TIDMATS

Artemis Alpha Trust plc (the 'Company')

LEI: 549300MQXY2QXEIL3756

Annual Report for the year ended 30 April 2023

Financial Highlights

Year ended Year ended

30 April 2023 30 April 2022

Total returns

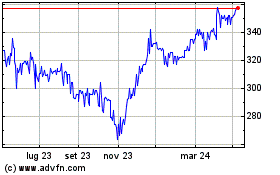

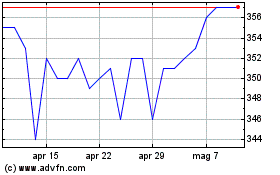

Net asset value per ordinary share* 1.3% (21.9)%

Ordinary share price* (1.2)% (24.8)%

FTSE All-Share Index 6.0% 8.7%

Revenue and dividends

Revenue earnings per ordinary share 6.74p 6.29p

Dividends per ordinary share 6.20p 5.60p

Ongoing charges* 1.08% 1.01%

As at As at

30 April 2023 30 April 2022

Capital

Net Assets (£'000) 119,817 124,101

Net asset value per ordinary share 366.02p 367.65p

Ordinary share price 319.00p 329.00p

Net gearing* 13.4% 9.4%

Total returns to 3 years 5 years 10 years Since 1 June 2003**

30 April 2023

Net asset value 23.5% 0.1% 41.8% 553.4%

per ordinary

share*

Ordinary share 34.4% 7.2% 28.3% 500.5%

price*

FTSE All-Share 45.2% 24.1% 80.7% 338.3%

Index

** The date when Artemis was appointed as Investment Adviser

* Alternative Performance Measure

Source: Artemis/Datastream

Chairman's Statement

Performance

During the year ended 30 April 2023, your Company's net asset value per share

rose by 1.3% and its share price fell 1.2% (on a total return basis). In

comparison the benchmark FTSE All- Share Index rose by 6.0%. The second half of

the year showed a stronger relative performance than the first half.

Although the FTSE All-Share Index is your Company's formal benchmark, a

significant proportion of the companies in the portfolio are relatively small

and form part of the FTSE 250 Index which declined by 3.3% over the year. As we

have reminded shareholders in the past, the portfolio bears little relationship

to the FTSE All-Share and the stock-selection is not constrained by it. As the

last two years have shown, short-term performance is likely to bear very little

resemblance to the benchmark; our aim remains to out-perform it over the long

term.

During the year global markets were dominated by Russia's invasion of Ukraine

and the resulting sharp increase in energy prices, inflation and interest rates.

The uncertainty caused by Brexit was exacerbated by the mishandling of the

economy by the Truss government, resulting in weakened sentiment towards the UK

market and, in particular, the consumer-orientated stocks which feature strongly

in our portfolio.

However, the Manager remains confident in the prospects for individual stocks

and convinced of the under-valuation of many UK companies. Although the

portfolio remains dominated by exposure to UK companies such as retailers, banks

and housebuilders, the Manager has also initiated positions in some non-UK

companies including out-of-favour digital companies such as Nintendo, Alphabet

and Meta.

Revenue earnings and dividends

We are pleased to be able to deliver growth in dividends at a rate in excess of

inflation, in line with our policy.

The Board has declared a final dividend of 3.87p (2022: 3.46p) per share, which

will be subject to approval by shareholders at the Company's Annual General

Meeting. The final dividend, if approved by shareholders, will be paid on 29

September 2023 to those shareholders on the register at 25 August 2023, with an

ex-dividend date of 24 August 2023.

Total dividends declared for the year will therefore amount to 6.20p per share

(2022: 5.60p), an increase of 10.7% on the previous year and ahead of the

increase in the Consumer Prices Index (9.0% as at April 2022), in line with our

target.

Investment income from our investee companies fell during the year by 1.5%. The

subsidiary company continues to have healthy reserves with which to support the

Company's earnings and dividends, if required.

Revenue earnings per share stand at 6.74p for the year to 30 April 2023, an

increase of 7.2% on the 6.29p of the prior year.

Share buy backs/discount

The discount to underlying asset value averaged 10.1% over the course of the

year, ranging from 4% to 14%, and at the year end stood at 12.8%. In general,

discounts of investment trusts, including our own peer group, have widened over

the last few months as a result of adverse market conditions.

During the year, the Company bought back a total of 1,019,766 ordinary shares at

a total cost of £3.1 million and an average discount of 11.1%, adding

approximately 1.19p to the net asset value per share. The policy of buying back

shares when in the best interests of our shareholders will continue. We aim to

do so in a pragmatic fashion, taking into account both market conditions and the

discounts prevailing amongst our peer group; we believe this to be the most

effective way of addressing any imbalance in the supply and demand for our

shares.

Board Succession

As noted last year, Blathnaid Bergin, having joined the Board in July 2015,

retired at the Annual General Meeting in October 2022. Blathnaid had served as

Chair of the Audit Committee and Senior Independent Director throughout that

time. I am pleased that Victoria Stewart has agreed to take on the role of

Senior Independent Director.

The Board spent a significant amount of time with its external advisers in

choosing the right candidate to replace Blathnaid Bergin as Chair of the Audit

Committee. The Board recognises the importance of achieving a balance of skills

and experience whilst paying close attention to the tenure of directors and the

level of diversity. Details of these discussions and the process followed can be

found within the Annual Report. This process resulted in Tom Smethers joining

the Board in March of this year; he brings outstanding and relevant experience

and I welcome him to the Board.

Annual General Meeting

Your Company's Annual General Meeting ("AGM") will take place on Thursday, 21

September 2023 at 10.00 a.m. at the London offices of Artemis Fund Managers,

Cassini House, 57 St. James's Street, London, SW1A 1LD. The Directors look

forward to welcoming shareholders.

The Investment Manager will make a presentation and answer any questions on the

portfolio performance and strategy.

I would encourage you to make use of your proxy votes by completing and

returning the form of proxy.

Outlook

Despite continued uncertainty and volatility in markets, our policy remains one

of picking individual stocks in pursuit of returns over the long term. Our

Investment Manager is confident in the prospects for these companies and the

opportunities arising from the current market dislocation.

Contact us

Shareholders can keep up to date with Company performance by visiting

artemisalphatrust.co.uk where you will find information on the Company, a

monthly factsheet and detailed quarterly updates from the Investment Manager.

The Board is always keen to hear from shareholders. Should you wish to, I can be

contacted by email on alpha.chairman@artemisfunds.com.

Duncan Budge

Chairman

11 July 2023

Investment Manager's Review

In the year ended April 2023, the Company's NAV increased by 1.3% compared to a

6.0% increase in the FTSE All-Share Index. In the last 6-month period since our

interim report, performance improved with NAV rising by 17.0%, compared to a

12.5% increase in its benchmark.

Key factors which influenced equity markets and our portfolio in the period

included:

· Energy prices rose sharply in response to the impact of the Russia/Ukraine

war on European gas supply, increasing the cost pressures affecting consumers

and corporates, before falling more recently.

· UK politics faced a crisis of confidence in September following the Liz

Truss budget. This caused extreme volatility in UK government bond yields and

forced an abrupt U-turn from the new government under Rishi Sunak.

