TIDMBKY

RNS Number : 9880Z

Berkeley Resources Limited

14 March 2013

BERKELEY RESOURCES LIMITED

Interim Financial Report

for the Half Year Ended

31 December 2012

abn 40 052 468 569

CORPORATE DIRECTORY

Directors Share Registry

Mr Ian Middlemas - Non-Executive Australia

Chairman Computershare Investor Services

Dr James Ross - Non-Executive Deputy Pty Ltd

Chairman Mr Robert Behets - Non-Executive Level 2

Director 45 St George's Terrace

Perth WA 6000

Telephone: +61 8 9323 2000

Company Secretary Facsimile: +61 8 9323 2033

Mr Clint McGhie

United Kingdom

Registered Office Computershare Investor Services

Level 9, BGC Centre Plc

28 The Esplanade PO Box 82

Perth WA 6000 The Pavillions

Australia Bridgwater Road

Bristol BS99 7NH

Telephone: +61 8 9322 6322 Telephone: +44 870 889 3105

Facsimile: +61 8 9322 6558

Stock Exchange Listing

Spanish Office Australia

Berkeley Minera Espana, S.A. Australian Securities Exchange

Carretera SA-451, Km 30 Home Branch - Perth

37495 Retortillo 2 The Esplanade

Salamanca Perth WA 6000

Spain

United Kingdom

Telephone: +34 923 193 903 London Stock Exchange - AIM

10 Paternoster Square

Auditor London EC4M 7LS

Stantons International

ASX Code

Website BKY - Fully paid ordinary shares

www.berkeleyresources.com.au BKYO - $0.75 Listed Option

Email AIM TIDM

info@berkeleyresources.com.au BKY - Fully paid ordinary shares

CONTENTS

Page

Directors' Report 1

Directors' Declaration 7

Condensed Consolidated Statement of Profit or

Loss and Other Comprehensive Income 8

Condensed Consolidated Statement of Financial

Position 9

Condensed Consolidated Statement of Changes in

Equity 10

Condensed Consolidated Statement of Cash Flows 11

Notes to the Financial Statements 12

The Auditor's Independence Declaration and the Independent

Auditor's Report are available in the full version of the Interim

Financial Report on Berkeley Resources Limited's website at:

www.berkeleyresources.com.au.

The Board of Directors of Berkeley Resources Limited present

their report on the consolidated entity of Berkeley Resources

Limited ("the Company" or "Berkeley") and the entities it

controlled during the half year ended 31 December 2012

("Consolidated Entity").

DIRECTORS

The names of the Directors of Berkeley in office during the half

year and until the date of this report are:

Mr Ian Middlemas

Dr James Ross

Mr Robert Behets

Mr Matthew Syme (Resigned 2 August 2012)

Señor Jose Ramon Esteruelas (Resigned 29 November 2012)

Unless otherwise disclosed, Directors were in office from the

beginning of the half year until the date of this report.

REVIEW OF OPERATIONS AND ACTIVITIES

Berkeley is a uranium exploration and development company with a

quality resource base in Spain. The Company has a 100% interest in

a total Mineral Resource estimated at 61.0 million pounds of

contained U(3) O(8) with an average grade of 430 ppm (at a cut-off

grade of 200 ppm U(3) O(8) ).

During the half year, the Company focused on advancing its

wholly owned flagship Salamanca Project, which comprises the

Retortillo and Alameda deposits plus a number of other Satellite

deposits, through the development phase.

The results of a Scoping Study completed in late 2012 confirmed

the technical and economic viability of the Salamanca Project and

its potential to support a significant scale, long life uranium

mining operation. Accordingly, the Company has commenced a

Pre-Feasibility Study ('PFS').

Highlights during, and subsequent to, the financial year end

include:

(i) A positive Scoping Study for the Salamanca Project

The Company announced the results of a positive Scoping Study in

November which confirmed the technical and economic viability of

the Salamanca Project, including:

Ø Initial mine life of 11 years, including 7 years steady state

operation, with strong potential to increase;

Ø Steady state annual production of 3.2 million pounds U(3) O(8)

, with average annual production of 2.6 million pounds U(3) O(8)

over the life of mine;

Ø Life of mine average operating costs of US$25.65 per pound of

U(3) O(8) ;

Ø Upfront capital cost of US$83.6 million to deliver initial

production. A further US$95.0 million, incurred in the second year

of production and largely funded from operating cashflow, to

achieve steady state operation.

