TIDMANX

RNS Number : 9794J

Anexo Group PLC

22 August 2023

For immediate release 22 August 2023

Anexo Group plc

('Anexo' or the 'Group')

Interim Results for the six months ended 30 June 2023

"Significant revenue and profit growth with unchanged outlook

for the year"

Anexo Group plc (AIM: ANX), the specialist integrated credit

hire and legal services provider, is pleased to report its Interim

Results for the six months ended 30 June 2023 ('H1 2023' or the

'period').

Financial Highlights

H1 2023 H1 2022 Movement

Revenue GBP77.8 million GBP68.6 million +13.4%

Operating profit GBP19.3 million GBP16.1 million +19.9%

Profit before tax GBP15.2 million GBP13.6 million +11.8%

Cash collection GBP77.4 million GBP67.9 million +14.0%

Basic EPS 8.6 pence 9.3 pence -7.5%

-- A significant reduction in Net Debt (including lease liabilities) was reported in the period

(GBP11.9 million). Net Debt as at 30 June 2023 stood at GBP61.2 million (30 June 2022: GBP74.2

million, 31 December 2022: GBP73.1 million).

-- Cash collections from settled cases increased 14% to GBP77.4 million (H1 2022: GBP67.9

million), excluding the legal fees associated with the Volkswagen AG ('VW') Emissions Claim.

-- The Group generated GBP15.7 million in Net Cash from Operating Activities (H1 2022: Net

Cash Used in Operating Activities: GBP5.1 million), a total improvement of GBP20.8 million.

-- Revenue increased 13% to GBP77.8 million (H1 2022: GBP68.6 million), reflecting the agreement

reached in the VW Emissions Claim and increased legal fee income from both Credit Hire and

Housing Disrepair ("HDR") claim settlements.

-- Operating profit increased 19% to GBP19.3 million (H1 2022: GBP16.1 million) due to improved

cash collections from all divisions in addition to the proceeds of the VW agreement, whilst

the number of new credit hire cases has been actively managed.

Operational Highlights

-- The Group has shown robust growth within legal services,

driving the increase seen in cash collections. HDR continues to be

an ever-increasing element, with revenues increasing by over 25%.

The HDR division settled 884 claims in H1 2023 (H1 2022: 556) and

now has a portfolio of 3,291 claims (H1 2022: 2,218).

-- The results for the period include the agreement reached in

the VW emissions case. The terms of the agreement are subject to

confidentiality restrictions. The Group announced on 5 June 2023

that the agreement had resulted in a net positive cash position to

Anexo of GBP7.2 million.

-- The Group continued its investment in litigation concerning

the Mercedes Benz Emissions Claim, with a total of over 12,000

claimants now forming part of the group action.

-- Vehicle numbers continued to be carefully managed to maximise

efficient use of working capital, supporting the significant

reduction in Net Debt. Strong growth is forecast for H2 2023

resulting from a steady increase in vehicle numbers.

-- The average number of Group vehicles on the road in H1 2023

reached 1,634, some 20% below that seen in H1 2022 (2,034). Vehicle

numbers at 18 August 2023 totalled 1,795.

KPIs H1 2023 H1 2022 Movement

Cash collections from settled

cases (GBP'000s) 77,413 67,931 +14.0%

Number of hire cases settled 4,369 3,563 +22.6%

Number of new hire cases funded 4,920 5,082 -3.2%

Completed vehicle hires 4,689 5,501 -14.8%

Number of vehicles on hire

at period end 1961 1947 +0.1%

Legal staff employed at period

end 690 633 +9.0%

Number of HDR cases at period

end 3,291 2,218 +48.4%

Number of HDR cases settled 884 556 +59.0%

Commenting on the Interim Results, Alan Sellers, Executive

Chairman of Anexo Group plc, said:

"The Board has been focused on delivering a meaningful reduction

in net debt and increasing cash collections during the first half

of the year. The results presented here are testament to the

quality of our people, the ever-increasing diversity of the Group's

activities and our commitment to investment into future growth and

opportunities for the business.

