TIDMAUSC

RNS Number : 3897K

abrdn UK Smaller Cos. Growth Trust

25 August 2023

abrdn UK Smaller Companies Growth Trust plc

Annual Financial Report for the year ended 30 June 2023

Legal Entity Identifier (LEI): 213800UUKA68SHSJBE37

Investment Objective

To achieve long-term capital growth by investment in UK-quoted

smaller companies

Reference Index

The Company's reference index is the Numis Smaller Companies

plus AIM (ex investment companies) Index.

Website

Up to date information can be found on the Company's website:

abrdnuksmallercompaniesgrowthtrust.co.uk

Performance Highlights and Financial Calendar

Net asset total return(AB) Share price total return(AB)

-7.4% -6.8%

2022 -27.3% 2022 -34.3%

Total dividends per share Discount to net asset value(AB)

11.00p 14.3%

2022 8.10p 2022 14.6%

Revenue return per share Ongoing charges ratio(ABC)

12.44p 0.95%

2022 9.07p 2022 0.82%

(A) Considered to be an Alternative Performance Measure.

(B) A Key Performance Indicator ("KPI").

(C) Calculated in accordance with AIC guidance issued in October 2020

to include the Company's share of costs of holdings in investment companies

on a look-through basis.

Financial Highlights

30 June 2023 30 June 2022 % change

===================================== =============== =============== ==========

Capital return

===================================== =============== =============== ==========

Total assets GBP451.5m GBP538.6m (16.2%)

===================================== =============== =============== ==========

Equity shareholders' funds GBP426.6m GBP498.6m (14.4%)

===================================== =============== =============== ==========

Market capitalisation(A) GBP365.7m GBP425.9m (14.1%)

===================================== =============== =============== ==========

Net asset value per share 482.95p 530.37p (8.9%)

===================================== =============== =============== ==========

Share price 414.00p 453.00p (8.6%)

===================================== =============== =============== ==========

Discount to NAV(B) 14.3% 14.6%

===================================== =============== =============== ==========

Net gearing(B) 2.5% 5.1%

===================================== =============== =============== ==========

Reference index(C) 5,199.92 5,520.20 (5.8%)

===================================== =============== =============== ==========

Dividends and earnings

===================================== =============== =============== ==========

Revenue return per share(D) 12.44p 9.07p 37.2%

===================================== =============== =============== ==========

Total dividends per share(E) 11.00p 8.10p 35.8%

===================================== =============== =============== ==========

Operating costs

===================================== =============== =============== ==========

Ongoing charges ratio(BF) 0.95% 0.82%

------------------------------------- --------------- --------------- ----------

(A) Represents the number of Ordinary shares in issue in the Company

multiplied by the Company's share price.

(B) Considered to be an Alternative Performance Measure.

(C) Numis Smaller Companies plus AIM (ex investment companies) Index.

(D) Measures the revenue earnings for the year divided by the weighted

average number of Ordinary shares in issue (see Statement of Comprehensive

Income).

(E) The figures for dividend per share reflect the years in which they

were earned (see note 8).

(F) Calculated in accordance with AIC guidance issued in October 2020

to include the Company's share of costs of holdings in investment companies

on a look-through basis.

For further information, please contact:

Stephanie Hocking

Evan Bruce-Gardyne

abrdn Fund Managers Limited

0131 372 2200

Please note that past performance is not necessarily a guide to

the future and that the value of investments and the income from

them may fall as well as rise. Investors may not get back the

amount they originally invested.

Chairman's Statement

Performance

I am disappointed to be reporting to shareholders that in the

year just ended, the Company has extended its period of

underperformance against its benchmark on both a net asset value

("NAV") and share price basis. We are very aware that the effect of

this underperformance, over one, three and five years, is that

anyone who made their initial investment in the Company in the last

five years will most likely have seen a reduction in the value of

their investment. This is clearly an uncomfortable position for

shareholders, and also for those of us who are responsible for the

portfolio and the Company.

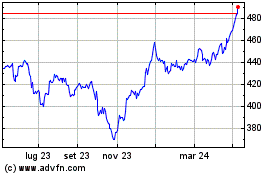

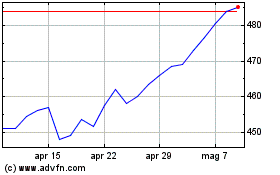

For the year ended 30 June 2023, the Company's NAV total return,

calculated on the basis that all dividends received are reinvested

in additional shares, was -7.4%. The share price total return,

calculated on the same basis, was -6.8%. By contrast, the total

return of the Company's reference index, the Numis Smaller

Companies plus AIM (ex investment companies) Index (the "reference

index"), was -2.8%.

The Board and the Manager have discussed the investment strategy

at length over the past couple of years but this year, in addition,

your Board has spent a lot of time considering the root causes of

the underperformance in order to be confident that the Company's

investment thesis remains intact. It also carried out a detailed

review to assess whether the investment process itself is being

robustly implemented.

As a consequence of these reviews, the Board is able to support

the Manager's view that the drivers of current underperformance are

primarily a confluence of external events. These conditions reflect

the weak UK economy, rising inflation and the sequential increases

in interest rates we are experiencing as well as the political

turbulence. These have created a difficult macro environment for

investing in small companies generally, but particularly for the

Manager's investment style, which focuses on Quality, Growth and

Momentum factors - and we believe does so to a greater extent than

any of the peer group companies in the sector. Whereas this favours

the performance of the Company in growth oriented markets, it

creates very challenging conditions in the market conditions we

have seen, which have resulted in periods of rotation and a

continual de-rating of the highly rated growth companies which

typify our portfolio.

Detailed commentary on markets and performance for the year is

contained in the Investment Manager's Review.

Earnings and Dividends

The revenue return per share ("EPS") for the year ended 30 June

2023 was 12.44p (2022: 9.07p). The increase of 37.2% builds on the

41% increase in 2022 and has come from both an increase in the

ordinary dividends received, special dividends of GBP942,000 (7.2%

of investment income), and a material increase in interest income,

as for the first time since 2008 cash balances are delivering a

return. Included in the EPS is the enhancement to earnings of 0.34p

per share (2.8%) as a result of share buy backs undertaken during

the year.

The Board is pleased to announce that this significant increase

in EPS is flowing through to a substantial increase in dividends

for shareholders and it is declaring a final dividend of 8.00p per

share. Together with the interim dividend of 3.00p per share

already paid, the total distribution for the financial year will be

11.00p per share, representing a 35.8% increase on the 8.10p per

share paid last year. This still permits a proportion of earnings

to be transferred to revenue reserves which will help your Company

to withstand any future downturn such as we witnessed in 2020/21

or, indeed, simply manage any reduction in dividend receipts in

future as income receipts from smaller companies are generally more

variable than those of larger companies.

Following the payment of the final dividend, an amount of

approximately 2.0p per share will be transferred to revenue

reserves.

Subject to approval by shareholders at the Annual General

Meeting ("AGM"), the final dividend will be paid on 30 November

2023 to shareholders on the register on 3 November 2023, with an

associated ex-dividend date of 2 November 2023.

