TIDMBKY

RNS Number : 4468N

Berkeley Energia Limited

26 October 2016

BERKELEY ENEGIA LIMITED

NEWS RELEASE | 26 October 2016 | AIM/ASX BKY

Quarterly Report September 2016

Salamanca mine development underway

Following a decade of exploration and US$60 million of

investment, development of the Salamanca mine commenced in August

2016 and is now well underway.

The goal is to establish the mine as one of the world's lowest

cost producers, reliably supplying long term customers from the

heart of the European Union.

The US$100 million project will be Europe's only major uranium

mine and once in production will be one of the world's biggest

producers supplying over four million pounds of uranium concentrate

a year, equivalent to approximately 10% of the continent's total

requirement.

The mine will rejuvenate a community suffering from lack of

investment and badly hit by long term unemployment.

Skills training programmes are being run for locals to equip

them for the 454 jobs the mine will create once in full production.

In addition it has been estimated that over time the mine will

generate indirectly an estimated further 2,295 jobs in the region.

During the main construction phase commencing in 2017 the

contractor workforce will peak at over 700.

Local businesses are being prioritized and the local

municipalities and communities will be fully supported throughout

the life of the mine.

Whilst spot uranium prices are expected to remain flat or fall

in the near term, from 2018 when the Salamanca mine is scheduled to

come into production, demand is expected to grow significantly as

US and EU utilities commence re-contracting for medium to long term

supply and Chinese demand for its US$570 billion new reactor fleet

begins to build.

Commenting on the progress of the Salamanca mine, Paul Atherley,

Managing Director, stated:

"We are extremely encouraged by the strong local support for the

development of the mine and in return we remain absolutely

committed to rejuvenating the local community, bringing badly

needed jobs, training and new business activity to the area."

"After a decade of investment we are bringing the Salamanca mine

into production at the bottom of the uranium price cycle and

judging by the interest we are receiving for offtake from 2018

onwards in particular from US and Asian utilities it looks like we

will be delivering into growing demand."

The Salamanca mine is the only major new uranium mine commencing

development in the world today and has caught the attention of a

wide range of industry participants and potential financiers.

The mine has a rare combination of extremely low operating costs

of around US$15 per pound of uranium produced and a low upfront

capital cost of around US$100 million, giving it robust economics

at the bottom of the uranium price cycle.

Salamanca's location at the heart of the European Union is also

proving to be of interest to those utilities looking to diversify

supply.

Approximately two thirds of the world's uranium is consumed in

OECD countries, mainly the US and the EU, whilst about the same

proportion of uranium is supplied from non OECD countries, mainly

Kazakhstan, Russia and Niger.

The Company is now in discussions with potential strategic

partners who are interested in taking a minority stake in the

project and who are undertaking legal, technical and financial due

diligence.

In September 2016, the Company signed a Letter of Intent with

Interalloys Trading Limited (Interalloys), a European based

commodity trading company, relating to the sale of the first

million pounds of production from the Salamanca mine over a five

year period commencing in 2019.

The Company is also in discussions with another utility company

in relation to a sales contract with terms similar to those

outlined in the Interalloys Agreement.

Subsequent to quarter end the Company has been invited to tender

on a ten-year 11 million pound supply contract with a major Asian

utility.

A number of major utility companies from both the US and Asia

have expressed interest in offtake and have undertaken due

diligence and visited site.

Exploration targeting further Zona 7 style deposits continued

during the quarter. Results from four holes drilled through the

near-surface Zona 7 deposit to a depth of 271 metres have reported

grades consistent with, or higher than, the average grade of the

Zona 7 resource itself pointing to a potential resource

upgrade.

The Company's good neighbour and business partner relationship

with the local community has been very well received.

The policy of preferentially hiring local residents and inviting

them to undertake a skills training programme for potential

employees has been heavily oversubscribed with over ninety locals

completing the two courses held to date.

In addition the organization and sponsorship of various sporting

activities and the installation of free Wi-Fi in the local villages

has provided immediate benefit to local residents.

