U.S. Dollar Weakens Amid Soft Consumer Confidence Data, Fed Rate Cut Bets

24 Settembre 2024 - 2:54PM

RTTF2

The U.S. dollar declined against its major counterparts in the

New York session on Tuesday, amid growing expectations for another

half-point rate cut in November.

The likelihood of another aggressive rate cut in November

increased and currently stands at 58.2%.

Investors focus on Fed Chair Jerome Powell's remarks and

personal consumption expenditures (PCE) data due later this week

for further policy moves.

The currency was also weighed by a weak consumer confidence

report.

Data from the Conference Board showed that the consumer

confidence index fell to 98.7 in September from an upwardly revised

105.6 in August. Economists had expected the index to edge down to

103.8 from the 103.3 originally reported for the previous

month.

The greenback weakened to near a 4-week low of 1.3464 against

the loonie, more than 1-year low of 0.6878 against the aussie and

an 8-1/2-month low of 0.6327 against the kiwi, off its early highs

of 1.3538, 0.6814 and 0.6259, respectively. Immediate support for

the currency is seen around 1.32 against the loonie, 0.70 against

the aussie and 0.645 against the kiwi.

The greenback fell to a 5-day low of 0.8450 against the franc

and a 2-1/2-year low of 1.3398 against the pound, from its early

highs of 0.8490 and 1.3331, respectively. The currency is seen

finding support around 0.83 against the franc and 1.35 against the

pound.

The greenback retreated to 1.1163 against the euro and 143.43

against the yen, from an early high of 1.1103 and nearly a 3-week

high of 144.68, respectively. The currency is likely to challenge

support around 1.13 against the euro and 137.00 against the

yen.

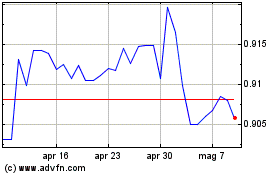

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Ott 2024 a Nov 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Nov 2023 a Nov 2024