(ii) Commencement of Pre-Feasibility Study

Pre-Feasibility Study commenced, targeting completion in the

third quarter of 2013. The study was awarded to Johannesburg based

SENET, who will be assisted by SRK Consulting for mine design,

Knight Piesold for heap design and Duro Felguera for the in-country

project cost estimates. Additional testwork is also being carried

out at the Mintek facilities in Johannesburg and ANSTO laboratories

in Sydney.

(iii) Advancement of Permitting

The permitting process for Retortillo continued to advance with

the Company's responses to the submissions received during the 30

day Public Information Period being delivered to the relevant

authorities for their review and evaluation. The Nuclear Safety

Council has also confirmed that all required information for the

preparation of their compulsory report regarding the mining

activities, and for the Initial Authorization of the process plant

as a radioactive facility has been submitted.

The permitting process for Alameda was initiated with the

submission to the relevant authorities of the Environmental Scoping

Document and documentation associated with the application for

reclassification (from rural to industrial use) of the affected

surface land area.

(iv) Resource Update

An updated Mineral Resource Estimate ('MRE') for Gambuta

estimated at 12.7 million tonnes averaging 394 ppm U(3) O(8) for a

contained 11.1 million pounds of U(3) O(8) at a lower cut-off grade

of 200 ppm U(3) O(8) was reported in October.

As at the date of this report, the Company has a 100% interest

in a total Mineral Resource estimated at 61.0 million pounds of

contained U(3) O(8) with an average grade of 430 ppm (at a cut-off

grade of 200 ppm U(3) O(8) ).

Salamanca Project

The Salamanca Project ('the Project') comprises the Retortillo,

Alameda and Gambuta deposits plus a number of other Satellite

deposits located in western Spain.

The results of a PFS completed in early 2012 confirmed the

technical and economic viability of a stand-alone project

exploiting Retortillo, whilst Alameda formed part of a separate

Feasibility Study completed in 2011.

In November 2012, the Company completed an initial assessment of

the integrated development of Retortillo and Alameda and reported

the results of the Scoping Study ('the Study').

The Study was managed by Berkeley with input from a number of

industry-recognised specialist consultants covering the key

disciplines. The Study incorporated all of the information

generated from the previous studies conducted on Retortillo and

Alameda, as well as additional drilling and metallurgical testwork

data.

Scoping Study Results

Using only the current Mineral Resource Estimates for Retortillo

and Alameda, which total 33.9 million pounds U(3) O(8) (35.9

million tonnes at 429 ppm; 200 ppm U(3) O(8) cut-off grade), as a

base case scenario, the Project can support an average annual

production of 3.2 million pounds of U(3) O(8) during the seven

years of steady state operation and 2.6 million pounds of U(3) O(8)

over a minimum eleven year mine life. There is strong potential to

increase the production profile and mine life through the

exploitation of additional resources held by the Company (totalling

27.1 million pounds U(3) O(8) ) and with ongoing exploration

work.

The Study was based on open pit mining, heap leaching, a

centralised process plant at Retortillo, and a remote ion exchange

operation at Alameda, with loaded resin trucked to the centralised

plant for final extraction and purification. The Company currently

favours a contractor mining scenario. The average annual ore

processing rate during steady state operation is 5.5 million

tonnes. Operating cost estimates average US$25.65 per pound U(3)

O(8) over the life of mine.

The initial capital cost (nominally +/- 30% accuracy) for the

Project is estimated at US$83.6 million. This cost is inclusive of

all mine, processing, infrastructure and indirect costs required to

develop and commence production at Retortillo. A further US$95.0

million of capital, incurred in the second year of production and

largely funded from operating cashflow, is required to develop

Alameda and achieve steady state operation. The Project's capital

cost reflects the excellent existing infrastructure, use of heap

leaching as the preferred processing route, and the favoured mining

contractor scenario (no mining fleet capital expenditure).