"We are immensely proud to be able to offer social justice and

full legal support to our clients and members of the public. Anexo

provides assistance to people who find themselves in an invidious

position through no fault of their own, whether through being

deprived of an essential vehicle or through living in substandard

housing conditions, along with the other problems which may be

exacerbated by such situations. We remain committed to providing

help to those who might otherwise be unable to obtain redress.

"Having demonstrated our ability to drive the business for cash

generation, we are expecting growth in vehicle numbers, revenues

and profits in the second half of the year, without the need to

fund this growth from our current debt facilities. As cash

collections continue to increase, we will be able to invest further

and drive growth across all our divisions including HDR and

emissions claims.

"The strong progress being made in HDR and group emissions

litigation underpins the forecast growth in the core business. The

Board remains confident of meeting market expectations for the

year."

- Ends -

Results Conference Call

An analyst conference call will be held at 09:30 BST today, 22

August 2023. Retail investors will also be able to listen to the

call but will not be eligible to ask questions. A copy of the

Interim Results presentation is available at the Group's website:

https://www.anexo-group.com/ . Please contact Nick Dashwood Brown,

Head of Investor Relations, at nick@anexo-group.com if you would

like to join the call.

An audio webcast of the conference call with analysts will be

available after 12:00 BST today on the Company's website:

www.anexo-group.com

For further enquiries:

Anexo Group plc +44 (0) 151 227 3008

www.anexo-group.com

Alan Sellers, Executive Chairman

Mark Bringloe, Interim Chief Financial Officer

Nick Dashwood Brown, Head of Investor Relations

WH Ireland Limited

(Nominated Adviser & Joint Broker)

Chris Hardie / Hugh Morgan/ Darshan Patel (Corporate) +44 (0) 20 7220 1666

Fraser Marshall / Harry Ansell (Broking) www.whirelandplc.com/capital-markets

Zeus

(Joint Broker)

David Foreman / Louisa Waddell (Investment Banking) +44 (0) 20 3829 5000

Simon Johnson (Corporate Broking) w ww.zeuscapital.co.uk

Notes to Editors:

Anexo is a specialist integrated credit hire and legal services

provider. The Group has created a unique business model by

combining a direct capture Credit Hire business with a wholly owned

Legal Services firm. The integrated business targets the

impecunious not at fault motorist, referring to those who do not

have the financial means or access to a replacement vehicle.

Through its dedicated Credit Hire sales team and network of

1,100 plus active introducers around the UK, Anexo provides

customers with an end-to-end service including the provision of

Credit Hire vehicles, assistance with repair and recovery, and

claims management services. The Group's Legal Services division,

Bond Turner, provides the legal support to maximise the recovery of

costs through settlement or court action as well as the processing

of any associated personal injury claim.

The Group was admitted to trading on AIM in June 2018 with the

ticker ANX. For additional information please visit:

www.anexo-group.com

Executive Chairman's Statement

On behalf of the Board, I am pleased to announce Anexo's results

for the six-month period ended 30 June 2023. The Group has

continued to demonstrate the effectiveness of its business model,

concentrating firmly on the transition of the Group to a cash

generative position and the achievement of a reduction in net debt.

Vehicle numbers within the credit hire division have been actively

managed, while increased case settlements within the legal services

division, including HDR, have driven the rise in cash

collections.

The strong performance in the first half of the year will enable

the Group to continue accepting an increased number of claims in

the second half leading to an improvement in both revenues and

profitability without the need to increase debt.

H1 2023 Group Performance

Anexo has actively managed the business to attain its stated

goals of reducing net debt and improving the conversion of profits

to free cash. The Group has delivered a strong performance across

all key financial metrics and KPIs over the first six months of the

year. Having increased case settlements alongside the VW Emissions

agreement, Group revenues in H1 2023 increased by 13% to GBP77.8

million (H1 2022: GBP68.6 million) and profit before tax rose by

11% to GBP15.2 million (H1 2022: GBP13.6 million).

