TIDMAAIF

RNS Number : 5545J

abrdn Asian Income Fund Limited

17 August 2023

abrdn Asian Income Fund Limited

Legal Entity Identifier: 549300U76MLZF5F8MN87

UNAUDITED HALF YEARLY REPORT FOR THE SIX MONTHSED 30 JUNE

2023

Performance Highlights

-- The NAV fell by 3.7% on a total return basis for the six

months ended 30 June 2023. This compares to a fall of 2.4% in the

MSCI AC Asia Pacific ex Japan Index.

-- The dividend yield at the end of the period was 5.3%.

Earnings per Ordinary share

Dividend yield (A) - basic (revenue)

Six months ended 30

As at 30 June 2023 5.3% June 2023 6.28p

Six months ended 30

As at 31 December 2022 4.7% June 2022 5.23p

------------------------ --------- ------

Net asset value total return Share price total return

(AB) (AB)

Six months ended 30 Six months ended 30

June 2023 -3.7% June 2023 -4.0%

Year ended 31 December Year ended 31 December

2022 -3.6% 2022 -2.7%

------------------------ --------- --------------------------- ------

MSCI AC Asia Pacific ex Japan MSCI AC Asia Pacific ex Japan

Index total return (currency High Dividend Yield Index total

adjusted) (B) return (currency adjusted) (B)

Six months ended 30 Six months ended 30

June 2023 -2.4% June 2023 1.4%

Year ended 31 December Year ended 31 December

2022 -6.8% 2022 3.2%

------------------------ --------- --------------------------- ------

Discount to net asset value

per Ordinary share (A) Ongoing charges (A)

Six months ended 30

As at 30 June 2023 12.3% June 2023 1.01%

Year ended 31 December

As at 31 December 2022 11.7% 2022 1.01%

------------------------ --------- --------------------------- ------

Net gearing (A)

As at 30 June 2023 10.0%

As at 31 December 2022 8.1%

------------------------ ---------

(A) Alternative Performance Measure.

(B) Total return represents the capital return plus

dividends reinvested.

Chairman's Statement

Highlights

-- Despite the short term underperformance, t he Company has

outperformed the MSCI AC Asia Pacific ex Japan Index over 1, 3 and

5 years

-- Our dividend for the year is expected to exceed 10.60p per

share, an increase from last year, and if achieved would provide a

yield of 5.4%

-- New holdings have been added to the portfolio to further

enhance the Company's income-generating capacity

-- Environmental, social and governance ('ESG') analysis is

firmly embedded in the research process and reflects our belief

that companies with good ESG practices will be the winners over the

longer term

Market Overview

The first half of 2023 was a challenging period for investors in

Asian stock markets, as the macroeconomic environment and monetary

policy moves continued to influence investor sentiment

significantly more than individual company performance.

In my previous annual statement, I had highlighted three key

areas of interest in the outlook: inflation, monetary policy, and

China. Through this review period, we have seen how each theme

proved pivotal in driving market direction. While recession risks

persist in Europe and the US, owing to continued policy rate

tightening, it bears noting that inflation remains lower in Asia. A

positive development was a fall in the price of some key raw

materials, which should help to relieve cost pressures faced by

companies. As for China, optimism around a demand recovery from the

country's Covid re-opening led to an initial rise in Asian stock

markets. This, however, soon gave way to weakness on the back of

signs that China's economic recovery might be stalling, although

markets stabilised subsequently and traded in a narrow range.

The period was also characterised by fluctuating markets caused

by uncertainty around inflation, the impact of the US Federal

Reserve's ("Fed") long series of policy rate increases and whether

a global recession could be avoided later in the year. T he

decision by the OPEC+ group of oil-producing countries to cut

output sparked fears that this could further stoke inflation.

Performance

In this environment, over the six months to 30 June 2023, the

net asset value ("NAV") total return declined by 3.7% on a total

return basis, which compares to the MSCI AC Asia Pacific ex Japan

Index's (the "Index") decline of 2.4%. The share price ended the

period at 201p, representing a discount of 12.3% to the NAV per

share.

Despite the short term underperformance, the Company has

outperformed the Index over 1, 3 and 5 years, underlining the

benefit of the Investment Manager's steadfast commitment to quality

companies offering both capital and income growth.

Portfolio Activity

The Investment Manager took advantage of weakness in the market

to add five holdings that should further enhance your Company's

income-generating capacity; Tencent, Autohome, Telstra, SITC

International and Astra International.

The positions in Medibank, Kasikornbank, and Macquarie Group

were sold to manage the Company's exposure to the financial sector

in the wake of the banking turmoil in the US and Europe. Stakes in

Okinawa Cellular and Bank Rakyat Indonesia were divested in order

to redirect the proceeds into higher yielding companies.

Revenue and Dividends

Revenue earnings per share were 6.28p for the six month period

ended 3 June 2023, an increase of 20.1% compared to the first six

months of the previous year. The Company has continued to benefit

from the Investment Manager's focus on high-yielding companies with

strong fundamentals, where it believes there is room for

significant increases in dividend receipts.

The Company has already declared first and second interim

dividends of 2.50p per share in respect of the year ending 31

December 2023, with the second interim dividend payable on 25

August 2023 to shareholders on the register on 28 July 2023.

