TIDMBKY

RNS Number : 4454D

Berkeley Resources Limited

02 December 2009

2 December 2009

BERKELEY RESOURCES LIMITED

Scoping Study confirms outstanding potential of the

Salamanca Uranium Project

Berkeley Resources Limited ("Berkeley") is pleased to announce that the Scoping

Study undertaken by the Company on its Salamanca Uranium Project has strongly

demonstrated the technical and economic viability of the Project.

Cash operating costs under the various scenarios in the Study ranged from

US$26.15 - $29.65 per lb of U3O8 produced over the life of the Project,

including a very high standard of rehabilitation.

Capital costs to re-commission the Quercus plant - fully loaded with a 20%

contingency and based on all new equipment - range from US$51.3m for the heap

leach scenarios, to US$88.9m for the tank leach scenarios.

The Study is based on mining a number of deposits within the ENUSA State

Reserves, which collectively have exploration targets ranging from 28.0Mt-34.1Mt

of ore at grades of 440-540 ppm of U3O8, as well as the Company's JORC resources

in the area of 15.9m lbs.

Drilling intended to bring the ENUSA deposits into accordance with the JORC Code

is underway, with a revised JORC statement expected in the New Year.

Mining is relatively simple, shallow open pit mining with drill, blast, load and

haul undertaken by local contractors. The average strip ratio for the various

pits included in the Study ranges from 2.4:1 when including the Retortillo and

Santidad deposits, or 1.9:1 without.

Processing options included a range of heap and tank leaching scenarios

utilising ENUSA's Quercus processing plant, currently on care and maintenance

and which Berkeley can lease under the ENUSA Co-operation Agreement.

The Project is already served by all necessary major infrastructure

requirements.

In order to allow comparison of the alternative scenarios, the Study assumed a

uranium price of US$55/lb and production of 2.1m lbs pa of U3O8 over the Project

life, effectively the permitted capacity of the Quercus Plant. Based on our

current understanding, future modeling will also consider potential to increase

the permitted capacity of the plant in order to optimize early cashflows. The

Project could ultimately produce for over 20 years, including feed from

Retortillo and more distant or subsequent resources.

The Study has reviewed the environmental, permitting and social considerations

for the Project and no substantial impediments have emerged. Discussions with

various authorities indicate strong support for the Project at a local level.

Permitting timelines indicate that Berkeley's objectives to re-commission

production by 2012 are achievable.

Berkeley always aims at world's best practice for environmental management and

rehabilitation. The Scoping Study assumes, inter alia, that all mining voids

will be double lined, backfilled and rehabilitated.

The Company is now proceeding with the full feasibility study on the Project,

which is due to be completed by November 2010. A fundamental part of the study

is the ongoing metallurgical testwork, designed to determine the optimum process

route for the various deposits, and particularly the suitability of heap

leaching. The Scoping Study highlights that the economic outcomes are very

positive under all potential processing scenarios, but does not definitively

favour any particular alternative.

The Study was prepared with substantial input from AMC Consultants, Aker

Solutions, Kappes Cassiday, Golder Associates and Ingemisa SA. These firms are

likely to be key advisers in the balance of the feasibility study process, under

the guidance of Berkeley's newly appointed MD and CEO, Mr Ian Stalker.

Enquiries - Managing Director: Ian Stalker Tel: +27 824 553 442

RBC Capital Markets: Martin Eales Tel: +44 20 7029 7881

NOTE - The ENUSA deposits have been extensively explored by ENUSA but are not

classed as mineral resources. The quantity and grade of Berkeley's exploration

targets for the ENUSA deposits are conceptual in nature and based on a review of

the available data on the projects to date. As there has been insufficient

exploration to estimate a Mineral Resource in accordance with the JORC Code, it

is uncertain whether further exploration will result in the determination of a

Mineral Resource.

INTRODUCTION

Berkeley's Salamanca Uranium Project is located in Salamanca Province, Spain,

approximately 250km west of Madrid, near the Portugese border.

