SCOR Investment Partners reaches EUR 20 billion of asset under management driven by significant net inflows

19 Marzo 2024 - 2:24PM

SCOR Investment Partners reaches EUR 20 billion of asset under

management driven by significant net inflows

|

PRESS RELEASE | March 19, 2024 |

N° 01- 2024 |

SCOR Investment Partners reaches EUR 20

billion of asset under management driven by significant net

inflows.

SCOR Investment Partners, the SCOR Group’s asset

management company, is proud to announce that it has surpassed the

milestone of EUR 20 billion of assets under management.

2023 provided a turning point for third-party

activities with a significant acceleration of assets under

management. This growth is the result of the strategic objectives

pursued by SCOR Investment Partners, which offers specialized

investment solutions to institutional clients, and is in line with

the SCOR group's latest strategic plan, Forward 2026. As of end

2023, third-party assets under management reached almost EUR 7.4

billion driven by close to EUR 900 million net inflows from

external investors.

Louis Bourrousse, Chief Executive Officer of

SCOR Investment Partners, comments: “We are thrilled of these

results confirming that we are recognized by our clients. These

results speak to the resilience and excellence that have driven

SCOR Investment Partners for nearly 15 years as our teams leverage

both an asymmetric risk culture and our sustainable investment

expertise. We look to continue this strong positive momentum

through 2024 with the launch of new investment propositions

building on our established expertise, notably across our value-add

real estate debt and infrastructure debt strategies, which are

designed to finance the energy and digital transitions.”

- End -

For more information, please

contact Anne-Laure Mugnier, Head of Marketing & Communications,

+33 1 58 44 84 53, amugnier@scor.com

About SCOR Investment

Partners

Financing the sustainable development of societies,

together.

SCOR Investment Partners is the asset management

company of the SCOR Group. Created in 2008 and accredited by the

Autorité des Marches financiers, the French financial market

regulatory body, in May 2009 (no. GP09000006). SCOR Investment

Partners has more than 80 employees and is structured around seven

management desks: Fixed Income, Corporate Loans, Infrastructure

Loans, Direct Real Estate, Real Estate Loans, Insurance-Linked

Securities and Fund Selection. Since 2012, SCOR Investment Partners

has given institutional investors access to some of the investment

strategies developed for the SCOR Group. Assets managed for outside

investors totaled EUR 7.4 billion as of December 31, 2023. As of

that same date, SCOR Investment Partners had total assets under

management of EUR 20.0 billion (including undrawn commitments).

Visit the SCOR Investment Partners

website at: www.scor-ip.com

This advertising communication, intended

exclusively for journalists and professionals of the press and

media, is produced for informational purposes only and should not

be construed as an offer, solicitation, invitation, or

recommendation to purchase any service or investment product.

Before making any final investment decision, you

must read all regulatory documents of the Fund, available free of

charge upon request, from the Sales & Marketing team of SCOR

Investment Partners SE.

| All

content published by the SCOR group since January 1, 2024, is

certified with Wiztrust. You can check the authenticity of this

content at wiztrust.com. |

- SCOR IP_PR_2024 03_AuM SIP Wiztrust

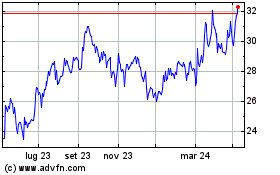

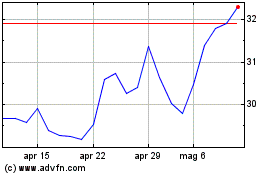

Grafico Azioni Scor (EU:SCR)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Scor (EU:SCR)

Storico

Da Nov 2023 a Nov 2024