Management Fee and Company Secretarial Fee

The Board continually reviews the management fee structure and,

during the year, considered that the existing structure of fees

paid to the Manager made the Company insufficiently competitive

relative to its closest peers. Accordingly, the Board has

negotiated a lower fee structure with the Manager. With effect from

1 July 2023 fees will be 0.75% per annum (previously 0.85%) on the

first GBP175 million (previously GBP250 million) of net assets,

0.65% per annum (unchanged) on net assets between this amount and

GBP550 million (unchanged), and 0.55% per annum (unchanged) on net

assets above GBP550 million (unchanged). In addition, from 1

January 2024 the Manager will no longer charge for the provision of

company secretarial services, saving the Company a further

GBP75,000 (+ VAT) per annum. On a pro-forma basis, based on the NAV

at 30 June 2023, the change would represent a saving in a full year

of around GBP415,000, or approximately 12% of management fee costs.

The Board considers that this makes the fee structure more

competitive when compared to the other similar investment trusts in

the sector.

Ongoing Charges

The ongoing charges ratio ("OCR") for the year ended 30 June

2023 was 0.95% (2022: 0.82%). As I highlighted last year, we

expected that the OCR would increase this year with a fall in the

NAV. In addition, the promotional fee, which is set annually, was

based on a higher NAV. We expect that the OCR in the coming year

will be lower, partly because of the reduction to the fees referred

to above and partly because the promotional fee will be lower.

There will be a further diminution of cost to come following the

Manager's recent decision to discontinue its Share Plan with effect

from the end of the year, as your Company currently contributes to

the marketing and administration of this Plan which accounts for

some 7% of our shareholder base.

Discount Control and Share Buy Backs

At the year end the discount of the share price to the cum

income NAV was 14.3% (2022: 14.6%).

Over the year, the Company bought back almost 5.7 million

shares, equating to 6.0% of its issued share capital, at a total

cost of GBP25.8 million and a weighted average price of 449.7p per

share. The weighted average discount at which the shares were

repurchased was 12.8%. The Board calculates that this has added

4.0p per share to the NAV for remaining shareholders.

The Company has been more active in buying back shares in the

last 12 months than in any previous year since it last undertook a

tender offer in 2015, buying back shares on over 180 days last

year. The increased activity has been caused by the level of the

discount, which has been wider than the 8% target that the Board is

committed to in the long term in normal market conditions.

Given the backdrop has continued to be unfavourable for the UK

smaller companies sector as a whole, evidenced by outflows in the

open ended sector, it is to be expected that we would see the

discount widen as it has across most of our peer group. Whilst the

Board takes sector levels into account when implementing its

discount control mechanism, it remains committed to its long term

target of 8% and will continue to be active in the market when it

believes it to be in the best interests of shareholders.

Full details of the Board's discount control policy can be found

in the Overview of Strategy below.

Gearing

The Board has given the Investment Manager discretion to vary

the level of gearing between 5% net cash and 25% net gearing (at

the time of drawdown). On 1 November 2022 the Company renewed its

loan facility with the Royal Bank of Scotland International, giving

it access to a GBP40 million revolving credit facility ("RCF"),

GBP25 million of which was drawn down at the year end. The gross

level of borrowings was offset by cash and money market funds of

GBP14.4 million resulting in net gearing at 30 June 2023 of 2.5%

(2022: 5.1%).

The Board

After seven years as a Director, Caroline Ramsay has informed

the Board that she does not intend to stand for re-election at the

Company's AGM in November. Consequently, the Board undertook a

search to find a replacement and appointed Manju Malhotra, who

joined the Board on 1 May 2023. Manju is a Chartered Accountant and

it is intended that she will assume the role of Chair of Audit

Committee at the completion of the AGM. On behalf of the Board, I

would like to thank Caroline for her contribution over the last few

years and we wish her well for the future, and to welcome Manju to

the Board. Manju will stand for election at the AGM. This period

has also seen the completion in May of the one year term of the

Company's first Board Apprentice, Jessica Norell Neeson. We thank

Jessica for her pertinent contributions to our discussions and wish

her well in the next stage of her career path.

Annual General Meeting

The Company's AGM will be held at 12 noon on Thursday 23

November 2023 at Wallacespace Spitalfields, 15 Artillery Lane,

London E1 7HA. The meeting will include a presentation from the

Investment Manager and will be followed by a buffet lunch. This is

a good opportunity for shareholders to meet the Board and Manager

and we would encourage you to attend.

Shareholders will be able to submit questions in advance of the

AGM at the following email address:

abrdnuksmallercompaniesgrowthtrust@abrdn.com. Should you be unable

to attend the AGM, the Investment Manager's presentation will be

made available on the Company's website shortly after the meeting.

The results of the AGM will also be published on the website.

In the meantime, the Board strongly encourages all shareholders

to exercise their votes in respect of the AGM in advance of the

meeting, and to appoint the Chairman of the meeting as their proxy,

by completing the enclosed form of proxy form, or letter of

direction for those who hold shares through the abrdn Investment

Trust savings plans. This will ensure that your votes are

registered.

Outlook

The economic challenges that existed during the year seem set to

continue through the current financial year. Although starting to

fall, inflation remains high and interest rates have increased

since the year end, with further increases expected. This will

likely prove again to be a difficult backdrop for investing in

smaller UK companies.

The Board considers the Investment Manager's process to be tried

and tested and it has yielded good results over the past two

decades albeit interspersed with periods of underperformance at

times of market turbulence such as this. Predicting when these

challenging market conditions will change is very difficult and we

must acknowledge the possibility that they may continue for longer

than they have in the past two decades. We must accept that much of

this period was characterised by unprecedented low interest rates

and loose monetary conditions which is no longer the case.

Notwithstanding this uncertainty, company quality and growth

factors should ultimately prove themselves in such an environment,

through resilience and earnings delivery. Share price valuations of

companies with these characteristics remain very attractive in

historic terms, and the Investment Manager believes that this

presents a significant opportunity to investors. The Investment

Manager has seen positive signs across the portfolio, with a strong

reporting season and earnings upgrades for some of our core

positions, even though significant economic challenges remain. If

continued, over time this should lead to an improvement in investor

sentiment to UK equities and the small and mid-cap sector in

particular. In summary, the Board continues to believe that there

are opportunities for your Company to achieve superior returns over

the economic cycle.

Liz Airey

Chairman

24 August 2023

Overview of Strategy

Business

The Company is an investment trust with a premium listing on the

London Stock Exchange.

Investment Objective

The Company's objective is to achieve long-term capital growth

by investment in UK-quoted smaller companies.

Investment Policy

The Company intends to achieve its investment objective by

investing in a diversified portfolio consisting mainly of UK-quoted

smaller companies. The portfolio will normally comprise between

50-60 holdings representing the Investment Manager's highest

conviction investment ideas. In order to reduce risk in the Company

without compromising flexibility, no holding within the portfolio

should exceed 5% of total assets at the time of acquisition.

