H1 2024: In a declining market, slight organic decrease in activity

Good operational performance, reflected by a clear growth in EBITDA

and margin Financial debt well-controlled and reduction of leverage

compared to June 2023

Results for H1 2024:

In a declining market, slight organic decrease in

activity

Good operational performance, reflected by a clear

growth in EBITDA and margin

Financial debt well-controlled and reduction of leverage

compared to June 2023

Results for the second quarter and first half of

2024

- Q2 revenue down by -2.1%, and -1.8% on a like-for-like

basis compared to Q2 2023

- H1 revenue down by -3.1% compared to H1 2023, i.e., a

decline of -2.2% on a like-for-like basis

- Adjusted EBITDA of €148 million in H1 2024, i.e. 9.5%

of sales, a clear increase compared to H1 2023 (€126 million, 7.8%

of sales)

- EBIT of €60 million in H1 2024, an improvement compared

to H1 2023 (€48 million)

- Net profit of €18.0 million compared to €2.8 million in

the first half of 2023

- Cash consumption kept under control during H1 and in

line with historical seasonality (-€76 million in free cash

flow)

- Net financial debt of €620 million, i.e., leverage of

2.0x adjusted EBITDA an improvement compared to June 2023

(-0.8x)

- Acquisition on 3 July 2024 of Classic Turf &

Tracks, a company specialising in the construction of sports fields

and athletic tracks

- Signing of a disposal agreement for the flooring

distribution activities in California

Paris, 25 July

2024: The Supervisory Board of Tarkett (Euronext Paris:

FR0004188670 TKTT), met today and reviewed the Group’s consolidated

results for the half year of the 2024 financial year.

The Group uses

alternative performance indicators (not defined under IFRS),

described in detail in Appendix 1 on page 6 of this document:

|

In millions of euros |

H1 2024 |

H1 2023 |

Change in % |

|

Revenue |

1,558.7 |

1,608.3 |

-3.1% |

|

Of which organic change |

-2.2% |

+3.9% |

|

Adjusted EBITDA |

148.2 |

126.1 |

+17.5% |

|

% of revenue |

9.5% |

7.8% |

|

Adjusted EBIT |

81.8 |

59.2 |

+38.2% |

|

% of revenue |

5.3% |

3.7% |

|

EBIT |

59.9 |

48.5 |

+23.5% |

|

% of revenue |

3.8% |

3.0% |

|

Net profit attributable to shareholders of the company |

18.0 |

2.8 |

- |

|

Fully diluted earnings per share (€) |

0.27 |

0.04 |

|

Free cash flow |

-75.9 |

27.3 |

- |

|

Net debt |

620.4 |

648.9 |

- |

|

Leverage (Net debt/adjusted EBITDA over 12 months) |

2.0x |

2.8x |

|

|

Revenue in the first half of

2024 amounted to €1,558.7 million, down by -3.1% compared to the

first half of 2023, reflecting an organic decline of -2.2%. Sales

prices remained stable over the financial year, i.e. -0.2% compared

to the first half of 2023.

In a declining market, sales in the three

flooring divisions were slightly down, particularly in the

residential end-user segment. The level of activity in Sports

division is stable compared to the record first half of 2023. The

currency effect was unfavourable, mainly due to the depreciation of

the rouble and the dollar.

Adjusted EBITDA in the first

half of the year amounted to €148.2 million, i.e. 9.5% of revenue,

compared to €126.1 million in the first half of 2023, i.e. 7.8% of

revenue.

The combined effect of volume and mix was

slightly negative at -2 million euros, with a favourable product

mix partially offsetting lower volumes.

The significant reduction in raw material costs

compared to the previous year had a positive effect of +35 million

euros over the six months, but wage inflation remained significant

(-15 million euros).

Selling prices were stable overall at (-0.2%

compared to the first half of 2023). Contained and controlled

reductions have been implemented for certain products (-4 million

euros).

SG&A increased slightly by (-8 million

euros) to support the growth of Sports and the launch of new

collections in flooring.

The good industrial performance and productivity

actions implemented by the Group enabled a significant reduction in

production costs of +17 million euros, which contributed

significantly to the improvement in margins over the first half of

the year.

The adjusted EBITDA margin for the first half of

the year improved significantly to 9.5% of sales compared to 7.8%

in the first half of 2023.

EBIT amounted to €59.9 million

in the first half of 2024 up from €48.5 million in 2023.