An independent Definitive Feasibility Study (DFS) completed by

an Amec Foster Wheeler Group (LSE: AMFW) specialist company, MDM

Engineering Limited, confirmed in July 2016 the Salamanca mine as

one of the world's lowest cost uranium producers, capable of

generating strong after tax cash flow through the current low point

in the uranium price cycle.

The Company is fully funded through the initial development

phase with A$13.4 million in cash and no debt as at 30 September

2016.

For further information please contact:

+44 20 7478

Berkeley Energia Limited 3900

Paul Atherley, Managing Director info@berkeleyenergia.com

Hugo Schumann, Corporate Manager

WH Ireland Limited (Nominated +44 20 7220

Adviser and Joint Broker) 1666

Paul Shackleton

Nick Prowting

Jay Ashfield

+44 20 7418

Peel Hunt LLP (Joint Broker) 8900

Matthew Armitt

Ross Allister

Chris Burrows

+44 207 466

Buchanan 5000

Bobby Morse, Senior Partner BKY@buchanan.uk.com

Anna Michniewicz, Account Director

Letter of Intent signed for first million pounds and growing

demand from US and Asian utilities

The Company continues to engage with major utilities and trading

houses and has now met with key potential customers across the US,

Europe and Asia, many of whom have shown high levels of interest in

securing offtake from the mine.

In September 2016, the Company signed a Letter of Intent with

Interalloys, a European based commodity trading company, relating

to the sale of the first million pounds of production from the

Salamanca mine.

The Agreement contemplates the sale of up to one million pounds

of uranium concentrate over a five-year period starting from the

commencement of production and extendable thereafter by mutual

consent.

The average price contemplated by the parties is above US$41 per

pound compared with the current spot price of around US$22 per

pound. A combination of fixed and market related pricing will apply

in order to secure positive margins in the early years of

production whilst ensuring that the company remains exposed to

higher prices in the future.

Discussions are underway to finalise the non-binding Agreement

into an offtake contract by the end of the year.

The Company is also in discussions with another US based utility

in relation to a sales contract with terms similar to those

outlined in the Interalloys Agreement.

Subsequent to quarter end, the Company has been invited to

tender on a ten-year 11 million pound supply contract with a major

Asian utility.

A number of major utility companies from both the US and Asia

have expressed interest in offtake and several of them have

undertaken due diligence and visited site.

As construction gets underway, the Company expects to enter into

further offtake agreements and build a book of offtake

contracts.

Whilst spot uranium prices are expected to remain flat in the

near term, from 2018 when the Salamanca mine is scheduled to come

into production, demand is expected to grow significantly for term

contracts as US and EU utilities commence re-contracting for medium

to long term uranium supply and Chinese demand for uranium for its

US$570 billion new reactor fleet begins to build.

High grade intercepts below Zona 7 point to potential resource

upgrade

A major exploration programme targeting further Zona 7 style

deposits across numerous key targets continued during the

quarter.

The programme is aimed at making new discoveries and converting

some of the 29.6 million pounds of Inferred resources into the mine

schedule with the objective of maintaining annual production at

over 4 million pounds a year on an ongoing basis.

Additional high grade intersections have been recorded below the

Zona 7 deposit, further supporting previous indications of

continuity of mineralisation beneath the current defined

resource.

Results from four holes drilled through the near-surface Zona 7

deposit and extended to a maximum depth of 271 metres have reported

grades consistent with, or higher than, the average grade of the

Zona 7 resource.

The drilling beneath Zona 7 complements three holes drilled

earlier this year in which broad, high grade intersections were

reported at up to 14 metres @ 4,481 ppm U(3) O(8) (please refer to

announcement on 27 January 2016).

Amec Foster Wheeler appointed to undertake FEED contract

During the quarter, the Company appointed MDM Engineering

Limited, a wholly owned specialist subsidiary of the Amec Foster

Wheeler Group (LSE: AMFW) to undertake the Front End Engineering

and Design (FEED) for the Salamanca mine.

The FEED is the execution phase of the project during which the

overall engineering and process design is translated into equipment

procurement packages and awards to specialist subcontractors.

The FTSE 250 listed Amec Foster Wheeler is a leading global

engineering group with extensive experience in delivering uranium

mining and processing solutions.

