TIDMBKY

RNS Number : 1621N

Berkeley Resources Limited

24 July 2014

24 July 2014

ASX/AIM:BKY

BERKELEY RESOURCES LIMITED

JUNE 2014 QUARTERLY REPORT

Berkeley Resources Limited ('Berkeley' or the 'the Company') is

pleased to present its quarterly report for the period ended 30

June 2014. The Company's primary focus during the period continued

to be the advancement of the Salamanca Project located in Spain.

Highlights during the quarter include:

-- Exploitation Concession ('Mining Licence') for Retortillo granted by Regional Government:

o Valid for an initial period of 30 years, renewable for two

further periods of 30 years;

o Covers an area of 25.2km(2) and includes the entire area

containing the Retortillo deposit;

o Retortillo deposit forms part of the integrated Salamanca

Project and is the first resource from which production is

scheduled to commence; and

o With the grant of Mining Licence, the approval processes

associated with other key permits, including the Initial

Authorisation of the process plant as a radioactive facility and

the Exceptional Authorisation for Land Use (application for

reclassification from rural to industrial use) of the affected

surface land area at Retortillo, may now be finalised.

-- Commencement of the Salamanca Project Definitive Feasibility Study ('DFS'):

o DFS focussed on the integrated development of Retortillo and

Alameda;

o A number of work programs providing key inputs to the DFS,

including detailed geological and structural mapping,

hydrogeological studies, metallurgical testwork, and preparations

for resource drilling at Retortillo, commenced during the

quarter.

-- 2014 drilling program at Zona 7 nearing completion:

o Previous drilling program at Zona 7 recorded significant high

grade intersections at shallow depths and essentially doubled the

strike extent of the mineralised zone. Better intercepts included

29 metres @ 3,391 ppm U(3) O(8) , 17 metres @ 1,260 ppm U(3) O(8) ,

15 metres @ 1,392 ppm U(3) O(8) , 25 metres @ 683 ppm U(3) O(8) ,

and 13 metres @ 1,161 ppm U(3) O(8) ;

o 2014 drill program, comprising approximately 2,750 metres of

reverse circulation and 300 metres of diamond core drilling, is

aimed at infilling the zone of mineralisation delineated by the

prior year drilling and extending it further to the south-west. The

current program, which is nearing completion, has been designed to

close the existing drill pattern down to a notional 100 metre by

100 metre pattern to facilitate the estimation of a revised

Inferred MRE for Zona 7.

Enquiries:

Robert Behets

Berkeley Resources

+61 8 9322 6322

John Prior / Paul Gillam - Nomad & Broker

Numis Securities

+44 (0) 207 260 1000

OPERATIONS

Berkeley Resources Limited ('Berkeley' or 'the Company') is a

uranium exploration and development company with a quality resource

base in Spain. Berkeley is currently focused on advancing its

wholly owned flagship Salamanca Project.

Salamanca Project

Berkeley's flagship Salamanca Project ('the Project') comprises

the Retortillo, Alameda, Gambuta and Zona 7 deposits, plus a number

of other Satellite deposits located in western Spain.

The Company has completed a Preliminary Feasibility Study

('PFS') on the integrated development of Retortillo and Alameda,

which clearly demonstrated the Project's potential to support a

significant scale, long life uranium mining operation (refer ASX

announcement dated 26 September 2013).

Using only the current Mineral Resource Estimates ('MRE') for

Retortillo and Alameda, which total 34.5 million pounds U(3) O(8)

(36.9 million tonnes at 424 ppm; 200 ppm U(3) O(8) cut-off grade),

as a base case scenario, the PFS showed that the Project can

support an average annual production of 3.3 million pounds of U(3)

O(8) during the seven years of steady state operation and 2.7

million pounds of U(3) O(8) over a minimum eleven year mine life.

There is strong potential to increase the production profile and/or

mine life through the exploitation of additional resources held by

the Company (totalling 27.1 million pounds U(3) O(8) ) and with

ongoing exploration work.

