TIDMBKY TIDMSVST

RNS Number : 2413V

Berkeley Resources Limited

29 October 2010

29 October 2010

BERKELEY RESOURCES LIMITED

Possible Takeover Bid of Berkeley Resources Ltd and Interim Funding Agreement

The Directors of Berkeley Resources Ltd. ("Berkeley" or the "Company") advise

that it has been approached by, and is presently in discussions with, OAO

Severstal ("Severstal"), one of the world's leading integrated steel and mining

companies, to agree the basis on which Severstal may make a proposal to acquire

control of the Company.

Severstal has indicated to the Company that, subject to Severstal completing and

being satisfied with the results of financial, technical and legal due diligence

and the entry into an implementation agreement which is on terms satisfactory to

the Company and Severstal, it would consider making a conditional all cash

proposal for all of the outstanding shares of Berkeley (the relevant conditions

to the proposal would be specified by Severstal in an announcement to the market

if it resolves to proceed with such a proposal).

Berkeley has entered into a Subscription Rights Deed with Severstal whereby it

has granted Severstal the right to subscribe for approximately 16.3 million new

Berkeley shares at a price of A$1.70 per share, subject to the condition that

Severstal publicly announces an intention to proceed with a takeover bid for the

Company at a price of A$2.00 per share (any such takeover bid would be subject

to conditions). The shares that may be issued to Severstal pursuant to the

Subscription Rights Deed would represent approximately 9.1% of the fully diluted

share capital of Berkeley (including the shares issued pursuant to the

approximately A$4.8 million placement announced today (and referred to below),

the shares issued as part of the placement fee, the approximately 16.3 million

Severstal subscription shares and the currently outstanding options).

Severstal's right to subscribe for shares in Berkeley will expire on 10 December

2010, unless it has announced an intention to proceed with such a takeover bid

on or before that date. A summary of the key terms of the Subscription Rights

Deed is contained in Annexure A to this announcement.

In the event that Severstal publicly announces a takeover bid for the Company at

a price of A$2.00 per share, Berkeley's Directors would unanimously recommend

that shareholders accept that offer, in the absence of a superior competing

proposal.

An offer price of A$2.00 per share would represent a premium of approximately

40% to the volume weighted average price of Berkeley shares traded on the ASX in

the three months from 29 July 2010 to 28 October 2010 (each date inclusive) of

A$1.43.

At an exchange rate of 1.63 (being the exchange rate at the close of business in

London on 28 October 2010) the offer price of A$2.00 per share would amount to

an offer price of approximately GBP1.23 per share.

SHAREHOLDERS SHOULD NOTE THAT THIS DOES NOT CONSTITUTE AN ANNOUNCEMENT OR PUBLIC

PROPOSAL BY THE COMPANY OR SEVERSTAL THAT SEVERSTAL WILL BE MAKING OR PROPOSING

A TAKEOVER BID FOR THE COMPANY AND THERE IS NO GUARANTEE THAT A TAKEOVER BID OR

ANY OTHER PROPOSAL WILL BE MADE OR PROPOSED. FURTHER, IF A TAKEOVER BID IS MADE

OR PROPOSED, THERE IS NO GUARANTEE THAT IT WILL BE AT A PRICE OF $2.00 PER

SHARE.

BERKELEY IS NOT SUBJECT TO THE UK CITY CODE ON TAKEOVERS AND MERGERS. HOWEVER,

IT IS SUBJECT TO THE TAKEOVER RULES CONTAINED IN THE AUSTRALIAN CORPORATIONS ACT

2001.

Severstal has no obligation to make a takeover bid or any other proposal for the

Company under the Subscription Rights Deed or under any other arrangements.

Berkeley's Salamanca Uranium Project has the potential to be a leading uranium

project and is scheduled to commence mining by late 2012. However, there are

considerable financing requirements to bring this uranium project into

production and it is appropriate at this stage that the Board considers its

financing options in the interests of shareholders. The Board believes that it

is likely that the terms offered by Severstal are more appealing than those

currently available via project or equity financing.

In the event that Severstal resolves not to make a takeover bid for the Company,

Berkeley plans to continue discussions regarding financing alternatives with

third parties, which may include Korean Electric Power Corporation (KEPCO). In

accordance with the terms of the Subscription Rights Deed, Berkeley has agreed

to suspend all discussions with KEPCO and any other interested parties until

such time as it receives notification from Severstal of its intention not to

proceed with a takeover bid or until 10 December 2010. Further details of

Berkeley's MOU with KEPCO may be found in Berkeley's press release dated 10

August 2010.