Amec Foster Wheeler's FEED will be based on the DFS with input

from a number of Spain's most reputable engineering groups

including Madrid IBX-35 listed companies Iberdrola (BME: IBE) and

OHL (BME: OHL).

Infrastructure development progressing well

The infrastructure development is progressing well and includes

the 5.2 kilometre road deviation, development of pedestrian

footpaths and secure cattle paths and the previous installation of

a Wi-Fi network for the local villagers, as part of the Company's

commitment to improve infrastructure for the local community.

The contract for rerouting the main powerline has been awarded

to Iberdrola, the owner of the line, the Company's study partner

for the radiological aspects of the mine and one of the leading

players in the Spanish energy generation and distribution

market.

Material procurement has commenced and construction will start

early next year following the completion of some of the road access

development. Construction of the road deviation will take

approximately three months.

This initial development is taking place on over 100 hectares of

land acquired from more than thirty local landowners.

Study confirms Salamanca mine as one of the world's lowest cost

uranium producers

An independent study released during the quarter has confirmed

the future Salamanca mine as one of the world's lowest cost

producers, capable of generating strong after tax cash flow through

the current low point in the uranium price cycle.

A DFS has reported that over an initial ten year period the

project is capable of producing an average of 4.4 million pounds of

uranium per year at a cash cost of US$13.30 per pound and at a

total cash cost of US$15.06 per pound, which compares with the

current spot price of US$22 per pound and term contract price of

US$41 per pound.

During this ten year steady state production period, based on

the most recent UxC forward curve of uranium prices, the project is

expected to generate an average annual net profit after tax of

US$116 million.

At the time of announcing the DFS, Managing Director Paul

Atherley commented: "The Salamanca mine is capable of generating

strong, sustainable cash flow through the low point in the uranium

price cycle. We have commenced initial infrastructure works and are

aiming to establish the operation as one of the world's top ten

producers, reliably supplying long term customers from the heart of

the European Union."

With operating costs almost exclusively in Euros and a revenue

stream in US dollars the project is expected to continue to benefit

from the effects of deflationary pressures within the EU.

The mine has an initial mine life of 14 years based on mining

and treating only the Measured and Indicated resources of 59.8

million pounds.

An ongoing annual exploration programme, as discussed above,

will take advantage of generous taxation incentives and has been

aimed at making new discoveries and converting some of the 29.6

million pounds of Inferred resources into the mine schedule with

the objective of maintaining annual production at over 4 million

pounds a year on an ongoing basis.

The mine design incorporates the very latest thinking on

minimising environmental impact and continuous rehabilitation such

that land used during mining and processing activities will be

quickly restored to agricultural usage.

Strong interest from financiers and strategic partners

The Salamanca mine is the only major new uranium mine commencing

development in the world today and has caught the attention of a

wide range of industry participants and potential financiers.

The mine has a rare combination of extremely low operating costs

of around US$15 per pound of uranium and low upfront capital cost

of around US$100 million giving it robust economics at the bottom

of the uranium price cycle.

The Salamanca mine's location at the heart of the European Union

is also proving to be of interest to those utilities looking to

diversify supply.

Approximately two thirds of the world's uranium is consumed in

OECD countries, mainly the US and the EU, whilst about the same

proportion of uranium is supplied from non OECD countries, mainly

Kazakhstan, Russia and Niger.

The Company is currently in a strong position and is considering

a range of financing options. It is in discussions with a number of

potential strategic partners who are interested in taking a

minority stake in the project and are currently undertaking legal,

technical and financial due diligence.

Commitment to the community and the environment

The Company continues to be committed to the rejuvenation of the

local community by being a good neighbour and a good community

business partner.

It has been by far the biggest investor in a rural community

suffering from decades of under investment and will continue to

invest and cooperate to promote local employment in a region with a

high level of unemployment, especially amongst its youth.

The Company has to date received over 20,500 applications for

the first 200 direct jobs it will create. The University of

Salamanca has estimated that for this type of business, there will

be a multiplier of 5.1 indirect jobs for every direct job created,

resulting in over 2,900 jobs being created as a result of the

investment when the mine is in production.