The PFS was based on open pit mining, heap leaching using on-off

leach pads, a centralised process plant at Retortillo, and a remote

ion exchange operation at Alameda, with loaded resin trucked to the

centralised plant for final extraction and purification. The open

pits are shallow (maximum depth of 135m) with low strip ratios

(average 1:2.1 ore to waste for the Project over the life of mine).

During steady state operation the annual ore processing rate is 5.5

million tonnes. Operating costs (C1 cash costs) average US$24.60

per pound U(3) O(8) over the life of mine.

The initial capital cost (nominally +/- 20% accuracy) for the

Project is estimated at US$95.1 million. This cost is inclusive of

all mine, processing, infrastructure and indirect costs required to

develop and commence production at Retortillo. A further US$74.4

million of capital, incurred in the second year of production, is

required to develop Alameda and achieve steady state operation. The

Project's capital cost reflects the excellent existing

infrastructure, use of heap leaching as the preferred processing

route, and the favoured mining contractor scenario (no mining fleet

capital expenditure).

Definitive Feasibility Study

The Definitive Feasibility Study ('DFS') for the Project

commenced during the quarter following finalisation of the Scope of

Work.

The key areas of focus for the DFS include:

-- Resource infill drilling programs aimed at upgrading the

classification of specific portions of the current Retortillo and

Alameda MRE's to the Measured category;

-- Further metallurgical testwork programs, including additional

column leach work (six metre columns), in combination with ion

exchange ('IX') at Alameda and solvent extraction ('SX') and

ammonium diuranate ('ADU') precipitation at Retortillo to generate

more detailed information relating to the pH and acid consumption

optimisation, design and sizing of the IX and SX units, and final

product specification;

-- Development of a Geo-Met model which will incorporate

additional geological and metallurgical parameters into the

resource block model to support metallurgical process modelling and

mine planning and optimisation;

-- Open pit optimisation, detailed mine design and production

scheduling using the upgraded MRE block models;

-- Enhanced design of the project infrastructure and site facilities;

-- Undertaking engineering studies to support capital and

operating cost estimates for the Project to a level of accuracy of

nominally +/-10%; and

-- Undertaking an evaluation of the various alternatives for

funding the development of the Project and the sale of future

uranium production (including uranium marketing and off-take

arrangements).

During the quarter a number of work programs providing key

inputs to the DFS, including the resource infill drilling program

at Retortillo, the metallurgical testwork program, development of

Geo-Met models and hydrogeological studies for both sites, were

advanced.

Geology and Drilling

Following completion of the detailed design of the infill

drilling program for Retortillo, which is aimed at upgrading the

resource classification of the areas to be mined during the initial

two years of the PFS production schedule to the Measured category,

activities including land owner authorisation, site access and

drill site preparation were undertaken during the quarter.

The drilling program will comprise approximately 70 reverse

circulation ('RC') holes for 4,600m and four diamond core ('DD')

holes for 300m. The program has been designed to close the existing

drill pattern down to a notional 35m by 35m pattern within the

areas targeted while the core obtained from the DD drilling will

facilitate enhanced geological and structural understanding of the

deposit.

The RC component of the resource drilling program commenced at

Retortillo in mid-July.

A detailed geological and structural mapping exercise at

Retortillo was also completed by experts from the University of

Salamanca during the quarter. The outputs of the mapping exercise,

including a new 1:1,000 scale geological map, has resulted in an

improved understanding of the structural and stratigraphic controls

on uranium mineralisation at Retortillo (and the broader region

hosting the Retortillo Satellite deposits) and provided a detailed

geological framework for resource estimation, hydrogeological and

geotechnical studies.

Hydrogeology

Eight short (15m depth) piezometer holes were drilled at

Retortillo as part of the DFS hydrogeological program during the

quarter. The objective of the piezometer holes is to enable the

water flow in a small creek proximal to the proposed open pit to be

compared with water table in the surrounding areas. The piezometers

will also be used for pumping and tracer tests.

A geophysical survey (Electrical Resistivity Tomography, 'ERT')

was completed at Retortillo, with data collected on eight cross

sections and four long sections. The sections have highlighted the

main faults/fractures within the deposit and surrounding area. The

spatial location of the fault/fracture zones will be taken into

account when siting drainage boreholes around the proposed open

pit.