The Directors are encouraged by the positive results of the

Scoping Study which clearly demonstrate the potential of the

integrated Salamanca Project to support a significant scale, long

life uranium mining operation. Further details on the Study are

available in the Company's ASX Announcement dated 29 November

2012.

PFS

Following completion of the Scoping Study, Berkeley commenced a

PFS for the Salamanca Project. The PFS was awarded to the

Johannesburg based company SENET, which will develop the study

assisted by SRK Consulting for the mine design, Knight Piesold for

the heaps design and Duro Felguera for the in-country project cost

estimates.

The Company will undertake a more detailed mine scheduling and

materials movement optimisation study, metallurgical testwork

program and infrastructure assessment during the PFS phase, with

the aim of identifying opportunities to further enhance the Project

economics through capital and operating cost reductions. Resource

infill and exploration drilling programs aimed at upgrading the

resource classification and increasing the overall resource base

also form part of the Study.

The PFS will be carried out with a confidence level of +/-20%

for both the capital and operating cost estimates and will include

the design details required to be submitted to the Spanish Nuclear

Safety Council as part of the Authorization for Construction

process for the processing plant.

Further metallurgical testwork will be carried out at the Mintek

laboratories in Johannesburg and the Australian Nuclear Science and

Technology Organisation ('ANSTO') facilities in Sydney.

The testwork program at Mintek aims to confirm the leaching

efficiency for each phase of the mine schedule and test ore

variability with respect to size distribution and geo-mechanical

behaviour. The ANSTO testwork program is designed to facilitate the

selection of the optimal backend of the process, with the

performance of direct Solvent Extraction ('SX') and ammonium

diuranate ('ADU') precipitation being compared to ion exchange

('IX') and UO(4) precipitation.

Exploration and Drilling

Drilling activity during the half year included diamond drilling

('DD') at Retortillo and Alameda for resource definition, to

provide drill core for metallurgical testwork and to provide drill

core for geotechnical testwork. Details of the 1,949 metres of DD

completed are summarised in Table 1.

Table 1: 2012 Drilling Summary

DD Q3 2012 DD Q4 2012 DD Total

Holes Metres Holes Metres Holes Metres

------------ ------ ------- ------ ------- ------ -------

Retortillo 1 70 19 963 20 1,033

------------ ------ ------- ------ ------- ------ -------

Alameda 1 44 18 872 19 916

------------ ------ ------- ------ ------- ------ -------

Gambuta - - - - - -

------------ ------ ------- ------ ------- ------ -------

Total 2 114 37 1,836 39 1,949

------------ ------ ------- ------ ------- ------ -------

Mineral Resources

The current MRE's for all deposits is tabulated below (using a

200ppm U(3) O(8) cut-off grade) incorporating the results from the

recent drilling campaigns and together with previously obtained

information.

Table 2: Berkeley Resources - Mineral Resource Statement

as at December 2012

(using 200ppm U(3) O(8) Cutoff)

SUMMARY RESOURCES Resource Tonnes U(3) O(8) U(3) O(8) U(3) O(8)

Category Grade (t)

(Mt) (ppm) (Mlbs)

Retortillo Indicated 8.9 395 3,535 7.8

Inferred 6.2 366 2,274 5.0

TOTAL 15.2 383 5,810 12.8

Alameda Indicated 20.0 455 9,107 20.1

Inferred 0.7 657 468 1.0

TOTAL 20.7 462 9,576 21.1

Other Satellite

Deposits Inferred 28.5 431 12,288 27.1

Indicated 29.0 437 12,643 27.9

TOTAL RESOURCES Inferred 35.4 424 15,031 33.1

----------- ------- ---------- ---------- ----------

TOTAL 64.4 430 27,674 61.0

Permitting

The permitting process at Retortillo continues to advance.

During the half year, a 30 day Public Information Period was held

(completed in mid September) and the Company's responses to the

submissions received were delivered to the relevant authorities for

their review and evaluation. Follow-up discussions regarding

appropriate mitigation measures have been held with the

authorities. It is anticipated that the Project will be raised for

mining and environmental approval within the first half of

2013.

