Australian Dollar Rises On Solid Jobs Data

17 Ottobre 2024 - 4:46AM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Thursday, after the release of a

strong Australian employment report in September.

Data from the Australian Bureau of Statistics showed that the

unemployment rate in Australia came in at a seasonally adjusted 4.1

percent in September. That was below estimates for 4.2 percent,

which would have been unchanged from the August reading.

The Australian economy added 64,100 jobs last month, blowing

away forecasts for an increase of 25,200 jobs following the

addition of 47,500 jobs in the previous month.

Asian stock markets traded higher, as investors continued to

benefit from optimism about the outlook for interest rates

following the release of the latest U.S. inflation data.

Following the recent latest batch of economic data, CME Group's

FedWatch tool is indicating a 94.2 percent chance the U.S. Fed will

lower interest rates by a quarter point next month.

Gains in energy and financial stocks as well as some mining and

technology stocks, also led to the upturn of investor

sentiment.

In the Asian trading today, the Australian dollar rose to 2-day

highs of 0.6711 against the U.S. dollar, 100.22 against the yen and

1.6191 against the euro, from yesterday's closing quotes of 0.6666,

99.74 and 1.6288, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 0.69 against the greenback,

102.00 against the yen and 1.59 against the euro.

Against the Canada and the New Zealand dollars, the aussie edged

up to 0.9225 and 1.1046 from Wednesday's closing quotes of 0.9166

and 1.1002, respectively. The next possible upside target for the

aussie is seen around 0.93 against the loonie and 1.11 against the

kiwi.

Looking ahead, Eurostat releases the euro area final inflation

data for September is due to be released at 5:00 am ET. The flash

estimate showed that inflation eased to 1.8 percent in September

from 2.2 percent in August. Foreign trade data is also due. The

trade surplus is seen at EUR 17.8 billion in August compared to EUR

21.2 billion in July.

At 8:15 am ET, the European Central Bank will announce its key

interest rates. The bank is forecast to cut the key rates by 25

basis points today after a similar reduction last month. The

deposit facility rate, which is the new policy rate, is likely to

be lowered to 3.25 percent.

In the New York session, U.S. retail sales data for September,

U.S. weekly jobless claims data, U.S. industrial and manufacturing

productions data, both for September, business inventories for

August, U.S. NAHB housing market index for October and U.S. EIA

crude oil data are slated for release.

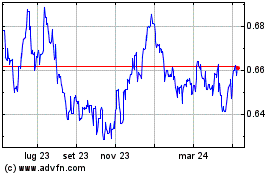

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Ott 2024 a Nov 2024

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Nov 2023 a Nov 2024