The Company has formalized its "good neighbour and good

community business partner" commitment via a Cooperation Agreement

with the highly supportive local municipalities which, in addition

to significant royalties and taxes being paid by the Company, gives

priority to the employment and training of local residents and the

preferential support for businesses by sourcing goods and services

locally.

In late 2015, the Company carried out its first training course

in the local community areas. The training course focused on

blasting techniques for the future operations and was attended by

over 30 local residents, with recognised diplomas being issued upon

graduation.

In 2016, the Company advertised a driver training course for

approximately 65 individuals from the local region. Participants

will be given a license to operate mobile equipment on completing

the course.

Training programmes will continue to run to ensure that

sufficient people from the local communities are qualified for jobs

created during the construction and mining phases. The policy of

preferentially hiring and training local residents has been very

well received with the programmes continuing to be heavily

oversubscribed, to date over 100 potential employees have attended

courses organized by the Company.

The Company's commitment to the environment remains a priority

and, as outlined in the Environmental License and the Environmental

Measures Plan, it will plant trees over some 75 to 100 hectares of

land in the region.

Commitment to raising the number of women employees

Subsequent to the quarter end the Company attended the Women in

Mining seminar to discuss the report recently published by Ernst

& Young, 'Has mining discovered its next great resource',

encouraging more women to join the mining industry.

Berkeley Energia remains committed to gender diversity, as

evidenced by the high number of women employed throughout the

various levels of the Company. Currently over 37% of the team in

Spain are women and we are committed to raising this number over

the coming years.

Corporate

The Company is fully funded through the initial development

phase with A$13.4 million in cash and no debt as at 30 September

2016.

Table 1 - Global Mineral Resource Estimates

(Cut-off grade of 200 ppm U(3) O(8) )

July 2016

------------------ ------------ --------------------------

Deposit Resource Tonnes U(3) U(3)

O(8) O(8)

Name Category (Mt) (ppm) (Mlbs)

------------------ ------------ ------- ------- --------

Retortillo Measured 4.1 498 4.5

Indicated 11.3 395 9.8

Inferred 0.2 368 0.2

------------------------------- ------- ------- --------

Total 15.6 422 14.5

------------------------------- ------- ------- --------

Zona 7 Measured 5.2 674 7.8

Indicated 10.5 761 17.6

Inferred 6.0 364 4.8

------------------------------- ------- ------- --------

Total 21.7 631 30.2

------------------------------- ------- ------- --------

Alameda Indicated 20.0 455 20.1

Inferred 0.7 657 1.0

------------------------------- ------- ------- --------

Total 20.7 462 21.1

------------------------------- ------- ------- --------

Las Carbas Inferred 0.6 443 0.6

Cristina Inferred 0.8 460 0.8

Caridad Inferred 0.4 382 0.4

Villares Inferred 0.7 672 1.1

Villares North Inferred 0.3 388 0.2

------------------ ------------ ------- ------- --------

Total Retortillo

Satellites Total 2.8 492 3.0

------------------ ------------ ------- ------- --------

Villar Inferred 5.0 446 4.9

Alameda Nth Zone

2 Inferred 1.2 472 1.3

Alameda Nth Zone

19 Inferred 1.1 492 1.2

Alameda Nth Zone

21 Inferred 1.8 531 2.1

------------------ ------------ ------- ------- --------

Total Alameda

Satellites Total 9.1 472 9.5

------------------ ------------ ------- ------- --------

Gambuta Inferred 12.7 394 11.1

------------------ ------------ ------- ------- --------

Salamanca mine

Total Measured 9.3 597 12.3

==================

Indicated 41.8 516 47.5

Inferred 31.5 395 29.6

------------------------------- ------- ------- --------

Total (*) 82.6 514 89.3

=============================== ======= ======= ========

(*) All figures are rounded to reflect appropriate levels of

confidence. Apparent differences occur due to rounding. The

Measured and Indicated Mineral Resources are inclusive of those

Mineral Resources modified to produce the Ore Reserves. The

Salamanca mine is 100% owned by the Company

Table 2 -Ore Reserve Estimate

July 2016

------------ ----------- --------------------------

Deposit Resource Tonnes U(3) U(3)

