TIDMAMAT

RNS Number : 9222A

Amati AIM VCT PLC

07 February 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, JAPAN OR

SOUTH AFRICA OR ANY JURISDICTION FOR WHICH THE SAME COULD BE

UNLAWFUL. THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE AN

OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION, INCLUDING IN THE

UNITED STATES, CANADA, AUSTRALIA, JAPAN OR THE REPUBLIC OF SOUTH

AFRICA.

Amati AIM VCT plc

7 February 2022

Amati AIM VCT plc (the "Company")

Legal Entity Identifier: 213800HAEDBBK9RWCD25

Publication of Circular and Notice of General Meeting

At the last Annual General Meeting ("AGM") of the Company, held

on 9 June 2021, the Board was given authority by shareholders to

issue or sell from treasury, on a non pre-emptive basis, 30 million

Ordinary Shares in the 12 months leading up to the 2022 AGM. This

equated to approximately 25 per cent. of the Company's then issued

share capital. Since the AGM held in June 2021, the Company

launched an offer for subscription (the "Offer") in order to raise

funds to enable the Company to make further qualifying investments

as and when suitable opportunities arose, in accordance with its

published investment policy. Under the terms of the Offer, the

Company sought to raise up to GBP40 million with an over-allotment

facility to allow the Company to raise a further GBP25 million

should there be sufficient investor demand for Ordinary Shares and

suitable investment opportunities.

The Company experienced strong demand for its Ordinary Shares

under the Offer. The Company announced on 4 August 2021 that GBP40

million had been raised under the Offer and, on 15 December 2021,

the Board announced that it intended to utilise the over-allotment

facility and to re-open the Offer in February 2022.

The number of Ordinary Shares issued under the Offer was higher

than was anticipated at the time the 2021 Notice of AGM was

published. This is as a result of the Company increasing the

aggregate size of the Offer from GBP60 million to GBP65 million in

anticipation of a strong pipeline of investment opportunities. In

addition, as the issue price of the Ordinary Shares issued under

the Offer is based on the Company's prevailing NAV per Ordinary

Share, the fall in NAV per Ordinary Share since the 2021 AGM Notice

was published means that a larger number of Ordinary Shares will

require to be issued to satisfy subscriptions than was

envisaged.

On the basis of the Company's NAV per Ordinary Share of 180.98

pence as at 3 February 2022 (the latest published NAV per Ordinary

Share), the Board believes that it will not have sufficient

authority to allot the requisite number of Ordinary Shares so as to

utilise the GBP25 million available under the over-allotment

facility in full, should it be fully taken up. This would therefore

limit the amount of capital that the Company could raise under the

Offer. For illustrative purposes only, the issue of the remaining

10,451,263 Ordinary Shares under the over-allotment facility would

only allow approximately GBP19.1 million to be raised under the

over-allotment facility (based on the NAV per Share as at 3

February 2022).

For this reason, the Board believes that it is in the best

interests of the Company and its shareholders as a whole that it be

granted additional authority so as to enable the Company utilise

fully the overallotment facility.

In the light of the above, the Board has today published a

circular (the "Circular") convening a general meeting (the "General

Meeting") at which shareholders will be asked to consider and, if

thought fit, approve the grant of additional authority, in addition

to any existing authority, to allow the Board to issue on a non

pre-emptive basis up to a further 10,000,000 Ordinary Shares (being

approximately 7.3 per cent. of the Company's issued share capital

as at 4 February 2022) up until the Company's 2022 AGM (the

"Proposed Authorities").

By enabling the Company to utilise its over-allotment facility

in full, the issue of new Ordinary Shares pursuant to the Proposed

Authorities would enable the Company to deploy further capital into

attractive investment opportunities. The Board believes the level

of the Proposed Authorities will be sufficient to allow the

over-allotment facility of GBP25 million to be utilised in full,

notwithstanding current market volatility.

