF THIS PRESS RELEASE IN CERTAIN JURISDICTIONS MAY BE

RESTRICTED BY LAW. PERSONS INTO WHOSE POSSESSION THIS PRESS RELEASE

COMES ARE REQUIRED BY THE COMPANY AND THE JOINT DEALER MANAGERS TO

INFORM THEMSELVES ABOUT, AND TO OBSERVE, ANY SUCH RESTRICTIONS.

UNITED STATES

THE INVITATION IS NOT BEING MADE AND WILL NOT BE

MADE, DIRECTLY OR INDIRECTLY, IN OR INTO, OR BY USE OF THE MAIL OF,

OR BY ANY MEANS OR INSTRUMENTALITY OF INTERSTATE OR FOREIGN

COMMERCE OF, OR OF ANY FACILITIES OF A NATIONAL SECURITIES EXCHANGE

OF, THE UNITED STATES. THIS INCLUDES, BUT IS NOT LIMITED TO,

FACSIMILE TRANSMISSION, ELECTRONIC MAIL, TELEX, TELEPHONE, THE

INTERNET AND OTHER FORMS OF ELECTRONIC COMMUNICATION.

THE 2025 BONDS MAY NOT BE TENDERED IN THE

INVITATION BY ANY SUCH USE, MEANS, INSTRUMENTALITY OR FACILITY FROM

OR WITHIN THE UNITED STATES. ACCORDINGLY, COPIES OF THIS PRESS

RELEASE AND ANY OTHER DOCUMENTS OR MATERIALS RELATING TO THE

INVITATION ARE NOT BEING, AND MUST NOT BE, DIRECTLY OR INDIRECTLY,

MAILED OR OTHERWISE TRANSMITTED, DISTRIBUTED OR FORWARDED

(INCLUDING, WITHOUT LIMITATION, BY CUSTODIANS, NOMINEES OR

TRUSTEES) IN OR INTO THE UNITED STATES. ANY PURPORTED TENDER OF

2025 BONDS IN THE INVITATION RESULTING DIRECTLY OR INDIRECTLY FROM

A VIOLATION OF THESE RESTRICTIONS WILL BE INVALID AND ANY PURPORTED

TENDER OF 2025 BONDS IN THE INVITATION MADE BY A PERSON LOCATED IN

THE UNITED STATES OR BY ANY AGENT, FIDUCIARY OR OTHER INTERMEDIARY

ACTING ON A NON-DISCRETIONARY BASIS FOR A PERSON OR A PRINCIPAL

GIVING INSTRUCTIONS FROM WITHIN THE UNITED STATES WILL BE INVALID

AND WILL NOT BE ACCEPTED.

EACH HOLDER OF 2025 BONDS PARTICIPATING IN THE

INVITATION WILL REPRESENT THAT IT IS NOT LOCATED IN THE UNITED

STATES AND IT IS NOT PARTICIPATING IN SUCH INVIATION FROM THE

UNITED STATES, OR IT IS ACTING ON A NON-DISCRETIONARY BASIS FOR A

PRINCIPAL THAT IS LOCATED OUTSIDE THE UNITED STATES AND THAT IS NOT

GIVING AN ORDER TO PARTICIPATE IN SUCH INVITATION FROM THE UNITED

STATES. FOR THE PURPOSES OF THIS AND THE ABOVE TWO PARAGRAPHS,

“UNITED STATES” MEANS THE UNITED STATES OF

AMERICA, ITS TERRITORIES AND POSSESSIONS (INCLUDING PUERTO RICO,

THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN SAMOA, WAKE ISLAND AND THE

NORTHERN MARIANA ISLANDS), ANY STATE OF THE UNITED STATES OF

AMERICA AND THE DISTRICT OF COLUMBIA.

UNITED KINGDOM

THE COMMUNICATION OF THIS PRESS RELEASE AND ANY

OTHER DOCUMENTS OR MATERIALS RELATING TO THE INVITATION IS NOT

BEING MADE, AND SUCH DOCUMENTS AND/OR MATERIALS HAVE NOT BEEN

APPROVED, BY AN AUTHORISED PERSON FOR THE PURPOSES OF SECTION 21 OF

THE FINANCIAL SERVICES AND MARKETS ACT 2000 AS AMENDED.