· Inflation remained higher than expected in the United Kingdom, Europe and

the US, although economic activity proved more resilient to interest rate

increases than first expected.

· Interest rates rose sharply as a result, and a high degree of uncertainty

remains over their future path.

This series of events has damaged consumer, corporate and investor confidence.

Confusingly, despite this, employment trends have remained robust and corporate

profitability has been better than expected.

Idiosyncratic events in the UK hurt sentiment that was already fragile since

Brexit. Markets are now pricing an idiosyncratic inflation problem in the UK,

leaving the UK with higher long-term bond yields than Greece or Italy.

We continue to anticipate attractive prospective returns from our portfolio

owing to a combination of macroeconomic and bottom-up factors:

· Inflation is likely to fall markedly to the benefit of consumers and

businesses worldwide.

· Discounted UK asset valuations should lead to higher future returns.

· Durable equity franchises are attractively valued and provide a long-term

hedge against inflation.

· Capital cycles are leading to increased profitability in capital intensive

and cyclical sectors.

· The impact of share buybacks at a time of low valuations should be very

positive.

The current portfolio is characterised by exposures to capital cycle

beneficiaries, structural growth opportunities, and discounted UK assets.

Airlines (easyJet/Ryanair) and retailers (Frasers/Currys) stand to see higher

returns from limited capacity / consolidation. Financials (Lloyds/Natwest,

Plus500, Hargreaves Lansdown) should be beneficiaries of interest rates

remaining higher than they have been in recent years whilst the UK housebuilders

should benefit if interest rates ease from current levels. Out-of-favour digital

winners (Nintendo, Delivery Hero, and Alphabet) continue to benefit from

structural trends that should improve their business economics.

Another reason we are confident in the prospective returns of the portfolio is

the result of the diversification in the sources of excess return that we have

identified. The portfolio also retains considerable liquidity, with over 80% of

the Company able to be sold within one day, which enables us to take advantage

of movements in the market.

We judge the greatest visible risks to our outlook to reside in energy markets

and geopolitics. Energy markets are fundamentally tight due to underinvestment

following the 2014/15 downturn and disruptions to European gas supply provoked

by the war. Higher demand or an unforeseen reduction in supply would be damaging

to economies with limited domestic supply. Both the UK and US will have

elections next year and US-China relations remain strained.

Inflationary pressures likely to ease

UK inflation markets suggest that inflation will be 4% over the next 3 years and

3.6% over the next 10 years. Our view is more sanguine.

Energy prices have fallen markedly in recent months. Luck has played its part as

Europe experienced an unusually warm winter. Russian oil production has also

proven more resilient than many feared. Following the re-opening of China, the

last pandemic-induced distortions to supply chains have eased. These factors

suggest downward pressure on goods inflation, when mathematically, inflation

should decline from its peak level, as the high rates of inflation seen in the

second half of 2023 cease to form part of calculations.

UK labour market tightness has showed signs of easing. In 2022, net migration

reached a record net 603,000 against many predictions of a fall following

Brexit. The widespread decline in real spending power caused by inflation is

providing incentives to seek employment and so the ratio of vacancies to job

seekers is falling.

Monetarists were amongst the few correctly to predict higher inflation following

the abnormal increase in money supply in response to the pandemic. They are now

highlighting marked contractions in money supply growth in both the US and

Europe resulting from the increase in interest rates and note that current

levels of interest rates would be consistent with the inflation rates seen in

the 2010s.

The importance of inflation targeting when making historic comparisons is a

factor that is seemingly overlooked. Inflation targeting was introduced in 1992,

ahead of the Bank of England becoming independent in 1997. The average annual

increase in CPI in the 28 years to 2020 was exactly 2.0%. In the prior 20-year

period, the average was 9%.

This illustrates the effectiveness of central banks that have the intent and

authority to target inflation over the long- term. Whilst a profound policy

mistake was made during the pandemic, central banks remain determined to

reassert credibility and have the authority to do what it takes to bring

inflation back down to target levels. We are sceptical, consequently, both about

expectations of inflation remaining above target and are wary of falling prey to

the excessive pessimism currently on display in financial markets as a result of

recent difficulties.

A decline in inflation and interest rate expectations should be supportive of

risk assets by lowering discount rates and by enabling debt markets to function

effectively, even if the cost in the short term is higher interest rates and

recession. A re-opening of debt and capital markets would be likely to lead to a

pick-up in corporate and private equity activity.

Low valuations in the UK should lead to higher returns

The equity risk premium is a measure of the premium you receive in return for

accepting the uncertainty of investing in equities and demonstrates the

cheapness of the UK market. At current levels, the earnings yield on the FTSE

All-Share is 11%. UK 10-year index linked government bonds yield 0.5%. This

implies an equity risk premium of over 10%.

Using the same methodology, the current US and European equity market risk

premia are 4% and 7%, respectively. In our judgement, this difference is not

justified by the long-term fundamental prospects for corporate profit growth but

reflects weak sentiment towards UK markets. Whilst this point might have been

made at any point in the last five years, it remains valid.

Our holdings in Natwest and Lloyds illustrate the significant value on offer.

Both banks trade on earnings yields in excess of 15% (equating to PE ratios of

less than 7x) and at a discount to their book value. This is despite being large

and enduring franchises that are also beneficiaries of a normalisation in

interest rates. Their combined net interest income in 2023 is forecast to be 40%

(>£7bn) more than in 2019.

All of our holdings across the UK housebuilders, with the exception of Berkeley

Group, trade below book value. This is attractive for businesses that have

consistently achieved returns on capital of over 15%. The UK faces an

accumulated supply deficit of over 1 million homes, which has worsened owing to

an increasingly difficult environment for planning permissions.

Higher interest rates have reduced demand in the short-term, but this does not

impact household formation, which continues every year. Demand for housing is

deferred, not eliminated, when it is not fulfilled immediately, and so it is

logical to expect industry volumes to recover, as and when mortgage rates

stabilise.

The takeover of Dignity highlights the neglected value in UK equities. We have

written extensively about the company's irreplicable position within the end-of

-life industry as the only vertically integrated provider of funerals (725

branches, #2 share), cremations (46 crematoria, #1 share) and pre-need plans

(£1.2bn assets, #1 share).

The Board recommended an offer for the business at an enterprise value of £789m

(550p). We have historically noted that the crematoria assets alone generate

£48m of EBITDA, implying a value of £820m-£960m based on the comparable

multiples of European infrastructure (17-20x). As the bidder offered an

opportunity to roll existing shareholdings into a new private vehicle, the

Takeover Panel required Morgan Stanley to provide an independent valuation. This

was publicly available and indicated a range of 660-990p, 20-80% above the offer

price.

We reduced our holding into the cash offer, but we have retained a considerable

exposure to the publicly quoted equity roll-over vehicle ("Castelnau") as we see

significant value in the business.

Durable equity franchises are attractively valued long-term hedges against

inflation

Equity valuation multiples initially contracted sharply in response to higher

interest rates, reflecting the fact that higher discount rates reduce equity

values. However, higher inflation also acts favourably for equities which

display durable pricing power. In our view, this is the primary explanation for

the resilience of equity markets that many have found surprising.

The Company has a number of holdings in durable equity franchises such as

Nintendo, GSK and EssilorLuxottica each of which enjoys significant pricing

power.

