Australian Dollar Rises As RBA Holds Interest Rate At 13-Year High

05 Novembre 2024 - 3:06AM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Monday, after Australia central

bank maintained its interest rate for the eighth straight session

at a 13-year high, as underlying inflation remains too high.

The policy board of the Reserve Bank of Australia governed by

Michele Bullock decided to hold the cash rate target at 4.35

percent. The bank had previously changed its rate in November 2023,

when it was lifted by 25 basis points to the highest level since

late 2011.

The interest rate paid on Exchange Settlement balances was kept

unchanged at 4.25 percent.

The committee said it needs to remain vigilant to upside risks

to inflation and is not ruling anything in or out.

"Policy will need to be sufficiently restrictive until the Board

is confident that inflation is moving sustainably towards the

target range," the bank said.

Data from Judo Bank showed that the services sector in Australia

continued to expand in October, and at a faster rate, with a PMI

score of 51.0. That's up from 50.5.

Following the announcement of the November monetary policy

decision, the Reserve Bank of Australia (RBA) Governor Michele

Bullock said at the press conference the need to maintain

restrictive interest rates for the time being due to ongoing

inflationary risks. Despite a tight labor market, wage growth is

showing signs of easing.

Traders remained cautious and seemed reluctant to make

significant moves ahead of the closely contested U.S. presidential

election later in the day and the U.S. Fed's upcoming interest rate

decision later this week.

The Fed is widely expected to lower interest rates by another 25

basis points, but traders will be looking to the accompanying

statement for clues about the likelihood of future rate cuts.

Crude oil prices rose sharply, buoyed by OPEC's decision to

delay plans to increase production, and on rising concerns about

tensions in the Middle East. West Texas Intermediate crude oil

futures for December closed up $1.98 or about 2.85% at $71.47 a

barrel, extending gains to a fourth straight session.

In the Asian trading now, the Australian dollar rose to 1.6484

against the euro and 100.64 against the yen, from yesterday's

closing quotes of 1.6518 and 100.16, respectively. If the aussie

extends its uptrend, it is likely to find resistance around 1.61

against the euro and 102.00 against the yen.

Against the U.S., the Canada and the New Zealand dollars, the

aussie advanced to 0.6599, 0.9171 and 1.1035 from Monday's closing

quotes of 06584, 0.9152 and 1.1021, respectively. The aussie may

test resistance around 0.69 against the greenback, 0.93 against the

loonie and 1.11 against the kiwi. Looking ahead, S&P Global

publishes final U.K. services Purchasing Managers' survey data for

October in the European session. The final services PMI is seen at

51.8 in October, in line with flash estimate, down from 52.4 in

September.

In the New York session, U.S. and Canada trade data for

September and PMI reports for October, are slated for release.

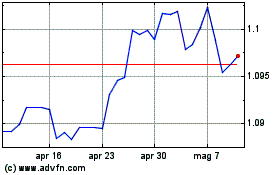

Grafico Cross AUD vs NZD (FX:AUDNZD)

Da Ott 2024 a Nov 2024

Grafico Cross AUD vs NZD (FX:AUDNZD)

Da Nov 2023 a Nov 2024