The Company may use derivatives for portfolio hedging purposes

(i.e. only for the purpose of reducing, transferring or eliminating

the investment risks in its investments in order to protect the

Company's portfolio).

Within the Company's Articles of Association, the maximum level

of gearing is 100% of net assets. The Directors have set parameters

of between 5% net cash and 25% net gearing (at the time of

drawdown) for the level of gearing that can be employed in normal

market conditions. The Directors have delegated responsibility to

the Investment Manager for the operation of the gearing level

within the above parameters.

Board Investment Limits

The Directors have set additional guidelines in order to reduce

the risk borne by the portfolio:

- Companies with a market capitalisation of below GBP50 million

should not represent more than 5% of total assets.

- Companies involved in "Blue Sky" products should not represent

more than 5% of total assets.

- No more than 50% of the portfolio should be invested in

companies that are constituents of the FTSE AIM All-Share

Index.

Investment Process

The Investment Manager's investment process combines asset

allocation, stock selection, portfolio construction, risk

management, and dealing. The investment process has evolved out of

the Investment Manager's 'Focus on Change' philosophy and is led by

Quality, Growth and Momentum. The Investment Manager's stock

selection led investment process involves compiling a shortlist of

potential investments using a proprietary screening tool known as

"The Matrix" which reflects Quality, Growth and Momentum based

factor analysis. The final portfolio is the result of intensive

research and includes face to face meetings with senior management

of these potential investments. This disciplined process has been

employed for many years and has delivered strong long term

performance.

Reference Index

The Company's reference index is the Numis Smaller Companies

plus AIM (ex investment companies) Index.

Delivering the Investment Objective

The Directors are responsible for determining the Company's

investment objective and investment policy. Day-to-day management

of the Company's assets has been delegated, via the Alternative

Investment Fund Manager (the "AIFM"), to the Investment

Manager.

Promoting the Success of the Company

The Board's statement below describes how the Directors have

discharged their duties and responsibilities over the course of the

financial year under section 172 (1) of the Companies Act 2006 and

how they have promoted the success of the Company for the benefit

of the members as a whole.

Key Performance Indicators ("KPIs")

The Board assesses the performance of the Company against the

range of KPIs shown below over a variety of timeframes, but has

particular focus on the long-term, which the Board considers to be

at least five years.

KPI Description

===================================== ===============================================

Net asset value ("NAV") total The Board measures the Company's NAV total

return performance return performance against the total return

of the reference index (the Numis Smaller

Companies plus AIM (ex investment companies)

Index) and its peer group of investment

trusts.

===================================== ===============================================

Share price total return performance The Board measures the Company's share

price total return performance against

the total return of the reference index

and its peer group of investment trusts.

===================================== ===============================================

Discount/premium to NAV The Board compares the discount or premium

of the Ordinary share price to the NAV

per share to the discount of the peer group

and also to the threshold of the Company's

discount target on a rolling 12 month basis.

===================================== ===============================================

Ongoing charges The Board monitors the Company's ongoing

charges ratio against prior years and other

similar sized companies in the peer group.

The Chairman's Statement contains details

of changes to the management fee arrangements

since the end of the year.

===================================== ===============================================

Principal and Emerging Risks and Uncertainties

The Board carries out a regular review of the risk environment

in which the Company operates, changes to the environment and

individual risks. The Board also considers emerging risks which

might affect the Company. During the year, the most significant

risks were, political instability, inflation and increasing

interest rates and the resultant volatility that this has created

in global stock markets. In addition, the conflict in Ukraine has

continued to create geo-political uncertainty which has further

increased market risk and volatility.

There are a number of other risks which, if realised, could have

a material adverse effect on the Company and its financial

condition, performance and prospects. The Board has carried out a

robust assessment of the Company's principal and emerging risks,

which include those that would threaten its business model, future

performance, solvency, liquidity or reputation.

The principal risks and uncertainties faced by the Company are

reviewed by the Audit Committee in the form of a risk matrix and

the Committee also gives consideration to the emerging risks facing

the Company.

The principal risks and uncertainties facing the Company at the

current time, together with a description of the mitigating actions

the Board has taken, are set out in the table below.

In terms of its appetite for risk, the Board has identified what

it considers to be the key risks to which the Company is exposed

and seeks to take a proportionate approach to the control of these

risks. In particular, by considering the likelihood and impact of a

specific risk, if the potential exposure is rated as Critical or

Significant, the Board ensures that significant mitigation is in

place to reduce the likelihood of occurrence whilst recognising

that this may not be possible in all cases.

The principal risks associated with an investment in the

Company's shares are published monthly in the Company's factsheet

and they can be found in the pre-investment disclosure document

("PIDD") published by the Manager, both of which are available on

the Company's website.

Risk Mitigating Action

================================== ==================================================

Strategy - the Company's Through regular updates from the Manager,

objectives or the investment the Board monitors the discount/ premium

trust sector as a whole at which the Company's shares trade relative

become unattractive to to the NAV. It also holds an annual strategy

investors, leading to a meeting and receives feedback from the

fall in demand for the Company's Stockbroker and shareholders

Company's shares. and updates from the Manager's investor

relations team at Board meetings.

================================== ==================================================

Investment performance The Board meets the Manager on a regular

- the appointment or continuing basis and keeps investment performance

appointment of an investment under close review. Representatives of

manager with inadequate the Investment Manager attend all Board

resources, skills or experience, meetings and a detailed formal appraisal

the investment style or of the Manager is carried out by the Management

process being out of favour, Engagement Committee on an annual basis.

or the adoption of inappropriate The Board sets and monitors the investment

strategies in pursuit of restrictions and guidelines and receives

the Company's objectives, regular reports which include performance

could result in poor investment reporting on the implementation of the

performance, a loss of investment policy, the investment process,

value for shareholders ESG matters, risk management and application

and a widening discount. of the investment guidelines.

================================== ==================================================

Key person risk - a change The Board discusses key person risk and

in the key succession planning with the Manager and

personnel involved in Investment Manager on a regular basis.

the investment management The Investment Manager employs a standardised

of the portfolio could investment process for the management

impact of the portfolio. The well-resourced smaller

on future investment performance companies team has grown in size over

and a number of years. These factors mitigate

lead to loss of investor against the impact of the departure of

confidence. any one member of the investment team.

================================== ==================================================

Share price - failure to The Company operates a discount control

manage the discount effectively mechanism and aims to maintain a discount

or an inappropriate marketing level of less than 8% to the cum-income

strategy could lead to NAV under normal market conditions. Details

a fall in the share price of the discount control mechanism are

relative to the NAV per contained in the Overview of Strategy.

share. The Directors undertake a programme of

inviting major shareholders to discuss

issues of governance or strategy with

the Chairman or Senior Independent Director.

In addition, the Company participates

in the Manager's investment trust promotional

programme where the Manager has an annual

programme of meetings with institutional

shareholders and reports back to the Board

on these meetings.