Independent consultant, FRASA, has commenced the process of

updating the three dimensional ('3D') hydrogeological model with

all new information from the additional hydrogeological

investigations being undertaken at Retortillo. The updated model

will be used to refine the water management system developed for

the site.

At Alameda, pumping tests were conducted in the north-western

and eastern areas of the site in order to confirm the hydraulic

conductivity within these areas and the capacity to produce a

sufficient water supply for the project. The data showed high

transmissivity in the northwest and lower transmissivity in the

east. The results are being used to update the hydrogeological

model for the site.

Metallurgical Testwork

Preparation for the three composite samples, representative of

various mining phases at Retortillo, is nearing completion and it

is anticipated that the six metre columns will be loaded with

agglomerated material and the testwork program will commence in

late July.

Permitting

A major permitting milestone was achieved during the quarter

with the grant of the Exploitation Concession ('Mining Licence')

for Retortillo by the Regional Government of Castilla and León

(refer ASX announcement dated 24 April 2014). The Retortillo

deposit forms part of the Salamanca Project and is the first

resource from which production is scheduled to commence.

The grant of the Mining Licence for Retortillo is a major

milestone for the Company and follows the approval of Exploitation

and Reclamation and Closure Plans for the proposed mining operation

submitted by Berkeley, and the completion of a number of studies

and technical review sessions with relevant government agencies.

The granting of the Mining Licence has also taken into account the

prerequisite approval of the Company's Environmental and Social

Impact Assessment ('ESIA') by the environmental authorities (the

Environmental Licence for Retortillo was awarded in October 2013),

and the favourable recommendation report issued by the Nuclear

Safety Council.

The Mining Licence is valid for an initial period of 30 years

and may be renewed for two additional periods of 30 years. It

covers an area of 25.2km(2) and includes the entire area containing

the Retortillo Mineral Resource Estimate.

With the grant of the Mining Licence, the approval processes

associated with other key permits including the Initial

Authorisation of the process plant as a radioactive facility and

the Exceptional Authorisation for Land Use (application for

reclassification from rural to industrial use) of the affected

surface land area at Retortillo, may now be finalised.

The process of obtaining all other permits necessary for the

development of Retortillo continued to advance during the

quarter.

The Environmental Scoping Document ('ESD')for Alameda and the

proposed power line to supply grid power to the site was

resubmitted to the relevant authorities during the quarter. The ESD

has been updated to incorporate the PFS results and inputs from the

granting of the Environmental and Mining Licenses for Retortillo.

The Company and its environmental consultants, MAGMA, subsequently

met with the authorities and presented an overview of the ESD in

early July.

Exploration - Zona 7

The next phase of drilling program at Zona 7 commenced in May

and was nearing completion at the time of this report.

Zona 7 is located approximately 10km to the northwest of the

proposed location of the centralised processing plant at Retortillo

and currently hosts an Inferred Mineral Resource Estimate ('MRE')

of 3.9 million tonnes averaging 414 ppm U(3) O(8) for a contained

3.6 million pounds of U(3) O(8) at a lower cut-off grade of 200 ppm

U(3) O(8) (refer ASX June 2012 Quarterly Report).

The potential extension of Zona 7 to the southwest towards Las

Carbas was identified as a priority drill target following a review

of all available data for the regional tenements surrounding the

existing resources. An 18 hole, 1,133m RC drill program was

subsequently completed in mid-2013 to test this priority

target.

Assay results returned from this drilling program in August 2013

confirmed that the Zona 7 mineralisation extends a further 1,200m

to the southwest of the current resource area. The drilling, which

was carried out on an approximately 400m by 100m grid, essentially

doubled the strike extent of the mineralised zone and it remains

open. Significant high grade intersections were recorded at shallow

depths (from 9m to a maximum depth of 84m), with thicknesses up to

29m. Better intercepts included 29m @ 3,391 ppm U(3) O(8) , 17m @

1,260 ppm U(3) O(8) , 15m @ 1,392 ppm U(3) O(8) , 25m @ 683 ppm

U(3) O(8) and 13m @ 1,161 ppm U(3) O(8) (refer ASX announcement

dated 7 August 2013).