Nintendo made considerable progress in the year in its strategy to become a

broad entertainment business, allowing it to improve monetisation of its

uniquely popular intellectual property. This was evident in the success of the

Super Mario Brothers movie, which has become the second most popular animated

movie of all time with global box office receipts of over $1.3bn.

GSK has successfully strengthened its balance sheet with the spin-off of its

consumer staples business Haleon. The company had a major pipeline success with

its RSV (Respiratory Syncytial Virus) vaccine, which has more than 90% efficacy

in adults over the age of 50, the cohort at the greatest risk of hospitalisation

with the disease.

EssilorLuxottica is the largest global eyewear business, operating in a

structurally growing industry and with an R&D budget larger than their four

closest competitors combined. This enables the group to provide innovative

essential eye care solutions to an ageing global population.

The share prices of Just Eat Takeaway and Delivery Hero have been weak as their

growth trends were impacted by consumer confidence and pandemic-related

distortions. Both companies have stemmed their losses far more quickly than the

market expected, despite declining order volumes. Ultimately, we believe the

industry remains in the early stages of long-term adoption and will be able to

achieve levels of profitability higher than are anticipated by investors.

The Company's principal focus in the year was to take advantage of volatility to

add new holdings in businesses characterised by the long duration of their

earnings potential.

In July, the Company initiated a holding in global infrastructure operator

Vinci. The company has a portfolio of world-class infrastructure assets (toll

roads and airports) with inflation- linked revenues. Vinci has funded these

investments from its cash generative contracting business that is benefitting

from significant tailwinds from the energy transition.

In August, the Company initiated a holding in Berkeley Group, a company with a

unique 16-year land bank and strong record of operational excellence including a

counter cyclical approach to buying land. London is a structurally under

-supplied market in the <£1m price range. The government estimates demand for

London housing to be c.90,000 units per annum, and in the last 3 years

deliveries have been less than 30,000 per annum.

The Company received shares in Haleon when the global personal care business was

spun out of GSK. The Company doubled its holding in August as we judged concerns

over the potential impact of Zantac litigation to be exaggerated. Haleon owns a

number of market-leading brands in oral care (Sensodyne), pain relief

(Panadol/Advil) and vitamins (Centrum) that have the potential to grow reliably

above GDP owing to trends such as ageing populations, self-medication, and

premiumisation.

In the second half of the year, the Company repurchased a holding in Meta and

initiated a position in Alphabet as we felt that investor pessimism was

excessive in the light of the stability of, respectively, their globally

dominant franchises in social media and internet search. The digital advertising

market has grown rapidly in recent years but remains underpenetrated in many

geographies and industry verticals. Meta and Alphabet are amongst the global

leaders in the field of artificial intelligence and stand to benefit from the

opportunities its development presents.

A new position was started in Hargreaves Lansdown in January as the stock was de

-rated sharply in response to slowing industry growth. The company retains an

attractive position with a >40% share of the UK direct-to-consumer (D2C)

investment market. The entire D2C market has total assets of £300bn, which is

only 5% of total UK household wealth of £15tn. We expect the market to grow as

costs fall and ageing populations move towards greater personal involvement in

their financial planning.

Capital cycles are leading to increased profitability in capital intensive and

cyclical sectors

Disruption from the pandemic and volatile demand patterns have created tough

conditions in many industries meaning a lack of capital investment is leading to

higher returns for those that survive.

In our view, this is most evident in the aviation industry, which was one of the

hardest hit sectors through the pandemic as demand evaporated and government

support was limited.

Boeing and Airbus combined produced almost 2,000 fewer planes than expected

during the pandemic and have full order books to the end of the decade. Demand

has rebounded strongly, resulting in a strong pricing environment where it is

hard to see how supply can respond.

Our holdings in low-cost airlines easyJet and Ryanair have been strong

performers as earnings expectations have been revised upwards owing to their

ability to increase fares significantly without loss of volume. Our judgement is

that valuations fail to capture the new environment of higher profitability and

the operational gearing of their business models to higher prices.

Retail is another sector that has seen dramatic changes owing to the shift to

online retail, forced store closures during the pandemic and unpredictable

demand. Frasers Group has outshone its peers through prudent cost management and

retaining a strong value proposition for customers.

The company has used its strong cash generation to take advantage of commercial

distress to acquire several businesses such as Studio Retail, Gieves & Hawkes,

Missguided, and Sportsmaster. The company's efficient infrastructure and

distribution platforms, combined with its frugal approach to cost, allow it to

extract value from businesses which previously struggled. The current

environment continues to create new opportunities for the business.

Impact of share buybacks underestimated

Share repurchases are an alternative way of returning cash to shareholders whose

value is theoretically equivalent to a reinvestment of dividends. In practice,

share buybacks can offer a number of advantages:

· Corporates can use share repurchases to distribute excess capital they might

not otherwise pay out as dividends.

· Capital gains taxes are lower than income tax in the UK.

· The resulting growth in earnings per share may be valued more highly by the

market than capital returns.

To illustrate the last point, consider a company that trades on 10x earnings and

grows earnings by 5% per annum over 10 years. Assuming a constant multiple, if

35% of net income is used to repurchase shares, the company's growth in earnings

per share doubles from 5% to 10%.

This highlights how lower valuations increases the compounding effect of share

repurchases, which in our view is relevant to the UK equity market and our

portfolio today and why Charlie Munger once said, "Pay close attention to the

cannibals - the businesses that are eating themselves by buying back their

stock."

Plus500 is one such example within the portfolio. The company's business model

allows it to grow earnings with limited capital required. Since our investment

in 2016, it has invested £330m in repurchasing its own shares and this has

helped it reduce its share count by 21% and grow its grown earnings by 17% per

annum. Plus500 continues to expand into new geographies and business areas,

including the US market, which has exciting potential.

Portfolio companies, which account for 45% of NAV, are repurchasing shares. This

segment of the portfolio trades on a weighted average multiple of 10x earnings.

Whilst the running dividend yield of the portfolio is 2%, including pro-rata

share repurchases, the aggregate distribution yield is close to 5%. We believe

that such characteristics offer a sound body for future returns to shareholders.

John Dodd and Kartik Kumar

Fund managers

Artemis Fund Managers Limited

11 July 2023

April 2023 -

Key Sector

Exposures

Sector 2023 2022 Companies

General retail 14.8% 16.0% Currys, Frasers

Housebuilding 13.2% 11.5% Barratt, Bellway, Berkeley, Redrow, Springfield

Airlines 12.8% 12.7% easyJet, Ryanair

Video games & 9.1% 10.5% Nintendo, Hornby

hobbies

Banking 7.7% 5.9% Lloyds, NatWest

Funerals 6.8% 10.1% Dignity

Food delivery 6.2% 8.0% Delivery Hero, Just Eat Takeaway.com

Financial 6.1% 3.5% Singer Capital Markets

services

Technology 5.9% - Alphabet, Darktrace, Meta

Aerospace & 5.4% 5.2% Reaction Engines

defence

Trading 5.0% 5.2% Plus500

platform

Consumer 4.1% 2.0% EssilorLuxottica, Haleon

staples

Pharmaceuticals 4.1% 5.6% GSK

China 3.0% 4.9% Prosus

technology

Industrials 2.1% 1.4% Vinci

Energy 0.9% - BP, Shell

Basic materials 0.9% - Anglo American

Property 0.7% 0.7% Claremont Alpha

Serviced - 3.1% IWG

offices

Leisure - 2.7% Flutter Entertainment, J D Wetherspoon

Source: Artemis

ESG & Stewardship at Artemis

Introduction

Artemis believes stewardship activities contribute to improvement in company

performance and to consequently higher returns for our clients.

