RNS Number : 5204E

Berkeley Resources Limited

29 September 2008

BERKELEY RESOURCES LIMITED

ANNUAL FINANCIAL REPORT

30 JUNE 2008

ABN 40 052 468 569

Contents Page

CORPORATE DIRECTORY 3

DIRECTORS' REPORT

4

INCOME STATEMENT

17

BALANCE SHEET

18

CASH FLOW STATEMENT 19

STATEMENT OF CHANGES IN EQUITY 20

tHE fOLLOWING SECTIONS ARE AVAILABLE in the full version of THE ANNUAL FINANCIAL REPORT ON bERKELEY RESOURCES LIMITED'S WEBSITE:

www.berkeleyresources.com.au

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

DIRECTORS' DECLARATION

auditor's independence declaration

INDEPENDENT AUDIT REPORT

Directors Bankers

Dr Robert Hawley - Chairman Australia and New Zealand

Mr Matthew Syme - Managing Banking Group Ltd

Director 77 St Georges Terrace

Mr Scott Yelland - Executive Perth WA 6000

Director

Dr James Ross

Senor Jose Ramon Esteruelas Share Registry

Mr Sean James Australia

Computershare Investor

Services Pty Ltd

Company Secretary Level 2

Mr Clint McGhie 45 St Georges Terrace

Perth WA 6000

Telephone: +61 8 9323

Registered Office 2000

Level 9, BGC Centre Facsimile: +61 8

28 The Esplanade 9323 2033

Perth WA 6000

Australia

Telephone: +61 8 9322 6322 United Kingdom

Facsimile: +61 8 9322 6558 Computershare Investor

Services Plc

PO Box 82

Spanish Office The Pavillions

Minera de Rio Alag Bridgwater Road

Carretera de Madrid, 13 Bristol BS99 7NH

Santa Marta de Tormes Telephone: +44 870 889

37900 - Salamanca 3105

Spain

Telephone: +34 923 193903

Stock Exchange Listings

Australia

Website Australian Securities

www.berkeleyresources.com.au Exchange Limited

Home Branch - Perth

2 The Esplanade

Email Perth WA 6000

info@berkeleyresources.com.au

United Kingdom

London Stock Exchange -

Auditor AIM

Stantons International 10 Paternoster Square

Level 1 London EC4M 7LS

1 Havelock Street

West Perth WA 6005

Nominated Advisor and

Broker

RBC Capital Markets

71 Queen Victoria Street

London EC4V 4DE

ASX/AIM Code

BKY - Fully paid ordinary

shares

The Directors of Berkeley Resources Limited submit their report on the Consolidated Entity consisting of Berkeley Resources Limited

("Company" or "Berkeley" or "Parent") and the entities it controlled at the end of, or during, the year ended 30 June 2008 ("Consolidated

Entity" or "Group").

Directors

The names of Directors in office at any time during the financial year or since the end of the financial year are:

Dr Robert Hawley

Mr Matthew Syme

Mr Scott Yelland - appointed 1 February 2008

Dr James Ross

Senor Jose Ramon Esteruelas

Mr Sean James

Unless otherwise disclosed, Directors held their office from 1 July 2007 until the date of this report.

Current Directors and Officers

Robert Hawley

Non-Executive Chairman

Qualifications - CBE, DSc, FRSE, FREng, Hon FIET, FIMechEng, FInstP

Dr Hawley is based in London and has extensive technical qualifications and substantial expertise in the nuclear energy industry as well

as broader public company management. He was Chief Executive of British Energy Plc from 1995 to 1997, Chief Executive of Nuclear Electric

Plc from 1992 to 1996 and prior to this enjoyed a long career in senior engineering and management positions with CA Parsons & Co Ltd,

Northern Engineering Industries Plc and Rolls-Royce Plc. Dr Hawley has been Managing Director of CA Parsons & Co Ltd, Managing Director of

Northern Engineering Industries Plc, a Director of Rolls-Royce Plc, Chairman of Taylor Woodrow Plc, an Advisor Director of HSBC Bank Plc and

is presently a director of Colt Telecom Group Ltd, Rutland Trust Plc, Carron Acquisition Co Ltd and Lister Petter Investment Holdings Ltd.

He was awarded the CBE in 1997 for services to the Energy Industry and to Engineering.

Dr Hawley's experience in managing Nuclear Electric Plc, the largest nuclear generator in the United Kingdom, and British Energy Plc,

the United Kingdom's leading electricity supplier, gives him a unique understanding of the nuclear generation sector in Europe and he is

acknowledged as an international expert on power generation and energy.

During the three year period to the end of the financial year, Dr Hawley has held directorships in Rutland Trust Plc (September 2000 -

July 2007), Colt Telecom Group Ltd (August 1998 - present),Carron Acquisition Co Ltd (April 2006 - present) and Lister Petter Investment

Holdings Ltd (September 2006 - present).

Dr Hawley was appointed a director of Berkeley Resources Limited on 20 April 2006.

Matthew Syme

Managing Director

Qualifications * B.Com, CA

Mr Syme is a Chartered Accountant and has over 20 years' experience as a senior executive of a number of companies in the Australian

resources and media sectors. He was a Manager in a major international Chartered Accounting firm before spending 3 years as an equities

analyst in a large stockbroking firm. He was then Chief Financial Officer of Pacmin Mining Limited, a successful Australian gold mining

company, as well as a number of other resources companies.

Mr Syme was appointed a director of Berkeley Resources Limited on 27 August 2004. Mr Syme has not held any other directorships of listed

companies in the last three years.

Current Directors and Officers (continued)

Scott Yelland

Chief Operating Officer / Executive Director

Qualifications - MSc CEng FIMMM

Mr Yelland is a mining engineer with over 25 years in the mining industry and has a Masters degree in Mining Engineering from the

Camborne School of Mines. He is a Chartered Engineer and Fellow of the Institute of Mining, Mineral and Materials.

Mr Yelland's experience as a mining engineer includes senior appointments in Russia, Australia, Spain, South America and Africa. Prior

to joining Berkeley in April 2007, he was most recently COO of Highland Gold, a leading gold producer in Russia, and spent 4 years as Mines

Manager of Navan Resources in Spain.

