U.S. Dollar Climbs As Key Data In Focus

28 Ottobre 2024 - 3:25PM

RTTF2

The U.S. dollar firmed against its major counterparts in the New

York session on Monday, as investors focus on key U.S. economic

data due later this week.

The monthly jobs report as well as a report on personal income

and spending that includes the Federal Reserve's preferred

inflation readings are likely to be in the spotlight.

Reports on third quarter GDP, consumer confidence, pending home

sales and manufacturing sector activity may also attract some

attention.

The data could impact the outlook for the economy as well as

expectations regarding how quickly the Fed will lower interest

rates.

Prominent U.S. companies that will report their earnings results

this week include Apple, Microsoft, Alphabet, Meta, Amazon, Intel

Advanced Micro Devices, McDonald's, Eli Lilly, ExxonMobil and

Starbucks.

The greenback fell to 1.0827 against the euro and 0.5997 against

the kiwi, from an early 4-day high of 1.0781 and a 2-1/2-month high

of 0.5957, respectively. The currency is seen finding support

around 1.10 against the euro and 0.62 against the kiwi.

The greenback dropped to 6-day lows of 0.8647 against the franc

and 1.3001 against the pound, from an early 2-1/2-month high of

0.8700 and a 4-day high of 1.2939, respectively. The next possible

support for the greenback is seen around 0.84 against the franc and

1.32 against the pound.

The greenback weakened to a 4-day low of 152.40 against the yen,

reversing from an early nearly 3-month high of 153.87. The currency

may challenge support around the 144.00 level.

The greenback retreated to 0.6609 against the aussie, from an

early 2-1/2-month high of 0.6579. If the currency falls further, it

is likely to test support around the 0.68 region.

In contrast, the greenback climbed to a 2-1/2-month high of

1.3908 against the loonie. The currency is poised to challenge

resistance around the 1.42 level.

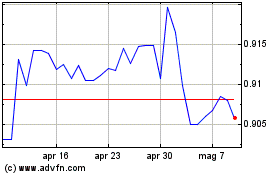

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Nov 2024 a Dic 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Dic 2023 a Dic 2024