The Board is very aware of the importance of dividends to

shareholders and is pleased to reiterate that, in the absence of

unforeseen circumstances, the intention is to declare a total

dividend exceeding 10.60p per Ordinary share in respect of the year

to 31 December 2023, equating to a dividend yield of 5.4% based on

the closing share price of 195.75p on 16 August 2023.

The level of the remaining two dividends for 2023 will be

considered at each quarter end, at which point an announcement will

be made by the Company. There are healthy revenue reserves built up

by the Company that the Board will consider using as appropriate.

Any decision as to whether revenue reserves will be utilised (and

by how much) will be taken at the time of the declaration of the

fourth interim dividend in January 2024.

This Company's history of increasing the dividend means that it

continues to be a "next generation dividend hero" as recognised by

the Association of Investment Companies. It is very much our

intention to continue to extend this record.

Share Capital Management

In line with the Board's policy to buy back shares when the

discount at which the Company's shares trade exceeds 5% to the

underlying NAV (exclusive of income), the Company bought back 1.1

million shares during the period to be held in treasury, at a cost

of GBP2.3 million.

These buybacks provide an enhancement to the Company's NAV and

benefit all shareholders. The Company will continue selectively to

buy back shares in the market, in normal market conditions and at

the discretion of the Board.

Gearing

The Company has a GBP10 million fixed rate term loan and a GBP40

million revolving credit facility, both of which mature in March

2024. At the period end, GBP30.1 million of the revolving credit

facility was drawn down, resulting in total borrowings of GBP40.1

million and gearing (net of cash) of 10.0%, compared to 8.1% at the

beginning of the period.

Jersey Administrator

On 16 August 2023, we announced that the Company had appointed a

new, Jersey based, regulated administrator, JTC Fund Solutions

(Jersey) Limited ("JTC") to carry out the Jersey regulatory

function with effect from 15 August 2023. All investment management

and fund administration functions will continue to be provided by

the abrdn group through its Singapore based Asian Equity team and

UK fund administration team. As a result, day-to-day investment

decisions and management of the Company will not be impacted by the

reorganisation. There are no changes to the management fee as a

result of the reorganisation and the administration fee charged by

JTC will be met by abrdn .

Outlook

Asian markets are likely to remain volatile until there is more

clarity about the strength of China's economy. The central

government will be watching economic data closely, and if the

economy does not improve, we could see Beijing increase its support

through targeted measures. The monetary tightening cycle in the US

will also remain a significant factor. While it is likely that this

tightening is close to its peak, recent comments by Fed chairman,

Jerome Powell, that inflation remains too high and that he expected

further tightening in the second half of the year did cause some

market uncertainty in this regard. With some Asian currencies

pegged to the US Dollar, any further interest rate rises will have

an effect on the markets in which your Company operates.

However, despite the recent difficulties, the fundamental

long-term rationale for investing in Asia remains compelling.

Rising affluence is leading to growth in consumption in premium

products in areas such as personal care, financial services and

food and beverages. Ongoing urbanisation is driving an

infrastructure boom which will benefit property developers and

mortgage providers.

The Investment Manager's focus remains on quality companies with

sustainable business models, strong cash flows and access to

structural growth drivers across Asia, as these support growth in

both capital and shareholder returns.

Ian Cadby

Chairman

17 August 2023

Investment Portfolio

As at 30 June 2023

Valuation Total assets

Company Country GBP'000 %

-------------------------------------- ---------------- ---------- -------------

Taiwan Semiconductor Manufacturing

Company Taiwan 31,768 7.4

Samsung Electronics (Pref) South Korea 22,550 5.3

BHP Group Australia 14,909 3.5

DBS Group Singapore 14,545 3.4

Oversea-Chinese Banking Corporation Singapore 14,167 3.3

Power Grid India 13,664 3.2

Hon Hai Precision Industry Taiwan 12,683 3.0

Venture Corporation Singapore 11,775 2.8

Charter Hall Long Wale REIT Australia 10,429 2.4

China Resources Land China 10,330 2.4

Top ten investments 156,820 36.7

-------------------------------------------------------- ---------- -------------

Region RE Australia 10,209 2.4

AIA Group Hong Kong 10,139 2.4

Sunonwealth Electric Machine Taiwan 10,091 2.4

United Overseas Bank Singapore 9,989 2.3

Rio Tinto (A) Australia 9,870 2.3

Taiwan Mobile Taiwan 9,555 2.2

LG Chem (Pref) South Korea 9,492 2.2

Keppel Infrastructure Trust Singapore 7,857 1.8

Spark New Zealand New Zealand 7,776 1.8

Singapore Telecommunications Singapore 7,230 1.7

Top twenty investments 249,028 58.2

-------------------------------------------------------- ---------- -------------

Commonwealth Bank of Australia Australia 6,638 1.6

Tisco Financial Group Foreign Thailand 6,622 1.5

Auckland International Airport New Zealand 6,407 1.5

Centuria Industries REIT Australia 6,185 1.5

Singapore Technologies Engineering Singapore 6,084 1.4

Hong Kong Exchanges & Clearing Hong Kong 6,024 1.4

Momo.com Inc Taiwan 5,886 1.4

Infosys India 5,682 1.3

Accton Technology Taiwan 5,650 1.3

Midea Group 'A' China 5,559 1.3

Top thirty investments 309,765 72.4

-------------------------------------------------------- ---------- -------------