Mr Yelland joined Berkeley in April 2007 as the Group's Chief Operating Officer and was appointed a director of Berkeley Resources

Limited on 1 February 2008. Mr Yelland has not held any other directorships of listed companies in the last three years.

James Ross

Technical Director

Qualifications - B.Sc. (Hons.),Hon.DSc (W.Aust), PhD, FAusIMM, FAICD

Dr Ross is a leading international geologist whose technical qualifications include an honours degree in Geology at UWA and a PhD in

Economic Geology from UC Berkeley. He first worked with Western Mining Corporation Limited for 25 years, where he held senior positions in

exploration, mining and research. Subsequent appointments have been at the level of Executive Director, Managing Director and Chairman in a

number of small listed companies in exploration, mining, geophysical technologies, renewable energy and timber. His considerable

international experience in exploration and mining includes South America, Africa, South East Asia and the Western Pacific.

Dr Ross is a Director of Kimberley Foundation Australia Inc, and chairs its Science Advisory Council. He also chairs the Boards of a

geoscience research centre and two foundations concerned with geoscience education in Western Australia.

He was appointed a director of Berkeley Resources Limited on 4 February 2005 and has not been a director of another listed company in

the three years prior to the end of the financial year.

Jose Ramon Esteruelas

Non-Executive Director

Senor Esteruelas is an experienced Spanish executive whose senior executive roles have included Director General of Correos y Telegrafos

(the Spanish postal service), President of Minas de Almaden y Arrayanes SA (formerly the world's largest mercury producer) and Chief

Executive Officer of Compania Espanola de Tabaco en Rama S.A., the leading tobacco transforming company in Spain.

Senor Esteruelas was appointed a Director of Berkeley Resources Limited on 16 November 2006. Senor Esteruelas has not held any other

directorships of listed companies in the last three years.

Sean James

Non-Executive Director

Qualifications - B.Sc. (Hons.)

Mr James is a mining engineer and was formerly the Managing Director of the Rossing Uranium Mine in Namibia which is the world's largest

low grade, open pit uranium mine. After 16 years at Rossing, he returned to London as a Group Mining Executive at Rio Tinto Plc in London.

Mr James' experience in managing the Rossing mine is ideally suited for the type of uranium mining operations the Company aims to

develop in the Iberian Peninsula.

Mr James was appointed a Director of Berkeley Resources Limited on 28 July 2006. Mr James has not held any other directorships of listed

companies in the last three years.

Current Directors and Officers (continued)

Mr Clint McGhie

Company Secretary

Qualifications - B.Com, CA, ACIS

Mr McGhie is a Chartered Accountant and Chartered Secretary. He commenced his career at a large international Chartered Accounting firm,

before moving to commerce in the role of financial controller and company secretary. Mr McGhie now works in the corporate office of a number

of public listed companies focussed on the resources sector.

Mr McGhie was appointed Company Secretary of Berkeley Resources Limited on 28 September 2007.

Principal Activities

The principal activities of the Consolidated Entity during the year consisted of mineral exploration. There was no significant change in

the nature of those activities.

Employees

2008 2007

The number of full time equivalent people employed by the

Consolidated Entity at balance date 29 20

Dividends

No dividends have been declared, provided for or paid in respect of the financial year ended 30 June 2008 (2007: nil).

Earnings Per Share

2008 2007

Cents Cents

Basic loss per share (6.80) (7.48)

Diluted loss per share (6.80) (7.48)

Corporate Structure

Berkeley Resources Limited is a company limited by shares that is incorporated and domiciled in Australia. The Company has prepared a

consolidated financial report including the entities it acquired and controlled during the financial year.

Consolidated Results

2008 2007

$ $

Loss of the Consolidated Entity before income tax (8,797,137) (7,430,597)

expense

Income tax expense - -

Net loss (8,797,137) (7,430,597)

Net loss attributable to minority interest 1,792,681 1,116,026

Net loss attributable to members of Berkeley (7,004,456) (6,314,571)

Resources Limited

Review of Operations AND ACTIVITIES

The year to 30 June 2008 was again a very productive year for Berkeley, with significant progress made towards our objective of becoming

a uranium producer in Spain.

Including the period subsequent to the end of the Financial Year, our achievements included:

* Our total resource base more than doubling from 11.9m lbs of U3O8 to over 26.1m lbs.

* Completion of a Scoping Study on the Salamanca I project which supported the viability of a mining operation on the Project, with

relatively low strip ratios and operating costs.

* The Salamanca I resource increased from 11.9m lbs to 16.9m lbs U3O8 and subsequent drilling will add further resources in due

course. Initial resources were calculated at Santidad, a virgin Berkeley discovery.

* The maiden resource of 9.2m lbs of U3O8 at the Gambuta Project is very encouraging, with strong potential to add further resources

in the near future.

* Completion of air surveys and other exploration work to provide a very substantial pipeline of future exploration targets.

* The Company sold a non-core asset, being its shareholding in Atlas Iron Ore Limited, realising a gain on disposal of $1,934,785.

Subsequent to the end of the Financial Year, Berkeley was chosen by the Spanish State uranium company, ENUSA, as partner to conduct a

Feasibility Study on and develop that company's uranium mining assets in Salamanca Province. The ENUSA assets include a number of State

Reserve licences which have been very extensively explored and also a uranium processing plant permitted to produce 950t pa of U3O8. More

details will be made available when a formal Agreement with ENUSA is finalised.

Berkeley will continue to work for the interests of shareholders by pursuing our core objective of mining uranium in Spain. The Company

is very well placed to capitalise on the outstanding foundations it has built to date.

The Company also continues to review other opportunities in the mining and energy sectors in Europe and elsewhere.

The net loss of the Consolidated Entity after minority interests for the year ended 30 June 2008 was $7,004,456 (2007: $6,314,571). This

loss is largely attributable to:

(i) The Consolidated Entity*s accounting policy of expensing exploration and evaluation expenditure incurred by the Consolidated

Entity subsequent to the acquisition of the rights to explore and up to the commencement of feasibility studies. During the year,

exploration expenditure totalled $8,624,391; and

(ii) The Consolidated Entity*s accounting policy of expensing the value (determined using the Binomial option pricing model) of share

options granted to Directors, employees, consultants and other advisors. The value is measured at grant date and recognised over the period

during which the option holders become unconditionally entitled to the options. During the year, non-cash share-based payment expenses

(excluding those classified as exploration costs) totalled $1,428,178 (2007: $2,357,250).