The current Zona 7 program, which comprises 38 RC holes for

approximately 2,750m and three DD holes for approximately 300m, is

aimed at infilling the zone of mineralisation defined by the 2013

drilling and extending it further to the south-west. The program

has been designed to close the existing drill pattern down to a

notional 100m by 100m pattern to facilitate the estimation of a

revised Inferred Mineral Resource for the prospect.

The RC drilling component of the 2014 program was recently

completed, and the DD drilling will be concluded in early August.

Assay results are pending.

The data obtained from both the 2013 and 2014 drilling programs

will form the basis for an upgraded Inferred Mineral Resource for

Zona 7, anticipated to be completed in the December quarter.

CORPORATE

At 30 June 2014, the Company had cash reserves of A$20.2

million.

The Company continues to maintain a strong focus on cost control

across all areas of the business.

Competent Persons Statement

The information in this Report that relates to Exploration

Results and Mineral Resources is based on information compiled by

Craig Gwatkin, who is a Member of The Australian Institute of

Mining and Metallurgy and was an employee of Berkeley Resources

Limited at the time of initial disclosure. Mr. Gwatkin has

sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the 2004 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Mr. Gwatkin consents to the inclusion in the report of

the matters based on his information in the form and context in

which it appears. This information was prepared and first disclosed

under the JORC Code 2004. It has not been updated since to comply

with the JORC Code 2012 on the basis that the information has not

materially changed since it was last reported.

The information in this Report that relates to the

Pre-Feasibility Study is based on information compiled by Neil

Senior of SENET (Pty) Ltd. Mr. Senior is a Fellow of The South

African Institute of Mining and Metallurgy and has sufficient

experience which is relevant to the style of mineralisation and

type of deposit under consideration and to the activity which he is

undertaking to qualify as a Competent Person as defined in the 2004

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. Mr. Senior consents

to the inclusion in this Report of the matters based on his

information in the form and context in which it appears. This

information was prepared and first disclosed under the JORC Code

2004. It has not been updated since to comply with the JORC Code

2012 on the basis that the information has not materially changed

since it was last reported.

Production Target

The Production Target stated in this Report is based on the

Company's Pre-Feasibility Study ('PFS') for the Salamanca Project

as released to the ASX on 26 September 2013, which included the

following material assumptions:

-- Minimum Life of Mine ('LOM') 11 years (including 7 years of steady state operation)

-- Mining Method Open pit for Retortillo and Alameda

-- Strip Ratios 1:2.6 for Retortillo and 1:1.8 Alameda (ore to

waste, averages over LOM)

-- Mining Cut-off Grades 105 ppm U(3) O(8) for Retortillo and 90

ppm U(3) O(8) for Alameda

-- Overall Pit Wall Slope Angles 35-45 degrees for Retortillo

and 35-55 degrees for Alameda

-- Processing Method Heap leaching using on-off leach pads at

Retortillo and Alameda, followed by uranium recovery and

purification by solvent extraction, ammonium diuranate

precipitation and calcination at Retortillo

-- Ore Processing Rates 2.2 million tonnes per annum for

Retortillo and 3.3 million tonnes per annum for Alameda during

steady state operation

-- Heap Leach Feed Grades 306 ppm U(3) O(8) for Retortillo and

322 ppm U(3) O(8) for Alameda (averages over LOM)

-- Metallurgical Recovery 85% for Retortillo and Alameda

-- Acid Consumption 18 kilograms per tonne for Retortillo and Alameda

-- Mining Costs US$14.50 per pound U(3) O(8) for Retortillo and

US$9.76 per pound U(3) O(8) for Alameda (average LOM C1

cash operating costs, assumes contract mining)

-- Processing Costs US$12.80 per pound U(3) O(8) for Retortillo

and US$10.41 per pound U(3) O(8) for Alameda (average LOM C1 cash

operating costs)

-- General and Administrative Costs US$2.03 per pound U(3) O(8)

for Retortillo and US$1.56 per pound U(3) O(8) for Alameda (average

LOM C1

cash operating costs)

-- Upfront Capital Costs US$95.1 million to deliver initial

production at Retortillo and a further US$74.4 million at Alameda

to

achieve steady state

-- Discount Rate 8%

-- Uranium Price US$65 per pound U(3) O(8)