China Merchants Bank 'A' China 5,295 1.2

ASX Australia 5,097 1.2

Capitaland Investment Singapore 5,065 1.2

Hang Lung Properties Hong Kong 4,987 1.2

SAIC Motor 'A' China 4,954 1.2

Siam Cement (B) Thailand 4,941 1.2

Hana Microelectronics (Foreign) Thailand 4,898 1.1

Capitland India Trust Singapore 4,694 1.1

Tencent Holdings Hong Kong 4,620 1.1

Telstra Corporation Australia 4,459 1.0

Top forty investments 358,775 83.9

-------------------------------------------------------- ---------- -------------

Tata Consultancy Services India 4,396 1.0

SITC International Holdings Hong Kong 4,395 1.0

Globalwafers Taiwan 4,368 1.0

Media Tek Taiwan 4,344 1.0

NZX New Zealand 4,169 1.0

National Australia Bank Australia 4,129 1.0

Amada Co Japan 3,953 0.9

Lotus Retail Growth Freehold And

Leasehold Property Fund Thailand 3,859 0.9

Dah Sing Financial Holding Hong Kong 3,805 0.9

Autohome Adr Cayman Islands 3,759 0.9

Top fifty investments 399,952 93.5

-------------------------------------------------------- ---------- -------------

China Vanke (H shares) China 3,586 0.8

KMC Kuei Meng Taiwan 3,539 0.8

ICICI Bank (C) India 3,405 0.8

Convenience Retail Asia Hong Kong 3,389 0.8

Land & Houses Foreign Thailand 3,267 0.8

Taiwan Union Technology Taiwan 2,228 0.5

AEM Holdings Singapore 2,156 0.5

Digital Core REIT Singapore 2,116 0.5

China Resources Gas Hong Kong 1,705 0.4

Capitaland Ascott Trust Singapore 94 0.0

Top sixty investments 425,437 99.4

-------------------------------------------------------- ---------- -------------

Autohome (A shares) Cayman Islands 30 0.0

Capitaland India Trust(Dummy Rights) Singapore 0 0.0

G3 Exploration (C) China 0 0.0

Total value of investments 425,467 99.4

-------------------------------------------------------- ---------- -------------

Net current assets (D) 2,582 0.6

Total assets 428,049 100.0

-------------------------------------------------------- ---------- -------------

(A) Incorporated in and listing held in United Kingdom.

(B) Holding includes investment in common (GBP3,303,000) and non-voting

depositary receipt (GBP1,638,000) lines.

(C) Corporate bonds.

(D) Excludes bank loans of GBP40,127,000.

Condensed Statement of Comprehensive Income

Six months ended Six months ended

30 June 2023 30 June 2022

(unaudited) (unaudited)

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- --------- --------- --------- ---------

Investment income

Dividend income 12,808 - 12,808 10,849 - 10,849

Interest income on investments

held at fair value through

profit or loss 219 - 219 159 - 159

Stock lending income 3 - 3 - - -

Traded option premiums - - - 47 - 47

-------------------------------- --------- --------- --------- --------- --------- ---------

Total revenue 13,030 - 13,030 11,055 - 11,055

Losses on investments

held at fair value through

profit or loss - (24,603) (24,603) - (36,224) (36,224)

Net currency gains/(losses) - 811 811 - (2,313) (2,313)

--------------------------------

13,030 (23,792) (10,762) 11,055 (38,537) (27,482)

-------------------------------- --------- --------- --------- --------- --------- ---------

Expenses

Investment management

fee (631) (946) (1,577) (668) (1,003) (1,671)

Other operating expenses (415) - (415) (496) - (496)

-------------------------------- --------- --------- --------- --------- --------- ---------

Total operating expenses (1,046) (946) (1,992) (1,164) (1,003) (2,167)

-------------------------------- --------- --------- --------- --------- --------- ---------

Profit/(loss) before

finance costs and tax 11,984 (24,738) (12,754) 9,891 (39,540) (29,649)

Finance costs (428) (643) (1,071) (169) (254) (423)

Profit/(loss) before

tax 11,556 (25,381) (13,825) 9,722 (39,794) (30,072)

Tax expense (924) (154) (1,078) (784) 319 (465)

-------------------------------- --------- --------- --------- ---------

Profit/(loss) for the

period 10,632 (25,535) (14,903) 8,938 (39,475) (30,537)

-------------------------------- --------- --------- --------- --------- --------- ---------

Earnings per Ordinary

share (pence) (note

3) 6.28 (15.08) (8.80) 5.23 (23.10) (17.87)

-------------------------------- --------- --------- --------- --------- --------- ---------

The Company does not have any income or expense that is not included

in profit/(loss) for the period, and therefore the "Profit/(loss) for

the period" is also the "Total comprehensive income for the period".

The total columns of this statement represent the Condensed Statement

of Comprehensive Income of the Company, prepared in accordance with

IFRS. The revenue and capital columns are supplementary to this and

are prepared under guidance published by the Association of Investment

Companies. All items in the above statement derive from continuing operations.

All of the profit/(loss) and total comprehensive income is attributable

to the equity holders of abrdn Asian Income Fund Limited. There are

no non-controlling interests.