Whilst the Board has indicated the Offer will re-open in

February 2022, it is not intended that the first allotment pursuant

to the use of the over-allotment facility will occur until after

the General Meeting has taken place.

For the avoidance of doubt, the Board intends, as is the usual

practice, to seek further share issuance authority at the 2022

AGM.

The purpose of the Circular is therefore to convene a General

Meeting at which the Proposed Authorities will be sought. The

General Meeting will be held at 11.00 a.m. on 2 March 2022 at the

offices of Amati Global Investors Limited, 8 Coates Crescent,

Edinburgh, Scotland EH3 7AL.

Should shareholders not pass the resolutions at the General

Meeting, the Company will only be authorised to issue up to

10,451,263 more Ordinary Shares under the Offer. As indicated

above, this would equate to raising approximately GBP19.1 million

under the over-allotment facility (based on the Company's NAV per

Ordinary Share as at 3 February 2022). Therefore, if the requested

authorities are not granted, investors wishing to subscribe for

Ordinary Shares under the over-allotment facility may not be able

to have their subscriptions satisfied in full. As further described

in the Company's prospectus dated 28 July 2021, in the event that

the Offer is over-subscribed, investor allocations may be scaled

back and/or investor subscription monies returned without being

processed.

A copy of the Circular has been submitted to the Financial

Conduct Authority and will be available for inspection at the

National Storage Mechanism which is located at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism and on the

Company's website at

https://www.amatiglobal.com/fund/amati-aim-vct/amati-aim-vct-offer

.

For further information, please contact the investor line at

Amati Global Investors on 0131 503 9115 or by email at

info@amatiglobal.com .

Notes

This Announcement is an advertisement for the purposes of the

Prospectus Regulation Rules of the UK Financial Conduct Authority

("FCA") and is not a prospectus. This Announcement does not

constitute or form part of, and should not be construed as, an

offer for sale or subscription of, or solicitation of any offer to

subscribe for or to acquire, any ordinary shares in Amati AIM VCT

plc (the "Company") in any jurisdiction, including in or into

Australia, Canada, Japan, the Republic of South Africa, the United

States or any member state of the EEA (other than any member state

of the EEA where the Company's securities may be lawfully

marketed). Investors should not subscribe for or purchase any

ordinary shares referred to in this Announcement except on the

basis of information in the prospectus (the "Prospectus") in its

final form, published on 28 July 2021 by the Company in connection

with the offer for subscription and the supplementary prospectus

published on 18 January 2022 related thereto. Copies of the

Prospectus and the supplementary prospectus are available for

inspection, subject to certain access restrictions, from the

Company's registered office, for viewing at the National Storage

Mechanism at https://data.fca.org.uk/#/nsm/nationalstoragemechanism

and on the Company's website ( www.amatiglobal.com ). Approval of

the Prospectus by the FCA should not be understood as an

endorsement of the securities that are the subject of the

Prospectus. Potential investors are recommended to read the

Prospectus and the supplementary prospectus before making an

investment decision in order to fully understand the potential

risks and rewards associated with a decision to invest in the

Company's securities.

The content of the Company's web-pages and the content of any

website or pages which may be accessed through hyperlinks on the

Company's web-pages, other than the content of the document

referred to above, is neither incorporated into nor forms part of

the above announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CIRXDLFBLLLFBBX

(END) Dow Jones Newswires

February 07, 2022 08:15 ET (13:15 GMT)

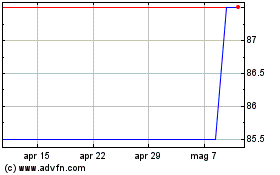

Grafico Azioni Amati Aim Vct (LSE:AMAT)

Storico

Da Apr 2024 a Mag 2024

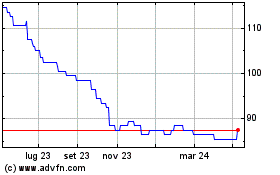

Grafico Azioni Amati Aim Vct (LSE:AMAT)

Storico

Da Mag 2023 a Mag 2024