MANAGEMENT CHANGES

If Severstal decides to proceed with a takeover bid for the Company and

exercises the Subscription Rights Deed, Severstal will have the right to appoint

one Director to the Board of Berkeley. If Severstal decides to proceed with a

takeover bid and it acquires more than 50% of the shares in issue and the

takeover bid becomes wholly unconditional, Severstal will be offered the

majority of the Board seats of the Company, including the Chair of the Board.

Severstal has not yet confirmed what its intentions would be in relation to

Board representation in either such scenario.

PLACEMENT FOR INTERIM FUNDING

If Severstal decides to proceed with a takeover bid for the Company, the bid

process may take approximately three to four months to complete, and possibly

longer. In these circumstances, the Directors consider it prudent to ensure

adequate working capital is in place for the ongoing Feasibility Study work in

relation to Berkeley's Salamanca Uranium Project for at least that period. The

Company has therefore resolved to issue a total of approximately 3.3 million

shares at an issue price of A$1.45 per share to a sophisticated investor for

gross proceeds of approximately A$4.8 million. Should Severstal decide not to

proceed with a takeover bid for the Company, Berkeley has the option to issue

approximately 7 million further shares at an issue price of A$1.45 per share for

gross proceeds of approximately A$10.2 million to the same sophisticated

investor at any point on or before 31 January 2011, subject to shareholder

approval. As consideration for the placement, the Company will issue 200,000

shares to the sophisticated investor or its nominees.

The Directors believe that this funding option will ensure that the Company will

have adequate working capital to pursue its near-term obligations.

Mr. Ian Stalker, Managing Director of Berkeley, commented:

"Berkeley has made significant progress to date in developing the Salamanca

Uranium Project and establishing significant JORC compliant mineral resources.

We are now at a point where we are confident that we can recommence mining

operations at one of the leading undeveloped uranium deposits in the world, and

plan to enter into production towards the end of 2012. Our anticipated

graduation from developer to producer would prove to be well timed given our

belief that uranium supply is expected to go in to deficit over the next two

years.

Severstal is considering an offer that represents a solid premium to the recent

share price and has substantial financing available to optimise the

re-commissioning of the Project. It also has positive experience cooperating

with Spanish companies and runs assets in Russia, Ukraine, Kazakhstan, the

European Union, North America and Africa. We look forward to updating

shareholders with further details in due course."

ACTION BY SHAREHOLDERS

The Board of Berkeley advises that shareholders take no action for the time

being, other than to consult their financial adviser, if appropriate. While

Berkeley looks forward to working with Severstal to determine whether it is

prepared to proceed with a takeover bid, there is no guarantee that a takeover

bid will be made or be completed.

It is also possible that a superior proposal may emerge from other parties.

FURTHER INFORMATION AND ADVISERS

Berkeley is being advised in the transaction by BMO Capital Markets and Hardy

Bowen lawyers.

Berkeley will provide further information to shareholders in due course. In the

interim, please contact:

Berkeley

Ian Stalker, Managing Director

+34 608 221 497

BMO Capital Markets

Sarfraz Visram, Managing Director

+1 416 359 5864

Robin Birchall, Vice President / Adam Janikowski, Vice President

+44 20 7664 8100

RBC Capital Markets, AIM Nominated Adviser

Martin Eales

+44 20 7653 4000

Conduit PR

Charlie Geller

+44 20 7429 6604

BACKGROUND ON SEVERSTAL

OAO Severstal is one of the world's leading integrated steel and mining

companies. The Company's shares are traded on the Russian Trading System (CHMF),

MICEX (CHMF, RTS) and the LSE (SVST). The company operates assets in Russia,

Ukraine, Kazakhstan, Italy, France, the USA and Africa. In 2009, Severstal

produced 16.7 million tonnes of steel, its revenues were $13.0 billion and its

EBITDA was $844 million.

Severstal Resources is the mining division of Severstal and one of the largest

mining companies in Russia. It comprises of two iron ore mining assets (Karelsky

Okatysh and Olcon), two coking coal complexes (Vorkutaugol in northwest Russia

and PBS Coals in the US), a ferroniobium producer (Stalmag) in east Russia and a

mine design company (SPb-Giproshakht). The Gold Segment with assets in Russia,

Kazakhstan, Burkina Faso, Guinea and Guyana is also a significant part of

Severstal Resources.

BACKGROUND ON BERKELEY

Berkeley Resources Ltd. is an exploration and development group with a dominant

land holding and uranium projects in Spain. Its stated objective is to become

the next mid-size European uranium producer.

