Swiss Franc Declines Against Majors

14 Ottobre 2024 - 3:07PM

RTTF2

The Swiss franc fell against its major counterparts in the New

York session on Monday, as U.S. stocks rose amid optimism about the

outlook for interest rates following last Friday's report on

producer price inflation.

The Labor Department report showed producer prices were

unexpectedly unchanged in September, while the annual rate price

growth slowed modestly.

While hopes the Federal Reserve will lower rates by another 50

basis points next month have largely evaporated, the data

reinforced optimism the central bank will cut rates by 25 basis

points.

Data from the Federal Statistical Office showed that

Switzerland's producer and import prices continued to decline in

September.

Producer and import prices dropped 1.3 percent year-on-year in

September, slightly faster than the 1.2 percent decline in August.

Prices have been falling since May 2023.

The producer price index dropped 0.2 percent annually in

September, and import prices registered a decrease of 3.5

percent.

The franc dropped to 1-week lows of 1.1276 against the pound and

0.9427 against the euro, off its early highs of 1.1194 and 0.9370,

respectively. The currency is seen finding support around 1.14

against the pound and 0.98 against the euro.

The franc touched near a 2-month low of 0.8641 against the

greenback. The currency may challenge support around the 0.89

level.

The franc reached as low as 173.42 against the yen. If the

currency falls further, it is likely to test support around the

167.00 region.

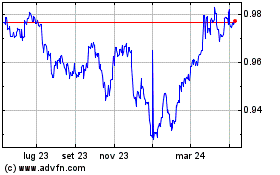

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Dic 2024 a Gen 2025

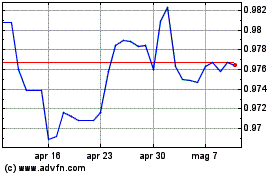

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Gen 2024 a Gen 2025