Condensed Statement of Comprehensive Income (cont'd)

Year ended

31 December 2022

(audited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------------- -------- -------- --------

Investment income

Dividend income 21,423 - 21,423

Interest income on investments held at fair value through profit or loss 371 - 371

Stock lending income - - -

Traded option premiums 47 - 47

------------------------------------------------------------------------- -------- -------- --------

Total revenue 21,841 - 21,841

Losses on investments held at fair value through profit or loss - (29,033) (29,033)

Net currency gains/(losses) - (3,204) (3,204)

-------------------------------------------------------------------------

21,841 (32,237) (10,396)

------------------------------------------------------------------------- -------- -------- --------

Expenses

Investment management fee (1,308) (1,962) (3,270)

Other operating expenses (939) - (939)

------------------------------------------------------------------------- -------- -------- --------

Total operating expenses (2,247) (1,962) (4,209)

------------------------------------------------------------------------- -------- -------- --------

Profit/(loss) before finance costs and tax 19,594 (34,199) (14,605)

Finance costs (470) (704) (1,174)

Profit/(loss) before tax 19,124 (34,903) (15,779)

Tax expense (1,695) 408 (1,287)

------------------------------------------------------------------------- -------- -------- --------

Profit/(loss) for the period 17,429 (34,495) (17,066)

------------------------------------------------------------------------- -------- -------- --------

Earnings per Ordinary share (pence) (note 3) 10.23 (20.24) (10.01)

------------------------------------------------------------------------- -------- -------- --------

Condensed Balance Sheet

As at As at As at

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

-------------------------------- ------ ------------ ------------ -------------

Non-current assets

Investments held at fair value

through profit or loss 425,467 455,329 448,323

-------------------------------- ------ ------------ ------------ -------------

Current assets

Cash and cash equivalents 4,894 4,434 7,328

Other receivables 3,600 2,194 1,175

8,494 6,628 8,503

-------------------------------- ------ ------------ ------------ -------------

Creditors: amounts falling

due within one year

Bank loans 6 (40,127) (39,158) (30,986)

Other payables (5,912) (2,821) (1,288)

(46,039) (41,979) (32,274)

-------------------------------- ------ ------------ ------------ -------------

Net current liabilities (37,545) (35,351) (23,771)

Total assets less current

liabilities 387,922 419,978 424,552

Creditors: amounts falling due after

more than one year

Deferred tax liability on

Indian capital gains (1,134) (1,297) (1,124)

Bank loan 6 - (9,973) (9,981)

--------------------------------

(1,134) (11,270) (11,105)

-------------------------------- ------ ------------ ------------ -------------

Net assets 386,788 408,708 413,447

-------------------------------- ------ ------------ ------------ -------------

Stated capital and reserves

Stated capital 7 194,933 194,933 194,933

Capital redemption reserve 1,560 1,560 1,560

Capital reserve 176,613 200,343 204,414

Revenue reserve 13,682 11,872 12,540

-------------------------------- ------ ------------ ------------ -------------

Equity shareholders' funds 386,788 408,708 413,447

-------------------------------- ------ ------------ ------------ -------------

Net asset value per Ordinary

share (pence) 4 229.17 240.04 243.44

The financial statements were approved by the Board of Directors and

authorised for issue on 17 August 2023 and were signed on its behalf

by:

Ian Cadby

Chairman

The accompanying notes are an integral part of the financial statements.

Condensed Statement of Changes in Equity

Six months ended 30 June

2023 (unaudited)

------------------------------- --------- ------------ --------- --------- ---------

Capital

Stated redemption Capital Revenue

capital reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- ------------ --------- --------- ---------

Opening balance 194,933 1,560 204,414 12,540 413,447

Buyback of Ordinary shares

for treasury - - (2,266) - (2,266)

(Loss)/profit for the period - - (25,535) 10,632 (14,903)

Dividends paid (note 5) - - - (9,490) (9,490)

Balance at 30 June 2023 194,933 1,560 176,613 13,682 386,788

------------------------------- --------- ------------ --------- --------- ---------

Six months ended 30 June

2022 (unaudited)

------------------------------- --------- ------------ --------- --------- ---------

Capital

Stated redemption Capital Revenue

capital reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- ------------ --------- --------- ---------

Opening balance 194,933 1,560 242,727 11,570 450,790

Buyback of Ordinary shares

for treasury - - (2,909) - (2,909)

(Loss)/profit for the period - - (39,475) 8,938 (30,537)

Dividends paid (note 5) - - - (8,636) (8,636)

Balance at 30 June 2022 194,933 1,560 200,343 11,872 408,708

------------------------------- --------- ------------ --------- --------- ---------

Year ended 31 December 2022

(audited)

------------------------------- --------- ------------ --------- --------- ---------

Capital

Stated redemption Capital Revenue

capital reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- ------------ --------- --------- ---------

Opening balance 194,933 1,560 242,727 11,570 450,790

Buyback of Ordinary shares

for treasury - - (3,818) - (3,818)

(Loss)/profit for the year - - (34,495) 17,429 (17,066)

Dividends paid (note 5) - - - (16,459) (16,459)

Balance at 31 December 2022 194,933 1,560 204,414 12,540 413,447

------------------------------- --------- ------------ --------- --------- ---------

The revenue reserve represents the amount of the Company's reserves

distributable by way of dividend.