The Project comprises a number of State Reserve licences and the Quercus uranium

processing plant, presently owned by ENUSA Industrias Avanzadas SA (ENUSA), the

Spanish state uranium company, as well as Berkeley's own extensive tenement

holdings in the area.

Berkeley has agreed to acquire a 90% interest in the ENUSA assets after

completion of a feasibility study on the project. Berkeley will pay ENUSA EUR20m

and a royalty as well as leasing the Quercus plant. For further details of the

Co-operation Agreement, please see the Berkeley announcement dated 10 December

2008.

Under the Agreement, the feasibility study is scheduled to be completed by

November 2010. The Scoping Study is intended to review the ENUSA information

pertaining to the historic exploration and operations on the State Reserves and

to assess the various processing options and the Project's potential viability.

SCOPING STUDY SCENARIOS

The Salamanca Uranium Project Scoping Study considers 4 different scenarios,

with a view to firstly, verify the potential value of the ENUSA assets and

secondly, to compare the likely processing alternatives.

The first 3 scenarios consider mining only the Mina D, Sageras and Alameda South

deposits and then 3 different processing alternatives:

1. Tank leaching all ore produced at the Quercus plant, with ore from Alameda South

trucked to the Quercus plant on a purpose built haul road,

2. Tank leaching all ore produced at the Quercus plant, with ore from Alameda South

transported to the Quercus plant on a purpose built conveyor belt,

3. Heap leaching all ore produced and transporting pregnant solution to the Quercus

plant for processing, extraction and packaging.

The fourth scenario also considers mining and heap leaching Berkeley's more

distant Retortillo and Santidad deposits.

4. Heap leaching Mina D, Sageras, Alameda South, Retortillo and Santidad and

processing solution at the Quercus plant.

A fifth alternative, which considered a hybrid process of tank leaching the high

grade ore and heap leaching the low grade ore, was disregarded as too expensive.

RESOURCES AND EXPLORATION TARGETS

There are a number of known uranium deposits which make up the Project. The

Retortillo and Santidad deposits are wholly owned by Berkeley and the remainder

of the deposits are on ENUSA's State Reserve licences.

The ENUSA deposits have been extensively explored in the past, however they do

not presently contain any JORC resources. Berkeley is currently undertaking a

campaign of confirmation drilling, one of the objectives of which is to verify

the historical data and enable the estimation of Mineral Resources in accordance

with the JORC Code. A revised statement of JORC compliant resources is expected

to be available early in 2010.

As described in Berkeley's Stock Exchange announcements of 10 December 2008 and

subsequently, there is a very extensive database of historic exploration

available for the ENUSA deposits. In simple terms, the Mina D and Sageras

deposits have been drilled on a 10m x 10m pattern by ENUSA and the Zona M and

Alameda deposits have been drilled on at least a 50m x 50m drilling pattern (in

some areas, effectively 35m x 35m).

ENUSA (and in some cases, its consultants) have also generated a range of block

models and polygonal estimates for the various deposits. Based on these models -

with remodeling where appropriate to correct anomalies in the data or add

subsequent data - Berkeley has generated a number of exploration targets as

previously disclosed.

AMC Consultants have also reviewed these models.

The exploration targets and Berkeley's own JORC compliant resources which were

considered in the Scoping Study are (all at 200ppm cutoff):

Table 1ENUSA Deposit Exploration Targets

+---------------+------------+------------+

| Deposit | Ore | U3O8 |

+---------------+------------+------------+

| | (Mt) | (ppm) |

+---------------+------------+------------+

| Sageras* | 7.5 - 9.0 | 340 - 420 |

+---------------+------------+------------+

| Zona M* | 1.8 - 2.2 | 430 - 530 |

+---------------+------------+------------+

| Total Sageras |9.3 - 11.2 | 360 - 440 |

+---------------+------------+------------+

| Mina D | 4.0 - 5.0 | 440 - 540 |

+---------------+------------+------------+

| Alameda South | 14.7 - | 495 - 605 |

| | 17.9 | |

+---------------+------------+------------+

| Total ENUSA | 28.0 - | 440 - 540 |

| | 34.1 | |

+---------------+------------+------------+

* The Sageras and Zona M deposits form part of a continuous body of mineralisation

collectively referred to as Sageras.