Corporate and Financial Position

The following material corporate events occurred during the year:

* On 6 August 2007, the Company issued 2,970,000 Unlisted Options to employees in accordance with the Company's Employee Option

Scheme. The options are exercisable for $1.86 each on or before 5 August 2011. Vesting conditions apply.

* On 6 September 2007 the Company announced the new discovery of uranium mineralisation at Santidad, 2km northwest of the Company's

main Retortillo deposit.

* On 30 September 2007, 2,000,000 Unlisted Options were exercised which raised approximately $0.45 million. The resulting shares

were issued on 4 October 2007.

* On 19 November 2007, the Company advised the results of an upgraded resource calculation for the flagship Salamanca I project,

including the Retortillo deposit and the new Santidad discovery.

* In January 2008, Berkeley disposed of its holding in 1,300,000 shares in Atlas Iron Limited on market. The Company received net

proceeds of $2,584,785 in consideration for these shares.

Review of Operations AND ACTIVITIES (continued)

Corporate and Financial Position (continued)

* On 1 February 2008, Mr Scott Yelland, the Company's Chief Operating Officer, was appointed a Director of the Company.

* On 5 February 2008, Berkeley presented the interpreted results of the aerial radiometric and magnetic survey flown over the

Salamanca I project.

* On 14 February 2008, the Company advised that a Scoping Study on mining at the Salamanca I project, prepared by AMC Consultants,

confirmed the potential economic viability of the project.

* On 10 April 2008, Berkeley announced the results of the first stage program of drilling at the Gambuta prospect in Caceres

Province, Spain, confirming significant shallow uranium mineralisation.

* On 30 May 2008, the Company announced the initial results of the first stage of exploration at the Ojaranzo prospect in Caceres

Province, Spain, confirming historical indications of widespread, shallow uranium mineralisation.

* On 6 June 2008, the Company announced more encouraging results from the drilling program at the Gambuta prospect in Caceres

Province, Spain.

* On 20 June 2008, the Company issued 450,000 Unlisted Options to employees in accordance with the Company's Employee Option Scheme.

The options are exercisable for $1.00 each on or before 19 June 2012. Vesting conditions apply.

* During the financial year, Berkeley increased its interest in its main Spanish operating subsidiary, Minera de Rio Alagon SL ("Rio

Alagon"), from 77.5% to 99.9%.

Business Strategies and Prospects

The Consolidated Entity currently has the following business strategies and prospects over the medium to long term:

* To conduct studies into the feasibility of mining its present assets and those to be acquired from ENUSA in Spain;

* To continue to explore its portfolio of minerals permits in Spain; and

* Continue to examine new opportunities in minerals and energy exploration and development.

Risk Management

The Board is responsible for the oversight of the Consolidated Entity's risk management and control framework. Responsibility for

control and risk management is delegated to the appropriate level of management with the Managing Director having ultimate responsibility to

the Board for the risk management and control framework.

Arrangements put in place by the Board to monitor risk management include monthly reporting to the Board in respect of operations and

the financial position of the Group.

Significant Changes in the State of Affairs

Other than as disclosed below, there were no significant changes in the state of affairs of the Consolidated Entity during the year.

* In January 2008, Berkeley disposed of its holding in 1,300,000 shares in Atlas Iron Limited on market. The Company received net

proceeds of $2,584,785 in consideration for these shares.

* During the financial year, Berkeley increased its interest in its main Spanish operating subsidiary, Minera de Rio Alagon SL ("Rio

Alagon"), from 77.5% to 99.9%.

Significant Post Balance Date Events

Since the end of the financial year, the following events have significantly affected, or may significantly affect, the operations of

the Consolidated Entity, the results of those operations, or the state of affairs of the Consolidated Entity in future financial years:

* On 16 July 2008, the Company advised that it has been chosen by ENUSA Industrias Avanzadas S.A. as that company's partner to

conduct a feasibility study upon and ultimately develop ENUSA's uranium mining assets in Salamanca Province, Spain.

* On 18 July 2008, the Company issued 287,500 Unlisted Options to employees in accordance with the Company's Employee Option Scheme.

The options are exercisable for $1.00 each on or before 19 June 2012. Vesting conditions apply. In addition, the Company advised that the

Board has agreed to issue 250,000 Unlisted Options on the same terms and conditions to Mr Scott Yelland, Chief Operating Officer and a

Director of the Company. These Incentive Options will be subject to Shareholder approval at the next general meeting of Shareholders.

* On 8 August 2008, Berkeley announced an initial inferred resource estimate of 9.23 million pounds of U3O8, at an average grade of

371ppm U3O8 (at a 200ppm cut-off), for the Gambuta uranium deposit in the Ceres Province of Spain.

Other than above, as at the date of this report there are no matters or circumstances, which have arisen since 30 June 2008 that have

significantly affected or may significantly affect:

* the operations, in financial years subsequent to 30 June 2008, of the Consolidated Entity;

* the results of those operations, in financial years subsequent to 30 June 2008, of the Consolidated Entity; or

* the state of affairs, in financial years subsequent to 30 June 2008, of the Consolidated Entity.

Environmental Regulation and Performance

The Consolidated Entity's operations are subject to various environmental laws and regulations under the relevant government's

legislation. Full compliance with these laws and regulations is regarded as a minimum standard for all operations to achieve.

Instances of environmental non-compliance by an operation are identified either by external compliance audits or inspections by relevant

government authorities.

There have been no significant known breaches by the Consolidated Entity during the financial year.

Likely Developments and Expected Results

It is the Board's current intention that the Consolidated Entity will continue with development of its Spanish uranium projects. The

Company will also continue to examine new opportunities in mineral exploration, including uranium.

All of these activities are inherently risky and the Board is unable to provide certainty that any or all of these activities will be

able to be achieved. In the opinion of the Directors, any further disclosure of information regarding likely developments in the operations

of the Consolidated Entity and the expected results of these operations in subsequent financial years may prejudice the interests of the

Company and accordingly no further information has been disclosed.