The stated capital in accordance with Companies (Jersey) Law 1991 Article

39A is GBP260,822,000 (30 June 2022 - GBP260,822,000; 31 December 2022

- GBP260,822,000). These amounts include proceeds arising from the issue

of shares by the Company, but exclude the cost of shares purchased for

cancellation or treasury by the Company.

Condensed Statement of Cash Flows

Six months Six months

ended ended Year ended

31 December

30 June 2023 30 June 2022 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------------------ -------------- -------------- -------------

Cash flows from operating activities

Dividend income received 10,673 9,919 21,140

Interest income received 237 153 354

Derivative income received - 47 47

Return of capital included in investment

income 313 - -

Investment management fee paid (786) (1,784) (5,169)

Other cash expenses (580) (479) (801)

------------------------------------------ -------------- -------------- -------------

Cash generated from operations 9,857 7,856 15,571

Interest paid (1,096) (435) (1,041)

Overseas taxation paid (881) (804) (1,712)

------------------------------------------ -------------- -------------- -------------

Net cash inflows from operating

activities 7,880 6,617 12,818

Cash flows from investing activities

Purchases of investments (66,923) (47,167) (55,017)

Sales of investments 68,545 53,206 75,625

Capital gains tax on sales (144) - (83)

Net cash inflow from investing

activities 1,478 6,039 20,525

Cash flows from financing activities

Purchase of own shares for treasury (2,266) (2,909) (3,818)

Dividends paid (9,490) (8,636) (16,459)

Repayment of loans - - (8,948)

Net cash outflow from financing

activities (11,756) (11,545) (29,225)

------------------------------------------ -------------- -------------- -------------

Net (decrease)/increase in cash

and cash equivalents (2,398) 1,111 4,118

Cash and cash equivalents at the

start of the period 7,328 3,268 3,268

Foreign exchange (36) 55 (58)

Cash and cash equivalents at the

end of the period 4,894 4,434 7,328

------------------------------------------ -------------- -------------- -------------

The accompanying notes are an integral part of the financial statements.

Notes to the Financial Statements

For the year ended 30 June 2023

Accounting policies - basis

1. of preparation

The Annual Report is prepared in accordance with International Financial

Reporting Standards (IFRS), as issued by the International Accounting

Standards Board (IASB), and interpretations issued by the International

Financial Reporting Interpretations Committee of the IASB (IFRIC).

The condensed Half Yearly Report has been prepared in accordance

with International Accounting Standards (IAS) 34 - 'Interim Financial

Reporting' and should be read in conjunction with the Annual Report

for the year ended 31 December 2022.

The financial statements have been prepared on a going concern basis.

In accordance with the Financial Reporting Council's guidance on

'Going Concern and Liquidity Risk' the Directors have undertaken

a review of the Company's assets and liabilities. The Company's assets

primarily consist of a diverse portfolio of listed equity shares

which, in most circumstances, are realisable within a very short

timescale.

The condensed interim financial statements have been prepared using

the same accounting policies as the preceding annual financial statements.

During the period the following standards, amendments to standards

and new interpretations became effective. The adoption of these standards

and amendments did not have a material impact on the financial statements:

IAS 1 Amendments Classification of Liabilities 1 January 2023

as Current or Non-Current

IAS 1 Amendments Disclosure of Accounting Policies 1 January 2023

IAS 8 Amendments Definition of Accounting Estimates 1 January 2023

IAS 12 Amendments Deferred Tax related to Assets 1 January 2023

and Liabilities arising from a

Single Transaction

IFRS 4 Amendments Deferral of effective date of 1 January 2023

IFRS 9

IFRS 17 Amendments Insurance Contracts 1 January 2023

IFRS 17 Amendments Amendments (Effective Date) 1 January 2023

(Initial Application of IFRS 17 1 January 2023

IFRS 17 Amendments and IFRS 9 - Comparative Information)

2. Segmental information

For management purposes, the Company is organised into one main operating

segment, which invests in equity securities and debt instruments.

All of the Company's activities are interrelated, and each activity

is dependent on the others. Accordingly, all significant operating

decisions are based upon analysis of the Company as one segment.

The financial results from this segment are equivalent to the financial

statements of the Company as a whole.

3. Earnings per Ordinary share

------------------------------ -------------- -------------- -------------

Six months Six months

ended ended Year ended

31 December

30 June 2023 30 June 2022 2022

(unaudited) (unaudited) (audited)

p p p

------------------------------ -------------- -------------- -------------

Revenue return 6.28 5.23 10.23

Capital return (15.08) (23.10) (20.24)

------------------------------------

Total return (8.80) (17.87) (10.01)

------------------------------------ -------------- -------------- -------------

The figures above are based

on the following:

Six months Six months

ended ended Year ended

31 December

30 June 2023 30 June 2022 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------ -------------- -------------- -------------

Revenue return 10,632 8,938 17,429

Capital return (25,535) (39,475) (34,495)

------------------------------------

Total return (14,903) (30,537) (17,066)

