Berkeley Energia Limited Salamanca aims to be world's lowest cost producer (2918H)

30 Novembre 2015 - 8:01AM

UK Regulatory

TIDMBKY

RNS Number : 2918H

Berkeley Energia Limited

30 November 2015

BERKELEY ENERGIA LIMITED

AIM RELEASE | 30 November 2015 | AIM / ASX: BKY

Salamanca aims to be the world's lowest cost producer

Optimisation studies have commenced on the Salamanca project

which are expected to reduce the operating costs making it the

amongst world's lowest cost uranium producers once developed.

As previously reported the high grade Zona 7 deposit has

transformed the economics of the project lifting the Net Present

Value to over US$871.5 million (GBP580.9 million, GBP3.22 per

share) and reducing operating costs from US$24.60 to US$15.60 per

pound of uranium produced during steady state operations.

Managing Director Paul Atherley commented:

"The near surface high grade Zona 7 deposit has transformed the

economics of the project largely due to an increase in grade. We

are now focussed on further reducing the operating costs with the

aim to make the Salamanca project the world's lowest cost

producer"

Early indications from the optimisation studies have

demonstrated that whilst the project has benefited from on average

a 42% increase in grade from the Zona 7 ore during the first ten

years of operation there is room for further improvement

particularly in the material handling scheduling, strip ratio, the

mining unit rates and the fixed costs associated with grade control

drilling and assaying.

The project continues to benefit from external factors such as

continued deflationary trends arising from ongoing strong

competition amongst major contractors and suppliers as well as the

continued depreciation of the Euro against the US dollar making

local costs cheaper against the US dollar denominated uranium

price.

The optimisation forms part of the definitive feasibility study

required by financiers and offtake parties to enable funding and

sales contracts to be put in place ahead of the commencement of

construction in mid-2016.

The study is being undertaken by metallurgical consultancy MDM

Engineering, part of the Amec Foster Wheeler group working in

conjunction with major Spanish engineering groups Iberdrola and OHL

and a number of specialist local contractors.

These groups are bringing to the project the latest industry

developments in automation, data analytics and process control and

reflect management's commitment to continuous improvement in all

aspects of its operations.

Interim results are expected to be reported early in the New

Year giving guidance on the progress of the optimisation

studies.

For further information contact:

Paul Atherley Hugo Schumann Paul Shackleton / Nick Prowting

(Nomad)

Managing Director Corporate Manager Jay Ashfield (Broker)

+44 207 478 3900 +44 207 478 3900 WH Ireland Limited

info@berkeleyenergia.com +44 207 220 1666

Competent Persons Statement

The information in this announcement that relates to the

Pre-Feasibility Study is extracted from the reports entitled 'Zona

7 transforms Salamanca project economics' dated 4 November 2015

which is available to view on Berkeley Energia Limited's (Berkeley)

website at www.berkeleyenergia.com. The information in the original

ASX announcement is based on information compiled by Mr Francisco

Bellon, a Competent Person who is a member of the Australasian

Institute of Mining and Metallurgy. Mr Bellon is the General

Manager Operation for Berkeley and a holder of shares, options and

performance rights in Berkeley. Mr Bellon has sufficient experience

which is relevant to the style of mineralisation and type of

deposit under consideration and to the activity which he is

undertaking to qualify as a Competent Person as defined in the 2012

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. The Company confirms

that it is not aware of any new information or data that materially

affects the information included in the original market

announcements and, in the case of estimates of the Production

Target and related forecast financial information derived from the

Production Target, all material assumptions and technical

parameters underpinning the estimates in the relevant original

market announcement continue to apply and have not materially

changed. The Company confirms that the form and context in which

the Competent Person's findings are presented have not been

materially modified from the original market announcement.

Forward Looking Statement

Statements regarding plans with respect to the Company's mineral

properties are forward-looking statements. There can be no

assurance that the Company's plans for development of its mineral

properties will proceed as currently expected. There can also be no

assurance that the Company will be able to confirm the presence of

additional mineral deposits, that any mineralisation will prove to

be economic or that a mine will successfully be developed on any of

the Company's mineral properties.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCLBLBXEFFFFBD

(END) Dow Jones Newswires

November 30, 2015 02:01 ET (07:01 GMT)

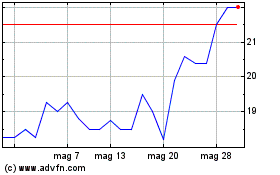

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

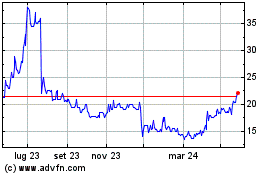

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024