The Company has been focused on the successful completion of a Feasibility Study

for the Salamanca Uranium Project, incorporating the fully-owned Retortillo

deposits as well as other assets previously operated by ENUSA, the Spanish State

uranium company. Berkeley will form a joint venture with ENUSA on a 90%-10%

basis to exploit these assets, which include the State Reserves, including the

Águila (Sageras, Palacios and Majuelos), Alameda (Alameda North and South) and

Villar Areas. The joint venture company will also manage and operate the Quercus

uranium processing plant.

Mineral Resources within Berkeley's projects currently total 83.2 Mlbs U3O8 with

46% in the Measured and Indicated categories.

ANNEXURE A

SUMMARY OF SUBSCRIPTION RIGHTS DEED

1. Exclusivity arrangements in the Subscription Rights Deed

1.1 Prohibition

During the Non-Solicitation Period, the Company must not, and must ensure that

each of its Representatives do not, directly or indirectly:

(a) solicit or initiate (including, without limitation, by the

provision of non-public information) any inquiries, expression of interest,

offer, proposal or discussion by any person to make a Competing Proposal

(whether from a person with whom the Company has previously been in discussions

or not);

(b) participate in or continue any negotiations or discussions with

respect to any inquiry, expression of interest, offer, proposal or discussion by

any person to make a Competing Proposal;

(c) negotiate, accept or enter into, or offer or agree to negotiate,

accept or enter into, any agreement, arrangement or understanding regarding a

Competing Proposal; or

(d) disclose any non-public information about the business or affairs

of the Company to a third party (other than a Public Authority) with a view to

obtaining or which may reasonably be expected to lead to receipt of a Competing

Proposal,

or communicate to any person an intention to do anything referred to in this

clause 1.1.

1.2Fiduciary exception

Clauses 1.1(b), 1.1(c) and 1.1(d) do not prohibit any action or inaction by the

Company or any Representative in relation to a Competing Proposal if compliance

with the relevant clause would, in the opinion of the Board formed in good

faith, after receiving written advice from its external legal and financial

advisers, constitute, or would be likely to constitute, a breach of any of the

duties of the Board provided that the approach or Competing Proposal by the

third party was not facilitated by or as a direct or indirect result of a breach

of clause 1.1(a).

1.3 Cease existing discussions

During the Non-Solicitation Period the Company will cease and shall not

recommence any discussions or negotiations existing as at the date of the

Subscription Rights Deed relating to any Competing Proposal.

1.4Notification of approaches

During the Non-Solicitation Period, the Company must as soon as possible notify

Severstal in writing if it, or any of its Representatives, becomes aware of any:

(a) approach or attempt to initiate any negotiations or discussions, or

intention to make such an approach or attempt to initiate any negotiations or

discussions in respect of any expression of interest, offer or proposal which

may result in a Competing Proposal;

(b) proposal made to the Company or any of its Representatives, in

connection with, or in respect of any exploration or consummation of, a

Competing Proposal or a proposed or potential Competing Proposal; or

(c) provision by the Company or any of its Representatives of any

material confidential information concerning the Company's operations to any

person in relation to a Competing Proposal or a proposed or potential Competing

Proposal.

A notification given under clause 1.4(a) must include the identity of the

relevant person making or proposing the relevant Competing Proposal, together

with all material terms and conditions of the Competing Proposal.

1.5Matching right

The Company:

(a) must not enter into any legally binding agreement, arrangement or

understanding (whether or not in writing) pursuant to which a third party and/or

the Company proposes to undertake or give effect to a Competing Proposal; and

(b) must use its best endeavours to procure that none of its directors

change their recommendation in favour of the Takeover Bid to publicly recommend

a Competing Proposal,

unless,

(c) the Board acting in good faith determines that the Competing

Proposal would be or would be likely to be a Superior Proposal;

(d) the Company has provided Severstal with the material terms and

conditions of the Superior Proposal, including price and the identity of the

Third Party making the Competing Proposal; and

(e) the Company has given Severstal at least 5 Business Days after the

provision of the information referred to in clause 1.5(d) to provide a matching

or superior proposal to the terms of the Superior Proposal.

2. Summary of the standstill arrangements in the Subscription Rights

Deed

Subject to certain exceptions (including that a third party publicly announces

that it is considering a takeover bid for the company or a scheme of arrangement

involving the Company), Severstal may not acquire or assist or encourage any

other person to acquire 19.9% of the shares in the Company other than the

subscription for shares pursuant to the Subscription Rights Deed.