NOTE - The ENUSA State Reserve deposits have been extensively explored by ENUSA

but are not classed as mineral resources. The quantity and grade of Berkeley's

exploration targets are conceptual in nature and based on a review of the

available data on the projects to date. As there has been insufficient

exploration to estimate a Mineral Resource in accordance with the JORC Code, it

is uncertain whether further exploration will result in the determination of a

Mineral Resource. Table 2 Berkeley JORC Inferred Resources Salamanca Uranium

Project

+----------------------+----------+--------+----------+

| | Ore | U3O8 | U3O8 |

| | (Mt) | (ppm) | Mlb |

+----------------------+----------+--------+----------+

| Retortillo | 9.6 | 615 | 13.0 |

+----------------------+----------+--------+----------+

| Santidad | 3.4 | 382 | 2.9 |

+----------------------+----------+--------+----------+

| TOTAL | 13.0 | 555 | 15.9 |

+----------------------+----------+--------+----------+

Note that there are a number of other deposits in the Salamanca area defined by

both Berkeley and ENUSA that are not included in the JORC inferred resources

exploration targets used for the Scoping Study. The total exploration targets

on the ENUSA State Reserves range from 41.5-48.5Mt at grades ranging from

430-500ppm of U3O8, as previously disclosed.

Berkeley's Gambuta project in the Caceres region approximately 200km to the

south of the Salamanca Uranium Project also has a JORC inferred resource of 9.2m

lbs of U3O8 in a similar shallow sediment hosted deposit. This deposit could

also conceivably constitute a stand alone heap leach operation supplying

pregnant resin or solution to the Salamanca Uranium Project however, the Scoping

Study does not consider this option.

The Scoping Study also makes a preliminary assessment of exploration potential

in the Project area, concluding that there are a number of potential extensions

of existing deposits and high quality brownfields exploration targets which

offer a high probability of increasing the Project resources in the short term.

NOTE - The ENUSA State Reserve deposits have been extensively explored by ENUSA

but are not classed as mineral resources. The quantity and grade of Berkeley's

exploration targets are conceptual in nature and based on a review of the

available data on the projects to date. As there has been insufficient

exploration to estimate a Mineral Resource in accordance with the JORC Code, it

is uncertain whether further exploration will result in the determination of a

Mineral Resource. MINING

Pit optimizations were carried out using Whittle 4D implementation of the Lerchs

Grossman algorithm and optimization shells were selected as a basis of the

schedules developed and were based on a uranium price of $55/lb U308 and

preliminary cost estimates from three major Spanish mining contractors. The

proposals were based on the following scope of works:

· The mining and processing operations are based on working 350 days per year

and 24 hours per day.

·The contractor to supply mining equipment, consumables, explosives and

accessories and labour to complete the following works:

* Drilling & Blasting

* Mining at the rate of 20,000tpd (ore and waste).

* Loading & Transportation of ore and waste

* Maintenance and Dewatering of the open pits

* Re-handling material for .rehabilitation

* Transportation of ore & waste over 2km. (i.e. Alameda)

The provisional rates used for the optimizations were $1.50/t for waste and

$1.70/t for ore.

At this stage no geotechnical work has been completed by Berkeley, and based on

the historical ENUSA open pits an overall slope angle of 45 degrees has been

applied. All of the pits are relatively shallow (<100m from surface) and

therefore the overall slope angle is less significant than it would be for a

deeper pit.

The average strip ratios (t:t) generated from the optimizations for the tank

leach option was 2.2:1 for Alameda, Sageras and Mina D and 1.9:1 for the heap

leach options

Within the mining and processing constraints, each option has been scheduled to

maximise recovered uranium, up to the licensed level of 950 tonnes per annum.

After an initial ramp up, 950 tonnes per annum is achievable for a number of

years until the grade of the ore available falls and with it the tonnage of

recovered uranium.