ACCORDINGLY, SUCH DOCUMENTS AND/OR MATERIALS ARE NOT BEING

DISTRIBUTED TO, AND MUST NOT BE PASSED ON TO, THE GENERAL PUBLIC IN

THE UNITED KINGDOM. THE COMMUNICATION OF SUCH DOCUMENTS AND/OR

MATERIALS AS A FINANCIAL PROMOTION IS ONLY BEING MADE TO THOSE

PERSONS IN THE UNITED KINGDOM FALLING WITHIN THE DEFINITION OF

INVESTMENT PROFESSIONALS (AS DEFINED IN ARTICLE 19(5) OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTIONS)

ORDER 2005 (THE “FINANCIAL PROMOTION ORDER”) OR

PERSONS WHO ARE WITHIN ARTICLE 43(2) OF THE FINANCIAL PROMOTION

ORDER OR ANY OTHER PERSONS TO WHOM IT MAY OTHERWISE LAWFULLY BE

MADE UNDER THE FINANCIAL PROMOTION ORDER.

ITALY

NONE OF THE INVITATION, THIS PRESS RELEASE OR

ANY OTHER DOCUMENTS OR MATERIALS RELATING TO THE INVITATION HAVE

BEEN OR WILL BE SUBMITTED TO THE CLEARANCE PROCEDURE OF THE

COMMISSIONE NAZIONALE PER LE SOCIETÀ E LA BORSA

(“CONSOB”) PURSUANT TO ITALIAN LAWS AND

REGULATIONS.

THE INVITATION IS BEING CARRIED OUT IN THE

REPUBLIC OF ITALY AS EXEMPTED OFFERS PURSUANT TO ARTICLE 101-BIS,

PARAGRAPH 3-BIS OF THE LEGISLATIVE DECREE NO. 58 OF 24 FEBRUARY

1998, AS AMENDED (THE “ITALIAN FINANCIAL SERVICES

ACT”) AND ARTICLE 35-BIS, PARAGRAPH 3, OF CONSOB

REGULATION NO. 11971 OF 14 MAY 1999, AS AMENDED FROM TIME TO TIME

(THE “ISSUERS’ REGULATION”). ACCORDINGLY, NO

TENDERS BY THE HOLDERS OF THE 2025 BONDS MAY BE COLLECTED, NOR ANY

OTHER MATERIALS RELATING TO THE INVITATION MAY BE DISTRIBUTED IN

THE REPUBLIC OF ITALY EXCEPT TO QUALIFIED INVESTORS (INVESTITORI

QUALIFICATI), AS DEFINED PURSUANT TO ARTICLE 100 OF THE ITALIAN

FINANCIAL SERVICES ACT AND ARTICLE 34- TER, FIRST PARAGRAPH, LETTER

B) OF THE ISSUERS' REGULATION. HOLDERS OR BENEFICIAL OWNERS OF THE

2025 BONDS THAT ARE RESIDENT OR LOCATED IN ITALY CAN TENDER SOME OR

ALL OF THEIR 2025 BONDS PURSUANT TO THE INVITATION THROUGH

AUTHORISED PERSONS (SUCH AS INVESTMENT FIRMS, BANKS OR FINANCIAL

INTERMEDIARIES PERMITTED TO CONDUCT SUCH ACTIVITIES IN ITALY IN

ACCORDANCE WITH THE ITALIAN FINANCIAL SERVICES ACT, CONSOB

REGULATION NO. 20307 OF 15 FEBRUARY 2018, AS AMENDED FROM TIME TO

TIME, AND LEGISLATIVE DECREE NO. 385 OF 1 SEPTEMBER 1993, AS

AMENDED) AND IN COMPLIANCE WITH APPLICABLE LAWS AND REGULATIONS OR

WITH REQUIREMENTS IMPOSED BY CONSOB, THE BANK OF ITALY OR ANY OTHER

ITALIAN AUTHORITY. HOLDERS OR BENEFICIAL OWNERS OF THE 2025 BONDS

THAT ARE RESIDENT OR LOCATED IN ITALY CAN TENDER SOME OR ALL OF

THEIR 2025 BONDS PURSUANT TO THE INVITATION THROUGH AUTHORISED

PERSONS (SUCH AS INVESTMENT FIRMS, BANKS OR FINANCIAL

INTERMEDIARIES PERMITTED TO CONDUCT SUCH ACTIVITIES IN ITALY IN

ACCORDANCE WITH THE ITALIAN FINANCIAL SERVICES ACT, CONSOB

REGULATION NO. 20307 OF 15 FEBRUARY 2018, AS AMENDED FROM TIME TO

TIME, AND LEGISLATIVE DECREE NO. 385 OF 1 SEPTEMBER 1993, AS

AMENDED) AND IN COMPLIANCE WITH APPLICABLE LAWS AND REGULATIONS OR

WITH REQUIREMENTS IMPOSED BY CONSOB, THE BANK OF ITALY OR ANY OTHER

ITALIAN AUTHORITY.