The Initial Authorisation for the process plant as a radioactive

facility is well advanced. The Nuclear Safety Council has informed

Berkeley that they have all required information for the

preparation of their compulsory report regarding the mining

activities, and also for the Initial Authorization of the process

plant as a radioactive facility. Both are anticipated during the

June quarter of 2013.

Ancillary permits, such as those associated with water and

roads, are also currently being advanced. Discussions have been

held with the relevant authorities (including the Water Authority

and Roads Department) and the required documentation submitted.

At Alameda, the Environmental Scoping Document and the

documentation associated with the change of the zoning of rural

land into that suitable for industrial purposes were submitted in

November and December, respectively. The Exploitation Plan,

Rehabilitation and Closure Plans and documents related to

Radiological Protection will be prepared based on the design

developed as part of the PFS, targeting submission of these

documents by mid 2013.

Corporate

At 31 December 2012, the Group had cash reserves of A$32.5

million, with no debt. This puts the Group in a strong financial

position as it looks to complete the PFS and progress the

development of the Salamanca Project.

During the half year, Mr Matthew Syme and Senor Jose Ramon

Esteruelas resigned as Non-Executive Directors of the Company,

effective 2 August 2012 and 29 November 2012 respectively.

On 9 November 2012, the Company issued 750,000 $0.475 Incentive

Options to a key employee of the Company. The options expire 22

December 2015 and 375,000 vest on 12 December 2013 and 375,000 vest

on 12 December 2014.

In July 2012, Berkeley reached agreement with ENUSA on terms

which provide the Company with a 100% interest in select uranium

resources within State Reserves held by ENUSA.

Under the agreement, Berkeley holds a 100% interest in, and the

exploitation rights to, State Reserves 28 and 29 (which include the

substantial unmined Alameda deposit) whilst waiving its rights to

mine in State Reserves where ENUSA has undertaken rehabilitation.

Refer to ASX Announcement dated 24 July 2012 for further

details.

Operating Results

The net operating loss after tax for the half year ended 31

December 2012 was $5,373,394 (2011: $8,752,860).

The loss for the period includes $5,640,251 (2011: $9,524,027)

in exploration and evaluation expenditure and share based payment

expenses of $142,952 (2011: $129,824) were also recognised during

the half year.

SIGNIFICANT POST BALANCE DATE EVENTS

At the date of this report there were no significant events

occurring after balance date requiring disclosure.

AUDITOR'S INDEPENDENCE DECLARATION

Section 307C of the Corporations Act 2001 requires our auditors,

Stantons International, to provide the Directors of Berkeley

Resources Limited with an Independence Declaration in relation to

the review of the half year financial report. This Independence

Declaration is on page 17 and forms part of this Directors'

Report.

Signed in accordance with a resolution of Directors.

Robert Behets

Non-Executive Director

14 March 2013

The information in this announcement that relates to Exploration

Results, Mineral Resources or Ore Reserves is based on information

compiled by Craig Gwatkin, who is a Member of The Australian

Institute of Mining and Metallurgy and is an employee of Berkeley

Resources Limited. Mr. Gwatkin has sufficient experience which is

relevant to the style of mineralisation and type of deposit under

consideration and to the activity which he is undertaking to

qualify as a Competent Person as defined in the 2004 Edition of the

'Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves'. Mr. Gwatkin consents to the inclusion

in the report of the matters based on his information in the form

and context in which it appears.

In accordance with a resolution of the Directors of Berkeley

Resources Limited, I state that:

In the opinion of the Directors:

(a) the financial statements and notes, as set out on pages 8 to

16, are in accordance with the Corporations Act 2001,

including:

(i) complying with Accounting Standard AASB 134: Interim

Financial Reporting and the Corporations Regulations 2001; and

(ii) giving a true and fair view of the consolidated entity's

financial position as at 31 December 2012 and of its performance

for the half year ended on that date.

(b) there are reasonable grounds to believe that the Company

will be able to pay its debts as and when they become due and

payable.