Adjustments to EBIT (detailed in Appendix 1)

amounted to €22.0 million in the first half of 2024 compared to

€10.7 million in the first half of 2023. They include, in

particular, restructuring costs related to the plan to reduce

general and administrative costs as well as the rationalisation of

the industrial organisation in Europe and the reorganisation of

certain central functions.

Financial expenses amounted to

€27.4 million in the first half of 2024, compared to €33.9 million

in the first half of 2023. This decrease is mainly due to lower use

of the short-term financing line (“Revolving Credit Facility”). The

income tax expense amounted to €13.4 million in 2024, up slightly

compared to the previous year (€11.4 million) due to the increase

in profits before tax.

The Net profit (group share) of

the first half of 2024 is €18.0 million, i.e. a diluted earnings

per share of €0.27.

- H1 2024 Revenue and EBITDA by segment

Net revenue per segment

|

In millions of euros |

H1 2024 |

H1 2023 |

Change |

Organic growth (1) |

|

EMEA |

439.3 |

443.1 |

-0.9% |

-3.7% |

|

North America |

446.3 |

458.1 |

-2.6% |

-2.2% |

|

CIS, APAC & Latin America |

243.8 |

277.8 |

-12.3% |

-3.7% |

|

Sports |

429.3 |

429.3 |

+0.0% |

+0.3% |

|

TOTAL |

1,558.7 |

1,608.3 |

-3.1% |

-2.2% |

(1) Selling price adjustments in the CIS

countries are historically intended to offset currency movements

and are therefore excluded from the “organic growth” indicator (see

Appendix 1).

Adjusted EBITDA per segment

The Group’s IT costs were historically reported

into central costs. From 2024, they will be reassigned to each

business segment according to their actual use of IT services. This

approach provides a more accurate reflection of the performance of

each segment.

As a result, the 2023 adjusted EBITDA of each segment has been

restated to allow comparison with 2024. The amount of 2023 IT costs

reallocated to the segments is €14.8 million (see reconciliation

table in Appendix 1).

|

In millions of euros |

H1 2024 |

H1 2023 Proforma |

Margin

2024 |

Margin

2023 |

|

EMEA |

41.4 |

30.4 |

9.4% |

6.9% |

|

North America |

48.0 |

38.1 |

10.8% |

8,3% |

|

CIS, APAC & Latin America |

27.8 |

32.8 |

11.4% |

11.8% |

|

Sports |

48.6 |

41.6 |

11.3% |

9.7% |

|

Central |

-17.6 |

-16.8 |

- |

- |

|

TOTAL |

148.2 |

126.1 |

9.5% |

7.8% |

Comments by segment

The EMEA segment generated

revenue of €439 million, slightly down by -0.9% including a

favourable currency effect of +0.5% and a scope effect of +2.3%

(integration of activities in Ukraine previously linked to CIS)

compared to the first half of 2023. The macroeconomic environment,

high interest rates and the cost of construction and renovation

projects continue to weigh negatively on demand in the eurozone,

but also in important markets such as the UK and Northern Europe.

In a declining flooring market, the volume of activity is down,

particularly in Residential. Some selling prices have been

selectively adjusted downwards to support business.

The segment’s adjusted EBITDA amounts to €41

million, i.e. 9.4% of sales, compared to €30 million/6.9% of sales

in the first half of 2023. The decrease in volumes and the

adjustment of certain sales prices were more than offset by the

drop in raw material purchase prices compared to the first half of

2023. Industrial productivity helped to offset the rise in

wages.

The North America segment

generated revenue of €446 million, down by -2.6% compared to the

first half of 2023, reflecting like-for-like growth of -2.2%. The

Commercial segments (Offices, Health and Education) held up well

and their volume of activity was slightly up compared to the first

half of 2023. In particular, they have benefited from an

improvement in carpet tile and LVT volumes. The Residential segment

is heavily penalised by inflation and rising mortgage rates, which

have led to a sharp reduction in new construction and renovation

projects.

The segment’s adjusted EBITDA increased

significantly to €48 million, i.e., 10.8% of sales, compared to €38

million/8.3% of sales in the first half of 2023. It benefits from

the positive inflation balance, the measures to turn around certain

business, and the good performance of the production sites.

Revenue in the CIS, APAC and Latin

America segment amounted to €244 million, down -12.3%

compared to the first quarter of 2023, with organic sales falling

by -3.7% (excluding sales price effects in CIS countries), a

negative currency effect (-4.9%) mainly linked to the depreciation

of the rouble and a scope effect of -3.7% (integration of

activities in Ukraine in the EMEA segment). In Russia, against a

background that remains complex, volumes are down by -10% compared

to 2023. Asia Pacific is driven by good momentum in Australia and

most Asian markets. In Latin America, demand remained low and

lagged behind considerably compared to the previous year,

especially in Brazil.