Legal Services Division

Credit Hire

The Group remains committed to its strategy of increasing its

claim settlement capacity, thereby maximising cash collections. The

number of senior fee earners remained broadly unchanged during the

period, standing at 243 as at 30 June 2023. The overall number of

legal staff rose by 9% to 690 (H1 2022: 633).

Investment during 2022 has underpinned continued growth in cash

collections, which rose 14% in H1 2023 to a total of GBP77.4

million (H1 2022: GBP67.9 million), excluding any value from the VW

Emissions agreement. Revenues from the Legal Services division,

which strongly converts to cash, more than doubled in the period to

GBP43.0 million in H1 2023 (H1 2022: GBP21.4 million), this figure

includes the proceeds from the VW agreement. Profit before taxation

increased sharply from GBP1.2 million in H1 2022 to GBP11.6 million

in H1 2023, reflecting an improvement in the core business

activities and the VW Emissions agreement in the period.

Housing Disrepair

The Group's HDR division continues to show significant growth.

The number of ongoing claims currently stands at approximately

3,300. HDR is now cash generative as the value of fee income

generated from settled claims exceeds the investment in staff and

marketing costs for the generation of new claims. Net cash

generation totalled GBP0.4 million in H1 2023 (H1 2022: Net cash

outflow GBP0.3 million). The current claims portfolio is expected

to contribute to an improvement in performance in the second half

of the year and beyond.

With an increase in revenues, HDR reported a profit of GBP2.6

million in the period (H1 2022: GBP2.4 million) having invested

GBP2.2 million in new claims (H1 2022: GBP1.7 million). These

marketing costs continue to be written off as incurred.

Emissions Litigation

The advocacy team reached an agreement in the claim against VW

and its subsidiaries. The terms of the agreement are subject to

confidentiality restrictions; the Group announced on 5 June 2023

that the agreement had resulted in a net positive cash position to

Anexo of GBP7.2 million.

The Group continues to pursue litigation in other emissions

cases, particularly in relation to Mercedes Benz. The Group

currently has approximately 12,000 Mercedes cases (H1 2022:

approximately 4,000 Mercedes cases).

Management believes there is a significant continued opportunity

for investment in emissions claims against specific vehicle

manufacturers. Accordingly, the Group has earmarked a continued

ongoing level of investment for the second half of the year and

beyond. Investment for the current year is being funded from an

additional GBP2.8 million, provided to the Group in part by certain

of the principal shareholders and directors of the Group.

Credit Hire Division

Whilst demand for vehicles has remained strong throughout the

period, the Group has actively managed the number of new claims

accepted to levels which maximise the conversion of profitability

to operating cash flow whilst supporting funding into other group

activities such as HDR and emissions. This also provides a strong

and diverse platform for future opportunities including credit hire

opportunities.

Having increased cash collections month on month to new record

levels, the Group has increased the number of claims funded

throughout H1 2023; vehicle numbers increased to 1,961 at 30 June

2023, some 20% above the average levels seen in the first half.

Vehicle numbers are fundamental to managing revenues and profits,

and this increase supports the Group's expectation of strong growth

in the second half of the year.

Against the backdrop of strong demand, the considered careful

management of the fleet has seen a consequent decline in Credit

Hire revenue, reported at GBP28.9 million in H1 2023 (H1 2022:

GBP42.5 million), and a resultant reduction in profit before tax to

GBP2.2 million. Completed vehicle hires reduced to 4,689 in H1 2023

(H1 2022: 5,501) but with vehicle numbers now approaching 2,000,

the expectation is that activity levels will rise driving a

significant improvement in performance for the Credit Hire Division

in the second half of the year.