On behalf of the Board

Robert Behets

Non-Executive Director

14 March 2013

Note Half Year Ended Half Year Ended

31 December 2012 31 December 2011

$ $

------------------------------------- ----- ------------------- -------------------

Revenue from continuing operations 5 850,849 1,367,406

Exploration and evaluation

costs (5,640,251) (9,524,027)

Corporate and administration

costs (440,038) (466,415)

Share based payments expense (142,952) (129,824)

Loss on Sale of Asset (1,002) -

Loss before income tax (5,373,394) (8,752,860)

Income tax expense - -

------------------------------------- ----- ------------------- -------------------

Loss for the half year attributable

to Members of Berkeley Resources

Limited (5,373,394) (8,752,860)

------------------------------------- ----- ------------------- -------------------

Other comprehensive income,

net of income tax:

Items that will not be reclassified - -

subsequently to profit or

loss

Items that may be reclassified

subsequently to profit or

loss

Exchange differences arising

on translation of foreign

operations 319,225 263,195

Other comprehensive income/(loss)

for the period, net of income

tax 319,225 263,195

------------------------------------- ----- ------------------- -------------------

Total comprehensive loss for

the half year attributable

to Members of Berkeley Resources

Limited (5,054,169) (8,489,665)

===================================== ===== =================== ===================

Earnings per share

Basic earnings per share (cents

per share) (3.00) (5.02)

Diluted earnings per share

(cents per share) (3.00) (5.02)

The above Condensed Consolidated Statement of Profit or Loss and

Other Comprehensive Income should be read in conjunction with the

accompanying notes.

Note 31 December 2012 30 June 2012

$ $

------------------------------- ----- ----------------- -------------

ASSETS

Current Assets

Cash and cash equivalents 32,520,667 37,716,585

Trade and other receivables 597,682 621,269

Prepaid Expenditure - 85,256

------------------------------- ----- ----------------- -------------

Total Current Assets 33,118,349 38,423,110

------------------------------- ----- ----------------- -------------

Non-current Assets

Exploration expenditure 6 13,293,060 13,011,723

Property, plant and equipment 1,708,105 1,209,771

Other financial assets 57,730 100,504

------------------------------- ----- ----------------- -------------

Total Non-current Assets 15,058,895 14,321,998

------------------------------- ----- ----------------- -------------

TOTAL ASSETS 48,177,244 52,745,108

------------------------------- ----- ----------------- -------------

LIABILITIES

Current Liabilities

Trade and other payables 1,353,681 1,049,812

Other financial liabilities 12,258 104,524

------------------------------- ----- ----------------- -------------

Total Current Liabilities 1,365,939 1,154,336

------------------------------- ----- ----------------- -------------

TOTAL LIABILITIES 1,365,939 1,154,336

------------------------------- ----- ----------------- -------------

NET ASSETS 46,811,305 51,590,772

=============================== ===== ================= =============

EQUITY

Issued capital 7 119,061,776 118,930,526

Reserves 8 1,038,828 585,382

Accumulated losses (73,289,299) (67,925,136)

------------------------------- ----- ----------------- -------------

TOTAL EQUITY 46,811,305 51,590,772

=============================== ===== ================= =============

The above Condensed Consolidated Statement of Financial Position

should be read in conjunction with the accompanying notes.

Issued Capital Option Premium Foreign Currency Accumulated Total

Reserve Translation Losses

Reserve

$ $ $ $ $

As at 1 July 2012 118,930,526 4,363,630 (3,778,248) (67,925,136) 51,590,772

Total comprehensive loss for the

period:

Net loss for the period - - - (5,373,394) (5,373,394)

Other comprehensive income:

Exchange differences arising on

translation of foreign

operations - - 319,225 - 319,225

---------------------------------- --------------- --------------- ----------------- -------------- -------------

Total comprehensive income/(loss) - - 319,225 (5,373,394) (5,054,169)

----------------------------------

Transactions with owners,

recorded directly in equity

Transfer from option premium

reserve - (9,231) - 9,231 -

Share based payments - 142,952 - - 142,952

Option issue price - 500 - - 500

Exercise of Listed Options 71,250 - - - 71,250

Reversal of Shares Issue Expense 60,000 - - - 60,000

As at 31 December 2012 119,061,776 4,497,851 (3,459,023) (73,289,299) 46,811,305

================================== =============== =============== ================= ============== =============

