Development and Financing Partnership with KEPCO

10 Agosto 2010 - 9:33AM

UK Regulatory

TIDMBKY

RNS Number : 8133Q

Berkeley Resources Limited

10 August 2010

10 August 2010

BERKELEY RESOURCES LIMITED

Development and Financing Partnership with KEPCO for the Salamanca Uranium

Project

Berkeley Resources Limited (ASX/AIM:BKY) is pleased to announce that it has

entered into a non-binding Memorandum of Understanding (MOU) with the Korea

Electric Power Corporation (`KEPCO'), to finance and develop the Salamanca

Uranium Project.

The Korea Electric Power Corporation is a Korean government invested diversified

energy company with assets over $US 80 billion and revenues of over $US 30

billion, on a consolidated basis as of December 31, 2009. The company is

involved in the generation, transmission and distribution of electrical power

from nuclear, hydro, coal, oil and LNG sources worldwide. KEPCO provides

electricity to almost all households in Korea and operates twenty nuclear power

plants in the country with six more under construction. The company has over

30,000 employees and is listed on the Korean Stock Exchange and the New York

Stock Exchange.

KEPCO will invest, at the Project level only, US$ 70 million for a 35% interest

in Berkeley's Salamanca Uranium Project, which comprises of Aguila, Alameda,

Retortillo and Villar mining areas. KEPCO will also contribute funding of 35%

for the development of the Salamanca Uranium Project assets to bring them into

production as well as ongoing operating expenditure.

Berkeley and KEPCO will work together through appropriate Board representation

at project level and will regularly review future Capital needs and off-take

arrangements as the project development phase progresses.

In return, this agreement provides that KEPCO will execute a proposed offtake

agreement to purchase 35% of the Salamanca Uranium Project's U308 production at

industry standard terms, based on a mix of spot and term prices.

Mr. Ian Stalker, Managing Director of Berkeley commented:

'The strategic partnership with such a successful industry heavyweight as KEPCO

confirms our determination to rapidly develop our Salamanca Uranium Project and

be operational by the end of 2012. We are delighted to have this added

flexibility in both our financing plan and market awareness, particularly at

this stage of our project development. This marks a significant achievement in

the progress of Berkeley's development cycle and goes a long way to achieve the

development of this unique and strategic Project. Berkeley will also retain 100%

of the exploration potential in its extensive portfolio as well as the Gambuta

Project, which has a JORC inferred resource of 9.2 Mlbs.'

The transaction is subject to the completion of a final sixty (60) days due

diligence by KEPCO, execution and delivery of a Definitive Agreement (DA) within

thirty (30) days thereafter and Berkeley and KEPCO Board approvals, as well as

the receipt of certain regulatory stock exchange approvals, if required.

For further information please contact:

Enquiries - Managing Director: Ian Stalker Tel: +34

608 221 497

RBC Capital Markets: Martin Eales Tel:

+44 20 7029 7881

BMO Capital Markets: Robin Birchall Tel: +44

20 7664 8121

Conduit PR Charlie Geller

Tel: +44 20 7429 6604

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGRGDIDXBBGGG

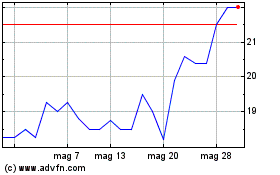

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

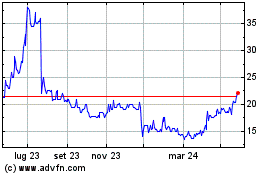

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024