Dividend

The Group continues to invest heavily in future opportunities

including HDR and Emissions and the Board has therefore resolved

that the interests of the Group and its shareholders would be best

served by considering the position with regards to payment of a

dividend following the preparation of the Group's full year

results.

Outlook

The focus in the first half of 2023 has been firmly on the

conversion of profits to operating cash flows. The Group has shown

robust growth during the period and plans to continue to optimise

cash generation in the second half, whilst increasing activity

levels within the Credit Hire division to levels previously seen in

the first half of 2022.

Growth in cash collections allows the Group to increase

activity, including continued investment in HDR and additional

emissions claims, without the need for increases in net debt. The

focus for the second half is to ensure this investment is

self-funded. Management has confidence in meeting market

expectations for the year.

Alan Sellers

Executive Chairman

22 August 2023

Consolidated Statement of Comprehensive Income

For the unaudited period ended 30 June 2023

Unaudited Unaudited

Half year Half year Audited

ended ended Year ended

30-Jun-23 30-Jun-22 31-Dec-22

Note GBP'000s GBP'000s GBP'000s

Revenue 2 77,772 68,610 138,329

Cost of sales (14,712) (16,253) (32,553)

---------- ---------- ------------

Gross profit 63,060 52,357 105,776

Depreciation & profit / loss

on disposal (4,574) (5,561) (10,436)

Amortisation (37) (74) (117)

Administrative expenses (39,176) (30,759) (64,982)

Operating profit before exceptional

items 19,273 15,963 30,241

---------- ---------- ------------

Share based payment credit - 175 175

Operating profit 19,273 16,138 30,416

---------- ---------- ------------

Net financing expense (4,085) (2,500) (6,323)

---------- ---------- ------------

Profit before tax 15,188 13,638 24,093

Taxation (5,110) (2,734) (4,616)

Profit and total comprehensive

income for the year attributable

to the owners of the company 10,078 10,904 19,477

---------- ---------- ------------

Earnings per share

Basic earnings per share (pence) 8.6 9.3 16.6

---------- ---------- ------------

Diluted earnings per share (pence) 8.6 9.3 16.6

---------- ---------- ------------

The above results were derived from continuing operations.

Consolidated Statement of Financial Position

Unaudited at 30 June 2023

Unaudited Unaudited Audited

30-Jun-23 30-Jun-22 31-Dec-22

Assets Note GBP'000s GBP'000s GBP'000s

Non-current assets

Property, plant and equipment 3 1,927 2,323 2,072

Right-of-use assets 10,216 16,816 12,657

Intangible assets 66 112 71

Deferred tax assets 112 112 112

---------- ---------- ----------

12,321 19,363 14,912

---------- ---------- ----------

Current assets

Trade and other receivables 4 233,501 209,817 222,272

Corporation tax receivable 1,161 - 606

Cash and cash equivalents 7,362 1,247 9,049

242,024 211,176 231,927

---------- ---------- ----------

Total assets 254,345 230,427 246,839

---------- ---------- ----------

Equity and liabilities

Equity

Share capital 59 59 59

Share premium 16,161 16,161 16,161

Retained earnings 138,435 121,554 130,127

---------- ---------- ----------

Equity attributable to the owners

of the Group 154,655 137,774 146,347

---------- ---------- ----------

Non-current liabilities

Other interest-bearing loans

and borrowings 5 27,760 20,710 25,000

Lease liabilities 5,842 8,462 7,176

Deferred tax liabilities - - 32

33,602 29,172 32,208

---------- ---------- ----------

Current liabilities

Other interest-bearing loans

and borrowings 5 30,074 37,235 43,594

Lease liabilities 4,857 9,018 6,403

Trade and other payables 20,398 9,966 13,225

Corporation tax liability 10,759 7,262 5,062

66,088 63,481 68,284

---------- ---------- ----------

Total liabilities 99,690 92,653 100,492

---------- ---------- ----------

Total equity and liabilities 254,345 230,427 246,839

---------- ---------- ----------

Consolidated Statement of Changes in Equity

For the unaudited period ended 30 June 2023

Share Retained

Share capital premium Share based payment reserve earnings Total

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

At 1 January 2023 59 16,161 - 130,127 146,347

Profit for the period and total

comprehensive income - - - 10,078 10,078

Dividends - - - (1,770) (1,770)