As at 1 July 2011 117,624,295 6,194,728 (2,722,948) (56,893,310) 64,202,765

Total comprehensive loss for the

period:

Net loss for the period - - - (8,752,860) (8,752,860)

Other comprehensive income:

Exchange differences arising on

translation of foreign

operations - - 263,195 - 263,195

---------------------------------- --------------- --------------- ----------------- -------------- -------------

Total comprehensive income/(loss) - - 263,195 (8,752,860) (8,489,665)

Transactions with owners,

recorded directly in equity

Share based payments - 129,824 - - 129,824

As at 31 December 2011 117,624,295 6,324,552 (2,459,753) (65,646,170) 55,842,924

================================== =============== =============== ================= ============== =============

The above Condensed Consolidated Statement of Changes in Equity

should be read in conjunction with the accompanying notes.

Half Year Ended Half Year Ended

31 December 2012 31 December 2011

$ $

-------------------------------------------------------------- ----------------- -----------------

Cash flows from operating activities

Payments to suppliers and employees (5,447,779) (8,879,357)

Interest received 828,147 1,219,017

Net cash outflow from operating activities (4,619,632) (7,660,340)

-------------------------------------------------------------- ----------------- -----------------

Cash flows from investing activities

Payments for property, plant and equipment (574,221) (117,069)

Payments for Exploration and Evaluation (93,344) -

-------------------------------------------------------------- ----------------- -----------------

Net cash outflow from investing activities (667,565) (117,069)

-------------------------------------------------------------- ----------------- -----------------

Cash flows from financing activities

Proceeds from issue of securities 71,750 -

Transaction costs from issue of shares and options - -

-------------------------------------------------------------- ----------------- -----------------

Net cash inflow from financing activities 71,750 -

-------------------------------------------------------------- ----------------- -----------------

Net increase/(decrease) in cash and cash equivalents held (5,215,447) (7,777,409)

Cash and cash equivalents at the beginning of the period 37,716,585 50,599,786

Effects of exchange rate changes on cash and cash equivalents 19,529 (16,829)

-------------------------------------------------------------- ----------------- -----------------

Cash and cash equivalents at the end of the period 32,520,667 42,805,548

============================================================== ================= =================

The above Condensed Consolidated Statement of Cash Flows should

be read in conjunction with the accompanying notes.

1. REPORTING ENTITY

Berkeley Resources Limited (the "Company") is a company

domiciled in Australia. The interim financial report of the Company

is as at and for the six months ended 31 December 2012.

The annual financial report of the Company as at and for the

year ended 30 June 2012 is available upon request from the

Company's registered office.

2. STATEMENT OF COMPLIANCE

The interim financial report is a general purpose financial

report which has been prepared in accordance with Accounting

Standard AASB 134: Interim Financial Reporting and the Corporations

Act 2001.

This interim financial report does not include all the

information of the type normally included in an annual financial

report. Accordingly, this report is to be read in conjunction with

the annual report of Berkeley Resources Limited for the year ended

30 June 2012 and any public announcements made by Berkeley

Resources Limited during the interim reporting period in accordance

with the continuous disclosure requirements of the Corporations Act

2001.

This interim financial report was approved by the Board of

Directors on 13 March 2013.

(a) Basis of Preparation of Half Year Financial Report

The principal accounting policies adopted in the preparation of

the financial report have been consistently applied to all the

periods presented, unless otherwise stated.

Historical cost convention

These financial statements have been prepared under the

historical cost convention, as modified where applicable by the

revaluation of available-for-sale financial assets, financial

assets and liabilities (including derivative instruments) at fair

value through profit or loss.

3. SIGNIFICANT ACCOUNTING POLICIES

Accounting policies applied by the Consolidated Entity in this

consolidated interim financial report are the same as those applied

by the Consolidated Entity in its consolidated financial report for

the year ended 30 June 2012, except as stated below.

In the current period, the Group has adopted all of the new and

revised Standards and Interpretations issued by the Australian

Accounting Standards Board (the AASB) that are relevant to its

operations and effective for annual reporting periods beginning on

or after 1 July 2012. The adoption of these new and revised

standards has not resulted in any significant changes to the

Group's accounting policies or to the amounts reported for the

current or prior periods.