The adjusted EBITDA of the CIS, APAC and Latin

America segment is down to €28 million, i.e., 11.4% of sales,

compared to €33 million/11.8% of sales in the first half of 2023,

mainly due to low volumes in Russia and rising raw material prices

in the CIS region. In the first half of the year, Russia accounted

for around 8% of Group sales.

The Sports segment maintains a

strong level of activity with a revenue of €429 million in the

first half of 2024, equalling the record level reached in the first

half of the previous year. The volume of activity in artificial

turf sports fields and athletics tracks in North America is stable

and the Group continues to develop its turnkey project offering.

Growth at constant exchange rates and scope was +0.3%.

The adjusted EBITDA of the Sports segment rose

to €49 million, i.e. 11.3% of sales, compared to €42 million/9.7%

of sales in the first half of 2023. This improvement is the result

of a positive inflation balance due to the good level of sales

prices and favourable raw material prices.

- Balance Sheet and Cash Flow

2024

Tarkett recorded a negative change in

working capital requirements in the first half of

2024 (€-121.6 million), in line with the seasonality of the

business that requires increasing inventory levels in the first

half to meet the peak in demand in the third quarter. The Group

continues to implement measures to improve its management of

working capital requirements. The inventory levels at the end of

June 2024 is slightly lower than at the end of June 2023, but will

be sufficient to meet demand in the second half of the year.

At the end of June 2024, net financing from

factoring programmes amounted to €191.3 million, marking an

increase compared to €179.2 million recorded at the end of 2023 and

€182.6 million in the same period in 2023.

Capital expenditure is under

control and amounts to €32.5 million allocated mainly to capacity

projects for growing products and automation to improve industrial

efficiency. In the first half of 2023, investments amounted to

€40.4 million.

Free cash flow for the first

half of the year is negative at €-75.9 million, which is in line

with the cash consumption profile for this period. Free cash flow

in the first half of 2023 was positive given the measures taken to

reduce the exceptionally high working capital requirement in

December 2022.

Net financial debt amounts to €620 million at

the end of June 2024, compared to €552 million at the end of

December 2023 and €649 million at the end of June 2023. Compared to

December 2023, debt is increasing due to seasonality, but

the leverage remains stable at 2.0x of the

adjusted EBITDA of the last 12 months (1.9x at the end of December

2023). Leverage was reduced by -0.8x compared to June 2023.

At the end of June 2024, the Group had a

high level of liquidity amounting to €525 million

comprising the undrawn RCF in an amount of €299 million, other

confirmed and unconfirmed credit lines in an amount of €51 million

and €175 million in cash.

- Scope effect

On 2 July 2024, the Group signed a disposal

agreement of its California distribution business (Diamond W –

around $60 million in annual revenue). The assets and liabilities

of this activity were classified as “assets held for sale” in the

accounts published on 30 June 2024.

In addition, on 3 July 2024, the Group concluded

the acquisition of one of its partners, Classic Turf & Tracks,

a sports field construction company specialising in post tension

concrete sub-bases. This will enable the Group to consolidate its

positions in certain states in Northeastern United States and

strengthen its tennis court offering. The company’s revenue is

around $25 million.

- Outlook

The trend observed in the first quarter of 2024

continued in the second quarter with a decline in activity in the

flooring sector. High interest rates and persistent inflation

continue to weigh on the number of new construction and renovation

projects. The Group does not anticipate a short-term improvement in

the environment or a rapid recovery of the building market.

The European market experienced the most severe

slowdown and remains sluggish. The Group has adapted its cost

structure, industrial footprint and organisation in order to be

more agile and profitable. These measures are combined with ongoing

commercial efforts (range renewal, new product launches,

innovation) and should support year-over-year performance

improvement.

In North America, the construction and

renovation indicators remain extremely low, primarily affecting the

Residential market, to which the Group is exposed to a limited

extent (~12% of the segment’s sales). The recovery measures taken

by the Group in this area are paying off in the growing Commercial

segments. The improvement in results recorded in the first half of

the year should be confirmed for the whole year.