At 30 June 2023 59 16,161 - 138,435 154,655

-------------- ----------- ------------------------------ ---------- ---------

At 1 January 2022 58 16,161 2,077 109,928 128,224

Profit for the period and total

comprehensive income - - 10,904 10,904

Issue of share capital 1 - - - 1

Transfer of share based payment

reserve - - (1,902) 1,902 -

Share based payment charge - - (175) - (175)

Dividends - - - (1,180) (1,180)

At 30 June 2022 59 16,161 - 121,554 137,774

Profit for the period and total

comprehensive income - - - 8,573 8,573

At 31 December 2022 59 16,161 - 130,127 146,347

-------------- ----------- ------------------------------ ---------- ---------

Anexo Group Plc

Consolidated Statement of Cash Flows

For the unaudited period ended 30 June 2023

Unaudited Unaudited

Half year Half year Audited

ended ended Year ended

30-Jun-23 30-Jun-22 31-Dec-22

GBP'000s GBP'000s GBP'000s

Cash flows from operating

activities

Profit for the year 10,078 10,904 19,477

Adjustments for:

Depreciation and profit

/ loss on disposal 4,574 5,561 10,436

Amortisation 37 74 117

Financial expense 4,085 2,500 6,323

Share based payment credit - (175) (175)

Taxation 5,110 2,734 4,616

---------- ---------- ------------

23,884 21,598 40,794

Working capital adjustments

Increase in trade and other

receivables (11,229) (21,682) (34,138)

(Decrease) / increase in

trade and other payables 7,173 (2,667) 590

---------- ---------- ------------

Cash generated from operations 19,828 (2,751) 7,246

Interest paid (4,085) (2,380) (5,722)

Tax paid - - (4,656)

Net cash from / (used)

in operating activities 15,743 (5,131) (3,132)

---------- ---------- ------------

Cash flows from investing

activities

Proceeds from sale of property,

plant and equipment 531 722 1,579

Acquisition of property, plant

and equipment (717) (1,285) (1,186)

Investment in intangible fixed

assets (31) - -

Net cash (used in) / from

investing activities (217) (563) 393

---------- ---------- ------------

Cash flows from financing

activities

Proceeds from new loans 8,946 10,265 24,430

Dividends paid (1,770) (1,180) (1,180)

Repayment of borrowings (19,117 (4,753) (8,749)

Lease payments (5,272) (4,953) (10,275)

Net cash from financing

activities (17,213) (621) 4,226

---------- ---------- ------------

Net (decrease) / increase in

cash and cash equivalents (1,687) (6,315) 1,487

Cash and cash equivalents

at 1 January 9,049 7,562 7,562

Cash and cash equivalents

at period end 7,362 1,247 9,049

---------- ---------- ------------

Anexo Group Plc

Notes to the Interim Statements

For the unaudited period ended 30 June 2023

1. Basis of preparation and significant accounting policies

The condensed consolidated financial statements are prepared

using accounting policies consistent with International Financial

Reporting Standards and in accordance with International Accounting

Standard ('IAS') 34, 'Interim Financial Reporting'.

The information for the year ended 31 December 2022 does not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor's

report on these accounts was not qualified and did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying the report and did not contain

statements under Section 498 (2) or (3) of the Companies Act

2006.

The condensed unaudited financial statements for the six months

to 30 June 2023 have not been audited or reviewed by auditors

pursuant to the Auditing Practices Board guidance on Review of

Interim Financial Information.

The condensed consolidated financial statements have been

prepared under the going concern assumption.