------------------------------------ -------------- -------------- -------------

Weighted average number

of Ordinary shares in issue 169,308,308 170,797,870 170,411,839

------------------------------------ -------------- -------------- -------------

4. Net asset value per share

Ordinary shares. The basic net asset value per Ordinary share and

the net asset values attributable to Ordinary shareholders at the

period end calculated in accordance with the Articles of Association

were as follows:

As at As at As at

31 December

30 June 2023 30 June 2022 2022

(unaudited) (unaudited) (audited)

------------------------------ -------------- -------------- -------------

Attributable net assets

(GBP'000) 386,788 408,708 413,447

Number of Ordinary shares

in issue (excluding shares

in issue held in treasury) 168,776,311 170,269,918 169,832,401

Net asset value per Ordinary

share (p) 229.17 240.04 243.44

------------------------------------ -------------- -------------- -------------

5. Dividends on equity shares

------------------------------------- -------------- -------------- -------------

Six months Six months

ended ended Year ended

31 December

30 June 2023 30 June 2022 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------------- -------------- -------------- -------------

Amounts recognised as distributions

to equity holders in the

period:

Second interim dividend

2022 - 2.30p per Ordinary

share - - 3,915

Third interim dividend 2022

- 2.30p per Ordinary share - - 3,908

Fourth interim dividend

for 2022 - 3.10p per Ordinary

share (2021 - 2.75p) 5,263 4,712 4,712

First interim dividend for

2023 - 2.50p per Ordinary

share (2022 - 2.30p) 4,227 3,924 3,924

9,490 8,636 16,459

------------------------------------------- -------------- -------------- -------------

A second interim dividend of 2.50p for the year to 31 December 2023

will be paid on 25 August 2023 to shareholders on the register on

28 July 2023. The ex-dividend date was 27 July 2023.

6. Bank loans

At the period end approximately GBP 15.8 million, USD 8.85 million

and HKD 73.5 million, equivalent to GBP30.1 million was drawn down

from the GBP40 million multi-currency revolving facility with bank

of Nova Scotia, London Branch. The interest rates attributed to the

GBP, USD and HKD loans at the period end were 5.6609%, 6.36448% and

5.94964% respectively.

In addition, the Company has an unsecured fixed GBP10 million credit

facility with Bank of Nova Scotia, London Branch at an all-in interest

rate of 1.53%. Both facilities mature on 2 March 2024.

7. Stated capital

The Company has issued 194,933,389 Ordinary shares of no par value,

which are fully paid (30 June 2022 -194,933,389; 31 December 2022

- 194,933,389).

During the period 1,056,090 Ordinary shares were bought back by the

Company for holding in treasury at a cost of GBP2,266,000 (30 June

2022 - 1,288,978 shares were bought back at a cost of GBP2,909,000;

31 December 2022 - 1,726,495 shares were bought back for holding in

treasury at a cost of GBP3,818,000). As at 30 June 2023 26,157,078

(30 June 2022 - 24,663,471; 31 December 2022 - 25,100,988) Ordinary

shares were held in treasury.

A further 238,157 Ordinary shares have been bought back by the Company

for holding in treasury, subsequent to the reporting period end, at

a cost of GBP490,000. Following the share buybacks there were 168,538,154

Ordinary shares in issue excluding those held in treasury.

8. Related party disclosures

There have been no transactions with related parties during the period

which have materially affected the financial position or the performance

of the Company.

9. Fair value hierarchy

IFRS 13 'Fair Value Measurement' requires an entity to classify fair

value measurements using a fair value hierarchy that reflects the

significance of the inputs used in making measurements. The fair

value hierarchy has the following levels:

Level 1: quoted prices (unadjusted) in active markets for identical

assets or liabilities;

Level 2: inputs other than quoted prices included within Level 1

that are observable for the assets or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3: inputs for the asset or liability that are not based on

observable market data (unobservable inputs).

The financial assets and liabilities measured at fair value in the

Condensed Balance Sheet are grouped into the fair value hierarchy

as follows:

Level Level

Level 1 2 3 Total

At 30 June 2023 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- --------- --------- --------- --------

Financial assets at fair value

through profit or loss

Quoted equities 422,062 - - 422,062

Quoted bonds - 3,405 - 3,405

--------- --------

Total assets 422,062 3,405 - 425,467

----------------------------------------- --------- --------- --------- --------

Level Level

Level 1 2 3 Total

At 30 June 2022 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- --------- --------- --------- --------

Financial assets at fair value

through profit or loss

Quoted equities 451,557 - - 451,557

Quoted bonds - 3,772 - 3,772

--------- --------- --------- --------

Total assets 451,557 3,772 - 455,329

----------------------------------------- --------- --------- --------- --------

Level Level

Level 1 2 3 Total

At 31 December 2022 (audited) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- --------- --------- --------- --------

Financial assets at fair value

through profit or loss

Quoted equities 444,727 - - 444,727

Quoted bonds - 3,596 - 3,596

--------- --------

Total assets 444,727 3,596 - 448,323

----------------------------------------- --------- --------- --------- --------

10. Subsequent Events

On 16 August 2023, the Company announced that it had appointed a

new, Jersey based, regulated administrator, JTC Fund Solutions (Jersey)

Limited ("JTC") to carry out the Jersey regulatory function with

effect from 15 August 2023. All investment management and fund administration

functions will continue to be provided by the abrdn group through

its Singapore based Asian Equity team and UK fund administration

team. As a result, day-to-day investment decisions and management

of the Company will not be impacted by the reorganisation. There

are no changes to the management fee as a result of the reorganisation

and the administration fee charged by JTC will be met by abrdn.