Stewardship is a fundamental element of our approach across all investment

strategies. Whilst individual strategies are distinctive, views and ideas are

shared across investment teams. The Stewardship team supports fund managers by

providing insight, research and analysis, discussion, and challenge on ESG and

stewardship matters.

In 2022 Artemis set goals for the Net Zero Asset Managers initiative, covering

80% of AuM. Additionally, we published our first Corporate Social Responsibility

report and achieved signatory status from the FRC. We have developed extensive

internal tools to inform and guide our Stewardship focuses and continue to

strengthen our controls, processes, and actions.

Approach to Stewardship

Our stewardship team is specifically dedicated to supporting our fund managers

by providing insight, research and analysis, discussion, and challenge on ESG

and stewardship matters including:

· Identifying and incorporating a wider set of risks and opportunities into

investment processes including ESG factors

· Monitoring and escalating issues with companies and exercising shareholder

rights at company meetings, and

· Working collaboratively to develop and promote best practice internally and

across the industry.

Artemis Alpha Stewardship approach

The Company employs a long-term value investing strategy to pick stocks. The

framework is based on valuing companies using fundamental analysis and sizing

positions according to the attractiveness of share prices relative to our view

of their value. The Company's strategy is underpinned by a core principle that

the key driver of long-term value is achieving a high and sustainable return on

capital employed.

Investee companies that do not adhere to strong governance, look after their

employees, or fail to recognise environmental and societal harm risk inhibiting

their long-term potential. The investment process requires a focus on the ESG

risks and opportunities present in each business and industry.

Risk mitigation

Our view is that ESG factors are most pertinent in their contribution when

creating the risk of a permanent loss of capital, usually through obsolescence,

excessive leverage, misjudged investment value, misallocations of capital, and

regulation.

This is evident in the portfolio where we are significantly underweight

controversial sectors (as defined by ESG data providers), and therefore are less

exposed to key ESG risks that may affect the prospects of these businesses.

We actively monitor ESG risks and opportunities primarily through our

fundamental and bottom-up driven research process for monitoring existing and

evaluating prospective investments. We frequently engage with management teams

on strategy, capital allocation, incentive alignment and communication.

Engagement and voting

The Fund Manager has expanded his engagement with current and potential

holdings, ensuring appropriate monitoring and due diligence for the portfolio.

During the year, the Fund Manager conducted 220 (vs 114 last year) company

meetings, 127 with existing and 93 with prospective investments.

During the year we met with the investor forum to improve the engagement and

disclosure of easyJet, and to represent our views on the company's capital

allocation. Additionally we raised concerns about the Board's oversight and

responded to concerns about remuneration and share issuance. As a result of this

initiative the company's chair agreed to meet with investors more regularly.

The team used its voting powers to express its dissatisfaction with

company/management policy. The number of votes that were not in line with

management guidance grew over the year 6x to 33, with the proportion of votes

not in line with recommendations rising from 2% to 8%. Votes against were

focussed on compensation, directors, and non-routine business.

Portfolio carbon emissions

The portfolio's carbon emissions relative to its benchmark, the FTSE All-Share

Index, have remained elevated since the onset of COVID-19 in early 2020. This is

because our airline holdings are still recovering from depressed revenues that

penalised their carbon intensity statistics based on emissions per revenue.

Furthermore, expectations of a strong recovery in revenue have resulted in

increases in their share prices, leading to an increased weighting in the

portfolio of their temporarily inflated carbon intensity figures. We expect this

measure to normalise somewhat as airline revenues fully recover in 2023.

Strategy and Business Review

Culture, Purpose & Values

The Directors drive the culture, purpose and values of Artemis Alpha Trust plc

("the Company") and by doing so seek to ensure that these three elements

underpin the delivery of strategy.

Culture

The Company is an externally managed investment trust and as such its culture is

created by the Board of Directors and the Investment Manager, Artemis Fund

Managers Limited.

Purpose

Our purpose is to provide our shareholders, large or small, with a diversified

and cost-effective investment opportunity to achieve long-term growth.

Values

The Company provides access to a portfolio of investments which the Board

expects to be managed with integrity, transparency and accountability and with

appropriate due diligence to environmental, social and governance matters. The

constructive and openly discursive nature of the relationship between the Board

and the Investment Manager helps ensure their respective values are aligned and

focused on delivering the strategy for our shareholders.

The core values that contribute to the Board culture include:

· Integrity: the Board seeks to comply with all applicable laws and

regulations, both to the letter and in spirit.

· Accountability: the Board recognises the need to explain the Company's

performance to investors and to highlight the risks in a clear and open manner.

The Board has a key role to encourage and challenge the performance of its

Investment Manager and its other service providers to help ensure the Company

continues to provide shareholder value.

· Respect & Transparency: the Board seeks to communicate clearly and openly

with shareholders and service providers respecting individual opinions and

expectations. Contact by shareholders via the Chairman's email address is

welcomed.

· Environmental, Social and Governance ("ESG") issues: We are stewards of our

shareholders' capital; both the Board and Investment Manager recognise that this

comes with responsibilities. ESG considerations are integrated within the

investment process.

An overview of the Investment Manager's culture, values and stewardship

activities can be found on the website at www.artemisfunds.com.

Corporate strategy & policy

The Company is incorporated in England as a public company limited by shares.

Its business as an investment trust is to buy and sell investments with the aim

of achieving the investment objective and in accordance with the policy.

Gearing

The Company uses gearing (i.e. borrowing) as part of its investment strategy.

The Company's Articles of Association limit borrowing to 50 per cent of the

Company's net assets. However, the investment policy limits this to 25 per cent

of net assets. Subject to compliance with this restriction, the level of

borrowing is a matter for the Board, whilst the utilisation of borrowings is

delegated to the Investment Manager. This utilisation may be subject to specific

guidelines established by the Board from time to time. The current guidelines

permit the Investment Manager to employ borrowings of up to 20 per cent of net

assets. The Company had no borrowing facility as at 30 April 2023 or the prior

year. The use of gearing by the Investment Manager will vary from time to time,

reflecting its views on the potential returns from stock markets. The Company's

gearing is reviewed by the Board and Investment Manager on an ongoing basis. At

the year end, net gearing was created through the use of contracts for

difference and stood at 13.4 per cent (9.4 per cent as at 30 April 2022).

Leverage

Leverage is defined in the Alternative Investment Fund Manager Directive

("AIFMD") as any method by which the Company can increase its exposure by

borrowing cash or securities, or from leverage that is embedded in derivative

positions. The Company has an agreement with Northern Trust to utilise contracts

for difference as a form of leverage. A result of 100 per cent indicates that no

leverage has been used. The Company is permitted by its Articles to borrow up to

50 per cent; however the Company's investment policy restricts this to 25 per

cent. The Company is permitted to have additional leverage of up to 100 per cent

of its net assets, which results in permitted total leverage of 225 per cent

under both ratios. Artemis as the Alternative Investment Fund Manager ("AIFM"),

monitors leverage limits on a daily basis and reviews them annually. No changes

have been made to these limits during the year. At 30 April 2023, the Company's

leverage was 134.2 per cent as determined using the gross method and 115.7 per

cent under the commitment method.