The Directors have assessed the future funding requirement of

the Group and have compared them to the levels of available cash

and funding resources. The assessment included a review of current

financial projections to December 2024. Having undertaken this

work, the Directors are of the opinion that the Group has adequate

resources to finance its operations for the foreseeable future and

accordingly, continue to adopt the going concern basis in preparing

the Interim Report.

2. Segmental Reporting

The Group's reportable segments are as follows:

-- the provision of credit hire vehicles to individuals who have

had a non-fault accident, and

-- associated legal services in the support of the individual

provided with a vehicle by the Group and other legal service

activities.

Management monitors the operating results of business segments

separately for the purpose of making decisions about resources to

be allocated and of assessing performance.

Other Legal Services and Housing Disrepair, are subsets of Legal

Services. We have however, distinguished the performance of Housing

Disrepair from within Legal Services as this division of the Legal

Services segment is an area where the Group is investing heavily,

is a focus for the Group at present and into the future and allows

readers of the financial statements to understand the contribution

Housing Disrepair has to the overall Group performance. The Housing

Disrepair division continues to grow and as the results become more

significant to the overall Group performance this division may well

become a segment in its own right, this could be reported in the

2023 financial statements.

Half year ended 30 June 2023

Housing Group and

Credit Other Legal Disrepair Central

Hire Services Costs Consolidated

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

Revenues

Third party 28,858 42,968 5,946 - 77,772

Total revenues 28,858 42,968 5,946 - 77,772

----------- -------------- ------------- ------------ ---------------

Profit before

taxation 2,233 11,578 2,639 (1,262) 15,188

----------- -------------- ------------- ------------ ---------------

Net cash from

operations 4,153 12,233 372 (1,015) 15,743

----------- -------------- ------------- ------------ ---------------

Depreciation 3,995 616 - - 4,611

----------- -------------- ------------- ------------ ---------------

Segment assets 170,295 71,814 10,872 1,364 254,345

----------- -------------- ------------- ------------ ---------------

Capital expenditure 420 297 - - 717

----------- -------------- ------------- ------------ ---------------

Segment liabilities 56,339 42,887 - 464 99,690

----------- -------------- ------------- ------------ ---------------

Half year ended 30 June 2022

Housing Group and

Credit Other Legal Disrepair Central

Hire Services Costs Consolidated

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

Revenues

Third party 42,503 21,392 4,715 - 68,610

Total revenues 42,503 21,392 4,715 - 68,610

----------- -------------- ------------- ------------ -----------------

Profit before taxation 10,941 1,249 2,353 (905) 13,638

----------- -------------- ------------- ------------ -----------------

Net cash from operations (3,990) 950 (257) (1,834) (5,131)

----------- -------------- ------------- ------------ -----------------

Depreciation 4,990 645 - - 5,635

----------- -------------- ------------- ------------ -----------------

Segment assets 176,822 46,927 6,358 320 230,427

----------- -------------- ------------- ------------ -----------------

Capital expenditure 1,198 87 - - 1,285

----------- -------------- ------------- ------------ -----------------

Segment liabilities 61,320 31,079 - 254 92,653

----------- -------------- ------------- ------------ -----------------

Year ended 31 December 2022

Housing Group and

Credit Other Legal Disrepair Central

Hire Services Costs Consolidated

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

Revenues

Third party 74,681 54,311 9,337 - 138,329

Total revenues 74,681 54,311 9,337 - 138,329

---------- ------------ ------------ ------------ ---------------

Profit before taxation 8,887 15,400 4,694 (4,888) 24,093

---------- ------------ ------------ ------------ ---------------

Net cash from

operations (2,310) 3,390 258 (4,470) (3,132)