Sports continues to benefit from a strong

artificial turf order book, similar to 2023. Athletics track

activities in North America and sports fields in Europe are

expected to generate annual revenue growth. Taking advantage of its

leading position in North America, Tarkett has a strong presence on

higher value-added projects, which should contribute to improving

profit margins over the year. In a highly competitive and

consolidating environment, the acquisition of Classic Turf and

Tracks strengthens this positioning, and the Group is paying close

attention to any other external growth opportunities.

The Group does not anticipate any rapid

improvement in market conditions and therefore continues to adapt

its production level and cost structure while investing in the

launch of new products, in particular ranges with a higher content

of recycled products, the renewal of existing collections, but also

in innovative growth, productivity and decarbonisation

projects.

The operational and financial recovery initiated

in 2023 will continue in 2024, where the Group aims to generate

positive cash flow and reduce debt at the end of the financial

year.

1) Selling price adjustments in the CIS

countries are historically intended to offset currency fluctuations

and are therefore excluded from the “organic growth” indicator (see

Appendix 1)

This press release may contain forward-looking statements.

These statements do not constitute forecasts regarding results or

any other performance indicator, but rather trends or targets.

These statements are by their nature subject to risks and

uncertainties as described in the Company’s Registration Document

available on its website

(https://www.tarkett-group.com/en/category/urd/).

They do not reflect the future performance of the Company, which

may differ significantly. The Company does not undertake to provide

updates to these statements.

Financial calendar

- 24 October 2024: Q3 2024 Revenue – press release after

close of trading

Investor Relations and Individual Shareholders

Contact

investors@tarkett.com

Media Contacts

Brunswick – tarkett@brunswickgroup.com – Tel.: +33 (0) 1 53 96 83

83

Hugues Boëton – Tel.: +33 (0) 6 79 99 27 15 – Benoit Grange – Tel.:

+33 (0) 6 14 45 09 26

About Tarkett

With a 140-year history, Tarkett is a worldwide leader in

innovative and durable flooring and sports surface solutions,

generating a revenue of €3.4 billion in 2023. The Group has around

12,000 employees and 23 R&D centres, 8 recycling centres and 34

production sites. Tarkett designs and manufactures solutions for

hospitals, schools, housing, hotels, offices, shops and sports

fields, serving customers in more than 100 countries. To

build “The Way to Better Floors”, the Group is committed to the

circular economy and sustainable development, in line with its

Tarkett Human-Conscious Design® approach. Tarkett is listed on the

Euronext regulated market (compartment B, ISIN: FR0004188670,

ticker: TKTT). www.tarkett-group.com

Appendices

1/ Definition of alternative performance indicators (not

defined under IFRS)

- Organic growth measures the change in turnover

compared with the same period in the previous year, excluding the

exchange rate effect and changes in scope. The foreign exchange

effect is obtained by applying the previous year’s exchange rate to

sales for the current year and calculating the difference with

sales for the current year. It also includes the effect of price

adjustments in the CIS countries intended to offset the change in

local currencies against the euro. In the first half of 2024, a 7.0

million euros positive impact of selling price adjustments is

excluded from organic growth and included in the foreign exchange

effect.

- The scope effect is composed of:

- current year sales by entities not included in the scope of

consolidation in the same period of the previous year, until the

anniversary of their consolidation, the reduction in sales due to

discontinued operations that are not included in the current year's

scope of consolidation but were included in sales for the same

period of the previous year, until the anniversary of their

disposal.

|

In millions of euros |

2024 Revenue |

2023 Revenue |

Change |

Of which volume |

Of which selling prices |

Of which CIS selling prices |

Of which exchange rate effect |

Of which scope effect |

|

Group Total Q1 |

668.1 |

698.5 |

-4.3% |

-2.3% |

-0.3%

|

+0.5% |

-2.2% |

+0.0% |

|

Of which organic growth |

-2.7% |

|

|

|

|

Of which selling price increases |

|

+0.,2% |

|

|

|

Group Total Q2 |

890.5 |

909.8 |

-2.1% |

-1.7%

|

-0.2%

|

+0.4% |

-0.7% |

+0.0% |

|

Of which organic growth |

-1.8% |

|

|

|

|

Of which selling price increases |

|

+0.2% |

|

|

|

Group Total H1 |

1,558.7 |

1,608.3 |

-3.1% |

-2.1%

|

-0.2%

|

0.4% |

-1.3% |

+0.0% |

|

Of which organic growth |

-2.2% |

|

|

|

|

Of which selling price increases |

|

+0.2% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

- IT costs have been reallocated by division from

2024 for better readability of the indicators. The segment

information for 2023 is presented pro forma with a re-allocation of

expenses of €14.8 million between central costs and the other

divisions.

