Anpario PLC Full year trading statement (6862A)

24 Gennaio 2024 - 8:00AM

UK Regulatory

TIDMANP

RNS Number : 6862A

Anpario PLC

24 January 2024

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION FOR THE

PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014

AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018.

Anpario plc

("Anpario", the "Group" or the "Company")

Full year trading statement

Anpario plc (AIM:ANP), the independent manufacturer of natural

sustainable animal feed additives for health, nutrition and

biosecurity, provides the following trading update for the year

ended 31 December 2023 ("FY 2023"). The figures used in this

announcement remain subject to audit.

Trading update

The Group delivered a stronger operating performance in the

second half of the year, notably within the Orego-Stim(R) product

brand. Group Sales are expected to be not less than GBP30.8m and

adjusted EBITDA(1) is now expected to be ahead of current market

expectations and not less than GBP4.4m. As part of regular review

processes, an impairment of research and development expenditure of

around GBP0.4m has been identified, adjusted EBITDA(1) is stated

before this charge. Our continued actions to recover raw material

price inflation and a favourable sales mix have delivered a further

recovery in gross margins, and the decision taken to reduce

overheads will help support future profitable growth.

Financial position

Our financial position remains strong and has further improved

following completion of the GBP9.0m tender offer in July 2023.

Working capital has been carefully managed to reduce stock levels,

held to overcome logistic and supply chain challenges, and improve

cash generation. Year-end cash balances were GBP10.6m (30 June

2023: GBP7.3m, including short-term investments of GBP0.1m), an

increase of GBP3.3m through the second half of the year, this is

after GBP1.8m of dividend payments being paid during the

period.

Our strong balance sheet enables the Group to invest in

innovative natural product solutions, expand our global reach and

explore earnings enhancing and complementary acquisitions to

continue the profitable development of the Group. We remain

confident in capturing the opportunities to grow the business for

the long-term benefit of all stakeholders.

India Partnership Agreement

The year has been challenging but our geographic and product

diversity affords the Group a measure of resilience. As such, we

were also delighted to sign a new agreement with our Indian partner

who has successfully represented Orego-Stim(R) since 2008. The

agreement means Orego-Stim(R) will be blended locally under

licence, helping to speed up sales growth and offer greater access

to new market segments. Orego-Stim(R) is recognised as a leading

phytogenic product in India and this enhanced partnership offers

more sales opportunities in one of the world's fastest growing

agriculture and aquaculture markets.

Grant of patent

We are also pleased to announce the grant of a UK patent for our

flagship toxin-binder product, Anpro(R). It is expected that this

will provide a tax benefit to the Group via the UK Patent Box

scheme which allows companies to apply a lower rate of corporation

tax to profits attributable to qualifying patents. We are working

with our tax and patent advisors to clarify the scope of qualifying

patents and the tax benefit, provisionally it is anticipated that

there will be a GBP0.1m benefit to FY2023, around half of which is

backdated for previous years. This will be in addition to the

benefit already received under the same scheme related to our

patent for Orego-Stim(R).

FY2023 Results

The Group expects to publish its FY2023 final results on 20

March 2024.

1 Adjusted EBITDA represents operating profit for the year

adjusted for: acquisition costs; share-based payments and

associated costs; and depreciation, amortisation, and impairment

charges.

Enquiries

Anpario plc

Richard Edwards, Chief Executive Officer +44(0)7776 417 129

Marc Wilson, Group Finance Director +44(0)1909 537 380

Shore Capital

(Nominated Adviser and Broker) +44 (0) 20 7408 4090

Stephane Auton Corporate Advisory

David Coaten

Tom Knibbs

Henry Willcocks Corporate Broking

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUPCGUPCPGW

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

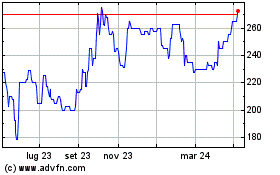

Grafico Azioni Anpario (LSE:ANP)

Storico

Da Ott 2024 a Nov 2024

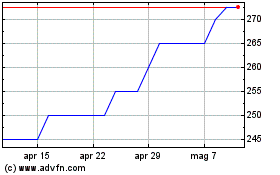

Grafico Azioni Anpario (LSE:ANP)

Storico

Da Nov 2023 a Nov 2024