The Investment Manager requires prior Board approval to:

(i) enter into any stocklending agreements;

(ii) borrow money against the security of the Company's investments; or

(iii) create any charges over any of the Company's investments.

Operating environment

The Company operates as an investment trust company and is an investment company

within the meaning of section 833 of the Companies Act 2006 (the "Act").

The Company has been approved as an investment trust in accordance with the

requirements of section 1158 of the Corporation Taxes Act 2010 which remains

subject to the Company continuing to meet the eligibility conditions and ongoing

requirements of the regulations. The Board will manage the Company so as to

continue to meet these conditions.

The Company has no employees and delegates most of its operational functions to

service providers.

Current & future developments

A summary of the Company's developments during the year ended 30 April 2023,

together with its prospects for the future, is set out in the Chairman's

Statement and the Investment Manager's Review in the Annual Report. The Board's

principal focus is the delivery of positive long-term returns for shareholders

and this will be dependent on the success of the investment strategy. The

investment strategy, and factors that may have an influence on it, such as

economic and stock market conditions, are discussed regularly by the Board and

the Investment Manager. The Board regularly considers the ongoing development

and strategic direction of the Company, including its promotion and the

effectiveness of communication with shareholders.

Key Performance Indicators ("KPIs")

The performance of the Company is reviewed regularly by the Board and it uses a

number of KPIs to assess the Company's success in meeting its objective. The

KPIs which have been established for this purpose and remain unchanged from the

prior year are:

Discrete annual total returns

Year ended 30 April Net asset value* Share price* FTSE

All-Share

Index

2018 11.0% 13.2% 8.2%

2019 (8.6)% (8.9)% 2.6%

2020 (11.3)% (12.5)% (16.7)%

2021 56.0% 80.8% 26.0%

2022 (21.9)% (24.8)% 8.7%

2023 1.3% (1.2)% 6.0%

Source: Artemis/Datastream

* Alternative Performance Measure

Dividends per ordinary share

Year Ordinary Special Total pence Ordinary Total

ended 30 per ordinary increase increase/

April (decrease)

share

2018 4.75p 1.60p 6.35p 10.4% 0.8%

2019 5.00p 0.50p 5.50p 5.3% (13.4)%

2020 5.20p - 5.20p 4.0% (5.5)%

2021 5.30p - 5.30p 1.9% 1.9%

2022 5.60p - 5.60p 5.6% 5.6%

2023 6.20p - 6.20p 10.7% 10.7%

Ongoing charges as a proportion of shareholders' funds

As at 30 April Ongoing charges*

2018 0.90%

2019 0.93%

2020 0.95%

2021 0.93%

2022 1.01%

2023 1.08%

* Alternative Performance Measure

Discount management

In addition to the above KPIs, the Board monitors the discount to the underlying

net asset value at which the shares trade. The discount levels throughout the

financial year are shown within the Financial Highlights in the Annual Report.

No specific discount target has been set, but the Board sets the share buyback

policy and has given the Investment Manager discretion to exercise the Company's

authority to buyback its own shares from time to time to address any imbalances

between the supply and demand in the Company's shares or at times where it is

believed this is the best use of available capital to increase NAV per share.

This is reviewed regularly by the Board. The Board will also use its authority

to issue new ordinary shares from time to time should there be excess demand for

the Company's shares. The Company will also provide tender offers every three

years. The first tender offer was due in 2021, for 25 per cent of the ordinary

shares then in issue. However, following a shareholder vote, this did not take

place. The next proposal for a tender offer will be in 2024.

Principal risks and risk management

As required by the 2018 UK Code of Corporate Governance, the Board has carried

out a robust assessment of the principal and emerging risks facing the Company.

Following consideration of the investment, regulatory and operational risks, the

Board has concluded that there are no emerging risks facing the Company that

require to be added to the principal risks.

The Board, in conjunction with the Investment Manager, has developed a risk map

which sets out the principal risks faced by the Company and the controls

established to mitigate these risks. This is an ongoing process and the risk

map, including any emerging risks, is formally reviewed every six months. The

Board has given particular attention to those risks that might threaten the long

-term viability of the Company. Further information on the Company's internal

controls is set out in the corporate governance section in the Annual Report. As

an investment company the main risks relate to the nature of the individual

investments and the investment activities generally; these include market price

risk, foreign currency risk, interest rate risk, credit risk and liquidity risk.

A summary of the key areas of risk, their movement during the year and their

mitigation is set out below:

Movement Principal risk Mitigation/control

No change Strategic risk The investment objective and policy of the Company

is set by the Board and is subject to ongoing

Investment review and monitoring in conjunction with the

objective and Investment Manager. Views expressed by the

policy are not Company's shareholders are also taken into account.

appropriate in

the current

market and not

favoured by

investors.

No change Investment The Board considers that this risk is justified by

risk the longer-term nature of the investment objective

and the Company's closed-ended structure, and that

The Company's such investments should be a source of positive

investments returns for shareholders. Risks are diversified

are selected through having a range of investments in the

on their portfolio covering various sectors. The Board

individual discusses the investment portfolio with the

merits and the Investment Manager at each Board meeting, and at

performance of each month end between Board meetings, and part of

the portfolio this discussion includes a detailed review of the

is not likely Company's unquoted investments, their valuations

to track the and future prospects together with their portfolio

wider UK weighting.

market (FTSE

All-Share The Board receives management information

Index). Whilst concerning the geographical sector split of the

the focus is portfolio. The Company is not materially exposed to

on large cap foreign currency risk.

companies the

Company also All borrowing arrangements entered into require the

invests in prior approval of the Board and gearing levels,

small cap provided by the use of contracts for difference,

(listed), AIM are regularly discussed and reviewed by the Board

traded and and Investment Manager.

unquoted

investments

which can be

subject to a

higher degree

of risk than

that of larger

quoted

investments.

From time to

time, the

Company may

also have

significant

exposure to

particular

industry

sectors.

The Investment

Manager's high

conviction

approach leads

to a

concentrated

portfolio,

typically

containing

between 25 and

60 stocks,

carrying a

higher degree

of stock

-specific risk

than a more

diversified

portfolio.

The Company's

functional and

reporting

currency is

Sterling.

However, the

investment

objective and

policy may

result in a

proportion of

the Company's

portfolio

being invested

in overseas

equities

denominated in

currencies

other than

Sterling. As a

result,

movements in

exchange rates

may affect the

Sterling value

of these

investments

and their

returns.

The Company

may borrow

money for

investment

purposes or

use

derivatives to

similarly

increase

exposure. If

the

investments

fall in value,

any

borrowings/use

of derivatives

will magnify

the extent of

the losses.

No change Legal and The Investment Manager provides investment, company

regulatory secretarial, administration and accounting services

risk through the use of qualified professionals.