| In

millions of euros |

H1 2023 |

IT Costs |

H1 2023 Proforma |

Margin

2023 |

Proforma Margin

2023 |

|

EMEA |

37.0 |

-6.6 |

30.4 |

8.4% |

6.9% |

|

North America |

41.4 |

-3.3 |

38.1 |

9.0% |

8.3% |

|

CIS, APAC & Latin America |

36.6 |

-3.8 |

32.8 |

13.2% |

11.8% |

|

Sports |

42.6 |

-1.0 |

41.6 |

9.9% |

9.7% |

|

Central |

- 31.6 |

14.8 |

-16.8 |

- |

- |

|

TOTAL |

126.1 |

- |

126.1 |

7.8% |

7.8% |

- Adjusted EBITDA is the operating result before

depreciation and amortisation restated for the following income and

expenses: restructuring costs with the aim of increasing the

Group’s future profitability, gains and losses on significant asset

disposals, provisions, and reversals of provisions for impairment,

costs related to business combinations and legal reorganisations,

expenses related to share-based payments and other one-off expenses

considered non-recurring by their nature.

|

In millions of euros |

Adjusted EBITDA H1

2024 |

Adjusted EBITDA H1

2023 |

Margin

H1 2024 |

Margin

H1 2023 |

|

| |

|

Group Total – Q1 |

39.7 |

31.8 |

5.9% |

4.6% |

|

|

Group Total – Q2 |

108.5 |

94.2 |

12.2% |

10.4% |

|

|

Group Total – H1 |

148.2 |

126.1 |

9.5% |

7.8% |

|

| In

millions of euros |

of which adjustments |

|

H1 2024 |

Restructuring |

Gains/losses on asset disposals/impairment |

Business combinations |

Share-based payments |

Other |

H1 2024 adjusted |

|

EBIT |

59.9 |

15.4 |

-4.8 |

0.0 |

2.0 |

9.3 |

81.8 |

|

Impairment, amortisation and depreciation |

62.2 |

- |

3.6 |

- |

- |

- |

65.8 |

|

Other |

0.6 |

- |

- |

- |

- |

- |

0.6 |

|

EBITDA |

122.6 |

15.4 |

1.1 |

0.0 |

2.0 |

9.3 |

148.2 |

| In

millions of euros |

of which adjustments |

|

H1 2023 |

Restructuring |

Gains/losses on asset disposals/impairment |

Business combinations |

Share-based payments |

Other |

H1 2023 adjusted |

|

EBIT |

48.5 |

3.8 |

0.3 |

0.0 |

3.6 |

2.9 |

59.2 |

|

Impairment, amortisation and depreciation |

65.4 |

- |

- |

- |

- |

- |

65.4 |

|

Other |

1.5 |

- |

- |

- |

- |

- |

1.5 |

|

EBITDA |

115.4 |

3.8 |

0.3 |

0.0 |

3.6 |

2.9 |

126.1 |

- Free cash flow is defined as cash generated

from operations before change in working capital, plus or minus the

following inflows and outflows: change in working capital,

repayment of lease liabilities, net interest received (paid), net

tax collected (paid), various operating items collected

(disbursed), acquisition of intangible assets and property, plant

and equipment, and income (loss) from fixed asset disposals.

|

Free cash flow (in millions of euros) |

H1 2024 |

H1 2023 |

|

Cash flow from operations before change in working capital

and repayment of lease liabilities |

138.2 |

111.1 |

|

Repayment of lease liabilities |

-21.5 |

-18.0 |

|

Cash flow from operations before change in working capital;

including repayment of lease liabilities |

116.7 |

93.1 |

|

Change in working capital |

121.6 |

23.3 |

|

of which change in factoring programmes |

6.8 |

4.3 |

|

Net interest paid |

-18.2 |

-25.1 |

|

Net tax paid |

-18.1 |

-18.7 |

|

Miscellaneous operating items paid |

-2.4 |

-5.0 |

|

Acquisition of intangible assets and property, plant and

equipment |

-32.5 |

-40.7 |

|

Proceeds from disposal of property, plant and equipment |

0.1 |

0.5 |

|

Free cash flow |

-75.9 |

27.3 |

- Net financial debt is defined as the sum of

interest-bearing loans and borrowings minus cash and cash

equivalents. Borrowings correspond to any obligation to repay funds

received or raised that are subject to repayment terms and

interest. They also include liabilities on leases.