Information on Directors' Interests in Securities of Berkeley

Interest in Securities at the date of this Report

Ordinary Shares(1) $1.00 Incentive $1.86 Employee Incentive

Options(2) Options(3)

Robert Hawley - 500,000 -

Matthew Syme 2,760,100 1,000,000 -

Scott Yelland - - 1,000,000

Sean James - 250,000 -

James Ross 300,000 250,000 -

Jose Ramon Esteruelas

- 250,000 -

Interest in Securities issued/granted during the year

Ordinary Shares(1) $1.00 Incentive $1.86 Employee Incentive

Options(2) Options(3)

Robert Hawley - - -

Matthew Syme 2,000,000(4) - -

Scott Yelland - - 1,000,000

Sean James - - -

James Ross - - -

Jose Ramon Esteruelas

- - -

Notes:

* "Ordinary Shares" means fully paid ordinary shares in the capital of the Company.

* "$1.00 Incentive Options" means an option to subscribe for 1 Ordinary Share in the capital of the Company at an exercise price of

$1.00 each on or before 30 November 2008.

* "$1.86 Employee Incentive Options" means an option to subscribe for 1 Ordinary Share in the capital of the Company at an exercise

price of $1.86 each on or before 5 August 2011.

* Mr Syme has an interest in the 2,000,000 shares issued during the year following the exercise of 2,000,000 Director Incentive

Options.

Share Options

At the date of this report the following options have been issued over unissued capital:

Unlisted Options

* 10,600,000 unlisted options at an exercise price of $0.70 each that expire on 30 April 2010.

* 2,250,000 unlisted options at an exercise price of $1.00 each that expire on 30 November 2008.

* 2,280,000 unlisted options at an exercise price of $1.86 each that expire on 5 August 2011.

* 737,500 unlisted options at an exercise price of $1.00 each that expire on 19 June 2012.

These options do not entitle the holders to participate in any share issue of the Company or any other body corporate. During the

financial year, 2,000,000 shares were issued as a result of the exercise of options. Since 30 June 2008, there have been no further

exercises of options.

Meetings of Directors

The following table sets out the number of meetings of the Company's directors held during the year ended 30 June 2008, and the number

of meetings attended by each director.

Board Meetings Board Meetings

Number Number

eligible attended

to attend

Current Directors

Robert Hawley 7 7

Matthew Syme 7 7

Scott Yelland 3 3

Sean James 7 7

James Ross 7 6

Jose Ramon Esteruelas 7 7

Remuneration Report (aUDITED) (30 June 2008 Year End)

This report details the amount and nature of remuneration of each director and executive officer of the Company.

Remuneration Policy

The remuneration policy for the Group's Key Management Personnel (including the Managing Director) has been developed by the Board

taking into account:

* the size of the Group;

* the size of the management team for the Group;

* the nature and stage of development of the Group's current operations; and

* market conditions and comparable salary levels for companies of a similar size and operating in similar sectors.

In addition to considering the above general factors, the Board has also placed emphasis on the following specific issues in determining

the remuneration policy for key management personnel:

* the Company is currently focused on undertaking exploration activities with a view to expanding and developing its resources. In

line with the Company's accounting policy, all exploration expenditure prior to a feasibility study is expensed. The Company continues to

examine new business opportunities in the energy and resources sector;

* risks associated with resource companies whilst exploring and developing projects; and

* other than profit which may be generated from asset sales (if any), the Company does not expect to be undertaking profitable

operations until sometime after the successful commercialisation, production and sales of commodities from one or more of its current

projects, or the acquisition of a profitable mining operation.

Remuneration Policy for Executives

The Group's remuneration policy is to provide a fixed remuneration component and a performance based component (options and a cash

bonus, see below). The Board believes that this remuneration policy is appropriate given the considerations discussed in the section above

and is appropriate in aligning Key Management Personnel objectives with shareholder and business objectives.

Performance Based Remuneration - Incentive Options

The Board has chosen to issue incentive options to Key Management Personnel as a key component of the incentive portion of their

remuneration, in order to attract and retain the services of the Key Management Personnel and to provide an incentive linked to the

performance of the Company. The Board considers that each Key Management Personnel's experience in the resources industry will greatly

assist the Company in progressing its projects to the next stage of development and the identification of new projects. As such, the Board

believes that the number of incentive options granted to Key Management Personnel is commensurate to their value to the Company.

The Board has a policy of granting options to Key Management Personnel with exercise prices at and/or above market share price (at time

of agreement). As such, incentive options granted to Key Management Personnel will generally only be of benefit if the Key Management

Personnel perform to the level whereby the value of the Company increases sufficiently to warrant exercising the incentive options granted.

Other than service-based vesting conditions, there are no additional performance criteria on the incentive options granted to Key

Management Personnel, as given the speculative nature of the Company's activities and the small management team responsible for its running,

it is considered the performance of the Key Management Personnel and the performance and value of the Company are closely related.

Performance Based Remuneration - Cash Bonus

In addition, some Key Management Personnel are entitled to an annual cash bonus upon achieving various key performance indicators, to be

determined by the Board. On an annual basis, after consideration of performance against key performance indicators, the Board determines the

amount, if any, of the annual cash bonus to be paid to each Key Management Personnel.

Impact of Shareholder Wealth on Key Management Personnel Remuneration

The Board does not directly base remuneration levels on the Company's share price or movement in the share price over the financial

year. However, as noted above, a number of Key Management Personnel have received options which generally will only be of value should the

value of the Company's shares increase sufficiently to warrant exercising the incentive options granted.

As a result of the Company's exploration and new business activities, the Board anticipates that it will retain future earnings (if any)

and other cash resources for the operation and development of its business. Accordingly the Company does not currently have a policy with

respect to the payment of dividends, and as a result the remuneration policy does not take into account the level of dividends or other

distributions to shareholders (eg return of capital).

Remuneration Report (continued)

Remuneration Policy (continued)

Impact of Earnings on Key Management Personnel Remuneration

As discussed above, the Company is currently undertaking exploration activities, and does not expect to be undertaking profitable

operations until sometime after the successful commercialisation, production and sales of commodities from one or more of its current

projects.

