Norway Central Bank Keeps Rate Unchanged As Expected

19 Settembre 2024 - 8:35AM

RTTF2

Norges Bank left its benchmark rate unchanged on Thursday and

suggested that the policy rate will be kept at the current level

until the end of this year although the time to ease is

approaching.

The Monetary Policy and Financial Stability Committee, headed by

Governor Ida Bache, decided to hold the policy rate at 4.50

percent.

"The policy rate will likely be kept at 4.5 percent to the end

of the year," Bache said.

"We believe that there is a need to keep the policy rate at

today's level for a period ahead but that the time to ease monetary

policy is approaching," the governor added.

Today's policy rate forecast suggests that the interest rate

will be gradually reduced from the first quarter of 2025. Although

the forecast is little changed from the June report, it indicates a

slightly faster fall in the policy rate through 2025.

Economic growth is expected to pick up slightly in the years

ahead and inflation is projected to approach 2 percent towards the

end of 2027.

Capital Economics' economist Andrew Kenningham said policymakers

are likely to begin cutting rates a little sooner and he has

pencilled in a first cut in December.

Further, the economist said the bank will cut rates somewhat

faster than suggested by its projections next year, at a pace close

to that which investors anticipate.

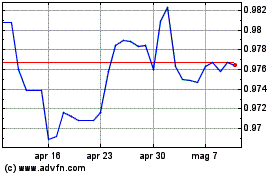

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Nov 2024 a Dic 2024

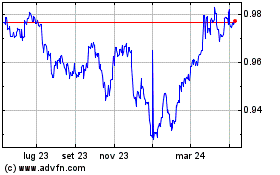

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Dic 2023 a Dic 2024