Birkby PLC - Chairman's AGM Statement

01 Settembre 1998 - 2:05PM

UK Regulatory

RNS No 2951c

BIRKBY PLC

1st September 1998

BIRKBY PLC

UK's leading provider of managed commercial property

to small and medium-sized businesses

AGM STATEMENT

Speaking at Birkby plc's AGM today, chairman, Anthony Lewis, said;

"I am delighted to announce an excellent start to the new financial year.

Demand for flexible space remains buoyant and we are continuing to increase

licence fees across both the workspace and retailspace divisions. Furthermore,

since the year end the group has acquired over one million sq ft of space. We

anticipate that these new purchases will yield our target investment return of

20% within 12 to 18 months.

Since 31 March 1998, the workspace division, IMEX, which represents 69% of

group operating profit, has increased the cash equivalent occupancy rate by

0.7% to 85.3%. On a like-for-like basis, excluding acquisitions, this

represents a rise of 4.2% on the same period last year. The retailspace

division, In Shops, which accounts for 24% of group operating profit, achieved

a cash equivalent occupancy rate at the end of August of 80%, up 1.5% on the

same point last year and up 0.2% since 31 March 1998. This increase from March

to August is particularly encouraging since this is In Shops' traditionally

weaker trading period. Each percentage point rise in the cash equivalent

occupancy generates additional income of #220,000 from the workspace division

and #266,000 from the retailspace division.

The ten new centres acquired during the first quarter, which were announced

with the year end results, have been swiftly integrated and are performing

well. I am pleased to say our acquisitions programme has continued to

progress strongly.

In July, we acquired a portfolio of 11 workspace centres in the north-east,

comprising 275,000 sq ft, from Easington District Council for a consideration

of #3.7 million. At the end of August we were delighted to acquire development

land from Midlothian Council for #127,000 on Bilston Glen Industrial Estate,

Edinburgh, just a quarter of a mile from our existing site which is fully

occupied. Demand for space remains strong in the area and we intend to build

18 workshop units on the site, which is expected to provide an initial return

of 15% and our target return thereafter.

Continuing our policy of acquiring established markets and arcades, I am

pleased to announce the acquisition for #750,000 of a retail arcade in

Accrington. The arcade is divided into 21 units, with office space above.

The initial return will be 14%, with further scope for improvement.

We are continually exploring new initiatives to strengthen our retail

portfolio. Where we see the potential to increase income, refurbishments are

undertaken. Work has recently commenced on the Swan shopping centre in

Birmingham and we have plans to upgrade a further four centres this year.

Birkby announced record results for the last financial year. This was

principally achieved from organic growth, with our acquisition activity

inhibited by the overheated conditions in the property market during the year.

In contrast, the new financial year so far has been characterised by both

healthy demand for workspace and retailspace and a considerably higher level

of acquisitions, as property prices have softened.

We anticipate that our acquisitions programme will continue vigorously and

with our strong balance sheet and modest gearing, we believe that we are very

well placed to take advantage of opportunities that exist in a property market

that is increasingly in our favour. Currently we have a number of sites under

offer, all offering our target investment return. We view prospects for both

the short and medium term with great optimism."

For enquiries:

Birkby plc

Bill Cran, chairman Tel: 0171 353 1234

Kim Taylor-Smith, chief executive (on 1 September only)

Biddick Associates Tel: 0171 377 6677

Zoe Biddick or Katie Tzouliadis

END

CAGALLLLAEILIAT

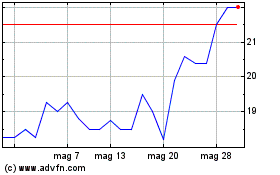

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Giu 2024 a Lug 2024

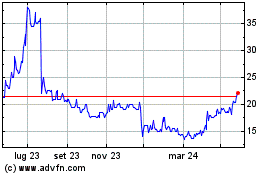

Grafico Azioni Berkeley Energia (LSE:BKY)

Storico

Da Lug 2023 a Lug 2024