3. Takeover terms

It has been agreed that a takeover bid by Severstal that would entitle Severstal

to subscribe for the shares in Berkeley, would be for all the shares (including

those shares issued upon the exercise of options), at a price of A$2.00 per

share and subject to a minimum acceptance condition of 50.1% (on a fully diluted

basis), obtaining all regulatory approvals (including FIRB) and various other

conditions, or on terms and conditions which are not substantially less

favourable to shareholders.

4. Definitions

In this Annexure A, capitalised terms have the following meaning.

Associate has the meaning given in section 12(2) of the Corporations Act.

Competing Proposal means any proposal, arrangement or transaction, which, if

entered into or completed, would mean a person (other than Severstal or any

Associate of Severstal) would:

(a) directly or indirectly acquire a Relevant Interest in, or have the

right to acquire, a legal, beneficial or economic interest in, or control of,

10% or more of the Shares or of the share capital of any of the subsidiaries of

the Company;

(b) acquire control of the Company, within the meaning of section 50AA

of the Corporations Act;

(c) otherwise acquire (whether directly or indirectly) or become the

holder of, or otherwise acquire, have a right to acquire or have an economic

interest in all or a material part of the Company's business or the business of

any subsidiary of the Company;

(d) otherwise acquire or merge with the Company; or

(e) enter into any agreement, arrangement or understanding requiring

Severstal to abandon, or otherwise fail to proceed with, the Takeover Bid,

whether by way of takeover bid, scheme of arrangement, shareholder approved

acquisition, capital reduction or buy back, sale or purchase of shares or

assets, global assignment of assets and liabilities, joint venture, dual-listed

company structure (or other synthetic merger), or other transaction or

arrangement.

Corporations Act means the Corporations Act 2001 (Cth of Australia).

Non-Solicitation Periodmeans the period from and including the date of the

Subscription Rights Deed to and including 10 December 2010 or such later date as

the Company and Severstal agree in writing.

Public Authority means any government or governmental, semi-governmental,

administrative, monetary, fiscal or judicial body, department, commission,

authority, tribunal, agency or entity in any part of the world including

(without limitation) any self regulatory organisation established under statute

or otherwise discharging substantially public or regulatory functions, and ASX

or any other stock exchange.

Related Bodies Corporatehas the meaning given in section 50 of the Corporations

Act.

Relevant Interest has the meaning given in sections 608 and 609 of the

Corporations Act.

Representative means:

(a) in respect of a Party, each Related Body Corporate of that Party,

each director, officer, employee, adviser, agent, representative, consultant,

investment banker, financial adviser, lawyer or other adviser of that Party and

each director, officer, employee, adviser, agent, representative, consultant,

investment banker, financial adviser, lawyer or other adviser of each Related

Body Corporate of that Party; and

(b) in respect of a any financial adviser retained by the Company in

relation to the Takeover Bid or a Competing Proposal from time to time, each

director, officer, employee or contractor of that financial adviser.

Superior Proposal means a bona fide Competing Proposal of the kind referred to

in any of paragraphs (a) (provided that such Competing Proposal contemplates the

acquisition of all or substantially all of the business or assets of the Group),

(c) or (d) of the definition of Competing Proposal (and not resulting from a

breach by the Company of its obligations under the non-solicitation provisions

(it being understood that any actions by the Representatives of the Company in

violation of the non-solicitation provisions shall be deemed to be a breach by

the Company for the purposes hereof)) which the Board, acting in good faith, and

after receiving written legal advice from its legal advisers and written advice

from its financial advisers, determines:

(a) is reasonably capable of being valued and completed taking into

account all aspects of the Competing Proposal including any timing

considerations and any conditions precedent; and

(b) would, if completed substantially in accordance with its terms, be

more favourable to Shareholders (as a whole) than the Takeover Bid (as such

Takeover Bid may be amended following application of the matching right), taking

into account all terms and conditions of the Competing Proposal.

A full version of this announcement including images can be downloaded from

Berkeley's website at www.berkeleyresources.com.au.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCVKLBLBBFEFBL

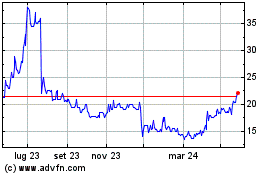

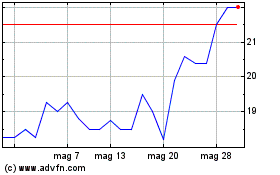

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Set 2024 a Ott 2024

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Ott 2023 a Ott 2024