Accordingly the Board does not consider current or prior year earnings when assessing remuneration of Key Management Personnel.

Remuneration Policy for Non Executive Directors

The Board policy is to remunerate Non-Executive Directors at market rates for comparable companies for time, commitment and

responsibilities. Given the current size, nature and risks of the Company, incentive options have been used to attract and retain

Non-Executive Directors. The Board determines payments to the Non-Executive Directors and reviews their remuneration annually, based on

market practice, duties and accountability. Independent external advice is sought when required.

The maximum aggregate amount of fees that can be paid to Non-Executive Directors is subject to approval by shareholders at a General

Meeting. Fees for Non-Executive Directors are not linked to the performance of the economic entity. However, to align Directors' interests

with shareholder interests, the Directors are encouraged to hold shares in the Company and Non-Executive Directors have received incentive

options in order to secure their services and as a key component of their remuneration.

General

Where required, Key Management Personnel receive superannuation contributions (or foreign equivalent), currently equal to 9% of their

salary, and do not receive any other retirement benefit. From time to time, some individuals have chosen to sacrifice part of their salary

to increase payments towards superannuation.

All remuneration paid to Key Management Personnel is valued at cost to the company and expensed. Incentive options are valued using the

Binomial option valuation methodology. The value of these incentive options is expensed over the vesting period.

Key Management Personnel Remuneration

Details of the nature and amount of each element of the remuneration of each Director and executive of the Company or Group for the

financial year are as follows:

2008 Short-Term Benefits Post Employment Share- Total Percentage

Percentage

Benefits Based of total Performance

Related

Payments remuneration

Other Non-Cash that consists

Benefits(i) of options

Salary & Fees Cash

Bonus

$ $ $ $ $ $ %

%

Directors

Robert Hawley 127,317 - - - 2,917 130,234 -

-

Matthew Syme 250,000 - 22,500 - 4,508 277,008 -

-

Scott Yelland 274,472 23,843 47,125 616,235 1,205 962,880 64.0

66.5

Sean James 45,708 - - - 6,675 52,383 -

-

James Ross 97,500 - 2,700 - 4,508 104,708 -

-

Jose Ramon Esteruelas - 84,012

-

81,095 - - 2,917 -

Executives

Shane Cranswick (ii)

- - - - - - -

-

Clint McGhie(ii) - - - - - - -

-

Notes:

(i) Other Non-Cash Benefits includes payments made for insurance premiums on behalf of the Directors, including Directors & Officers

insurance, and in some instances, working directors insurance.

(ii) Mr Cranswick provided services as the Company Secretary until 28 September 2007 when he was replaced as Company Secretary by Mr

McGhie. These services have been provided through a services agreement with Apollo Group Pty Ltd. Under the agreement, Apollo Group Pty Ltd

provides administrative, company secretarial and accounting services, and the provision of a fully serviced office to the Company for a

monthly retainer of $12,000. The monthly retainer has increased to $15,000 from 1 July 2008.

Remuneration Report (continued)

Key Management Personnel Remuneration (continued)

2007 Short-Term Benefits Post Employment Share- Total Percentage

Percentage

Benefits Based of total

Performance Related

Payments remuneration

Other Non-Cash that consists

Benefits(ii) of options

Salary & Fees Cash

Bonus

$ $ $ $ $ $ %

%

Directors

Robert Hawley 130,648 - - 298,500 4,483 433,631 68.8

68.8

Matthew Syme 250,000 - 22,500 1,273,000 8,060 1,553,560 81.9

81.9

Sean James 86,540 - - 318,250 7,402 412,192 77.2

77.2

James Ross 63,700 - 2,700 149,250 8,060 223,710 66.7

66.7

Jose Ramon Esteruelas 318,250 367,917

46,891 - - 2,776 86.5

86.5

Ian Middlemas 13,500 - - - 1,708 15,208 -

-

Executives

Scott Yelland (i) 66,952 - - - - 66,952 -

-

Shane Cranswick (iii)

- - - - - - -

-

Notes:

(i) Mr Yelland was appointed as an executive of the Company on 6 April 2007, and appointed as a Director on 1 February 2008.

(ii) Other Non-Cash Benefits includes payments made for insurance premiums on behalf of the Directors, including Directors & Officers

insurance, and in some instances, working directors insurance.

(iii) Mr Cranswick provided services as the Company Secretary through a services agreement with Apollo Group Pty Ltd. Under the

agreement, Apollo Group Pty Ltd provides administrative, company secretarial and accounting services, and the provision of a fully serviced

office to the Company for a monthly retainer of $12,000.

Options Granted to Key Management Personnel

Details of options granted to each Director and executive of the Company or Group during the financial year are as follows:

2008 Issuing entity Grant Expiry Exercise price Grant date fair No. granted No. vested

Date Date $ value

$

Director

Scott Yelland Berkeley Resources 6-Aug-07 5-Aug-11 1.86 1.121 1,000,000 -

Ltd

2007 Issuing entity Grant Expiry Exercise price Grant date fair No. granted No. vested

date date $ value

$

Directors

Robert Hawley Berkeley Resources 30-Nov-06 30-Nov-08 1.00 0.597 500,000 500,000

Ltd

Matthew Syme Berkeley Resources 21-Jun-07 30-Nov-08 1.00 1.273 1,000,000 1,000,000

Ltd

Sean James Berkeley Resources 21-Jun-07 30-Nov-08 1.00 1.273 250,000 250,000

Ltd

James Ross Berkeley Resources 30-Nov-06 30-Nov-08 1.00 0.597 250,000 250,000

Ltd

Jose Ramon Esteruelas Berkeley Resources 21-Jun-07 30-Nov-08 1.00 1.273 250,000 250,000

Ltd

Notes:

(i) For details on the valuation of the options, including models and assumptions used, please refer to Note 18 to the financial

statements.