To reduce waste rehandle under each option, backfilling of waste will be

conducted throughout the mine's life, although the majority of backfilling is

scheduled after the productive years.

For each schedule total tonnes moved include the following material: ore and

waste mined ROM rehandle, rejects reclaim, and backfill.

The schedules for Option 1 (trucking Alameda ore) and Option 2 (conveying

Alameda ore) are the same, in which the processing rate is 2.1 Mt/annum ROM ore.

The ROM tonnage mined was limited to around 2.2 Mt/annum. After an initial ramp

up in the total tonnes moved and a peak in Year 3 at over 15.6 Mt, the rate

remains flat at 11 Mt/annum.

In Option 4, after an initial ramp up in the total tonnes moved and a peak in

Year 3 at over 15.9 Mt, the rate is flattened at 11 Mt/annum. When waste removal

and production begins at Retortillo and Santidad, the total tonnes moved per

annum is increased to 17 Mt/annum for three years and then dropped to 14

Mt/annum.

PROCESSING

The four mining and processing scenarios were optimised, scheduled, and costed

by AMC, based on work prepared by Aker Solutions, Kappes Cassiday and Berkeley.

The Retortillo and Santidad deposits are 25km from the Quercus plant, and the

option to transport ore from these deposits to the plant for tank leach

processing is not considered to be viable at this time.

To provide a direct comparison between tank leaching and heap leaching outcomes,

only the Mina D, Sageras, and Alameda deposits were considered in Options 1, 2

and 3.

For the tank leach cases - Options 1 and 2 - two alternative methods of ore,

tails, and rejects transport from and to Alameda were evaluated to determine the

most cost effective option.

Subsequently an additional heap leach scenario - Option 4 - was prepared,

including the Berkeley deposits at Retortillo and Santidad, in order to

demonstrate the additional potential of these deposits.

The tank leach and heap leach metal recoveries were assumed to be 90.7% and 80%

respectively. The tank leach estimate is based on historical ENUSA Quercus Plant

tank leach recoveries of 92%, adjusted for soluble uranium losses of 2%.

The heap leach recovery estimate is based on bottle roll and column leach

testwork for Retortillo samples, which gave recoveries above 90%. Further

testwork will incorporate the use of a reusable (on/off) single 6m high leach

pad, the possible addition of Ferric Sulphate, which has been identified as an

oxidant to increase the rate of uranium mineral dissolution and the use of acid

dosing and agglomeration. Testwork on the Retortillo samples suggested that the

overall benefits of acid agglomeration are important for near surface ores, the

high fines content requires a positive agglomerating action to ensure that the

fines migration during stacking and leaching do not reduce the heap

permeability.

Radiometric sorting has been included in all options based on the radiometric

testing that was carried out on samples from the Retortillo deposit. The sorting

facility will handle up to 40% of the mined output. The feed will be coarse

screen oversize, predominantly +80mm. This will have a lower grade than finer

particles. The sorting plant will be tuned to reject at least 50% of its feed

material; this represents 20% of the ROM output. The uranium loss in this coarse

reject has been projected to be 2% of the total uranium delivered from the mine.

The processing options are essentially based on the historical processes used by

ENUSA - for both tank and heap leaching. Both processes are conventional

sulfuric acid leach with MnO2 as an oxidant and solvent extraction using

kerosene, Alamine and iso-decanol. Historic performance and Berkeley's testwork

indicate acid consumption of approximately 22kg/t ore for tank leaching and

16kg/t for heap leaching.

The key elements of both processes are:

Tank Leach Option

* Primary crushing and stockpile

* 3-Stage fine crushing and screening

* Radiometric ore sorting of +80mm material

* Rod milling - P80 0.7mm

* Tank leach

* Cyclone classification

* CCD washing of slimes

* Horizontal belt filter washing of sands

* Pregnant solution clarification

* Solvent extraction

* Yellowcake precipitation, drying and drumming

Heap Leach Option

* Primary crushing and stockpile

* 2-Stage fine crushing and screening

* Radiometric ore sorting of +80mm material

* Heap leach of minus 12mm ore

* Pregnant solution clarification

* Solvent extraction

* Yellowcake precipitation, drying and drumming

All necessary plant is available for both processes, with the exception of the

crushing and milling circuits, radiometric sorting facility and belt filtering,

which are included in the capital cost estimates below. It is uncertain whether

the existing heap leach facility is the best option for future use and the

capital cost also assumes a new facility.