A range of amendments to Standards and Interpretations have been

made which are available for early adoption for financial reporting

periods beginning on or after 1 July 2012. New and revised

standards and amendments thereof and interpretations effective for

the current half-year that are relevant to the Consolidated Entity

include:

-- Amendments to AASB 1, 5, 7, 101, 112, 120, 121, 132, 133 and

134 as a consequence of AASB 2011-9 'Amendments to Australian

Accounting Standards - Presentation of Items of Other Comprehensive

Income'

The adoption of new and revised Standards and Interpretations

has not affected the amounts reported for the current or prior

year. However the application of AASB 2011-9 has resulted in a

change to the Group's presentation of, or disclosure in, its half

year financial statements.

3. SIGNIFICANT ACCOUNTING POLICIES (continued)

AASB 2011-9 introduces new terminology for the statement of

comprehensive income and income statement. Under the amendments to

AASB 101, the statement of comprehensive income is renamed as

statement of profit or loss. The amendments to AASB 101 retain the

option to present profit or loss and other comprehensive income in

either a single statement or in two separate but consecutive

statements. However, the amendments to AASB 101 require items of

other comprehensive income to be grouped into two categories in the

other comprehensive income section: (a) items that will not be

reclassified subsequently to profit or loss and (b) items that may

be reclassified subsequently to profit or loss when specific

conditions are met. Income tax on items of other comprehensive

income is required to be allocated on the same basis - the

amendments do not change the option to present items of other

comprehensive income either before tax or net of tax. The

amendments have been applied retrospectively, and hence the

representation of items of other comprehensive income has been

modified to reflect the changes. Other than the above mentioned

presentation changes, the application of the amendments to AASB 101

does not result in any impact on profit or loss, other

comprehensive income and total comprehensive income

4. SEGMENT INFORMATION

AASB 8 requires operating segments to be identified on the basis

of internal reports about components of the Consolidated Entity

that are regularly reviewed by the chief operating decision maker

in order to allocate resources to the segment and to assess its

performance.

The Consolidated Entity operates in one operating segment, being

exploration for mineral resources within Spain. This is the basis

on which internal reports are provided to the Directors for

assessing performance and determining the allocation of resources

within the Consolidated Entity.

5. REVENUE FROM CONTINUING OPERATIONS

Consolidated Consolidated

31 December 31 December

2012 2012

$ $

------------------ -------------- --------------

Interest revenue 850,849 1,367,406

850,849 1,367,406

================== ============== ==============

6. NON-CURRENT ASSETS - EXPLORATION EXPENDITURE

Consolidated Consolidated

31 December

2012 30 June 2012

The group has mineral exploration

costs carried forward in respect

of areas of interest: $ $

Areas in exploration at cost:

Balance at the beginning of year 13,011,723 13,646,937

Net Additions 104,406 91,744

Foreign exchange differences 220,931 (726,958)

------------------------------------- -------------- ----------------

13,337,060 13,011,723

Capitalised exploration expenditure

written off (44,000) -

------------------------------------- -------------- ----------------

Balance at end of year 13,293,060 13,011,723

===================================== ============== ================

The value of the exploration interests is dependent upon the

discovery of commercially viable reserves and the successful

development or alternatively sale, of the respective tenements. An

amount of EUR6m (A$7.43m) relates to the capitalisation of the fees

paid to ENUSA under the Co-operation Agreement relating to the

tenements within the State Reserves. The Company reached agreement

with ENUSA in July 2012 in the form of an Addendum to the

Consortium Agreement signed in January 2009. The Addendum includes

the following terms:

-- The Consortium now consists of State Reserves 28 and 29;

-- Berkeley's stake in the Consortium has increased to 100%;

-- ENUSA will remain the owner of State Reserves 28 and 29,

however the exploitation rights have been assigned to Berkeley,

together with authority to submit all applications for the

permitting process;

-- The Company is now the sole and exclusive operator in the

Addendum Reserves, with the right to exploit the contained uranium

resources and have full ownership of any uranium produced;

-- ENUSA will receive a production fee equivalent to 2.5% of the

net sale value (after marketing and transport costs) of any uranium

produced within the Addendum Reserves;

-- Berkeley has waived its rights to mining in State Reserves

2,25, 30, 31, Hoja 528-1 and the Saelices El Chico Exploitation

Concession, and has waived any rights to management of the Quercus

plant; and

-- The Co-operation Agreement with ENUSA, signed on 29 January 2009, has been terminated.