================================== ==================================================

Financial instruments - As stated above, the Board sets investment

insufficient oversight guidelines and restrictions which are

or controls over financial reviewed regularly and the Manager reports

risks, including market on compliance with them at Board meetings.

price risk, liquidity risk Further details of the Company's financial

and credit risk could result instruments and risk management are included

in losses to the Company. in note 16 to the financial statements.

================================== ==================================================

Financial obligations - At each Board meeting, the Board reviews

inadequate controls over management accounts and receives a report

financial record keeping from the Administrator, detailing any

and forecasting, the setting breaches during the period under review.

of an inappropriate gearing The Board sets gearing limits and monitors

strategy or the breaching the level of gearing and compliance with

of loan covenants could the main financial covenants at Board

result in the Company being meetings.

unable to meet its financial The Audit Committee meets representatives

obligations, losses to from the Manager's Compliance and Internal

the Company and impact Audit teams on at least an annual basis

its ability to continue and discusses any findings and recommendations

trading as a going concern. relevant to the Company.

================================== ==================================================

Regulatory - failure to The Board receives updates on relevant

comply with relevant laws changes in regulation from the Manager,

and regulations could result industry bodies and external advisers

in fines, loss of reputation and the Board and Audit Committee monitor

and potential loss of investment compliance with regulations by review

trust status. of checklists and internal control reports

from the Manager. Directors keep up to

date in a variety of ways, including attendance

at training courses and seminars.

================================== ==================================================

Operational - the Company The Audit Committee reviews reports from

is dependent on third parties the Manager on its internal controls and

for the provision of all risk management (including an annual ISAE

systems and services (in Report) and considers assurances from

particular those of the all its other significant service providers

Manager and the Depositary) on at least an annual basis, including

and any control failures on matters relating to business continuity

and gaps in their systems and cyber security. The Audit Committee

and services could result meets representatives from the Manager's

in a loss or damage to Compliance and Internal Audit teams on

the Company. at least an annual basis and discusses

any findings and recommendations relevant

to the Company. Written agreements are

in place with all third party service

providers.

The Manager monitors closely the control

environments and quality of services provided

by third parties, including those of the

Depositary, through service level agreements,

regular meetings and key performance indicators,

and provides periodic updates to the Board

on this work.

A formal appraisal of the Company's main

third party service providers is carried

out by the Management Engagement Committee

on an annual basis.

================================== ==================================================

Geopolitical - the effects Current geopolitical risks include the

of geopolitical instability actions taken by governments in relation

or change could have an to climate change, the conflict in Ukraine

adverse impact on stock and the impact of increased inflation

markets and the value of and interest rates. The Investment Manager's

the Company's investment focus on quality companies, the diversified

portfolio. nature of the portfolio and a

managed level of gearing all serve to

provide a degree of protection in

times of market volatility.

================================== ==================================================

Promotional Activities

The Board recognises the importance of promoting the Company to

prospective investors both for improving liquidity and enhancing

the rating of the Company's shares. The Board believes one

effective way to achieve this is through subscription to, and

participation in, the promotional programme run by the Manager on

behalf of a number of investment trusts under its management. The

Company also supports the Manager's investor relations programme

which involves regional roadshows, promotional and public relations

campaigns. The Manager's promotional and investor relations teams

report to the Board on a quarterly basis giving analysis of the

promotional activities as well as updates on the shareholder

register and any changes in the make-up of that register.

The purpose of the promotional and investor relations programmes

is both to communicate effectively with existing shareholders and

to gain new shareholders, with the aim of improving liquidity and

enhancing the value and rating of the Company's shares.

Communicating the long-term attractions of the Company is key. The

promotional programme includes commissioning independent paid for

research on the Company, most recently from Edison Investment

Research Limited. A copy of the latest research note is available

from the Company's website.

The cost to the Company of participating in these programmes is

matched by the Manager through the provision of the necessary

resources to carry out the marketing and promotional

activities.

Employees and Human Rights

The Company has no employees as the Board has delegated the day

to day management and administrative functions to the Manager.

There are therefore no disclosures to be made in respect of

employees or human rights.

Modern Slavery Act

Due to the nature of its business, being a company that does not

offer goods and services to customers, the Board considers that the

Company is not within the scope of the Modern Slavery Act 2015

because it has no turnover. The Company is therefore not required

to make a slavery and human trafficking statement. In any event,

the Board considers the Company's supply chains, dealing

predominantly with professional advisers and service providers in

the financial services industry, to be low risk in relation to this

matter.

Environmental, Social and Governance ("ESG") Matters

The Board supports the Investment Manager's approach to ESG

considerations which are fully embedded into the investment

process.

The UK Stewardship Code and Proxy Voting

The Company supports the UK Stewardship Code, and seeks to play

its role in supporting good stewardship of the companies in which

it invests. Responsibility for actively monitoring the activities

of portfolio companies has been delegated by the Board to the

Manager which has sub-delegated that authority to the Investment

Manager. abrdn plc is a tier 1 signatory of the UK Stewardship Code

which aims to enhance the quality of engagement by investors with

investee companies in order to improve their socially responsible

performance and the long-term investment return to shareholders.

While delivery of stewardship activities has been delegated to the

Manager, the Board acknowledges its role in setting the tone for

the effective delivery of stewardship on the Company's behalf.

The Board has also given discretionary powers to the Manager to

exercise voting rights on resolutions proposed by the investee

companies within the Company's portfolio. The Manager reports on a

quarterly basis on stewardship (including voting) issues.

Global Greenhouse Gas Emissions

The Company has no greenhouse gas emissions to report from its

operations, nor does it have responsibility for any other emissions

producing sources under the Companies Act 2006 (Strategic Report

and Directors' Reports) Regulations 2013.

Task Force for Climate-Related financial Disclosures

("TCFD")

Under Listing Rule 15.4.29(R), the Company, as a closed ended

investment company, is exempt from complying with the Task Force on

Climate-related Financial Disclosures ("TCFD").

Whilst TCFD is currently not applicable to the Company, the

Manager has produced a product level report on the Company in

accordance with the FCA's rules and guidance regarding the

disclosure of climate-related financial information consistent with

TCFD Recommendations and Recommended Disclosures. These disclosures

are intended to help meet the information needs of market

participants, including institutional clients and consumers of

financial products, in relation to the climate-related impact and

risks of the Manager's TCFD in-scope business. The product level

report on the Company is available on the Manager's website at:

invtrusts.co.uk.

Discount Control Policy

The Board operates a discount control mechanism which targets a

maximum discount of the share price to the cum-income net asset

value of 8% under normal market conditions. In pursuit of this

objective, the Board closely monitors the level of the discount and

buys back shares in the market when it believes it is in the best

interests of shareholders as a whole to do so. At each Annual

General Meeting, the Board seeks shareholder approval to buy back

up to 14.99% of the Company's share capital. Share buy-backs will

only be made where the Board believes it to be in the best

interests of shareholders as a whole and the making and timing of

share buy-backs will be at the discretion of the Board.