---------- ------------ ------------ ------------ ---------------

Depreciation 9,271 1,282 - - 10,553

---------- ------------ ------------ ------------ ---------------

Segment assets 174,503 58,562 8,084 5,690 246,839

---------- ------------ ------------ ------------ ---------------

Capital expenditure 980 206 - - 1,186

---------- ------------ ------------ ------------ ---------------

Segment liabilities 66,507 33,985 - - 100,492

---------- ------------ ------------ ------------ ---------------

3. Property, Plant and Equipment

Fixtures

Fittings

Property & Right of Office

Improvement Equipment Use assets Equipment Total

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

Cost or valuation

At 1 January 2022 494 3,125 29,644 629 33,892

Additions 152 193 5,845 266 6,456

Disposals - - (3,976) - (3,976)

At 30 June 2022 646 3,318 31,513 895 36,372

Additions - 126 1,181 23 1,330

Disposals (9) - (4,708) - (4,717)

------------ ---------- ----------- ---------- -----------

At 31 December

2022 637 3,444 27,986 918 32,985

Additions - 294 2,654 2 2,950

Disposals (274) (160) (8,268) (291) (8,993)

At 30 June 2023 363 3,578 22,370 629 26,942

------------ ---------- ----------- ---------- -----------

Depreciation

At 1 January 2022 322 1,418 12,748 437 14,925

Charge for year 16 288 5,300 55 5,659

Eliminated on disposal - - (3,351) - (3,351)

At 30 June 2022 338 1,706 14,697 492 17,233

Charge for the

year 19 308 4,681 64 5,072

Disposals - - (4,049) - (4,049)

------------ ---------- ----------- ---------- -----------

At 31 December

2022 357 2,014 15,329 556 18,256

Charge for the

year 20 314 3,969 60 4,363

Disposals (261) (121) (7,147) (291) (7,820)

At 30 June 2023 116 2,207 12,151 325 14,799

------------ ---------- ----------- ---------- -----------

Carrying amount

At 30 June 2023 247 1,371 10,221 304 12,143

------------ ---------- ----------- ---------- -----------

At 31 December

2022 280 1,430 12,657 362 14,729

------------ ---------- ----------- ---------- -----------

At 30 June 2022 308 1,612 16,816 403 19,139

------------ ---------- ----------- ---------- -----------

4. Trade and Other Receivables

Jun-23 Jun-22 Dec-22

GBP'000s GBP'000s GBP'000s

Trade receivables - gross

claim value 370,711 370,433 393,560

Settlement adjustment on initial

recognition (174,644) (179,759) (203,518)

Provision for impairment of

trade receivables (27,654) (26,207) (24,674)

---------- ---------- ----------

Net trade receivables 168,413 164,467 165,368

Accrued income 59,861 44,177 54,778

Prepayments 6,311 821 1,603

Other debtors 885 352 523

233,501 209,817 222,272

---------- ---------- ----------

The Group's exposure to credit and market risks, including

impairments and allowances for credit losses, relating to trade and

other receivables is disclosed in the financial risk management and

impairment of financial assets note.

Trade receivables stated above include amounts due at the end of

the reporting period for which an allowance for doubtful debts has

not been recognised as the amounts are still considered recoverable

and there has been no significant change in credit quality.

5. Borrowings

Jun-23 Jun-22 Dec-22

GBP'000s GBP'000s GBP'000s

Non-current loans and borrowings

Revolving credit facility 10,000 10,000 10,000

Other borrowings 17,760 10,710 15,000

Lease liabilities 5,842 8,462 7,176

----------- ----------- -----------

33,602 29,172 32,176

----------- ----------- -----------

Current loans and borrowings

Invoice discounting facility 24,598 31,364 30,562

Other borrowings 5,476 5,871 13,032

Lease liabilities 4,857 9,018 6,403

----------- ----------- -----------

34,931 46,253 49,997

----------- ----------- -----------

Total Borrowings 68,533 75,425 82,173

----------- ----------- -----------

Direct Accident Management Limited uses an invoice discounting

facility which is secured on the trade receivables of that company.