O(8) O(8)

Name Category (Mt) (ppm) (Mlbs)

------------ ----------- ------- ------- --------

Retortillo Proved 4.0 397 3.5

Probable 11.9 302 7.9

Total 15.9 325 11.4

------------------------ ------- ------- --------

Zona 7 Proved 6.5 542 7.8

Probable 11.9 624 16.4

------------------------ ------- ------- --------

Total 18.4 595 24.2

------------------------ ------- ------- --------

Alameda Proved 0.0 0.0 0.0

Probable 26.4 327 19.0

------------------------ ------- ------- --------

Total 26.4 327 19.0

------------------------ ------- ------- --------

Total Proved 10.5 487 11.3

============

Probable 50.3 391 43.4

Total (*) 60.7 408 54.6

======================== ======= ======= ========

(*) cut-off grade for Retortillo 107 ppm, Zona 7 125 ppm,

Alameda 90 ppm. Apparent differences occur due to rounding. The

Salamanca mine is 100% owned by the Company.

Competent Persons Statement

The information in this announcement that relates to the

Definitive Feasibility Study, Mineral Resources for Zona 7, Ore

Reserve Estimates, Mining, Uranium Preparation, Infrastructure,

Production Targets and Cost Estimation is extracted from the

announcement entitled 'Study confirms the Salamanca project as one

of the world's lowest cost uranium producers' dated 14 July 2016,

which is available to view on Berkeley's Energia Limited (Berkeley)

website at www.berkeleyenergia.com.

Berkeley confirms that: a) it is not aware of any new

information or data that materially affects the information

included in the original announcement; b) all material assumptions

and technical parameters underpinning the Mineral Resources, Ore

Reserve Estimate, Production Target, and related forecast financial

information derived from the Production Target included in the

original announcement continue to apply and have not materially

changed; and c) the form and context in which the relevant

Competent Persons' findings are presented in this announcement have

not been materially modified from the original announcements.

The information in the original announcement that relates to the

Definitive Feasibility Study is based on, and fairly represents,

information compiled or reviewed by Mr. Mr Jeffrey Peter Stevens, a

Competent Person who is a Member of The Southern African Institute

of Mining & Metallurgy, a 'Recognised Professional

Organisation' (RPO) included in a list posted on the ASX website

from time to time. Mr. Stevens is employed by MDM Engineering (part

of the Amec Foster Wheeler Group). Mr. Stevens has sufficient

experience that is relevant to the style of mineralization and type

of deposit under consideration and to the activity being undertaken

to qualify as a Competent Person as defined in the 2012 Edition of

the 'Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves'.

The information in the original announcement that relates to the

Ore Reserve Estimates, Mining, Uranium Preparation, Infrastructure,

Production Targets and Cost Estimation is based on, and fairly

represents, information compiled or reviewed by Mr. Andrew David

Pooley, a Competent Person who is a Member of The Southern African

Institute of Mining and Metallurgy', a Recognised Professional

Organisation' (RPO) included in a list posted on the ASX website

from time to time. Mr. Pooley is employed by Bara Consulting (Pty)

Ltd. Mr. Pooley has sufficient experience that is relevant to the

style of mineralization and type of deposit under consideration and

to the activity being undertaken to qualify as a Competent Person

as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'.

The information in the original announcement that relates to the

Mineral Resources for Zona 7 is based on, and fairly represents,

information compiled or reviewed by Mr Malcolm Titley, a Competent

Person who is a Member of The Australasian Institute of Mining and

Metallurgy. Mr Titley is employed by Maja Mining Limited, an

independent consulting company. Mr Titley has sufficient experience

which is relevant to the style of mineralisation and type of

deposit under consideration and to the activity which he is

undertaking to qualify as a Competent Person as defined in the 2012

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'.