The Board considers that, given the backdrop has continued to be

unfavourable for the UK smaller companies sector as a whole,

evidenced by outflows in the open ended sector, it is to be

expected that the Company's discount would widen as it has across

most of the peer group. Whilst the Board takes sector levels into

account when implementing its discount control mechanism, it

remains committed to its long term target of 8% and will continue

to be active in the market when it believes it to be in the best

interests of shareholders.

The Company has a tender offer mechanism in place and the Board

intends to continue to seek shareholder approval at each Annual

General Meeting to enable it to carry out tender offers on a

discretionary basis in circumstances where the Board believes that

share buy-backs are not sufficient to maintain the discount at an

appropriate level, although it expects that buy-backs should be the

primary mechanism for managing the discount.

Viability Statement

The Board considers that the Company, which does not have a

fixed life, is a long-term investment vehicle and, for the purposes

of this statement, has decided that five years is an appropriate

period over which to consider its viability. The Board considers

that this period reflects a balance between looking out over a

long-term horizon and the inherent uncertainties of looking out

further than

five years.

Taking into account the Company's current financial position and

the potential impact of its principal risks and uncertainties, the

Directors have a reasonable expectation that the Company will be

able to continue in operation and meet its liabilities as they fall

due for a period of five years from the date of this Report.

In assessing the viability of the Company over the review

period, the Directors have focused upon the following factors:

- The principal risks and uncertainties detailed above and the

steps taken to mitigate these risks, together with the emerging

risks identified by the Board.

- The Company is invested in listed securities that are

readily-realisable in normal market conditions and there is a

spread of investments held.

- The Company is closed ended in nature and therefore it is not

required to sell investments when shareholders wish to sell their

shares.

- The Company's long-term performance record.

- The Company's level of gearing. The Company had net gearing of

2.5% as at 30 June 2023. The Company has a GBP40 million unsecured

loan facility agreement with The Royal Bank of Scotland

International Limited which expires on 1 November 2025. The Board

has set overall limits for borrowing and reviews regularly the

Company's level of gearing, cash flow projections and compliance

with banking covenants. The Board has also performed stress testing

and liquidity analysis. In the event that the facility is not

refinanced, there is considered to be sufficient portfolio

liquidity to enable borrowings to be repaid.

- The Company has cash and money market funds which at 30 June

2023 amounted to GBP14.4 million. These balances allow the Company

to meet liabilities as they fall due.

- The level of ongoing charges (the Chairman's Statement

contains details of changes to the management fee arrangements

since the end of the year).

- There are no capital commitments currently foreseen that would alter the Board's view.

- The robustness of the operations of the Company's third party service suppliers.

The Directors have also reviewed the revenue and ongoing

expenses forecasts for the coming year and considered the Company's

Statement of Financial Position as at 30 June 2023 which shows net

current liabilities of GBP11.8 million at that date, and do not

consider this to be a concern due to the liquidity of the portfolio

which would enable the Company to meet any short term liabilities

if required.

In assessing the Company's future viability, the Board has

assumed that shareholders will wish to continue to have exposure to

the Company's activities in the form of a closed ended entity and

the Company will continue to have access to sufficient capital.

In making its assessment, the Board is also aware that there are

other matters that could have an impact on the Company's prospects

or viability in the future, including the conflict in Ukraine,

economic shocks or significant stock market volatility caused by

other factors, and changes in regulation or investor sentiment.

Future Strategy

The Board intends to maintain the strategic direction set out in

the Strategic Report for the year ending 30 June 2024 as it

believes that this is in the best interests of shareholders.

On behalf of the Board

Liz Airey

Chairman

24 August 2023

Promoting the Success of the Company

Introduction

Section 172 (1) of the Companies Act 2006 (the "Act") requires

each Director to act in the way he/she considers, in good faith,

would be most likely to promote the success of the Company for the

benefit of its members as a whole.

The Board is required to describe to the Company's shareholders

how the Directors have discharged their duties and responsibilities

over the course of the financial year under that provision of the

Act (the "Section 172 Statement"). This statement provides an

explanation of how the Directors have promoted the success of the

Company for the benefit of its members as a whole, taking into

account, among other things, the likely long-term consequences of

decisions, the need to foster relationships with all stakeholders

and the impact of the Company's operations on the environment.

The Purpose of the Company and Role of the Board

The purpose of the Company is to act as an investment vehicle to

provide, over time, financial returns (both income and capital) to

its shareholders. Investment trusts, such as the Company, are

long-term investment vehicles and are typically externally managed,

have no employees, and are overseen by an independent non-executive

board of directors.

The Board, which at the end of the year, comprised six

independent non-executive Directors with a broad range of skills

and experience across all major functions that affect the Company,

retains responsibility for taking all decisions relating to the

Company's investment objective and policy, gearing, corporate

governance and strategy, and for monitoring the performance of the

Company's service providers.

The Board's philosophy is that the Company should operate in a

transparent culture where all parties are treated with respect and

provided with the opportunity to offer practical challenge and

participate in positive debate which is focused on the aim of

achieving the expectations of shareholders and other stakeholders

alike. The Board reviews the culture and manner in which the

Manager and Investment Manager operate at its meetings and receives

regular reporting and feedback from the other key service

providers. The Board is very conscious of the ways it promotes the

Company's culture and ensures as part of its regular oversight that

the integrity of the Company's affairs is foremost in the way that

the activities are managed and promoted. The Board works very

closely with the Manager and Investment Manager in reviewing how

stakeholder issues are handled, ensuring good governance and

responsibility in managing the Company's affairs, as well as

visibility and openness in how the affairs are conducted.

The Company's main stakeholders have been identified as its

shareholders, the Manager (and Investment Manager), service

providers, investee companies, debt providers and, more broadly,

the environment and community at large.

How the Board Engages with Stakeholders

The Board considers its stakeholders at Board meetings and

receives feedback on the Manager's interactions with them.

Stakeholder How We Engage

========================== ============================================================

Shareholders Shareholders are key stakeholders and the Board

places great importance on communication with

them. The Board welcomes all shareholders' views

and aims to act fairly to all shareholders. The

Manager and Company's Stockbroker regularly meet

with current and prospective shareholders to discuss

performance and shareholder feedback is discussed

by the Directors at Board meetings. In addition,

Directors meet shareholders at the Annual General

Meeting and the Chairman offers to meet with the

Company's larger shareholders to discuss their

views.

The Company subscribes to the Manager's investor

relations programme in order to maintain communication

channels with the Company's shareholder base.

Regular updates are provided to shareholders through

the Annual Report, Half Yearly Report, monthly

factsheets, Company announcements, including daily

net asset value announcements, and the Company's

website.

The Company's Annual General Meeting provides

a forum, both formal and informal, for shareholders

to meet and discuss issues with the Directors

and Manager. The Board encourages as many shareholders

as possible to attend the Company's Annual General

Meeting and to provide feedback on the Company.