- Financial leverage is the ratio of net

financial debt, including leases accounted for as per IFRS 16, to

adjusted EBITDA over the last 12 months.

In millions of euros |

|

30 June 2024 |

31 December 2023 |

30 June 2023 |

|

Financial debts – long term |

|

586.7 |

592.6 |

696.3 |

|

Financial debts and bank overdrafts – short term |

|

77.3 |

40.0 |

44.9 |

|

Financial debts excluding IFRS 16 (A) |

|

664.0 |

632.6 |

741.2 |

|

Lease liabilities – long term |

|

101.0 |

111.8 |

103.2 |

|

Lease liabilities – short term |

|

30.8 |

31.6 |

27.4 |

|

Lease liabilities – IFRS 16 (B) |

|

131.8 |

143.4 |

130.6 |

|

Gross debt – long term |

|

799.5 |

704.4 |

799.5 |

|

Gross debt – short term |

|

72.3 |

71.6 |

72.3 |

|

Gross debt (C) = (A) + (B) |

|

795.8 |

776.0 |

871.8 |

|

|

|

|

|

|

|

Cash and cash equivalents (D) |

|

175.4 |

224.3 |

222.8 |

|

|

|

|

|

|

|

Net debt (E) = (C) - (D) |

|

620.4 |

551.7 |

648.9 |

|

|

|

|

|

|

|

Adjusted EBITDA 12 months (F) |

|

309.9 |

287.8 |

234.8 |

|

|

|

|

|

|

|

Ratio (E)/(F) |

|

2.0x |

1.9x |

2.8x |

2/ Bridges in millions of euros, H1 and Q2

2024

Net revenue by segment

Adjusted EBITDA by nature

|

Q2 2023 |

909.8 |

|

+/- EMEA |

-1.9 |

|

+/- North America |

2.9 |

|

+/-CIS, APAC & Latin America |

-8.6 |

|

+/- Sports |

-9.1 |

|

Q2 2023 Like-for-Like |

893.2 |

|

+/- Currencies |

1.5 |

|

+/- “Lag effect” in CIS (1) |

-4.2 |

|

+/- Scope |

0.0 |

|

Q2 2024 |

890.5 |

- Including selling price increases

|

Q2 2023 |

94.2 |

|

+/- Volume/Mix |

2.2 |

|

+/- Selling prices |

-1.4 |

|

+/- Raw materials and Transport |

18.8 |

|

+/- Salary increases |

-7.8 |

|

+/- Productivity |

7.4 |

|

+/- SG&A |

-4.1 |

|

+/- Non-recurring and other |

-0.5 |

|

+/- “Lag effect” in CIS (1) |

0.3 |

|

+/- Currencies |

-0.6 |

|

+/- Scope |

0.0 |

|

Q2 2024 |

108.5 |

- Including selling price increases

|

H1 2023 |

126.1 |

|

+/- Volume/Mix |

-1.7 |

|

+/- Selling prices |

-3.6 |

|

+/- Raw materials and Transport |

35.0 |

|

+/- Salary increases |

-15.3 |

|

+/- Productivity |

16.8 |

|

+/- SG&A |

-8.5 |

|

+/- Non-recurring and other |

0.0 |

|

+/- “Lag effect” in CIS(1) |

1.0 |

|

+/- Currencies |

-1.4 |

|

+/- Scope |

0.0 |

|

H1 2024 |

148.2 |

|

H1 2023 |

1,608.3 |

|

+/- EMEA |

-16.4 |

|

+/- North America |

-10.0 |

|

+/-CIS, APAC & Latin America |

-10.1 |

|

+/- Sports |

1.4 |

|

H1 2023 Like-for-Like |

1,573.1 |

|

+/- Currencies |

-1.5 |

|

+/- “Lag effect” in CIS (1) |

-12.9 |

|

+/- Scope |

0.0 |

|

H1 2024 |

1,558.7 |

- Including selling price increases

- Including selling price increases

***

- Press Release - Tarkett - Résultats H1 2024

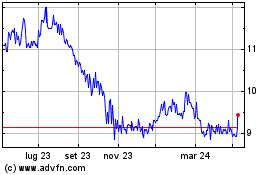

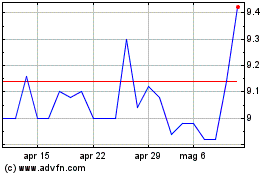

Grafico Azioni Tarkett (EU:TKTT)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Tarkett (EU:TKTT)

Storico

Da Feb 2024 a Feb 2025