-- Exchange Rate US$/EUR 1.28

The PFS and Production Target were based solely on the

Retortillo and Alameda Indicated Mineral Resources, being 14.4

million tonnes averaging 378 ppm U(3) O(8) for a contained 12.0

million pounds U(3) O(8) and 20.0 million tonnes averaging 455 ppm

U(3) O(8) for a contained 20.1 million pounds U(3) O(8)

respectively, at a lower cut-off grade of 200 ppm U(3) O(8) . The

PFS and Production Target do not incorporate any Inferred Mineral

Resources.

The Indicated Mineral Resources underpinning the Production

Target were prepared by a Competent Person in accordance with the

requirements in Appendix 5A (JORC Code). This information was first

disclosed on 26 September 2013 under the JORC Code 2004. It has not

been updated since to comply with the JORC Code 2012 on the basis

that the information has not materially changed since it was last

reported. The Competent Person Statement relating to the Indicated

Mineral Resources is above.

The Company confirms that the material assumptions underpinning

the PFS and Production Target referenced in the 26 September 2013

release continue to apply and have not materially changed.

Forward Looking Statement

Statements regarding plans with respect to the Company's mineral

properties are forward-looking statements. There can be no

assurance that the Company's plans for development of its mineral

properties will proceed as currently expected. There can also be no

assurance that the Company will be able to confirm the presence of

additional mineral deposits, that any mineralisation will prove to

be economic or that a mine will successfully be developed on any of

the Company's mineral properties.

Appendix 1: Summary of Mining Tenements

As at 30 June 2014, the Company had an interest in the following

tenements:

Location Tenement Name Interest Status

------------- ----------------------------- --------- ---------

Spain

Salamanca D.S.R Salamanca 28 (Alameda) 100% Granted

D.S.R Salamanca 29 (Villar) 100% Granted

E.C Retortillo-Santidad 100% Granted

I.P. Abedules 100% Granted

I.P. Abetos 100% Granted

I.P. Alcornoques 100% Granted

I.P. Alisos 100% Granted

I.P. Bardal 100% Granted

I.P. Barquilla 100% Granted

I.P. Berzosa 100% Granted

I.P. Campillo 100% Granted

I.P. Castaños 2 100% Granted

I.P. Ciervo 100% Granted

I.P. Dehesa 100% Granted

I.P. El Águlia 100% Granted

I.P. Espinera 100% Granted

I.P. Horcajada 100% Granted

I.P. Mailleras 100% Granted

I.P. Mimbre 100% Granted

I.P. Oñoro 100% Granted

I.P. Pedreras(Fractions 100% Granted

1 - 4)

I.P. Alimoche 100% Pending

I.P. El Vaqueril 100% Pending

I.P. Halcón 100% Pending

Cáceres I.P. Almendro 100% Granted

I.P. Ibor 100% Granted

I.P. Olmos 100% Granted

Badajoz I.P Don Benito Este - 100% Pending

U

I.P Don Benito Este - 100% Pending

C

I.P Don Benito Oeste 100% Pending

- U

I.P Don Benito Oeste 100% Pending

- C

Ciudad Real I.P Damkina Fraccion 100% Granted

1

I.P Damkina Fraccion 100% Granted

2

I.P Damkina Fraccion 100% Granted

3

Exploitation Concession for Retortillo-Santidad was granted

during the quarter ended 30 June 2014. No tenements were acquired

or disposed of during the quarter ended 30 June 2014. There were no

changes to beneficial interest in any mining tenements due to

Farm-in or Farm-out agreements. No beneficial interest in Farm-in

or Farm-out agreements were acquired or disposed during the

quarter.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFIRDAIVFIS

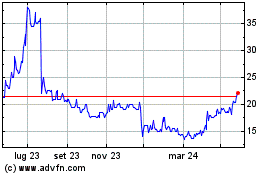

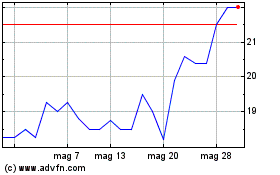

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024