11. Half Yearly Financial Report

The financial information for the six months ended 30 June 2023 and

30 June 2022 has not been audited.

Alternative Performance Measures

Alternative performance measures are numerical measures of the Company's

current, historical or future performance, financial position or cash

flows, other than financial measures defined or specified in the applicable

financial framework. The Company's applicable financial framework includes

IFRS and the AIC SORP. The Directors assess the Company's performance

against a range of criteria which are viewed as particularly relevant

for closed-end investment companies.

Discount to net asset value per Ordinary share

The discount is the amount by which the share price is lower than the

net asset value per share, expressed as a percentage of the net asset

value.

31 December

30 June 2023 2022

----------------------------------------------- ------------- ------------- ------------

NAV per Ordinary share (p) a 229.17p 243.44p

Share price (p) b 201.00p 215.00p

Discount (a-b)/a 12.3% 11.7%

----------------------------------------------- ------------- ------------- ------------

Dividend yield

The yield for 30 June 2023 is calculated based on the prospective annual

dividend for 2023 per Ordinary share in accordance with the Board's stated

target divided by the share price, expressed as a percentage. The yield

for 31 December 2022 is calculated based on the annual dividend for 2022

per Ordinary share divided by the share price, expressed as a percentage.

31 December

30 June 2023 2022

----------------------------------------------- ------------- ------------- ------------

Annual dividend per Ordinary share

(p) a 10.60p 10.00p

Share price (p) b 201.00p 215.00p

Dividend yield a/b 5.3% 4.7%

----------------------------------------------- ------------- ------------- ------------

Net gearing

Net gearing measures the total borrowings less cash and cash equivalents

dividend by shareholders' funds, expressed as a percentage. Under AIC

reporting guidance cash and cash equivalents includes amounts due to

and from brokers at the period end as well as cash and cash equivalents.

31 December

30 June 2023 2022

----------------------------------------------- ------------- ------------- ------------

Borrowings (GBP'000) a 40,127 40,967

Cash (GBP'000) b 4,894 7,238

Amounts due to brokers (GBP'000) c 3,938 -

Amounts due from brokers (GBP'000) d 473 -

Shareholders' funds (GBP'000) e 386,788 413,447

Net gearing (a-b+c-d)/e 10.0% 8.1%

----------------------------------------------- ------------- ------------- ------------

Ongoing charges ratio

The ongoing charges ratio has been calculated in accordance with guidance

issued by the AIC as the total of investment management fees and administrative

expenses and expressed as a percentage of the average published daily

net asset values with debt at fair value throughout the year. The ratio

for 30 June 2023 is based on forecast ongoing charges for the year ending

31 December 2023.

31 December

30 June 2023 2022

----------------------------------------------- ------------- ------------- ------------

Investment management fees (GBP'000) 3,094 3,270

Administrative expenses (GBP'000) 850 939

Less: non-recurring charges (A) (GBP'000) (8) (42)

Ongoing charges (GBP'000) 3,936 4,167

-------------------------------------------------------------- ------------- ------------

Average net assets (GBP'000) 398,166 421,170

-------------------------------------------------------------- ------------- ------------

Ongoing charges ratio (excluding look-through

costs) 0.99% 0.99%

-------------------------------------------------------------- ------------- ------------

Look-through costs (B) 0.02% 0.02%

-------------------------------------------------------------- ------------- ------------

Ongoing charges ratio (including look-through

costs) 1.01% 1.01%

-------------------------------------------------------------- ------------- ------------

(A) Professional services comprising advisory and legal fees considered

unlikely to recur.

(B) Calculated in accordance with AIC guidance issued in October 2020

to include the Company's share of costs of holdings in investment companies

on a look-through basis.

The ongoing charges percentage provided in the Company's Key Information

Document is calculated in line with the PRIIPs regulations which among

other things, includes the cost of borrowings and transaction costs.

Total return

NAV and share price total returns show how the NAV and share price has

performed over a period of time in percentage terms, taking into account

both capital returns and dividends paid to shareholders. Share price

and NAV total returns are monitored against open-ended and closed-ended

competitors, and the Reference Index, respectively.

Share

Six months ended 30 June 2023 NAV Price

----------------------------------------------- ------------- ------------- ------------

Opening at 1 January 2023 a 243.44p 215.00p

Closing at 30 June 2023 b 229.17p 201.00p

Price movements c=(b/a)-1 -5.9% -6.5%

Dividend reinvestment (A) d 2.2% 2.5%

----------------------------------------------- ------------- ------------- ------------

Total return c+d -3.7% -4.0%

----------------------------------------------- ------------- ------------- ------------

Share

Year ended 31 December 2022 NAV Price

----------------------------------------------- ------------- ------------- ------------

Opening at 1 January 2022 a 262.76p 231.00p

Closing at 31 December 2022 b 243.44p 215.00p

Price movements c=(b/a)-1 -7.4% -6.9%

Dividend reinvestment (A) d 3.8% 4.2%

----------------------------------------------- ------------- ------------- ------------

Total return c+d -3.6% -2.7%

----------------------------------------------- ------------- ------------- ------------

(A) NAV total return involves investing the net dividend in the NAV

of the Company with debt at fair value on the date on which that dividend

goes ex-dividend. Share price total return involves reinvesting the net

dividend in the share price of the Company on the date on which that

dividend goes ex-dividend.