The information in this announcement that relates to the Mineral

Resources for Retortillo is extracted from the announcement

entitled 'Increase in Retortillo grade expected to boost economics'

dated 7 January 2015 which is available to view on Berkeley's

website at www.berkeleyenergia.com. The information in the original

announcement is based on, and fairly represents, information

compiled by Mr Malcolm Titley, a Competent Person who is a Member

of The Australasian Institute of Mining and Metallurgy. Mr Titley

is employed by Maja Mining Limited, an independent consulting

company. Mr Titley has sufficient experience which is relevant to

the style of mineralisation and type of deposit under consideration

and to the activity which he is undertaking to qualify as a

Competent Person as defined in the 2012 Edition of the

'Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves'. The Company confirms that it is not

aware of any new information or data that materially affects the

information included in the original market announcement and, in

the case of estimates of Mineral Resources that all material

assumptions and technical parameters underpinning the estimates in

the relevant market announcement continue to apply and have not

materially changed. The Company confirms that the form and context

in which the Competent Person's findings are presented have not

been materially modified from the original market announcement.

The information in this announcement that relates to the Mineral

Resources for Alameda (refer ASX announcement dated 31 July 2012)

is based on, and fairly represents, information compiled by Mr

Craig Gwatkin, who is a Member of The Australasian Institute of

Mining and Metallurgy and was an employee of Berkeley Energy

Limited at the time of initial disclosure. Mr Gwatkin has

sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the 2004 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Mr Gwatkin consents to the inclusion in the announcement

of the matters based on his information in the form and context in

which it appears. This information was prepared and first disclosed

under the JORC Code 2004. It has not been updated since to comply

with the JORC Code 2012 on the basis that the information has not

materially changed since it was last reported.

The information in this report that relates to the 2016

Exploration Results for Zona 7 is extracted from the announcement

entitled 'High grades intersected immediately below Zona 7 deposit'

dated 27 January 2016, which is available to view on Berkeley

Energia Limited's ('Berkeley') website at www.berkeleyenergia.com.

The information in the original ASX announcement is based on, and

fairly represents, information compiled by Mr Malcolm Titley, a

Competent Person who is a Member of The Australasian Institute of

Mining and Metallurgy. Mr Titley is employed by Maja Mining

Limited, an independent consulting company. Mr Titley has

sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Berkeley confirms that it is not aware of any new

information or data that materially affects the information

included in the original market announcements and, in the case of

estimates of Mineral Resources that all material assumptions and

technical parameters underpinning the estimates in the relevant

market announcement continue to apply and have not materially

changed. Berkeley confirms that the form and context in which the

Competent Person's findings are presented have not been materially

modified from the original market announcement.

Forward Looking Statement

Statements regarding plans with respect to Berkeley's mineral

properties are forward-looking statements. There can be no

assurance that Berkeley's plans for development of its mineral

properties will proceed as currently expected. There can also be no

assurance that Berkeley will be able to confirm the presence of

additional mineral deposits, that any mineralisation will prove to

be economic or that a mine will successfully be developed on any of

Berkeley's mineral properties.

Appendix 1: Summary of Mining Tenements

As at 30 September 2016, the Company had an interest in the

following tenements:

Location Tenement Name Percentage Status

Interest

------------- ------------------------- ----------- --------

Spain

Salamanca D.S.R Salamanca 100% Granted

28 (Alameda)

D.S.R Salamanca 100% Granted

29 (Villar)