Remuneration Report (continued)

Options Granted to Directors and Executives (continued)

Details of the value of options granted, exercised or lapsed for each Director and executive of the Company or Group during the

financial year are as follows:

2008 Value of options Value of options Value of options Total value of Value of options

Percentage of

granted during the exercised during the lapsed during the options granted, included in remuneration

for the

year year year exercised and lapsed remuneration for the

year

$ $ $ $ year that

consists

$ of

options

%

Directors

Matthew Syme - 2,930,000 - 2,930,000 -

-

Scott Yelland 1,121,000 - - 1,121,000 616,235

64.7

2007 Value of options Value of options Value of options Total value of Value of options

Percentage of

granted during the exercised during the lapsed during the options granted, included in

remuneration for the

year year year exercised and lapsed remuneration for the

year

$ $ $ $ year

that consists

$

of options

%

Directors

Robert Hawley 298,500 - - 298,500 298,500

68.8

Matthew Syme 1,273,000 920,000 - 2,193,000 1,273,000

81.9

Sean James 318,250 - - 318,250 318,250

77.2

James Ross 149,250 - - 149,250 149,250

66.7

Jose Ramon Esteruelas

318,250 - - 318,250 318,250

86.5

Notes:

(i) For details on the valuation of the options, including models and assumptions used, please refer to Note 18 to the financial

statements.

(ii) The value of options granted during the year is recognised in compensation over the vesting period of the grant, in accordance

with Australian accounting standards.

Employment Contracts with Directors and Executive Officers

Mr Matthew Syme, Managing Director, has a contract of employment with Berkeley Resources Limited dated 27 August 2004. The terms of this

contract were revised effective from 1 May 2006. The contract specifies the duties and obligations to be fulfilled by the Managing Director.

The contract has a rolling term and may be terminated by the Company by giving three months notice. No amount is payable in the event of

termination for neglect of duty or gross misconduct. Mr Syme receives a fixed remuneration component of $250,000 per annum exclusive of

superannuation. The contract also provides for the payment of a cash bonus which the Board may determine at its discretion which reflects

the contribution of Mr Syme towards the Company's achievement of its overall objectives. As at the date of this report no cash bonus has

been paid or is payable.

Following shareholder approval, on 21 June 2007 Mr Syme was granted 1,000,000 director incentive options exercisable at $1.00 each on or

before 30 November 2008 in accordance with his employment terms.

Mr Scott Yelland was appointed Chief Operating Officer of the Company on 6 April 2007 and was subsequently appointed a Director of the

Company on 1 February 2008. Mr Yelland has a letter of employment with Berkeley Resources Limited dated 27 March 2007. The letter specifies

the duties and obligations to be fulfilled by the Chief Operating Officer. The letter of employment may be terminated by either party by

giving three months notice. No amount is payable by the Company in the event of termination for neglect of duty or gross misconduct. Mr

Yelland receives a fixed remuneration component of �125,000 per annum exclusive of employer National Insurance Contributions (United

Kingdom).

Remuneration Report (continued)

Employment Contracts with Directors and Executive Officers (continued)

Prior to his appointment as a Director and in accordance with his engagement terms Mr Yelland was granted 1,000,000 options, with an

exercise price of $1.86 each, on 6 August 2007 under the Employee Option Scheme approved by shareholders on 21 June 2007. The options will

vest in 3 equal tranches every 12 months from the date of commencement and will expire on 5 August 2011.

Following his appointment as a Director, the Board has agreed to grant Mr Yelland with an additional 500,000 unlisted options with an

exercise price of $1.00 each. The options will vest in 3 equal tranches every 12 months from the date of commencement and will expire on 19

June 2012. The issue of these options is subject to shareholder approval.

Dr James Ross, Technical Director, has a letter of engagement with Berkeley Resources Limited dated 4 February 2005. The letter

specifies the duties and obligations to be fulfilled by the Technical Director. Dr Ross receives a fixed remuneration component of $30,000

per annum exclusive of superannuation. The letter also includes a consultancy arrangement which provides for a consultancy fee at the rate

of $800 per day, with a minimum of 1 day per week. The consultancy arrangement has a rolling term and may be terminated by the company by

giving 1 months notice.

Following shareholder approval, on 30 November 2006, Dr Ross was granted 250,000 director incentive options exercisable at $1.00 each on

or before 30 November 2008 in accordance with his employment terms.

Dr Robert Hawley, Non Executive Chairman, was appointed a Director of the Company on 20 April 2006. Dr Hawley has a letter of engagement

with Berkeley Resources Limited dated 19 April 2006. The letter specifies a fixed remuneration component of �55,000 per annum.

Following shareholder approval on 30 November 2006, Dr Hawley was granted 500,000 incentive options exercisable at $1.00 each on or

before 30 November 2008 in accordance with his engagement terms.

Mr Sean James, Non Executive Director, was originally appointed an Executive Director of the Company on 28 July 2006. Mr James had a

letter of employment with Berkeley Resources Limited dated 28 July 2006 and was to receive a fixed remuneration component of �100,000 per

annum exclusive of employer National Insurance Contributions (United Kingdom). On 17 November 2006, Mr James relinquished his executive

role but remained as a Non Executive Director and consultant to the Company. Mr James receives a fixed remuneration of �18,000 per annum.

The letter also includes a consultancy agreement which provides for a consultancy fee of �400 per day. The consultancy agreement has a

rolling term and may be terminated by Mr James or by the Company giving one month's notice.

Following shareholder approval on 21 June 2007, Mr James was granted 250,000 incentive options exercisable at $1.00 each on or before 30

November 2008 in accordance with his engagement terms.

Senor Jose Ramon Esteruelas, Non Executive Director, was appointed a Director of the Company on 1 November 2006. Senor Esteruelas has a

letter of employment with Berkeley Resources Limited dated 16 November 2006. Senor Esteruelas receives a fixed remuneration component of

EUR48,000 per annum. The letter also includes a consultancy agreement which provides for a consultancy fee of EUR1,000 per day. The

consultancy agreement has a rolling term and may be terminated by Senor Esteruelas or by the Company by giving one month's notice.

Following shareholder approval on 21 June 2007, Senor Esteruelas was granted 250,000 incentive options exercisable at $1.00 each on or

before 30 November 2008.

Exercise of options granted as remuneration

During the financial year ended 30 June 2008, Mr Syme was issued 2,000,000 shares following the exercise of 1,000,000 options at $0.20

per share and 1,000,000 options at $0.25 per share.