EACH INTERMEDIARY MUST COMPLY WITH THE

APPLICABLE LAWS AND REGULATIONS CONCERNING INFORMATION DUTIES

VIS-À-VIS ITS CLIENTS IN CONNECTION WITH THE 2025 BONDS OR THE

INVITATION.

FRANCE

THE INVITATION IS NOT BEING MADE, DIRECTLY OR

INDIRECTLY, TO THE PUBLIC IN THE REPUBLIC OF FRANCE

(“FRANCE”). NEITHER THIS PRESS RELEASE NOR ANY

OTHER DOCUMENTS OR MATERIALS RELATING TO THE INVITATION HAVE BEEN

OR SHALL BE DISTRIBUTED TO THE PUBLIC IN FRANCE AND ONLY (I)

PROVIDERS OF INVESTMENT SERVICES RELATING TO PORTFOLIO MANAGEMENT

FOR THE ACCOUNT OF THIRD PARTIES (PERSONNES FOURNISSANT LE SERVICE

D’INVESTISSEMENT DE GESTION DE PORTEFEUILLE POUR COMPTE DE TIERS)

AND/OR (II) QUALIFIED INVESTORS (INVESTISSEURS QUALIFIÉS) OTHER

THAN INDIVIDUALS, IN EACH CASE ACTING ON THEIR OWN ACCOUNT AND ALL

AS DEFINED IN, AND IN ACCORDANCE WITH, ARTICLES L.411-1, L.411-2

AND D.411-1 OF THE FRENCH CODE MONÉTAIRE ET FINANCIER, ARE ELIGIBLE

TO PARTICIPATE IN THE INVITATION. THIS PRESS RELEASE AND ANY OTHER

DOCUMENT OR MATERIAL RELATING TO THE INVITATION HAVE NOT BEEN AND

WILL NOT BE SUBMITTED FOR CLEARANCE TO NOR APPROVED BY THE AUTORITÉ

DES MARCHÉS FINANCIERS.

GENERAL

NEITHER THIS ANNOUNCEMENT NOR THE ELECTRONIC

TRANSMISSION THEREOF CONSTITUTES AN OFFER TO BUY OR THE

SOLICITATION OF AN OFFER TO SELL 2025 BONDS (AND TENDERS OF 2025

BONDS FOR PURCHASE PURSUANT TO THE INVITATION WILL NOT BE ACCEPTED

FROM HOLDERS OF 2025 BONDS) IN ANY CIRCUMSTANCES IN WHICH SUCH

OFFER OR SOLICITATION IS UNLAWFUL. IN THOSE JURISDICTIONS WHERE THE

SECURITIES, BLUE SKY OR OTHER LAWS REQUIRE THE INVITATION TO BE

MADE BY A LICENSED BROKER OR DEALER AND THE JOINT DEALER MANAGERS

OR ANY OF THEIR AFFILIATES ARE SUCH A LICENSED BROKER OR DEALER IN

ANY SUCH JURISDICTION, THE INVITATION SHALL BE DEEMED TO BE MADE BY

THE JOINT DEALER MANAGERS OR SUCH AFFILIATE, AS THE CASE MAY BE, ON

BEHALF OF THE COMPANY IN SUCH JURISDICTION.

THE COMPANY, THE JOINT DEALER MANAGERS AND

OTHERS WILL RELY UPON THE TRUTH AND ACCURACY OF THE FOREGOING

REPRESENTATIONS, ACKNOWLEDGEMENTS AND AGREEMENTS.

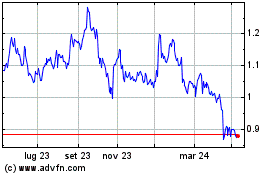

Grafico Azioni Pharming Group NV (EU:PHARM)

Storico

Da Feb 2025 a Mar 2025

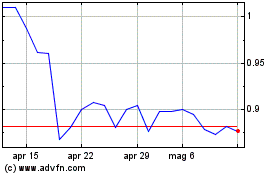

Grafico Azioni Pharming Group NV (EU:PHARM)

Storico

Da Mar 2024 a Mar 2025