The existing plant has been inspected by Aker Solutions and other consultants

and is in a good state of repair, with limited capital required to bring it back

to operable condition.

The Project area is accessed by a major highway from Madrid. Electrical power is

available and connected from the national grid to the Quercus site and raw water

is available from the river adjacent to the mine site.

CAPITAL COSTS

In the case of tank leaching, the capital cost to refurbish and re-commission

the Quercus plant is estimated at US$88.8m.

Table 3 - Capital Cost Estimates for Tank Leach Classified by Plant Area

+----------------------------------------------------+--------------+

| Plant Area |Capital Cost |

| | (US$m) |

+----------------------------------------------------+--------------+

| Crushing | 21.18 |

+----------------------------------------------------+--------------+

| Ore Sorting | 6.56 |

+----------------------------------------------------+--------------+

| Milling, Tank Leach, & Belt Filtration | 38.14 |

+----------------------------------------------------+--------------+

| Refurbishment of Existing Process Plant excluding | 8.17 |

| CCD circuit & Refurbishment of Existing | |

| Clarification, SX and Product Recovery | |

+----------------------------------------------------+--------------+

| Laboratory | 1.07 |

+----------------------------------------------------+--------------+

| SX Organic Inventory | 0.60 |

+----------------------------------------------------+--------------+

| Contingency | 13.17 |

+----------------------------------------------------+--------------+

| Total | 88.88 |

+----------------------------------------------------+--------------+

Potential additional capital costs for transporting ore from Alameda to the

Quercus plant are estimated at approximately US$3m for a dedicated haul road or

approximately US$50m for a conveyor belt system.

In the case of heap leaching, the capital cost to refurbish the existing Quercus

plant final processing stage infrastructure and to build a heap leach facility

for Mina D and Sageras is $51.28M.

Table 4 - Capital Cost Estimates for Heap Leach Classified by Plant Area

+--------------------------------------------------+---------------+

| Plant Area | Capital Cost |

| | (US$m) |

+--------------------------------------------------+---------------+

| Crushing | 15.15 |

+--------------------------------------------------+---------------+

| Ore Sorting | 6.56 |

+--------------------------------------------------+---------------+

| Heap Leach | 16.40 |

+--------------------------------------------------+---------------+

| Refurbishment of Existing Clarification, SX and | 4.55 |

| Product Recovery | |

+--------------------------------------------------+---------------+

| Laboratory | 1.07 |

+--------------------------------------------------+---------------+

| SX Organic Inventory | 0.60 |

+--------------------------------------------------+---------------+

| Contingency | 6.96 |

+--------------------------------------------------+---------------+

| Total | 51.28 |

+--------------------------------------------------+---------------+

OPERATING COSTS

Operating costs have been calculated for the heap and tank leach options and

range from $26 - $30 per lb of U308 produced over the life of mine.

The processing operating cost estimates have been provided by Aker Solutions and

Kappes Cassidy and take into consideration the scope of work associated with the

complete Process Plant, excluding General and Administration costs.

All of the process options operate on a 7 day a week, 3 shift per day basis,

with the exception of the product recovery which has been assumed to operate on

a day shift only, 5 days per week.

Mining cost estimates have been based on proposals from three Spanish mining

contractors.