A breach of The Board receives internal control reports from

s1158 the Investment Manager confirming compliance with

Corporation regulations. These reports also highlight any

Tax Act 2010 matter that the Compliance team feel should be

could lead to brought to the Board's attention along with any

a loss of items discussed during internal audit review.

investment

trust status The Board meets each year with the Risk and

and the Compliance team to discuss the areas of risk

resultant appropriate to the Company and the control

taxation of environment.

realised

capital gains.

The principal

laws and

regulations

the Company is

required to

comply with

are the

Companies Act

2006, the

Alternative

Investment

Fund Managers'

Directive, the

Market Abuse

Regulation,

the UK Listing

Rules and the

Disclosure

Guidance and

Transparency

Rules.

A breach of

the FCA

listing rules

could lead to

suspension of

the Company's

shares. A

breach of the

Companies Act

2006 could

lead to

criminal

proceedings

and

reputational

and financial

damage.

No change Operational Both the Investment Manager and the Administrator

risk have established business continuity plans to

facilitate continued operation in the event of a

Disruption to, major service disruption or disaster.

or failure of,

the Investment All of the Investment Manager's and Administrator's

Manager's staff can work from home with no impact to

and/or any operations.

other third

-party service The move to Northern Trust was planned in detail

providers' with contingencies in place as required. The move

systems which has now been completed and the risk returned to the

could result prior year level.

in an

inability to

report

accurately and

monitor the

Company's

financial

position.

Northern Trust

became

administrator,

custodian and

depositary

during the

year taking

over from JP

Morgan Europe.

There was a

temporary

additional

risk in

relation to

this move due

to the

operational

changes

required.

No change Cyber risk The Company benefits from the cyber security

precautions in place at the Investment Manager and

Failure or also those in place at the third-party suppliers

disruption of such as the registrar and depositary.

the Investment

Manager's and/ The Board receives regular updates from the

or any other Investment Manager and its service providers which

third-party describe the protective measures taken to enhance

service security.

providers'

systems as a

result of a

cyber-attack,

data theft,

service

disruption,

etc. Whilst

the risk of a

direct

financial loss

by the Company

is low, the

risk of

reputational

damage and the

risk of loss

of control of

sensitive

information is

more

significant.

No change Climate change The Investment Manager takes such risks into

account, along with the downside risk to any

Globally, company (whether in the form of its business

climate change prospects or market valuation or sustainability of

effects are dividends) that is perceived to be making a

already detrimental contribution to climate change. The

emerging in Company invests in a broad portfolio of businesses

the form of with operations spread geographically, which should

changing limit the impact of location- specific weather

weather events.

patterns.

Extreme

weather events

could

potentially

impair the

operations of

individual

investee

companies,

potential

investee

companies,

their supply

chains and

their

customers.

Increased Geopolitical The Board discusses such risks as they arise and

risk continues to monitor the impact on the Company and

its investments through discussion with the

There is an Investment Manager as and when required.

increasing

risk to market The Company does not have any direct investments in

stability from countries where there is geopolitical conflict.

geo-political However, the Board is provided with information

conflicts, from the Investment Manager on the measures it

such as takes to assess the potential impact of

between Russia geopolitical events, both on itself and other

and Ukraine. service providers, and any action taken.

Increased Inflationary The Board and its Investment Manager have regular

risk discussions to assess the likely impact of

inflation rates on the economy, corporate

Central Bank profitability and asset prices.

decisions, the

war in Ukraine

or any other

economic or

political

factors or

global events,

may result in

increasing

levels of

inflation

directly

affecting

economic

growth and the

underlying

investment

values.

The Pandemic risk noted in the 2022 Annual Report is no longer considered an

emerging or principal risk.

Further information on risks and the management of them are set out in the notes

to the financial statements

Long-term Viability

Viability statement

In accordance with the Association of Investment Companies (the "AIC") Code of

Corporate Governance, the Board has considered the longer-term prospects for the

Company beyond the twelve months required by the going concern basis of

accounting. The period assessed is for five years to 30 April 2028. The Board

has concluded that this period is appropriate, carefully taking into account the

inherent risk with equities and the long-term investor outlook.

As part of its assessment of the viability of the Company, the Board has

discussed and considered each of the principal risks, including matters relating

to geopolitical events and inflationary pressures, and their impact on the

Company. Although the damage to the economy through the total impact of

inflation and the geopolitical effect of Russia/ Ukraine cannot be known with

certainty, the Board has considered these risks and does not believe they affect

the long-term viability of the Company and its portfolio. The Investment Manager

carried out stress testing scenarios in connection with a longer-lasting damage

to the economy, of the withdrawal of liquidity by the financial authorities and

of a significant and sustained fall in markets. The Board has also considered

the liquidity of the Company's portfolio to ensure that it will be able to meet

its liabilities, as they fall due. The results demonstrated the impact on the

Company's NAV throughout the five year period and on its expenses and

liabilities. The Board have concluded, given the realisable nature of the

majority of the investments, the level of ongoing expenses and the availability

of gearing that the Company will continue to be in a position to cover its

liabilities.

The Board also made the below assumptions when considering the viability of the

Company:

· Investors will continue to wish to have exposure to UK listed companies

· There will be continued demand for investment trusts

· Regulation will not increase to such an extent as to hinder operational

efficiency

The Directors do not expect there to be any significant change in the current

principal risks and the associated mitigating controls other than the decreased

risk in relation to Covid-19. The Directors also do not envisage any change in

strategy or objectives that would prevent the Company from continuing to operate

over the five-year period. The Company's assets are liquid, its commitments

limited, and it intends to continue as an investment trust.

The 2024 tender offer of up to 25% of the share capital has been considered by

the Board when assessing the continuing viability of the Company.

Taking into account the results of the above review, the Board has a reasonable

expectation that the Company will be able to continue in operation and meet its

liabilities as they fall due over the period to 30 April 2028.

Life of the Company

The Company operates a triennial liquidity event for shareholders. The tender

offers may be made every three years, with the next event proposed in 2024,

subject to shareholder approval. Each tender offer will be for up to 25 per cent

of the ordinary shares then in issue (excluding Treasury Shares), save that the

Board may, at its sole discretion, decide not to proceed with a tender offer if

the ordinary shares are trading at a premium to the estimated tender price.

Share capital

Shareholders authorised the Company to buyback up to 14.99 per cent of the

shares in issue at the 2022 AGM.

During the year the Company bought back 1,019,766 ordinary shares. As at 30

April 2023, 4,525,566 ordinary shares bought back during the year are held in

treasury.

A resolution to renew the Company's buyback authority will be put to

shareholders at the AGM on 21 September 2023.

No ordinary shares were issued during the year.

Duty to Promote the Success of the Company

How the Directors discharge their duties under s172 of the Companies Act

Under section 172 of the Companies Act 2006, the Directors have a duty to act in

a way they consider, in good faith, would be likely to promote the success of

the Company for the benefit of its shareholders as a whole, and in doing so have

regard to:

a) the likely consequences of any decision in the long term;

b) the interests of the Company's employees;

c) the need to foster the Company's business relationships with suppliers,

customers and others;

d) the impact of the Company's operations on the community and the

environment;

e) the desirability of the Company maintaining a reputation for high

standards of business conduct; and

f) the need to act fairly as between members of the Company.

As an externally managed investment trust, the Company has no employees or

physical assets, our stakeholders include our shareholders and service

providers, such as the Investment Manager.