E.C. Retortillo-Santidad 100% Granted

E.C. Lucero 100% Pending

I.P. Abedules 100% Granted

I.P. Abetos 100% Granted

I.P. Alcornoques 100% Granted

I.P. Alisos 100% Granted

I.P. Bardal 100% Granted

I.P. Barquilla 100% Granted

I.P. Berzosa 100% Granted

I.P. Campillo 100% Granted

I.P. Castaños 100% Granted

2

I.P. Ciervo 100% Granted

I.P. Dehesa 100% Granted

I.P. El Águlia 100% Granted

I.P. Espinera 100% Granted

I.P.Halcón 100% Granted

I.P. Horcajada 100% Granted

I.P. Mailleras 100% Granted

I.P. Mimbre 100% Granted

I.P. Oñoro 100% Granted

I.P. Pedreras 100% Granted

I.P. El Vaqueril 100% Pending

I.P. Calixto 100% Pending

I.P. Melibea 100% Pending

I.P. Clerecía 100% Pending

I.P. Clavero 100% Pending

I.P. Conchas 100% Pending

I.P. Lis 100% Pending

E.P. Herradura 100% Pending

------------- ------------------------- ----------- --------

Cáceres I.P. Almendro 100% Granted

I.P. Ibor 100% Granted

I.P. Olmos 100% Granted

Badajoz I.P. Don Benito 100% Granted

Este

I.P. Don Benito 100% Granted

Oeste

Ciudad Real I.P. Damkina 100% Granted

Fraccion 1

I.P. Damkina 100% Granted

Fraccion 2

I.P. Damkina 100% Granted

Fraccion 3

No tenements were acquired or disposed of during the quarter

ended 30 September 2016. There were no changes to beneficial

interest in any mining tenements due to Farm-in or Farm-out

agreements. No beneficial interest in Farm-in or Farm-out

agreements were acquired or disposed during the quarter.

+Rule 5.5

Appendix 5B

Mining exploration entity and oil and gas exploration entity

quarterly report

Introduced 01/07/96 Origin Appendix 8 Amended 01/07/97,

01/07/98, 30/09/01, 01/06/10, 17/12/10, 01/05/13, 01/09/16

Name of entity

-------------------------------------------

Berkeley Energia Limited

-------------------------------------------

ABN Quarter ended ("current

quarter")

--------------- ------------------------

40 052 468 569 30 September 2016

--------------- ------------------------

Consolidated statement Current quarter Year to date

of cash flows $A'000

(3 months)

$A'000

--------------------------------------- ---------------- -------------

1. Cash flows from operating

activities

1.1 Receipts from customers - -

1.2 Payments for

(a) exploration & evaluation (2,178) (2,178)

(b) development - -

(c) production - -

(d) staff costs (1,113) (1,113)

(e) administration

and corporate costs (457) (457)

1.3 Dividends received - -

(see note 3)

1.4 Interest received 52 52

1.5 Interest and other - -

costs of finance paid

1.6 Income taxes paid - -

1.7 Research and development - -

refunds

1.8 Other (provide details

if material): - -

---------------- -------------

Net cash from / (used

1.9 in) operating activities (3,696) (3,696)

----- -------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire:

(a) property, plant

and equipment - -

(b) tenements (see - -

item 10)

(c) investments - -

(d) other non-current

assets (557) (557)

2.2 Proceeds from the disposal

of:

(a) property, plant

and equipment - -

(b) tenements (see - -

item 10)

(c) investments - -

(d) other non-current - -

assets

2.3 Cash flows from loans - -

to other entities

2.4 Dividends received - -

(see note 3)

2.5 Other (provide details - -

if material):

---------------- -------------

Net cash from / (used

2.6 in) investing activities (557) (557)

------- ------------------------------ ---------------- -------------

3. Cash flows from financing

activities

3.1 Proceeds from issues

of shares - -

3.2 Proceeds from issue - -

of convertible notes

3.3 Proceeds from exercise - -

of share options

Transaction costs related

to issues of shares,

convertible notes or

3.4 options (17) (17)

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings - -

3.7 Transaction costs related

to loans and borrowings - -

3.8 Dividends paid - -

Other (provide details

3.9 if material)

(a) Proceeds from sale

of royalty 6,531 6,531

(b) Costs in relation

to sale of royalty (167) (167)

---------------- -------------

Net cash from / (used

3.10 in) financing activities 6,347 6,347

------- ------------------------------ ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 11,346 11,346

Net cash from / (used

in) operating activities

4.2 (item 1.9 above) (3,696) (3,696)

Net cash from / (used

in) investing activities

4.3 (item 2.6 above) (557) (557)

Net cash from / (used

in) financing activities

4.4 (item 3.10 above) 6,347 6,347

Effect of movement

in exchange rates on

4.5 cash held (1) (1)