Interim Board Report - Disclosures

Principal Risk Factors

The principal risks and uncertainties affecting the Company are

set out below and in detail on pages 22 to 23 of the Annual Report

for the year ended 31 December 2022 and are not expected to change

materially for the remaining six months of the Company's financial

year.

The risks outlined below are those risks that the Directors

considered at the date of this Half Yearly Report to be material

but are not the only risks relating to the Company or its shares.

If any of the adverse events described below actually occur, the

Company's financial condition, performance and prospects and the

price of its shares could be materially adversely affected and

shareholders may lose all or part of their investment. Additional

risks which were not known to the Directors at the date of this

Half Yearly Report, or that the Directors considered at the date of

this Report to be immaterial, may also have an effect on the

Company's financial condition, performance and prospects and the

price of the shares.

If shareholders are in any doubt as to the consequences of their

acquiring, holding or disposing of shares in the Company or whether

an investment in the Company is suitable for them, they should

consult their stockbroker, bank manager, solicitor, accountant or

other independent financial adviser authorised

under the Financial Securities and Markets Act 2000 (as amended

by the Financial Services Act 2012) or, in the case of prospective

investors outside the United Kingdom, another appropriately

authorised independent financial adviser.

The risks can be summarised under the following headings:

- Investment strategy and objectives;

- Investment portfolio, investment management;

- Financial obligations;

- Financial;

- Regulatory;

- Operational; and

- Income and dividend risk.

The Board considers that a number of contingent risks stemming

from the Covid-19 pandemic may continue to linger, which may impact

the operation of the Company. These include investment risks

surrounding the companies in the portfolio such as employee

absence, reduced demand, reduced turnover and supply chain

breakdowns. In addition, the Russian military offensive against

Ukraine has resulted in heightened security and cyber threats

across the globe as well as market disruption and heightened

geo-political uncertainty.

Whilst the Company has no holdings in Ukraine or Russia, these

contingent and emerging risks from the conflict may have a global

impact for some time and may affect the portfolio in the form of

higher energy prices as well as increased volatility.

The Investment Manager will continue to review carefully the

composition of the Company's portfolio and to be pro-active in

taking investment decisions where necessary.

An explanation of other risks relating to the Company's

investment activities, specifically market price, liquidity and

credit risk, and a note of how these risks are managed, are

contained in note 18 on pages 82 to 89 of the Annual Report for the

year ended 31 December 2022.

Going Concern

The Directors have undertaken a robust review of the Company's

ability to continue as a going concern. The Company's assets

consist primarily of a diverse portfolio of listed equity shares

which in most circumstances are realisable within a very short

timescale.

The Directors have reviewed forecasts detailing revenue and

liabilities, have set limits for borrowing and reviewed compliance

with banking covenants, including the headroom available. They have

also considered the ability of the Company to re-finance its loan

facilities which are due to mature in March 2024. Having taken

these factors into account, the Directors believe that the Company

has adequate financial resources to continue in operational

existence for the foreseeable future and at least 12 months from

the date of this Half Yearly Report. Accordingly, the Directors

continue to adopt the going concern basis in preparing these

financial statements.

Directors' Responsibility Statement

The Directors are responsible for preparing this Half Yearly

Financial Report in accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

- the condensed set of interim financial statements contained

within the Half Yearly Financial Report which have been prepared in

accordance with IAS 34 "Interim Financial Reporting", give a true

and fair view of the assets, liabilities, financial position and

profit or loss of the Company;

- the Half-Yearly Board Report includes a fair review of the

information required by rule 4.2.7R of the Disclosure and

Transparency Rules (being an indication of important events that

have occurred during the first six months of the financial year and

their impact on the condensed set of Financial Statements and a

description of the principal risks and uncertainties for the

remaining six months of the financial year); and

- the Half-Yearly Board Report includes a fair review of the

information required by 4.2.8R (being related party transactions

that have taken place during the first six months of the financial

year and that have materially affected the financial position of

the Company during that period; and any changes in the related

party transactions described in the last Annual Report that could

do so).

On behalf of the Board

Ian Cadby

Chairman

17 August 2023

The Half Year Report will be posted to shareholders in August

2023 and copies will be available on the Company's website (

asian-income.co.uk* ).

*Neither the Company's website nor the content of any website

accessible from hyperlinks on that website (or any other website)

is (or is deemed to be) incorporated into, or forms (or is deemed

to form) part of this announcement

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFSFMMEDSEEA

(END) Dow Jones Newswires

August 17, 2023 02:00 ET (06:00 GMT)

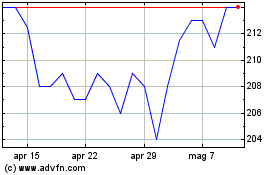

Grafico Azioni Abrdn Asian Income (LSE:AAIF)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Abrdn Asian Income (LSE:AAIF)

Storico

Da Mag 2023 a Mag 2024