========================== ============================================================

Manager (and Investment The Investment Manager's Review details the key

Manager) investment decisions taken during the year. The

Investment Manager has continued to manage the

portfolio and other assets in accordance with

the mandate agreed with the Company, with oversight

provided by the Board.

The Board regularly reviews the Company's performance

against its investment objective and the Board

undertakes an annual strategy review meeting to

ensure that the Company is positioned well for

the future delivery of its objective for its stakeholders.

The Board receives presentations from the Investment

Manager at every Board meeting to help it to exercise

effective oversight of the Investment Manager

and the Company's strategy.

The Board, through the Management Engagement Committee,

formally reviews the performance of the Manager

at least annually.

========================== ============================================================

Service Providers The Board seeks to maintain constructive relationships

with the Company's service providers either directly

or through the Manager with regular communications

and meetings.

The Management Engagement Committee conducts an

annual review of the performance, terms and conditions

of the Company's main service providers to ensure

they are performing in line with Board expectations,

carrying out their responsibilities and providing

value

for money.

========================== ============================================================

Investee Companies Responsibility for monitoring the activities of

portfolio companies has been delegated by the

Board to the Manager which has sub-delegated that

authority to the Investment Manager.

The Board has also given discretionary powers

to the Manager to exercise voting rights on resolutions

proposed by the investee companies within the

Company's portfolio. The Manager reports on a

quarterly basis on stewardship (including voting)

issues.

Through engagement and exercising voting rights,

the Investment Manager actively works with companies

to improve corporate standards, transparency and

accountability.

The Board monitors investments made and divested

and questions the rationale for investment and

voting decisions made.

========================== ============================================================

Debt Providers On behalf of the Company, the Manager maintains

a positive working relationship with The Royal

Bank of Scotland International Limited, the provider

of the Company's loan facility, and provides regular

updates on business activity and compliance with

its loan covenants.

========================== ============================================================

Environment and Community The Board and Manager are committed to investing

in a responsible manner and the Investment Manager

embeds Environmental, Social and Governance ("ESG")

considerations into its research and analysis

as part of the investment decision-making process.

========================== ============================================================

Specific Examples of Stakeholder Consideration During the

Year

While the importance of giving due consideration to the

Company's stakeholders is not a new requirement, and is considered

during every significant Board decision, the Directors were

particularly mindful of stakeholder considerations as part of the

following decisions made during the year ended 30 June 2023. Each

of these decisions was made after taking into account the short and

long-term benefits for stakeholders.

Portfolio and Investment Performance

The Investment Manager's Review details the key investment

decisions taken during the year. The overall shape and structure of

the investment portfolio is an important factor in delivering the

Company's stated investment objective and is reviewed at every

Board meeting.

As explained in more detail in the Chairman's Statement, the

Board and Manager have discussed the investment strategy at length

over the past couple of years but during the year, in addition, the

Board spent time considering the root causes of the Company's

underperformance in order to be confident that the investment

thesis remained intact. It also carried out a detailed review to

assess whether the investment process itself was being robustly

implemented.

As a consequence of these reviews, the Board was able to support

the Investment Manager's view that the drivers of current

underperformance are primarily a confluence of external events

which have created a difficult macro environment for investing in

small companies generally, but particularly for the Investment

Manager's investment style, which focuses on Quality, Growth and

Momentum factors - and the Board believes does so to a greater

extent than any of its peer group companies in the sector. Whereas

this favours the performance of the Company in growth oriented

markets, it creates very challenging conditions in the market

conditions seen recently, which have resulted in periods of

rotation and a continual de-rating of the highly rated growth

companies which typify the portfolio.

During the year the Management Engagement Committee decided that

the continuing appointment of the Manager is in the best interests

of shareholders.

Management Fee

As explained in the Chairman Statement, during the year, the

Board considered that the existing structure of fees paid to the

Manager made the Company insufficiently competitive relative to its

closest peers. Accordingly, the Board negotiated a lower fee

structure with the Manager which the Board considers is more

competitive when compared to the other similar investment trusts in

the sector.

Dividends

The Board is recommending payment of a final dividend for the

year of 8.00p per Ordinary share. Following payment of the final

dividend, total dividends for the year will amount to 11.00p per

Ordinary share, an increase of 35.8% compared to the previous year.

Although the Company has a capital growth objective, the Board

recognises the importance of dividends to shareholders.

Share Buy Backs

In accordance with the discount control policy included in the

Overview of Strategy, during the year the Company bought back

5,682,136 Ordinary shares to be held in treasury, providing a small

accretion to the NAV per share and a degree of liquidity to the

market at times when the discount to the NAV per share has widened

in normal market conditions. It is the view of the Board that this

policy is in the interest of all shareholders.

Renewal of Bank Loan

On 1 November 2022 the Company renewed its loan facility with

the Royal Bank of Scotland International, giving it access to a

GBP40 million revolving credit facility ("RCF"), GBP25 million of

which was drawn down at the year end. The gross level of borrowings

was offset by cash and money market funds of GBP14.6 million

resulting in net gearing at 30 June 2023 of 2.5% (2022: 5.1%).

The Board continues to believe that gearing is beneficial to

long term net asset value returns and is one of the benefits of the

closed ended investment trust structure.

Consumer Duty

During the year, the FCA's Consumer Duty Regulations came into

effect, introducing new rules for FCA regulated firms which

manufacture or distribute products and services to retail

customers. The Consumer Duty rules do not apply to the Company but

do apply to the Manager,

The Board has reviewed the methodology employed by the Manager

to assess value of the Company under the Consumer Duty regulations

and will review the Manager's assessment of value an ongoing

basis.

Board Succession

As explained in the Directors' Report, a fter seven years as a

Director, Caroline Ramsay has informed the Board that she does not

intend to stand for re-election at the Company's Annual General

Meeting in November. Consequently, following a formal recruitment

process, the Board decided to appoint Ms Manju Malhotra as an

independent Director on 1 May 2023. New Board appointments seek to

achieve a good balance of skills, experience, gender and

ethnicity.

The Board believes that shareholders' interests are best served

by ensuring a smooth and orderly refreshment of the Board which

serves to provide continuity and maintain the Board's open and

collegiate style.

On behalf of the Board

Liz Airey

Chairman

24 August 2023

Performance

Performance (total return)

1 year return 3 years 5 years 10 years

return return return

% % % %

=================================== ============= ======= ======= ========

Net asset value(AB) -7.4 -4.4 -6.1 +98.9

=================================== ============= ======= ======= ========

Share price(B) -6.8 -10.1 -10.4 +72.9

=================================== ============= ======= ======= ========

Reference Index -2.8 +19.9 -0.7 +72.4

=================================== ============= ======= ======= ========

Peer Group weighted average (NAV) +1.0 +24.5 +3.3 +107.3

=================================== ============= ======= ======= ========

Peer Group weighted average (share

price) +1.4 +20.1 -0.4 +113.3

----------------------------------- ------------- ------- ------- --------

(A) Cum-income NAV with debt at fair value.

(B) Considered to be an Alternative Performance Measure.