The below tables describe the impact of engagement with our stakeholders that

has taken place during the year:

Engagement with key stakeholders

Stakeholders Engagement Impact

Shareholders The Board is responsible for Through the

and potential promoting the long-term publication of

investors sustainable success and the Annual

strategic direction of the Report and the

Company for the benefit of the Half-Yearly

Company's shareholders. Whilst Report,

certain responsibilities are monthly

delegated, Directors' factsheets and

responsibilities are set out in Fund Manager

the schedule of matters reserved updates to the

for the Board and the terms of Company's

reference of its committees, website,

which are reviewed regularly by shareholders

the Board. are kept

informed of

To help the Board in its aim to Company

act fairly as between the performance

Company's members, it encourages and portfolio

communications with all activities.

shareholders. The Annual and

Half-Yearly reports are issued Shareholders

to shareholders and are are encouraged

available on the Investment to raise

Manager's website together with questions and

other relevant information communicate

including monthly factsheets. with the

The Board receives regular Chairman and

feedback on shareholder meetings the Fund

from the Company's broker and Manager.

any shareholder communications

are reviewed and discussed by

the Board to ensure that

shareholder views are taken into

consideration as part of any

decisions taken by the Board.

The Chairman is available to

contact via email:

alpha.chairman@artemisfunds.com.

The Board considers

communication with shareholders

an important function and

Directors are always available

to respond to shareholder

queries. For further information

see `Relations with

shareholders'.

Artemis as The Board has set the parameters During the

Investment within which the Investment year the

Manager Manager operates and these are performance of

set out in the Investment the Company

· Fund Management Agreement and agreed fell against

management by the Board. its benchmark.

· Company Buybacks were

secretarial The Board receives regular performed

· Financial updates from the Investment during the

reporting Manager and other service year to help

· Sales & providers and ensures that maintain and

marketing information pertaining to its narrow the

· stakeholders is provided, as discount. The

Compliance and required, as part of the liquidity in

internal information presented in regular the market for

control Board meetings. During the year, the Company's

functions additional monthly performance shares

· Internal updates were held between the continued to

audit Board and Investment Manager to increase on

· discuss the continuing impact of the prior

Investment geopolitical, inflationary and year, further

administration market movements events on the detail can be

(outsourced to Company and its portfolio. The found within

Northern Trust) Board, with the support of its the Chairman's

Management Engagement Committee, Statement and

regularly reviews the Investment

performance of the Investment Manager's

Manager and other service Review.

providers to ensure that

services provided to the Company The Fund

are managed efficiently and Manager worked

effectively for the benefit of on a number of

the Company's shareholders. initiatives to

raise the

The Board has reviewed and profile of the

discussed plans for the future Company and

marketing and development of the generate

Company with the Investment interest with

Manager during the year. new investors;

taking part in

various

shareholder in

-person events

and webinars

during the

year.

During the

year, the

investment

administrator

changed from

JP Morgan to

Northern

Trust. This

was discussed

in advance by

the Board and

approval was

given.

Other third As an investment company, all The

-party service services are outsourced to third performance of

providers -party service providers. The the third

Board considers the Depositary, -party service

· Northern the Custodian, the Broker, the providers is

Trust as Registrar and Auditor to be key continually

Depositary and stakeholders. monitored

Custodian throughout the

· Singer The Board relies on the year. As and

Capital Markets Investment Manager to work when

as alongside these key stakeholders appropriate,

Broker to meet the requirements of the third-party

· Link Group Company. The Management providers

as Registrar Engagement Committee reviews the present to the

· Johnston performance of these service Board.

Carmichael LLP providers, along with their fee

as Auditor levels, and provides Following

recommendations to the Board as formal review

required. by the

Management

The Investment Manager has Engagement

constant interaction with the Committee and

service providers and provides Board at the

feedback to and from the Board year end, it

as required. was concluded

that the

Annual assurance reports are service

received to assist the review of providers were

the internal control operating

environments of the Depositary effectively

and Custodian. and provided a

good level of

The FRC performs and publishes service.

audit quality reviews on a

sample of audit firms and audits Following the

each year. move of

administration

services,

Depositary and

Custodian

services are

now provided

by Northern

Trust.

Investee The Board sets the investment The engagement

companies objective and discusses stock of the Fund

selection, asset allocation, and Manager with

the ESG qualities of investee the investee

companies with the Fund Manager companies aids

at each Board meeting. awareness and

understanding

The Fund Manager engages with of the ESG

the investee companies, prior to environment in

investment and on an on-going operation as

basis. well as the

valuation and

The Fund Manager has a dedicated prospects of

Stewardship Team which supports their

the Fund Manager in the businesses.

investment process.

The Association The Company is a member of the The Board

of Investment AIC which is an organisation chooses to

Companies that represents the interests of report under

("AIC") investment trusts, VCTs and the AIC Code

other closed-end funds. of Corporate

Governance.

This Code

better

reflects the

nature of an

investment

trust in the

context of

good corporate

governance.

Board discussions and decisions

The following are the key discussions and decisions made by the Board during the

year ended 30 April 2023:

Topic Background & Decision

discussion

Share buyback policy The level of The Board weighs up the

buybacks and effectiveness of the buyback

their effect on policy in helping to

the discount is maintain/reduce the discount to

discussed at NAV against its impact on the

each Board Company and the liquidity of its

meeting. shares. In light of market

developments, buybacks were

The strategy in conducted at a reduced pace in

relation to the period.

buybacks and

investor The Board decided to reduce the

feedback thereon monetary amount of buybacks and

is discussed and continue to monitor the rate in

monitored by the line with discount and liquidity

Board. The requirements.

economic

environment had

worsened over

the period from

when the initial

extended buyback

programme had

been put in

place.

Environmental, social and The Board The Board received reporting on

governance matters (`ESG') discussed its ESG, sustainability and voting

responsibilities records quarterly. A

for ESG and how representative of the Risk team

Artemis, as presents as required to the

Investment Board.

Manager,

undertook the It was decided that ESG was

required steps appropriately incorporated

to ensure ESG within the Artemis investment

was incorporated process and the Board would

within the continue to discuss and monitor

investment on an on-going basis.

process.

The Board made

enquiries of the

Investment

Manager as to

the ESG

credentials of

the underlying

portfolio. The

Investment

Manager

confirmed

engagement with

investee boards

helped gain an

understanding of

the governance

in place.

Administration, Depositary The Board The Board confirmed satisfaction

and Custodian arrangements considered and with the progress on the

discussed the migration of third parties and

progress of the the change of responsibilities

change of was completed on 6 March 2023.

administrator,

depositary and

custodian to

Northern Trust.

Gearing The Board The Board decided that this

discussed the policy continues to provide

current policy gearing at a reduced cost

of providing compared to a conventional bank

gearing through loan.

Contracts for

Difference.

Internal audit The Audit The Audit Committee and Board

Committee decided the Company should

discussed the continue to place reliance on

possibility of the internal audit function

the Company performed by the Investment

having its own Manager.

internal audit

function.