During the financial year ended 30 June 2007, Mr Syme was issued 1,000,000 shares following the exercise of 1,000,000 options at $0.15

per share.

There are no amounts unpaid on the shares issued as a result of the exercise of the options in the 2008 financial year.

AUDITORS AND OFFICERS' INDEMNITIES AND INSURANCE

Under the Constitution the Company is obliged, to the extent permitted by law, to indemnify an officer (including Directors) of the

Company against liabilities incurred by the officer in that capacity, against costs and expenses incurred by the officer in successfully

defending civil or criminal proceedings, and against any liability which arises out of conduct not involving a lack of good faith.

During the financial year, the Company has paid an insurance premium to insure Directors and officers of the Company against certain

liabilities arising out of their conduct while acting as a Director or Officer of the Company. The net premium paid was $15,790. Under the

terms and conditions of the insurance contract, the nature of liabilities insured against cannot be disclosed.

The Company has not, during or since the end of the financial year, indemnified or agreed to indemnify an auditor of the Company or of

any related body corporate against a liability incurred as such an auditor.

NON-AUDIT SERVICES

There were no non-audit services provided by the auditor (or by another person or firm on the auditor's behalf) during the financial

year.

Auditor's Independence Declaration

The auditor's independence declaration is on page 60 of the Annual Financial Report.

This report is made in accordance with a resolution of the Directors made pursuant to section 298(2) of the Corporations Act 2001.

For and on behalf of the Directors

MATTHEW SYME

Managing Director

Madrid, Spain

26 September 2008

INCOME STATEMENT

FOR THE YEAR ENDED 30 JUNE 2008

Consolidated Parent

Note 2008 2007 2008 2007

$ $ $ $

1,473,848 569,126 1,473,427 569,126

Revenue from continuing 2

operations

Other Income 2 1,934,785 998,200 1,934,785 998,200

Administration costs (1,806,818) (1,815,527) (1,806,173) (1,815,527)

Business development costs (284,498) (415,878) (284,498) (415,878)

Exploration costs (8,624,391) (4,409,268) (656,500) (2,145,752)

Other share based payments 3 (1,428,177) (2,357,250) (1,428,177) (2,357,250)

expense

Foreign exchange loss (61,886) - (62,845) -

Loss before income tax expense (8,797,137) (7,430,597) (829,981) (5,167,081)

Income tax expense 4 - - - -

Loss after income tax expense (8,797,137) (7,430,597) (829,981) (5,167,081)

Loss attributable to minority (1,792,681) (1,116,026) - -

interest

Loss attributable to members

of Berkeley Resources Limited (7,004,456) (6,314,571) (829,981) (5,167,081)

Loss after income tax expense (8,797,137) (7,430,597) (829,981) (5,167,081)

Basic loss per share (cents 22 (6.80) (7.48)

per share)

Diluted loss per share (cents 22 (6.80) (7.48)

per share)

Notes to and forming part of the Income Statement are set out on pages 22 to 58.

BALANCE SHEET

AS AT 30 JUNE 2008

Consolidated Parent

Note 2008 2007 2008 2007

ASSETS $ $ $ $

Current Assets

Cash and cash equivalents 23(b) 18,171,171 25,535,846 17,485,427 25,329,172

Trade and other receivables 5 1,289,281 327,538 121,474 19,587

Total Current Assets 19,460,452 25,863,384 17,606,901 25,348,759

Non-current Assets

Exploration expenditure 6 5,938,391 4,135,220 137,000 137,000

Property, plant and equipment 7 509,497 232,184 16,166 21,297

Trade and other receivables 8 - - 493,899 318,877

Other financial assets 9 119,228 1,802,015 14,310,715 6,993,062

Total Non-current Assets 6,567,116 6,169,419 14,957,780 7,470,236

TOTAL ASSETS 26,027,568 32,032,803 32,564,681 32,818,995

LIABILITIES

Current Liabilities

Trade and other payables 10 978,010 642,182 170,941 336,358

Provisions 11 44,295 34,432 44,295 34,432

Total Current Liabilities 1,022,305 676,614 215,236 370,790

TOTAL LIABILITIES 1,022,305 676,614 215,236 370,790

NET ASSETS 25,005,263 31,356,189 32,349,445 32,448,205

EQUITY

Equity attributable to equity

holders of the Company

Issued capital 12 41,444,842 40,560,013 41,444,842 40,560,013

Reserves 13 4,449,269 4,604,619 4,472,973 4,626,581

Accumulated losses 14 (20,890,335) (13,885,879) (13,568,370) (12,738,389)

Parent Interests 25,003,776 31,278,753 32,349,445 32,448,205

Minority Interests 15 1,487 77,436 - -

TOTAL EQUITY 25,005,263 31,356,189 32,349,445 32,448,205

Notes to and forming part of the Balance Sheet are set out on pages 22 to 58.

CASH FLOW STATEMENT

FOR THE YEAR ENDED 30 JUNE 2008

Consolidated Parent

Note 2008 2007 2008 2007

$ $ $ $

Cash flows from operating

activities

Payments to suppliers and (11,045,850) (6,592,292) (2,890,739) (4,348,536)

employees

Interest received 1,364,784 569,126 1,364,363 569,126

Net cash inflow/(outflow) from

operating activities

23(a) (9,681,066) (6,023,166) (1,526,376) (3,779,410)

Cash flows from investing

activities

Proceeds from sale of - 348,200 - 348,200

exploration projects

Payments for exploration (78,313) (156,567) - -

Payment for investment in - - (8,846,230) (1,998,612)

related entity

Security bond deposit (110,730) - - -

Amounts advanced to related - - (491,722) (320,094)

parties

Proceeds on sale of investment 2,584,784 - 2,584,783 -

Payments for property, plant (458,755) (141,036) (11,244) (21,877)

and equipment

Net cash inflow/(outflow) from investing (1,992,383)

activities 1,936,986 50,597 (6,764,413)

Cash flows from financing

activities

Proceeds from issue of shares 450,000 26,667,275 450,000 26,667,275

Transaction costs from issue (2,956) (1,410,701) (2,956) (1,410,701)

of shares and options

Net cash inflow from financing 447,044 25,256,574 447,044 25,256,574

activities

Net increase/(decrease) in

cash and cash equivalents held (7,297,036) 19,284,005 (7,843,745) 19,484,781

Cash and cash equivalents at

the beginning of the financial

year 25,535,846 6,295,162 25,329,172 5,844,391

Effects of exchange rate (67,639) (43,321) - -

changes

Cash and cash equivalents at

the end of the financial year

23(b) 18,171,171 25,535,846 17,485,427 25,329,172

Notes to and forming part of the Cash Flow Statement are set out on pages 22 to 58.