Source: Morningstar

Ten Year Financial Record

Year to 30 June 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Per Ordinary share (p)

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Net revenue return 5.05 6.76 6.76 6.42 7.24 8.80 6.74 6.43 9.07 12.44

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Ordinary dividends paid/proposed 4.50 5.80 6.60 6.70 7.00 7.70 7.70 7.70 8.10 11.00

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Net asset value(A) 298.92 336.89 345.43 456.60 552.93 539.54 527.73 737.97 530.37 482.95

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Share price 281.25 300.00 316.00 431.00 500.00 491.50 482.00 698.00 453.00 414.00

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Discount(%)(A) 5.9 10.9 8.5 5.6 9.6 8.9 8.7 5.4 14.6 14.3

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Ongoing charges ratio

(%)(B) 1.19 1.19 1.13 1.08 1.04 0.90 0.91 0.88 0.82 0.95

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Gearing ratio (%)(C) (4.6) 4.1 3.6 1.7 3.6 1.5 (0.3) 5.7 5.1 2.5

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Shareholders' funds (GBPm)(D) 219 243 241 324 408 543 528 728 499 427

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

Revenue reserves (GBPm)(E) 4.34 5.83 6.50 6.26 8.30 10.87 8.80 7.53 8.81 12.47

================================= ====== ====== ====== ====== ====== ====== ====== ====== ====== ======

(A) Calculated with debt at par value and diluted for the effect of

Convertible Unsecured Loan Stock conversion from 01 July 2013 until

30 June 2017. From 30 June 2018, net asset value is calculated with

debt at par value.

(B) Calculated as an average of shareholders' funds throughout the

year and in accordance with updated AIC guidance issued in October

2020, to include the Company's share of costs of holdings in investment

companies on a look-through basis.

(C) Net gearing ratio calculated as debt less cash invested in AAA-rated

money market funds and short-term deposits divided by net assets at

the year end.

(D) Increase in 2018 included the effect of the merger with Dunedin

Smaller Companies Investment Trust PLC.

(E) Revenue reserves are reported prior to paying the final dividend

for the year.

Investment Manager's Review

The net asset value ("NAV") total return for the Company for the

year ended 30 June 2023 was -7.4%, while the share price total

return was -6.8%. By comparison, the UK smaller companies sector as

represented by the Numis Smaller Companies plus AIM (ex investment

companies) Index (the "reference index") delivered a total return

of -2.8%.

Equity Markets

During the year under review, markets were volatile and top down

driven, with the dominating narrative one of persistent inflation

and higher interest rates. Against this backdrop, bottom-up company

fundamentals have come second. Whilst the portfolio holdings have

been delivering well fundamentally, that has often not been

reflected in share prices.

The UK stock market, as represented by the FTSE All-Share Index,

gained a small amount of ground over the period, with a total

return of 7.9%. The FTSE 100 Index outperformed the FTSE 250 Index

(excluding investment companies), the latter of which generated a

total return of only 1.9%. Investors have remained cautious around

the UK economic picture, which has challenged the more domestically

focused small and mid-cap areas of the market.

The period was dominated by high inflation, rising interest

rates and fears of a sustained economic downturn. Inflation drivers

included the war in Ukraine as well as unsettled supply chains post

Covid. Political uncertainty in the UK did little to reduce

share-price volatility, with Boris Johnson's resignation as Prime

Minister in July and the tax-cutting strategy unveiled by his

successor Liz Truss in September adding to market turbulence.

Inflation reached 10.1% in July, and the Bank of England ("BoE")

warned that price rises could accelerate in the autumn as a result

of higher energy costs. The BoE continued to tighten monetary

policy by raising interest rates to combat inflation. Through late

2022, data showed successive falls in output in the UK

manufacturing sector, while retail spending weakened, and we saw a

sharp rise in mortgage rates.

In the aftermath of the disastrous mini-Budget presented by new

prime minister Liz Truss and her chancellor Kwasi Kwarteng at the

end of September, Truss was forced to sack Kwarteng, reverse her

tax-cutting policies and finally resign, to be replaced by Rishi

Sunak. These developments were welcomed by markets.

UK small and mid-cap equities enjoyed a positive final quarter

of calendar year 2022 as hopes rose that inflation had peaked and

central banks would soon slow the pace of monetary-policy

tightening. However, there remained significant difficulties and

recession risk for the UK economy. The mid-cap FTSE 250 Index rose

by 10.6% in the final quarter of 2022, reversing some of the heavy

losses seen earlier in the year, whilst the FTSE Small Cap Index

returned 8.9%. Officials said rates would continue to increase

until inflation was significantly closer to the 2% long-term

target, regardless of the short-term economic impact. Late 2022

also saw many industries battling with supply chain challenges, a

result of Covid shutdowns combining with increasing re-opening

demand. This provided many challenges for companies and was a

contributor to the inflationary pressures. As we turned into 2023,

many of the supply shortages and logistics challenges had eased -

one less headache for companies to try to navigate.

The turn of the year saw the strongest surprises coming through

in consumer-exposed companies; consumer spending proving more

resilient than expected. The fear of a tough two year recession

outlined by the BoE appeared behind us for now. Hopes rose that the

pace of interest rate rises would start to slow, while indicators

suggested the economy would avoid falling into recession.

Disappointingly, inflation remaining stubbornly high. March saw the

collapse of Silicon Valley Bank and a loss of confidence in Credit

Suisse sparked fears about the resilience of the global financial

system. Trading conditions in a number of sectors remained

challenging. Mortgage lending declined to its lowest level since

2016 in February, while in March house prices recorded their

steepest falls since 2009, a sharp reminder of the broad global

challenges.

However, with UK inflation remaining high and above other major

geographies, and interest rates continuing to increase, UK share

prices lagged major markets in Europe and North America. The big

question globally, but particularly in the UK, with GDP numbers

proving more resilient than many thought, is whether we get a

recession or not.

Performance

Overall through the year, the net asset value ("NAV") fell by

7.4% on a total return basis, underperforming the reference index

total return of -2.8%.

We had hoped for a more stable backdrop for the period, yet the

dominating market narrative has been one of UK inflation that

requires the BoE to increase interest rates. Through the period,

policymakers still expected inflation to be benign and central

banks to increase rates slowly. This, however, proved to be too

complacent as the UK suffered from high persistent inflation and

this changed the trajectory of interest rates. Inflation injects

uncertainty into stock markets, affecting investor confidence.

Value stocks typically have strong current cash flows which are

more likely to grow slowly or diminish over time, while growth

stocks are likely to represent fast growing companies that have

stronger cash flows in the future. When valuing companies' share

prices using the discounted cash flow method in times of rising

interest rates, growth stocks are hit harder by this effect than

value stocks, This has placed our Quality, Growth and Momentum

process out of favour.

Our quality focus has ensured that we have invested in companies

which have had supportive earnings and resilience. These companies

have also demonstrated pricing power with the ability to protect

margins. The portfolio has not been entirely immune from macro

shocks, but we have seen the overall resilience and growth

delivering robust dividend payments.