7. CONTRIBUTED EQUITY

(a) Issued and Paid Up Capital

Date Consolidated Consolidated

31 December 30 June 2012

2012

$ $

----------------------------------------- -------------- ---------------

174,393,273 (30 June 2012: 179,298,273)

fully paid ordinary shares 119,061,776 118,930,526

========================================= ============== ===============

7. CONTRIBUTED EQUITY (Continued)

(b) Movements in Ordinary Share Capital During the Six Month Period ended 31 December 2012:

Date Details Number of Issue Price $

Shares $

1 Jul 12 Opening Balance 179,298,273 118,930,526

Reversal of Share

1 Jul 12 Issue Expense - 60,000

Exercise of listed

10 Aug 12 options 95,000 0.75 71,250

31 Dec 12 Closing Balance 179,393,273 119,061,776

=========== ==================== ============ ============= ============

(c) Movements in Options During the Six Month Period ended 31 December 2012:

Date Details Number of Listed Number of Incentive Fair Value Share based payments

Options Options reserve

$ $

----------- ---------------------- ---------------------- --------------------- ----------- ---------------------

1 Jul 12 Opening Balance 11,989,428 10,758,333 4,363,630

1 Jul 12 Option issue proceeds - - 500

10 Aug 12 Exercise of listed (95,000)

options - -

Grant of $0.475

incentive Options

expiring 22 December

9 Nov 12 2015 - 750,000 0.21 -

Adjustment for expired options - (16,667) (9,231)

Share based payments expense(1) - - 142,952

31 Dec 12 Closing Balance 11,894,428 11,491,666 4,497,851

=========== ====================== ====================== ===================== =========== =====================

Note:

(1) The value of Incentive Options granted is recognised over

the vesting period of the grant, in accordance with Australian

Accounting Standards.

The following options have been issued over unissued capital as

at 31 December 2012:

Listed Options

-- 11,989,428 listed options at an exercise price of $0.75 each that expire on 15 May 2013.

Unlisted Options

.

-- 1,000,000 unlisted options at an exercise price of $1.25 each

that expire on 1 December 2013.

-- 2,241,666 unlisted options at an exercise price of $1.35 each

that expire on 18 June 2014.

-- 1,750,000 unlisted options at an exercise price of $0.475

each that expire on 22 December 2015.

-- 1,000,000 unlisted options at an exercise price of $0.41 each

that expire on 21 September 2015.

-- 5,500,000 unlisted options at an exercise price of $0.45 each

that expire on 30 June 2016.

8. RESERVES

31 December 30 June 2012

2012

$ $

------------------------------ ------------ -------------

(a) Reserves

Share based payments reserve 4,497,851 4,363,630

Foreign exchange reserve (3,459,023) (3,778,248)

1,038,828 585,382

============================== ============ =============

9. CONTINGENT LIABILITIES AND COMMITMENTS

There was no material change in contingent liabilities or

commitments as previously disclosed at the last reporting

period.

10. DIVIDENDS PAID OR PROVIDED FOR

No dividend has been paid or provided for during the half

year.

11. SUBSEQUENT EVENTS AFTER BALANCE DATE

As at the date of this report there were no significant events

occurring after balance date requiring disclosure.

The Auditor's Independence Declaration and the Independent

Auditor's Report are available in the full version of the Interim

Financial Report on Berkeley Resources Limited's website at:

www.berkeleyresources.com.au.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GRGDXSBBBGXS

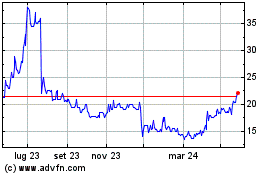

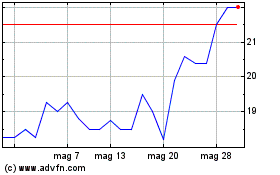

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024