---------------- -------------

Cash and cash equivalents

4.6 at end of period 13,439 13,439

------- ------------------------------ ---------------- -------------

5. Reconciliation of cash Current quarter Previous

and cash equivalents $A'000 quarter

at the end of the $A'000

quarter (as shown in

the consolidated statement

of cash flows) to the

related items in the

accounts

---- ---------------------------- ---------------- ---------

5.1 Bank balances 13,439 11,346

5.2 Call deposits - -

5.3 Bank overdrafts - -

5.4 Other (provide details) - -

---------------- ---------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 13,439 11,346

---- ---------------------------- ---------------- ---------

6. Payments to directors of the entity Current quarter

and their associates $A'000

----------------

Aggregate amount of payments to

these parties included in item

6.1 1.2 (303)

----------------

6.2 Aggregate amount of cash flow

from loans to these parties included

in item 2.3 -

----------------

6.3 Include below any explanation necessary

to understand the transactions included

in items 6.1 and 6.2

---- --------------------------------------------------------

Payments include directors' fees, superannuation,

bonuses and consulting fees.

--------------------------------------------------------------

7. Payments to related entities of Current quarter

the entity and their associates $A'000

----------------

7.1 Aggregate amount of payments to -

these parties included in item

1.2

----------------

7.2 Aggregate amount of cash flow

from loans to these parties included

in item 2.3 -

----------------

7.3 Include below any explanation necessary

to understand the transactions included

in items 7.1 and 7.2

---- --------------------------------------------------------

Not applicable.

--------------------------------------------------------------

8. Financing facilities Total facility Amount drawn

available amount at at quarter

Add notes as necessary quarter end end

for an understanding $A'000 $A'000

of the position

--------------- -------------

8.1 Loan facilities - -

--------------- -------------

8.2 Credit standby arrangements - -

--------------- -------------

8.3 Other (please specify) - -

--------------- -------------

8.4 Include below a description of each facility

above, including the lender, interest rate

and whether it is secured or unsecured.

If any additional facilities have been entered

into or are proposed to be entered into

after quarter end, include details of those

facilities as well.

---- ------------------------------------------------------------

Not applicable.

------------------------------------------------------------------

9. Estimated cash outflows $A'000

for next quarter

---- ------------------------------ --------

9.1 Exploration and evaluation (2,700)

9.2 Development -

9.3 Production -

9.4 Staff costs (500)

Administration and corporate

9.5 costs (300)

9.6 Other (provide details if -

material)

--------

9.7 Total estimated cash outflows (3,500)

---- ------------------------------ --------

10. Changes in Tenement Nature Interest Interest

tenements reference of interest at beginning at end

(items 2.1(b) and location of quarter of quarter

and 2.2(b)

above)

----- ---------------------- -------------- ------------- -------------- ------------

10.1 Interests - - - -

in mining

tenements

and petroleum

tenements

lapsed, relinquished

or reduced

----- ---------------------- -------------- ------------- -------------- ------------

10.2 Interests - - - -

in mining

tenements

and petroleum

tenements

acquired

or increased

----- ---------------------- -------------- ------------- -------------- ------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Sign here:

............................................................ Date:

26 October 2016

(Director/Company secretary)

Print name: Dylan Browne

Notes

1. The quarterly report provides a basis for informing the

market how the entity's activities have been financed for the past

quarter and the effect on its cash position. An entity that wishes

to disclose additional information is encouraged to do so, in a

note or notes included in or attached to this report.

2. If this quarterly report has been prepared in accordance with

Australian Accounting Standards, the definitions in, and provisions

of, AASB 6: Exploration for and Evaluation of Mineral Resources and

AASB 107: Statement of Cash Flows apply to this report. If this

quarterly report has been prepared in accordance with other

accounting standards agreed by ASX pursuant to Listing Rule 19.11A,

the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDKMMZGRKKGVZM

(END) Dow Jones Newswires

October 26, 2016 02:00 ET (06:00 GMT)

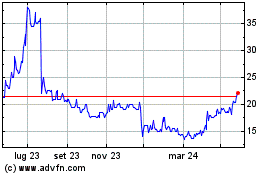

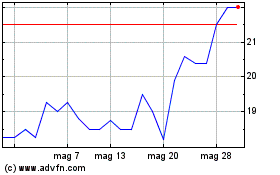

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024