The final quarter of 2022 saw UK markets rebound sharply, and

the portfolio outperformed the reference index. That rally come

earlier than many would have expected, given the recession outlook.

We believe this highlighted the attractive valuations those growth

businesses are trading on, combined with the resilient earnings

growth they continue to provide.

Early 2023 saw market relief as consumers appeared resilient in

the face of the cost of living squeeze. This drove the market to

focus less on quality, and cheaper rated and more cyclical

companies performed well, proving a more difficult start to the

calendar year for the Company. As we moved through the remainder of

the financial year, macro top down influences continued to drive

the direction of the markets, however we have felt more comfortable

with the degree of rationalism in share price moves, and the focus

towards company fundamentals. Whilst the market remains wary of

companies which are trading at high valuations relative to their

history, we have seen overall less of a value bias to the market in

recent months, and we are seeing more importance placed back on

factors such as earnings revisions.

The five leading positive contributors to relative performance

during the year were as follows:

- 4imprint 198bps (shares +106%) delivered strong results

through the year exceeding expectations on many occasions, and also

providing strong dividend growth and a special dividend. Whilst

benefitting from increased face to face interactions at events

driving promotional product usage, self-help growth has been

enabled through spend on marketing in a highly fragmented market,

capturing market share and new repeat customers.

- Games Workshop 135bps (shares +60%) has delivered strong

growth despite consumer spending challenges globally. Its continued

investment in new product innovation and community engagement is

paying off, resulting in dividend increases and strong returns for

shareholders again this year. The shares were also supported by the

announcement of Amazon taking a license for Warhammer for TV

production.

- Diploma 99bps (shares +33%) traded well through the year,

proving itself as a quality industrial company. To complement

organic growth, it has also completed attractive bolt on

acquisitions, such as the TIE deal which was partly funded through

an equity raise.

- Kainos 95bps (shares + 11%) has successfully navigated the

macroeconomic environment this year, delivering consistent growth

and pricing power to offset wage inflation. Its customer base is

sticky, and digitisation spend remains a priority for corporates.

With the departure of long term respected CEO Brendan Mooney, it

has also demonstrated strong succession planning.

- discoverIE 88bps (shares + 27%) has proved another quality

industrial business, trading strongly through the year. It has

proactively chosen exposures to regulatory and structurally growing

areas, and with products being designed into its customers'

solutions, this provides stickiness of revenue and resultant

visibility of earnings. In addition, it has complemented organic

growth through bolt on acquisitions.

The five worst contributors to relative performance during the

year were as follows:

- Focusrite -130bp (shares -57%) the shares have struggled this

year, partly as a normalisation of Covid spending has impacted

demand for the company's products. It navigated supply chain issues

early in the year and continued to invest in new product solutions

to drive demand.

- Hilton Food -111bps (shares -38%) the shares suffered from a

short term inability to pass on all input cost inflation in the

fish division of the business. This was successfully navigated

within a few months, and in the second half of the period the

company traded strongly and also announced interesting new customer

wins.

- Future -106bps (shares -60%) the shares suffered from a lower

advertising spend environment, as well as concerns on consumer

spend softening. The CEO also announced her intention to leave the

company, which created more market uncertainty over the outlook for

the business.

- Mortgage Advice Bureau -99bps (shares -33%) was a casualty of

the Truss mini budget, driving interest rates up and causing

activity on housing and mortgages to fall sharply. Whilst activity

levels and its shares recovered in early 2023, they are still below

previous levels, and more recent mortgage rate increases will be

challenging in the short term. Over the medium term this remains a

very strong business, taking market share and with many levers for

growth.

- Marshalls -85bps (shares -46%) has suffered from reduced

activity in residential refurbishment and improvement work, as well

as lower new build housing activity. The commercial and

infrastructure side of the business has remained more resilient,

and the management team has taken cost and restructuring action to

support the business against the macro-economic challenges

currently being faced.

Dealing and Activity

Portfolio turnover was around 15%, which represents an average

holding period of almost seven years and is not out of line with

previous periods. Over the year, we added eight new positions, and

exited eleven holdings. There were no IPO participations this

period, in a quiet year in the markets for IPO activity.

We initiated positions in some holdings which have been held

historically in the portfolio. Ricardo has transformed its

business, now positioned as a leader in environmental and

engineering consultancy; working with governments, agencies and

corporates to implement sustainability agendas and strategies.

Paragon Banking is a specialist lender, with a focus on buy-to-let

markets in the UK. The business has demonstrated strong credit

quality through the years, and with a strong retail funding model

and capital support, it continues to take market share as a

specialist, particularly in the professional landlord arena. Smart

Metering Systems has two key divisions; household smart meters

which provide long term visible and inflation linked revenue

streams, along with the new exposure to battery storage in grid

networks - an attractive return and growth exposure for the

business. FDM Group is a specialist at recruiting, training and

deploying IT and business professionals, operating globally.

Craneware is a technology specialist operating in

the US healthcare market, focused on financial and operational

optimisation for hospitals. Coats is a global leader in thread

production, with exposure to apparel, footwear and specialty

markets. One key growth area for its business is its leading

position in sustainable thread, a product increasingly in demand as

industries move towards more sustainable production. Alpha Group

(previously called Alpha FX) is another business which has expanded

into interesting adjacent markets; now half fintech, half

consultancy. Whilst its FX (foreign exchange) risk management

business for corporates has gone from strength to strength, it has

also expanded into banking solutions for alternative asset

managers, and the corporate services and fund administration

companies that support them. Spirent is a leading provider of

automated testing and assurance solutions for networks, security

and positioning.

Key tops up in the period included the position in Volution (

leading supplier of ventilation products, with global exposure),

CVS (vet practices across the UK), and Serica Energy (North Sea gas

and oil producer). We also added to 4imprint (US promotional

products), Games Workshop (hobby business with Warhammer IP),

YouGov (data services business for market research), Gamma

Communications (telecommunication and services provider for

businesses), Midwich (audio visual value added reseller), Treatt

(natural flavours and fragrances), and Tatton Asset Management (a

leading provider to the UK's IFA community, including through

strong growth in its MPS (managed portfolio services)

offering).

Key reductions to positions were in companies across a range of

sectors. We trimmed the position in Kainos where the valuation of

the business left demanding earnings upgrades required, and the

environment has got tougher in some areas such as the NHS. Watches

of Switzerland showed resilient demand and order books, but some

weakness in its jewellery exposure, and we were conscious that the

market was looking to derate this business given consumer concern.

We also reduced the holding in Alpha Financial Markets but remain

very positive on the outlook and growth of this business. GB Group

was challenged by earnings downgrades from the normalisation in

cryptocurrency markets. Telecom Plus is a resilient revenue stream

business, but its valuation had increased considerably prior to the

period, and some market headwinds were increasing. We controlled

the position size in Diploma , which continued to deliver strong

results, but whose market capitalisation is now quite large. Real

Estate was a sector where we trimmed holdings in Safestore and