Rehabilitation and closure costs of $1.00/t material mined have been used and

include:

* Transportation of tailings and waste to lined mining pits

* Waste backfill

* Rehabilitation & Reclamation

* Closure costs and monitoring

Table 5 - Operating Costs for Tank Leaching Options

+--------------------------------+-----------------------------+

| Cost Area | Operating Cost |

+--------------------------------+-----------------------------+

| Waste Mining | $1.50/t waste |

+--------------------------------+-----------------------------+

| Ore Mining | $1.70/t ore |

+--------------------------------+-----------------------------+

| Alameda Conveyor | $1.40/t Alameda ore |

+--------------------------------+-----------------------------+

| Alameda Trucks | $3.25/t Alameda ore |

+--------------------------------+-----------------------------+

| Processing | $10.4/t ore |

+--------------------------------+-----------------------------+

| Lease of Quercus Plant | 2.5% of Revenue |

+--------------------------------+-----------------------------+

| Rehabilitation Allowance | $1.00/t material mined |

+--------------------------------+-----------------------------+

| Additional Alameda Tails | $0.50/t Alameda ore |

| Disposal | |

+--------------------------------+-----------------------------+

| General and Administration | $3M/productive year, |

| | $1.5M/non-productive year |

+--------------------------------+-----------------------------+

| Royalty | 2.5% of Revenue |

+--------------------------------+-----------------------------+

Operating costs for the heap leach option are tabulated below and includes an

additional $1.00/t ore mined for the processing and transportation of a loaded

resin to the Quercus Plant.

Table 6 - Operating Costs for Heap Leaching Options

+---------------------------------+----------------------------+

| Cost Area | Operating Cost |

+---------------------------------+----------------------------+

| Waste Mining | $1.50/t waste |

+---------------------------------+----------------------------+

| Ore Mining | $1.70/t ore |

+---------------------------------+----------------------------+

| Processing | $9.8/t ore |

+---------------------------------+----------------------------+

| Additional Alameda & | $1.00/t remote site ore |

| Retortillo/Santidad processing | |

| & resin transport cost | |

+---------------------------------+----------------------------+

| Lease of Quercus Plant | 2.5% of Revenue |

+---------------------------------+----------------------------+

| Rehabilitation Allowance | $0.50/t ore mined & |

| | $1.00/t waste mined |

+---------------------------------+----------------------------+

| General and Administration | $3M/productive year, |

| | $1.5M/non-productive year |

+---------------------------------+----------------------------+

| Royalty | 2.5% of Revenue |

+---------------------------------+----------------------------+

ENVIRONMENTAL, PERMITTING AND SOCIAL

Golder Associates (Golder) have reviewed the environmental, social and

permitting aspects of the project. The landscape of the area is characteristic

of the Mediterranean climate, with dry farming areas and pastures with

occasional holm oak trees in a relatively undulating, 700 to 800 m.a.s.l.

relief. The River Agueda and its tributaries run through the area and no

significant groundwater aquifers are reported. Average annual rainfall is 490mm

The land is typically used for dry agriculture and animal breeding. Six local

communities are demographically dispersed and have been in recession for

decades. Beyond the environmental protection schemes, private hunting and

livestock trails, land use planning is nominal and industrial activities are

widely related to a long mining tradition.

The primary identified environmental restrictions are related to the Special

Protection Areas for birds and the rehabilitation requirements associated with

mining, nuclear, and environmental legislation. Waste management and the

solutions for waste disposal (including tailings and ripios), operational

management and long term aftercare have been identified as essential for closure

and abandonment planning.

The actual permitting requirements and processes for the Project will depend on

a number of factors which are as yet undecided - such as the processing route

chosen, heap leaching components and locations thereof, mining scheduling,

transport options and variations to the plant and historical process.

As a general principle, the more the processing route varies from the historical

processing route, the greater will be the permitting requirements and the longer

the permitting process. Berkeley has initiated discussions with the relevant

authorities to begin consideration of potential mining of the Project.

Based on Berkeley's current understanding and expectations, the Company aims to

be in production in FY 2012.

The ENUSA State Reserves are administered as Exploitation Licences under Spanish

Mining Law and Berkeley's Retortillo and Santidad deposits are within an

Exploration Licence, which is yet to be converted to an Exploitation Licence.