Security held in relation to the facility includes a debenture over

all assets of Direct Accident Management Limited dated 11 October

2016, extended to cover the assets of Anexo Group Plc and Edge

Vehicles Rentals Group Limited from 20 June 2018 and 28 June 2018

respectively, as well as a cross corporate guarantee with

Professional and Legal Services Limited dated 21 February 2018.

In July 2020 Direct Accident Management Limited secured a GBP5.0

million loan facility from Secure Trust Bank Plc, under the

Government's CLBILS scheme. The loan was secured on a repayment

basis over the three year period, with a three month capital

repayment holiday, this loan was fully repaid by 30 June 2023.

Direct Accident Management Limited is also party to a number of

leases which are secured over the respective assets funded.

The revolving credit facility is secured by way of a fixed

charge dated 26 September 2019, over all present and future

property, assets and rights (including uncalled capital) of Bond

Turner Limited, with a cross company guarantee provided by Anexo

Group Plc. The loan is structured as a revolving credit facility

which is committed for a three-year period, until 13 October 2024,

with no associated repayments due before that date. Interest is

charged at 3.25% over the Respective Rate.

In July 2020 Anexo Group Plc secured a loan of GBP2.1 million

from a specialist funder to support the investment in marketing

costs associated with the VW Emissions Class Action. The terms of

the loan are that interest accrues at the rate of 10% per annum,

with maturity three years from the date of receipt of funding with

an option to repay early without charge. In addition to the

interest charges the loan attracts a share of the proceeds to be

determined by reference to the level of fees generated for the

Group. Having reached agreement in the VW Emissions Class Action,

this loan was fully repaid in the period to 30 June 2023.

In November 2021 a further GBP3.0 million loan was sourced from

certain of the principal shareholders and directors of the Group to

support the marketing investment in 2022 in the Mercedes Benz

Emissions Claim. The terms of the loan are that interest accrues at

the rate of 10% per annum, with maturity two years from the date of

receipt of funding with an option to repay early without charge. In

addition to the interest charges the loan attracts a share of the

proceeds to be determined by reference to the level of fees

generated for the Group. Having reached an agreement in the VW

Emissions Class Action, this loan was partially repaid in the

period to 30 June 2023 with any residual amount due upon successful

conclusion of the Mercedes Benz Emissions Claim.

In March 2022 the Group secured a loan of GBP7.5 million from

Blazehill Capital Finance Limited, with an additional GBP7.5

million drawn in September 2022, the total balance drawn at 30 June

2023 was GBP15.0 million. The loan is non amortising and committed

for a three year period. Interest is charged and paid monthly at

13% above the central bank rate. The facility is secured by way of

a fixed charge dated 29 March 2022, over all present and future

property, assets and rights (including uncalled capital) of Direct

Accident Management Limited, with a cross company guarantee

provided by Anexo Group Plc.

In June 2023 a loan of GBP2.8 million was sourced from certain

of the principal shareholders and directors of the Group to support

further marketing in the Mercedes Benz Emissions Claim and other

emissions opportunities. The terms of the loan are that interest

accrues at the rate of 10% per annum, with maturity two years from

the date of receipt of funding with an option to repay early

without charge. In addition to the interest charges the loan

attracts a share of the proceeds generated for the Group from the

Mercedes Benz Emissions Claim.

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIRTDILFIV

(END) Dow Jones Newswires

August 22, 2023 02:01 ET (06:01 GMT)

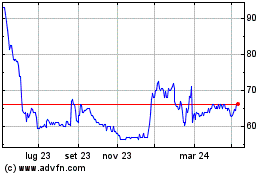

Grafico Azioni Anexo (LSE:ANX)

Storico

Da Gen 2025 a Feb 2025

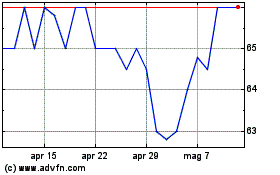

Grafico Azioni Anexo (LSE:ANX)

Storico

Da Feb 2024 a Feb 2025