Director succession The Board It was agreed to enlist the

discussed the services of Nurole as an

succession of external, independent

Directors taking recruitment consultant to assist

into account the with the replacement of Ms

number of years Bergin.

served, the mix

of skills Mrs Stewart became interim

required to Chairman of the Audit Committee

perform the role in October 2022 and became

and the Senior Independent Director on

diversity 28 June 2023.

requirements of

the new Mr Smethers offered the sought

legislation. after financial and audit skills

and was agreed to be an

The recruitment excellent addition to the skills

process to already present on the Board.

replace Ms The Board approved the

Bergin was recruitment of Mr Smethers and

discussed. A his role as Chairman of the

comprehensive Audit Committee.

list of

applicants for While the Board acknowledges

the role of that it has not been compliant

Chairman of the with the gender diversity

Audit Committee guidelines during the second

was received half of the year, its firm

from Nurole. intention is to return to a

These were position of compliance.

reviewed and

discussed at

length to ensure

the right

candidates were

chosen for

interview. The

Board were keen

to see

candidates with

commercial

financial and

audit skills as

well as those

from a more

conventional

investment trust

background.

The Board's primary focus is to promote the long-term success of the Company for

the benefit of the Company's shareholders. In doing so, the Board has regard to

the impact of its actions on other stakeholders as described above.

Directors & Diversity

The Directors of the Company and their biographical details are set out in the

Annual Report.

No Director has a contract of service with the Company.

The Board supports the recommendations of the Hampton-Alexander Review on gender

diversity and the Parker Review on ethnic representation on Boards.

The Board recognises the principles of diversity in the boardroom and

acknowledges the benefits of having greater diversity, including gender, social

and ethnic backgrounds, and cognitive and personal strengths. When setting a new

appointment brief, the Nomination Committee considers diversity alongside

seeking to ensure that the overall balance of skills and knowledge that the

Board has remains appropriate, so that it can continue to operate effectively.

The Board's Director selection policy will, first and foremost, seek to identify

the person best qualified to become a Director of the Company, based on merit

and objective criteria.

The Board is currently comprised of four male Directors and one female Director.

The FCA announced a new policy statement on diversity and inclusion on company

boards in April 2022. Companies are required to comply with the targets or

explain the reasons for non-compliance. Outlined below is an overview of the

targets and the Company's compliance as at 30 April 2023 in accordance with

Listing Rule 9.8.6R(9):

· 40% of the Board is represented by women: 40% of the individuals on the

Board were women up to 13 October 2022, the date of Ms Bergin's retirement. From

that point to 15 March 2023, 25% of the Board were women and from 15 March 2023

to 30 April 2023, 20% of the Board were women. As at 30 April 2023, the Company

does not meet this diversity target and a further explanation is given in the

Annual Report.

· One woman in a senior position: as at 30 April 2023 no woman was in a

senior position. In the absence of Executive roles, the Company also considers

the role of Chairman of the Audit Committee, along with the role of Senior

Independent Director, to qualify as a senior position. Ms Bergin held these

roles throughout the year until retirement on 13 October 2022 at which point Mrs

Stewart became interim Chairman of the Audit Committee until 15 March 2023 and

the appointment of Mr Smethers to the role. The Company therefore does not meet

this diversity target as at 30 April 2023. Mrs Stewart subsequently became

Senior Independent Director on 28 June 2023.

· One individual from a minority ethnic background: as at 30 April 2023, no

individuals on the Board are from a minority ethnic background. The Company does

not therefore meet this diversity target and a further explanation is given in

the Annual Report.

The following tables set out the data on the diversity of the Directors on the

Company's Board in accordance with Listing Rule 9.8.6R(10) as at 30 April 2023.

This data has been collected through consultation with the Board. Subsequent to

the record date of 30 April 2023, Mrs Stewart became the Senior Independent

Director.

Number of Percentage Number of senior Number in Percentage of

Board of the positions on the executive executive

members Board Board management2 management2

Men 4 80% 21 N/A N/A

Women 1 20% 0 N/A N/A

Not N/A N/A N/A N/A N/A

specified/

prefer

not to

say

1 Duncan Budge is the Chairman of the Board, a senior position as defined by the

Listing Rules and Mr Smethers is Chairman of the Audit Committee.

2 Not applicable as the Company does not have an executive management team.

Number of Percentage Number of senior Number in Percentage of

Board of the positions on the executive executive

members Board Board management1 management1

White 5 100% 2 N/A N/A

British

or

other

White

Mixed/Mult 0 0% 0 N/A N/A

iple

ethnic

groups

Asian/Asia 0 0% 0 N/A N/A

n

British

Black/Afri 0 0% 0 N/A N/A

can/Carib

bean/Black

British

Other 0 0% 0 N/A N/A

ethnic

group,

including

Arab

Not N/ N/A N/A N/A N/A

specified/ A

prefer

not to

say

1 Not applicable as the Company does not have an executive management

team.

Modern Slavery Act 2015

The Company does not fall within the scope of the Modern Slavery Act 2015 as its

turnover is less than £36m. Therefore, no slavery and human trafficking

statement is included in the Annual Report.

Sustainability and Environmental, social and governance

(`ESG') matters

The Board recognises that the most material way in which the Company can have an

impact on ESG is through responsible ownership of its investments. The Board has

appointed Artemis as Investment Manager, who engages actively with investee

companies undertaking extensive evaluation and engagement on a variety of

matters such as strategy, performance, risk, dividend policy, governance and

remuneration. All risks and opportunities are considered as part of the

investment process in the context of enhancing the long-term value of

shareholders' investments. This will include matters relating to material

environmental, human rights and social considerations that will ultimately

impact the profitability of a company or its stock market rating and hence these

matters are an integral part of Artemis' thinking as investors. The ESG and

stewardship engagement of Artemis is detailed in the Annual Report.

Financial Statements

The financial statements of the Company are included in the Annual Report.

For and on behalf of the Board,

Duncan Budge

Chairman

11 July 2023

Statement of Directors' Responsibilities in respect of the Annual Report

Management Report

Listed companies are required by the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules (the "Rules") to include a management report in

their annual financial statements. The information required to be in the

management report for the purpose of the Rules is included in the Strategic

Report in the Annual Report. Therefore no separate management report has been

included.

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Annual Report and the financial

statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare financial statements for each

financial year. Under that law they are required to prepare the financial

statements in accordance with UK-adopted international accounting standards.

Under company law the Directors must not approve the financial statements unless

they are satisfied that they give a true and fair view of the state of affairs

of the Company and of their profit or loss for that period. In preparing each of

the financial statements, the Directors are required to:

· select suitable accounting policies and then apply them consistently;

· make judgements and estimates that are reasonable

· and prudent;

· state whether they have been prepared in accordance with UK-adopted

international accounting standards; and

· prepare the financial statements on a going concern basis unless it is

inappropriate to presume that the Company will continue in business.

The Directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions and disclose with

reasonable accuracy at any time the financial position of the Company and enable

them to ensure that its financial statements comply with the Companies Act 2006.

They have general responsibility for taking such steps as are reasonably open to

them to safeguard the assets of the Company and to prevent and detect fraud and

other irregularities.

Under applicable law and regulations, the Directors are also responsible for

preparing a Strategic Report, Directors' Report, Directors' Remuneration Report

and Corporate Governance Statement that comply with that law and those

regulations.

The financial statements are published on a website, artemisalphatrust.co.uk,

maintained by the Company's Investment Manager, Artemis. Responsibility for the