STATEMENT OF CHANGES IN EQUITY

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2008

CONSOLIDATED

Note

Attributable to equity holder of the parent Minority Total equity

IssuedCapital $ Option Premium Reserve $ ForeignCurrencyTranslation Reserve$ Net Unrealised

Gains Reserve$ Accumulated Losses $ Total $ Interest $ $

As at 1 July 2006 14,258,232 2,170,538 -

- (7,571,308) 8,857,462 321,421 9,178,883

Net loss for the period - - -

- (6,314,571) (6,314,571) (1,116,026) (7,430,597)

Total recognised income and - - -

- (6,314,571) (6,314,571) (1,116,026) (7,430,597)

expense

Issue of shares 23,125,000 - -

- - 23,125,000 - 23,125,000

Exchange differences arising - - (21,962)

- - (21,962) (21,358) (43,320)

on translation of foreign

operations

Net unrealised gain on held - - -

1,144,000 - 1,144,000 - 1,144,000

for sale financial assets

Step up acquisition of - - -

- - - 893,399 893,399

minority interest

Exercise of options 4,587,482 (1,045,207) -

- - 3,542,275 - 3,542,275

Cost of share based payments - 2,357,250 -

- - 2,357,250 - 2,357,250

Share issue costs (1,410,701) - -

- - (1,410,701) - (1,410,701)

Amounts recognised directly in 26,301,781 1,312,043 (21,962)

1,144,000 - 28,735,862 872,041 29,607,903

equity

As at 30 June 2007 40,560,013 3,482,581 (21,962)

1,144,000 (13,885,879) 31,278,753 77,436 31,356,189

As at 1 July 2007 40,560,013 3,482,581 (21,962) 1,144,000

(13,885,879) 31,278,753 77,436 31,356,189

Net loss for the period - - - -

(7,004,456) (7,004,456) (1,792,681) (8,797,137)

Total recognised income and - - - -

(7,004,456) (7,004,456) (1,792,681) (8,797,137)

expense

Exchange differences arising - - (1,742) -

- (1,742) (227) (1,969)

on translation of foreign

operations

Net unrealised gain on held - - - 1,326,000

- 1,326,000 - 1,326,000

for sale financial assets

Net realised gain on held for 2(b) - - - (2,470,000)

- (2,470,000) - (2,470,000)

sale financial assets

Step up acquisition of - - - -

- - 1,716,959 1,716,959

minority interest

Exercise of options 887,000 (437,000) - -

- 450,000 - 450,000

Expiry of options 785 (785) - -

- - - -

Cost of share based -(2,956) 1,428,177- -- --

-- 1,428,177(2,956) -- 1,428,177(2,956)

paymentsShare issue costs

Amounts recognised directly in 884,829 990,392 (1,742) (1,144,000)

- 729,479 1,716,732 2,446,211

equity

As at 30 June 2008 41,444,842 4,472,973 (23,704) -

(20,890,335) 25,003,776 1,487 25,005,263

Notes to and forming part of the Statement of Changes in Equity are set out on pages 22 to 58.

STATEMENT OF CHANGES IN EQUITY

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2008

PARENT

Note Issued Option Premium Net Unrealised Gains Accumulated Losses Total

Capital Reserve Reserve Equit

$ y

$

$

$

$

Balance at 1 July 2006 14,258,232 2,170,538 - (7,571,308) 8,857,462

Issue of shares 23,125,000 - - - 23,125,000

Net unrealised gain on held

for sale financial assets - - 1,144,000 - 1,144,000

Exercise of options 4,587,482 (1,045,207) - - 3,542,275

Cost of share based payments - 2,357,250 - - 2,357,250

Share issue costs (1,410,701) - - - (1,410,701)

Amounts recognised directly in 26,301,781 1,312,043 1,144,000 - 28,757,824

equity

Net loss for the year - - - (5,167,081) (5,167,081)

Total recognised income and - - - (5,167,081) (5,167,081)

expense

Balance at 30 June 2007 40,560,013 3,482,581 1,144,000 (12,738,389) 32,448,205

Balance at 1 July 2007 40,560,013 3,482,581 1,144,000 (12,738,389) 32,448,205

Exercise of options 887,000 (437,000) - - 450,000

Expiry of options 785 (785) - - -

Cost of share based payments - 1,428,177 - - 1,428,177

Net unrealised gain on held

for sale financial assets - - 1,326,000 - 1,326,000

Net realised gain on held for

sale financial assets 2(b) - - (2,470,000) - (2,470,000)

Share issue costs (2,956) - - - (2,956)

Amounts recognised directly in 884,829 990,392 (1,144,000) - 731,221

equity

Net loss for the year - - - (829,981) (829,981)

Total recognised income and - - - (829,981) (829,981)

expense

Balance at 30 June 2008 41,444,842 4,472,973 - (13,568,370) 32,349,445

Notes to and forming part of the Statement of Changes in Equity are set out on pages 22 to 58.

tHE fOLLOWING SECTIONS ARE AVAILABLE in the full version of THE ANNUAL FINANCIAL REPORT ON bERKELEY RESOURCES LIMITED'S WEBSITE:

www.berkeleyresources.com.au

* NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

* DIRECTORS' DECLARATION

* auditor's independence declaration

* INDEPENDENT AUDIT REPORT

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UKSBRWURKURR

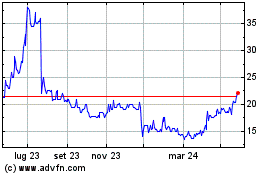

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Set 2024 a Ott 2024

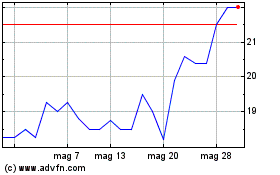

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Ott 2023 a Ott 2024