Resource Update

08 Agosto 2008 - 9:55AM

UK Regulatory

RNS Number : 9423A

Berkeley Resources Limited

08 August 2008

8 August 2008

INITIAL RESOURCE OF 9.23 million pounds

at THE GAMBUTA DEPOSIT

The Directors of Berkeley Resources Limited (AIM: BKY.L) are pleased to announce an initial inferred resource estimate of 9.23 million

pounds of U3O8, at an average grade of 371ppm U3O8 (at a 200ppm cutoff), for the Gambuta uranium deposit in the Ceres Province of Spain.

The deposit remains open along strike to the north-west however, drilling has ceased during the current fire season.

It is anticipated that drilling to test the considerable strike potential beneath Tertiary and Quaternary cover to the northwest will

resume in early October.

Background

The Gambuta deposit occurs within the Caceres VI license and is located 165kms west-southwest of Madrid, about 20kms south of the

Badajoz - Madrid freeway and 6 kms east of the village of Bohonal de Ibor. It is typical of a number of perigranitic, shale hosted uranium

mineral occurrences within the Caceres VI licence, such as El Zarzal and Ojaranzo, located in the central and eastern part of the tenement

respectively. Additional targets for uranium, exploration have been identified in adjacent areas.

Gambuta is associated with an area of anomalous radiometrics defined by the Junta de Energia Nuclear (JEN) in the 1960's and briefly

explored by CISA (a joint venture between COGEMA (now AREVA) and ENUSA (Empresa Nacional Uranio S.A.)) in the early 1990's. Roto percussion

drilling by CISA (24 holes) identified a mineralised, north-westerly trending, structural zone with dimensions of approximately 900m x 400m,

including a central untested area of Tertiary cover.

A 36 hole program by Berkeley has confirmed the CISA results and defined a continuous, structurally controlled, zone of mineralisation

which is 250 - 350m wide, up to 94m below surface (see Figure 3) and is continuous for 1,500m in a west-northwesterly direction. This zone

appears to extend beneath Tertiary and Quaternary cover to the north-west and about 1,300m of untested strike potential remains within the

license.

Uranium mineralisation occurs within a sequence of strongly deformed Proterozoic spotted and banded grey to black phyllites which have

been contact metamorphosed by Hercynian granites. The contacts between the phyllites and the granite to the east and northeast are tectonic.

The sequence of host phyllites at Gambuta is similar to that hosting the Retortillo deposit in the Salamanca I license.

As at Retortillo, the Gambuta uranium mineralisation is generally sub-horizontal and associated with the weathering profile; a similar

model of formation is envisaged. Most mineralisation occurs in the zone of partial oxidation. Deeper mineralisation is associated with

oxidation along steeply dipping shears and fractures, dominantly sub-parallel to the mineralised trends. Uranium mineralisation occurs

within the schistosity, particularly in zones of shearing and fracturing. The only visible uranium minerals are secondary autunite and

torbernite.

The main mineralised horizon averages 9.4m in thickness and occurs at an average depth of 18.0m, beneath Tertiary cover and shales. A

lower mineralised horizon averages 2.1m in thickness and is separated from the main horizon by 16.3m of shales. A central, higher grade

(+0.1% U3O8,) zone, about 100m wide, is evident in the north-western half of the deposit and is open along strike.

Resource Calculation

All drilling results for the deposit have been previously reported in Stock Exchange announcements on 10 April, 6 June and 31 July 2008.

Assessment and interpretation of the historical and Berkeley drilling information was undertaken by Company geologists and resource

modelling was assisted by McDonald Speijers, a consulting group with more than 15 years experience in resource calculations. Resources were

calculated by block modelling methods, using an inverse distance squared method of grade distribution, and cross-checked using kriging

methods. The resource classification has been completed in accordance with the JORC Code. Grades were estimated using a calculated U3O8

value from total uranium as determined by Delayed Neutron Count, determined by Actlabs (Canada) with associated duplicates, blanks and

standards.

Of necessity, the block model employed large block sizes (25m x 25m x 2m) consistent with the wide-spaced location of drillholes, within

a wireframe defined by the interpretation of geological, radiometric and weathering data. This has resulted in some "spreading" of the grade

and subsequent infill drilling is expected to result in a more realistic grade distribution. Incorporation of variable densities was based

on measurements on selected core samples from diamond drill core, using the wet dry method.

Initial inferred uranium resources for the Gambuta deposit have been calculated as follows:

At a 200ppm U3O8 cut-off,

11.29Mt of ore at a grade of 371ppm U3O8 containing 9.23Mlbs U3O8

At a 150ppm U3O8 cut-off,

15.49Mt of ore at a grade of 318ppm U3O8 containing 10.85Mlbs U3O8

At a 100ppm U3O8 cut-off,

19.46Mt of ore at a grade of 278ppm U3O8 containing 11.95Mlbs U3O8

.

Future work

The next round of RC and diamond drilling will commence at the end of the high risk fire season, which is anticipated to be early in

October. This program will focus on defining the north-westerly extent of the deposit, where topography indicates potential for extensions

beneath Tertiary and Quaternary cover for a further 1.3km.

Infill drilling will be undertaken as required to better define the limits of mineralisation, in particular, the central zone of higher

grade mineralisation.

Diamond drilling will initially be directed to acquiring material for metallurgical testwork.

Enquiries - Managing Director: Matt Syme Tel: +61 417 906 717

RBC Capital Markets: Martin Eales Tel: +44 20 7029 7881

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSSDSWASASEIA

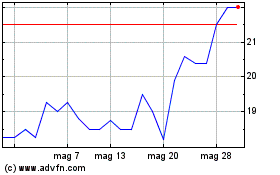

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

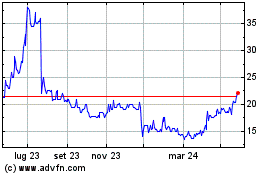

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024