BlackRock Greater Europe Investment Trust Plc Portfolio Update

29 Dicembre 2023 - 6:20PM

UK Regulatory

TIDMBRGE

The information contained in this release was correct as at 30 November 2023.

BLACKROCK GREATER EUROPE INVESTMENT TRUST PLC (LEI - 5493003R8FJ6I76ZUW55)

All information is at 30 November 2023 and unaudited.

Performance at month end with net income reinvested

One Three One Three Launch

Month Months Year Years (20 Sep 04)

Net asset value (undiluted) 11.1% 1.4% 13.0% 15.2% 682.3%

Share price 12.5% 0.6% 10.7% 9.3% 638.1%

FTSE World Europe ex UK 6.3% 2.0% 10.3% 24.0% 394.4%

Sources: BlackRock and Datastream

At month end

Net asset value (capital only): 563.12p

Net asset value (including income): 563.29p

Share price: 525.00p

Discount to NAV (including income): 6.8%

Net gearing: 7.2%

Net yield1: 1.3%

Total assets (including income): £567.9m

Ordinary shares in issue2: 100,812,161

Ongoing charges3: 0.98%

1 Based on an interim dividend of 1.75p per share and a final dividend of 5.00p

per share for the year ended 31 August 2023.

2 Excluding 17,116,777 shares held in treasury.

3 The Company's ongoing charges are calculated as a percentage of average daily

net assets and using the management fee and all other operating expenses

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation, write back of prior year expenses and certain non

-recurring items for the year ended 31 August 2023.

Sector Analysis Country Analysis Total Assets (%)

Total Assets (%) France 21.2

Technology Netherlands 18.2

25.0 Switzerland 17.9

Industrials Denmark 15.4

24.0 United Kingdom 7.1

Consumer Sweden 6.3

Discretionary 22.7 Ireland 5.8

Health Care Italy 3.9

14.7 Spain 2.3

Financials Belgium 1.7

8.3 Germany 1.1

Consumer Staples Net Current Liabilities -0.9

3.3 -----

Basic Materials 100.0

2.9 =====

Net Current

Liabilities -0.9

-----

100.0

=====

Top 10 holdings Country Fund %

Novo Nordisk Denmark 9.1

RELX United Kingdom 6.3

ASML Netherlands 6.0

LVMH France 5.1

BE Semiconductor Netherlands 4.8

Hermès France 4.2

STMicroelectronics Switzerland 4.0

Ferrari Italy 3.8

Safran France 3.7

ASM International Netherlands 3.4

Commenting on the markets, Stefan Gries and Alexandra Dangoor, representing the

Investment Manager noted:

During the month, the Company's NAV rose by 11.1% and the share price was up by

12.5%. For reference, the FTSE World Europe ex UK Index returned 6.3% during the

period.

November was an incredibly strong month for European ex UK markets. Economic

data released in November showed a continued fall in inflation: Eurozone

inflation dropped sharply to 2.4% from 2.9% in the previous month, which was the

lowest annual inflation number since July 2021. Lower energy, food and services

prices were the main drivers behind the improving inflation numbers. This led

investors to gain confidence that central banks have likely reached the peak of

their tightening cycles without causing significant damage to the economy.

Hence, markets rallied from oversold levels after having lost ground from August

to October.

The market was led by bond proxies such as real estate and risk assets including

IT, industrials, financials and consumer discretionary. Energy, health care and

consumer staples were the weakest performers in the market.

The Company outperformed its reference index during the month, driven by both

positive sector allocation and stock selection. In sector terms, the portfolio's

overweight allocation to IT and industrials aided returns. A lower weight to

commodities including energy and materials was also positive for relative

returns. Our zero exposure to real estate detracted during the month.

Semiconductor names BESI, STMicroelectronics and ASML rallied through the month.

Despite limited stock specific news, shares performed well given improving

smartphone demand data and a better environment for risk assets in general. An

update from American Nvidia also showed continued strong demand, particularly in

data centre end markets.

Speciality chemical distributor IMCD was amongst the top contributors. The

company guided to an improvement in end markets and IMCD specifically noted that

they expected to see an increase in volumes in Q4 versus Q3.

Shares in Partners Group performed strongly over the month, benefiting from an

improved rate environment and outlook for fundraising activity. We have spoken

to the company's CEO over the month, with management noting funding more readily

available and an optimistic outlook for deal making.

Royal Unibrew was the worst performer during the period. The company reported

weak Q3 results, with sales declining -1% versus expectations of 8% growth. This

was driven by much weaker volumes than anticipated, which the company attributed

to weather and price increases in Northern Europe in particular. The company

also marginally lowered guidance for the rest of the year in part due to a lower

contribution from the recently acquired Vrumona (soft drinks manufacturing)

business, bringing the reliability of the management team's execution into

question. We are monitoring the developments closely as part of a reassessment

of our investment thesis.

DSV also continued to underperform following the news of a CEO transition and

the announcement of a logistics joint venture with Saudi's NEOM city project, as

we discussed in last month's report. We would however note that management have

done a decent job explaining the potential of the project and the protection

mechanisms DSV have.

Outlook

The noise around market moves seems to increase with every passing year. We make

no attempt to predict to the basis point next quarters' GDP, inflation, or

unemployment number. Nor do we pay much heed to top-down indicators or what they

may reveal about the health of the global economy. From our point of view, the

world finds itself currently in the midst of several transitions: Covid to post

Covid, inflation to disinflation, low interest rates to high interest rates.

These dynamics must be considered when assessing the health of the global

economy and the prospects for equity markets. Various end markets may continue

to imply weak demand as inventories are run down, while others - perhaps those

associated with Chinese real estate - may have more prolonged problems.

However, assessing the economy from the bottom-up, company by company, we see no

reason for investors with a reasonable time horizon to be alarmed. Corporate

balance sheets are strong after 15 years of deleveraging, margins remain at

healthy levels and we may be at the foothills of an increase in capex spending

resulting in a `modern era industrial revolution'. Similarly, household debt

relative to assets is low in large economies, interest rate sensitivity is lower

than in previous cycles and real wages are growing.

As investors we must be forward looking, we must anticipate areas of enduring

demand and identify those special companies whose characteristics enable them to

capitalise on this demand and, in doing so, benefit their stakeholders and

shareholders. We remain optimistic about the prospects of companies held in our

portfolio.

29 December 2023

ENDS

Latest information is available by typing www.blackrock.com/uk/brge on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 29, 2023 12:20 ET (17:20 GMT)

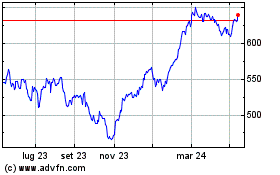

Grafico Azioni Blackrock Greater Europe... (LSE:BRGE)

Storico

Da Nov 2024 a Dic 2024

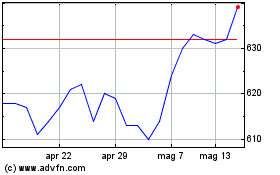

Grafico Azioni Blackrock Greater Europe... (LSE:BRGE)

Storico

Da Dic 2023 a Dic 2024