Berkeley Resources Limited Environmental Licence (9813P)

08 Ottobre 2013 - 11:34AM

UK Regulatory

TIDMBKY

RNS Number : 9813P

Berkeley Resources Limited

08 October 2013

BERKELEY RESOURCES LIMITED

AIM RELEASE | 8 OCTOBER 2013 | ASX/AIM:BKY

ENVIRONMENTAL LICENCE GRANTED FOR RETORTILLO

Highlights:

-- Regional Government has granted a Favourable Declaration of

Environmental Impact ('Environmental Licence') for Retortillo

following submission and extensive review of the Company's

Environmental and Social Impact Assessment ('ESIA'); and

-- Approval of the Company's Exploitation and Reclamation and

Closure Plans is now the only outstanding prerequisite for the

granting of the Exploitation Concession ('Mining Licence') for

Retortillo.

Berkeley Resources Limited ('Berkeley' or 'the Company') is

pleased to announce that the Environmental Licence for Retortillo

has been granted by the Regional Government of Castilla and León.

The Retortillo deposit forms part of the Company's flagship

Salamanca Project (the 'Project') in Spain and is where production

is scheduled to commence.

The grant of the Environmental Licence is a major milestone for

the Company and follows substantial work over the last 24 months

directed towards permitting of the Project, including environmental

and social baseline studies and culminating with the submission of

the ESIA, together with the Exploitation Plan and the Reclamation

and Closure Plan for Retortillo.

The ESIA and associated documentation were subjected to

extensive review by all relevant authorities and key stakeholders,

including a 30 day Public Information Period, prior to the grant of

the Environmental Licence. The Environmental Licence covers all

mining and processing activities, including treatment of loaded

resin transported to Retortillo from other deposits.

Key activities undertaken during the ESIA process, which was

managed by Berkeley with input from a multi-disciplinary group of

specialist consultants, included environmental baseline monitoring

studies, census work to understand the flora and fauna within and

around the tenement area, ecosystem and habitat sensitivity

surveys, noise and air quality studies, surface and underground

water studies, and extensive community engagement.

With the grant of the Environmental Licence and the favourable

recommendation report recently submitted by the Nuclear Safety

Council to the Regional Government, approval of the Company's

Exploitation and Reclamation and Closure Plans is now the only

outstanding prerequisite for the granting of the Mining Licence for

Retortillo.

The Directors are extremely encouraged by the grant of the

Environmental Licence which highlights the positive progress being

made with the permitting process for the Project. This milestone

follows the recent successful completion of the Project

Pre-Feasibility Study ('PFS') which focused on the integrated

development of the Retortillo and Alameda deposits. The PFS results

clearly demonstrated the Project's potential to support a

significant scale, long life, low cost uranium operation (refer ASX

announcement dated 26 September 2013).

Using only the current Mineral Resource Estimates for Retortillo

and Alameda, as a base case scenario, the PFS showed the Project

can support an average annual production of 3.3 million pounds of

U(3) O(8) during the seven years of steady state operation and 2.7

million pounds of U(3) O(8) over a minimum eleven year mine life.

Operating cost estimates (C1 cash costs) average US$24.60 per pound

U(3) O(8) over the life of mine. The initial capital cost

(nominally +/- 20% accuracy) for the Project was estimated at

US$95.1 million. This cost is inclusive of all mine, processing,

infrastructure and indirect costs required to develop and commence

production at Retortillo. A further US$74.4 million of capital,

incurred in the second year of production, is required to develop

Alameda and achieve steady state operation. The Project's capital

cost reflects the excellent existing infrastructure that services

the region, the use of heap leaching as the preferred processing

route, and the use of contractor mining.

Enquiries: Robert Behets

Berkeley Resources

+61 8 9322 6322

Martin Eales

RBC Capital Markets

+44 20 7653 4000

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEANEPEDFDFEF

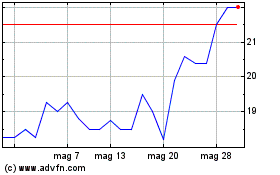

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

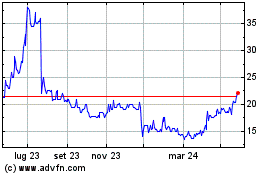

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024