Berkeley Energia Limited Successful Execution of Royalty Financing (0648D)

04 Luglio 2016 - 8:00AM

UK Regulatory

TIDMBKY

RNS Number : 0648D

Berkeley Energia Limited

04 July 2016

BERKELEY ENERGIA LIMITED

NEWS RELEASE | 4 July 2016 | AIM/ASX: BKY

Successful Execution of Royalty Financing

Berkeley Energia Limited is pleased to announce that formal

documentation in relation to the previously announced US$5 million

royalty financing with RCF V Annex Fund L.P. (RCF VA) has been

successfully completed and executed.

The royalty financing comprised the sale of a 0.375% fully

secured net smelter royalty over the project for US$5 million

alongside an additional US$5 million equity placement to RCF VA

which was completed at a 15% premium to the 30-day VWAP at the

time.

The royalty is consistent with the Company's focus on minimising

dilution in order to protect the equity value of its shareholders.

Funds from the royalty will be made available to Berkeley following

satisfaction of conditions precedent related to the lodgement of

security documentation with Spanish authorities which will occur in

the coming weeks.

Managing Director Paul Atherley commented:

"The funding allows us to undertake the initial infrastructure

development ahead of the commencement of main construction and

financing later in the year.

In addition it has allowed us to recommence drilling at a number

of the previously identified high potential exploration targets,

including extensions to the Zona 7 deposit to the south and at

depth.

The results of the optimization studies being undertaken as part

of the definitive feasibility study to be published in the next

coming days are likely to demonstrate the Salamanca project's

robust economics even at the current low uranium prices."

For further information please contact:

Paul Atherley Hugo Schumann Paul Shackleton / Nick

Prowting (Nomad)

Managing Director Corporate Jay Ashfield (Broker)

Manager

+44 207 478

+44 207 478 3900 3900 WH Ireland Limited

info@berkeleyenergia.com +44 207 220 1666

About RCF

Resource Capital Funds (RCF) is a group of commonly managed

private equity funds, established in 1998 with a mining sector

specific investment mandate spanning all hard mineral commodities

and geographic regions. Since inception, RCF has supported 150

mining companies, with projects located in 47 countries and across

29 commodities. The sixth fund, Resource Capital Fund VI L.P. (RCF

VI) with committed capital of $2.04 billion, is now being invested.

Further information about RCF can be found on its website

(www.resourcecapitalfunds.com).

RCF has a strong team of investment professionals, with wide

ranging industry and technical expertise and a demonstrated history

of investments in mining globally. RCF's track record is based on

its ability to pick technically and commercially compelling assets

and support management to achieve desired outcomes whilst remaining

throughout a source of patient capital. RCF aims to partner with

companies to build strong, successful and sustainable businesses

and in doing so strives to earn superior returns for all

shareholders.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCFMGGNRFZGVZG

(END) Dow Jones Newswires

July 04, 2016 02:00 ET (06:00 GMT)

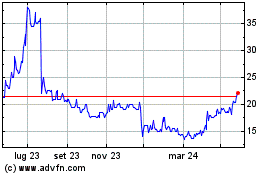

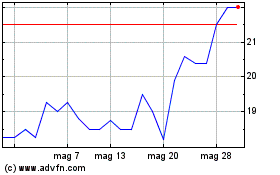

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024