Each proposed mining pit will require a Mining Exploitation Permit. Mining was

already undertaken at Mina D and the Mina D pits already have a 30 year Permit

granted in 1992, authorizing production of 3.3mtpa. A revised mining plan for

Mina D will be submitted to the Ministry of Industry and updated waste

management, restoration and closure and monitoring plans and an

updated Environmental Impact Assessment will be submitted to the Salamanca

Environmental Agency, along with a Radiological Safety Study to the Nuclear

Safety Council (the main nuclear safety authority in Spain). This process is

estimated to take 12-18 months depending on the process route chosen.

The permitting process for the other pits is essentially the same, however the

Permit applications and process will be more comprehensive in the absence of a

previous Permit (as exists for Mina D) and is estimated to take 18-24 months for

each deposit. The more distant deposits will also require a permit for

transportation of ore or pregnant solution to the Quercus plant, however those

deposits will also require extensive in-fill drilling and so are not scheduled

to supply feed for at least 4-5 years.

In all cases - and in the project cost estimates - Berkeley has assumed that all

mining voids will be double lined and backfilled with waste and tailings, or

ripios from the heap leach facility, before contouring, topdressing and

replanting.

The Quercus plant has an existing licence to produce 950tpa and is currently on

a "stand by" basis until a decision is reached to either restart or dismantle

the plant. In order to re-commission the Quercus Plant on the same basis as it

was historically used, an application to the Ministry of Industry is required,

including engineering design work, radiological safety study, HSE and industrial

studies and restoration and closure plans. If used in its current condition,

re-permitting is estimated to take approximately 12 months. If there are

substantial changes to the plant (for example installation of belt filtering)

further information will be required by the Nuclear Safety Council and the

process is estimated to take up to 24 months.

Based on the processing alternatives considered in the Scoping Study, there are

no substantial legislative, environmental or social impediments to the Salamanca

Uranium Project. While the environmental standards are high, the permitting

process is clear and well understood, given the uranium mining and processing

history in the region. Local support to date is positive and the Project could

have a substantial positive impact on the economy and employment in a region

with limited alternative industry.

FEASIBILITY STUDY

Berkeley will now proceed with a full feasibility study for the Salamanca

Uranium Project. The initial focus of the Study will be an ongoing suite of

metallurgical testwork designed to provide a basis for choosing the most

appropriate process routes for the various deposits.

Parallel with that work, Berkeley will progress its exploration programs with a

view to:

* bringing the exploration targets (or part thereof) into accordance with the JORC

code

* providing additional infill drilling data to upgrade the resources; and

* testing initial target areas for potential additional resources.

The feasibility study will also deal with the environmental, social and

permitting elements of the Project on a more comprehensive basis, as the

implications of the processing decisions become clearer.

Under the Co-operation Agreement, Berkeley is obliged to complete the

feasibility study by late November 2010, or opt to extend the study by 12

months. Berkeley's current plan is to meet the earlier timetable.

CONSULTANTS

The Scoping Study has been completed using a number of external consultants for

the various disciplines as follows:

* Study Management AMC Consultants (UK) Ltd

* Geology and Resource Estimation: Berkeley Resources internal studies

* Review of Resources: AMC Consultants (UK) Ltd

* Heap Leach Processing: Kappes, Cassiday & Associates Australia

* Tank Leach Processing: Aker Solutions

* Mining: AMC Consultants (UK) Ltd

* Environment and Permitting: Golder Associates

* Operating Cost Estimation: Berkeley Resources/Aker Solutions

* Capital Cost Estimation Berkeley/Aker Solutions/Kappes Cassiday

* Radiological protection: Ingemisa SA

A number of these consultants are likely to be involved in the ongoing

feasibility study process, along with other leading mining and environmental

consulting firms.

A full version of this announcement including images can be downloaded from

Berkeley's website at www.berkeleyresources.com.au.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAPAAEFSNFEE

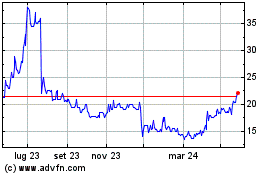

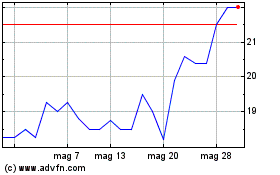

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024